In this issue:

The PEOPLE demand madness

Don’t blame me, blame Dollar Tree

R.I.P. Mr. Goxx

The PEOPLE demand madness

We’ve talked a few times recently about ConstitutionDAO, the flash-mob fundraising effort that gathered a record breaking 12k ETH (~$47M) in an ultimately failed bid to buy a copy of the U.S. Constitution.1 The actual winner (billionaire Citadel CEO Ken Griffin) paid $43M for the document in an effort to cement his legacy as Reddit’s least favorite person.2

Not winning the auction was disappointing obviously but it was also pretty awkward. To the extent ConstitutionDAO had any plans at all they were about what to do with a precious manuscript, not what to do with a pile of other people’s money.

The obvious thing to do of course is to give the money back — but refunds on the Ethereum network are not cheap. I was careful to time my own donation and refund to minimize fees and it cost me ~$215 in total. Unfortunately the median donation to ConstitutionDAO was $206.26, which means the "refund" in most cases left a typical donor with nothing.

The next most obvious thing to do is to hold a vote about what to do with the money. Maybe you could shop around for a copy of the Magna Carta or form a DAO PAC. The problem if you sell something your customers can use to vote about what you do with the money you raised, then what you sold was probably a security. Unless you were careful about who you sold it to selling it was probably a crime.

I’ve written before about how DAOs are for crimes, but ConstitutionDAO isn’t really a DAO and they were trying their best not to do crimes. A DAO is an organization whose charter exists on (and is enforced by) the blockchain — but ConstitutionDAO doesn’t have an official charter and is in practice just a group of 9 people who share control of the multi-signature wallet holding the funds. It was for all intents and purposes not that different from a Kickstarter project.

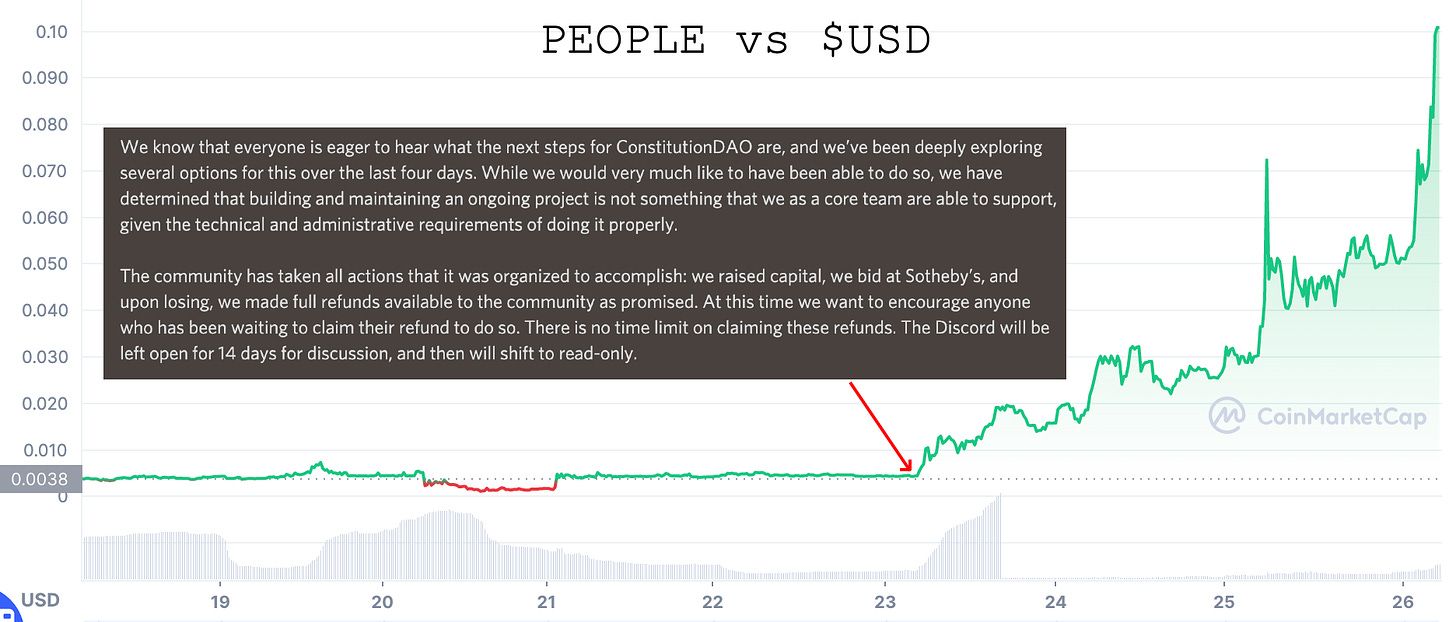

The group running the ConstitutionDAO fumbled the messaging quite a bit in the days after losing the auction, announcing and then retracting several plans as they oscillated between wanting to do something and the slow realization that they probably couldn’t. It was all very messy. Ultimately they closed the project and made clear refunds were the only remaining action ConstitutionDAO would take:

While we would very much like to have been able to do so, we have determined that building and maintaining an ongoing project is not something that we as a core team are able to support … At this time we want to encourage anyone who has been waiting to claim their refund to do so. There is no time limit on claiming these refunds. The Discord will be left open for 14 days for discussion, and then will shift to read-only.

Maybe this was obvious to you but I did not see the next step coming:

PEOPLE, the now meaningless token of a defunct DAO, is now trading at ~$0.10/PEOPLE, around ~20x the original purchase value. That’s a market cap of ~$680M, almost ~15x more than was raised by the original DAO. (Editor’s note: I had to rewrite that last sentence three times during drafting because numbers kept changing.)

15x is a lot of growth but PEOPLE is still small relative to the market cap of major memecoins like Dogecoin ($26B) or Shiba Inu Coin ($21B). "Logically worthless but with broad populist appeal" has been an explosive growth category this year.

Don’t blame me, blame Dollar Tree

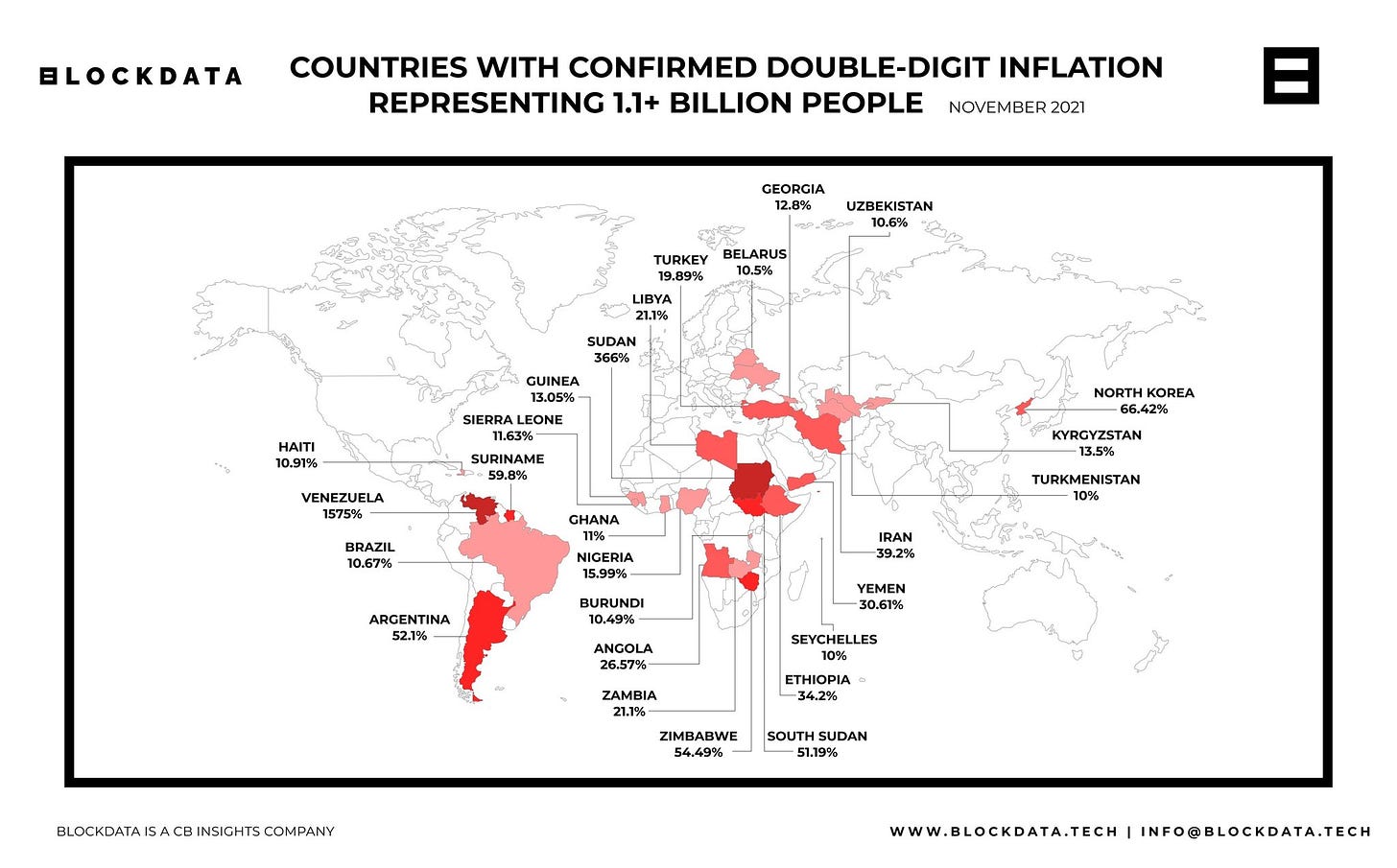

Bitcoin’s price is sluggish in USD but in Turkey where inflation has been raging the price of Bitcoin has been reaching new all-time highs. That’s because Turkey’s currency (the lira) has been crashing in value — it has lost roughly ~40% of its purchasing power since the beginning of the year:

Inflation is of course caused by different things in different countries — in Turkey for example inflation is a result of the political leadership undermining the independence of the central bank. In America on the other hand low interest rates are good and inflation is caused by greedy corporations, not politicians. Just ask the politicians:

I’m not an economic historian per se but I am reasonably sure corporations were greedy last year and the year before that, too. Perhaps Senator Warren thinks the Dollar Tree store raised prices for the first time in 35 years because its executive team finally caved to temptation, but I think there are better explanations.

Politicians probably understand the situation better in private than they let on in public. Biden recently authorized the largest ever release from the U.S. strategic oil reserves in a bid to lower heating and gas prices. Hillary Clinton has started repeatedly emphasizing the strategic need to defend the dollar’s reserve status from encroaching cryptocurrencies. Official government inflation is at ~6.2% (a 31 year high) and conventional wisdom no longer treats it as transitory.

Here is what ~6.2% in official numbers looks like at the store:

Inflation is a funny beast — it can be a self-fulfilling prophecy. The more consumers expect inflation the more they tolerate it. The more businesses raises their prices, the easier it is for other businesses to do the same. "Don’t blame me!" the shopkeepers exclaim, "Even Dollar Tree had to raise prices!"

Other things happening right now:

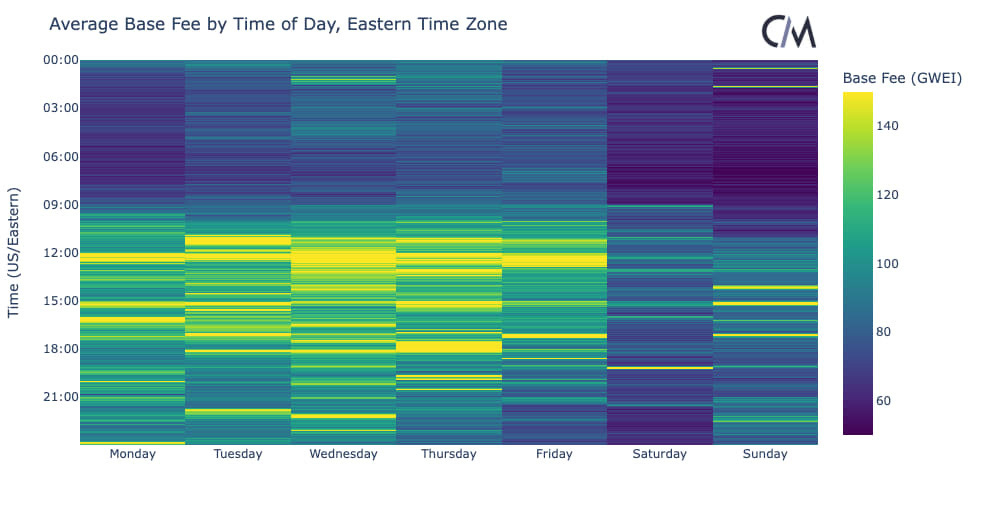

Useful analysis from CoinMetrics if you ever transact on the Ethereum network and are wondering how to time your transactions to minimize fees:

Mr. Goxx, the crypto-trading hamster who became famous back in October for outperforming the S&P 500 has died. Mr. Goxx is survived by his human partners at Goxx Capital and the legacy of having incontrovertibly demonstrated that everyone is a genius in a bull market.

Crypto lending platform Celsius Network recently admitted "an employee" had been arrested in Israel. The employee in question is the CFO and second-in-command executive at the company, so that seems ... troubling? We discussed Celsius previously here and here.

Presented without comment:

Disclosure/disclaimer: I was a small participant in ConstitutionDAO — I never claimed any PEOPLE tokens and already claimed a refund. You can read more about my potential conflicts of interest on my disclosures page.

The ConstitutionDAO stopped bidding at $40M because a portion of the budget needed to be set aside for downstream costs, etc: "The proper care and maintenance of the Constitution requires a reserve that is needed to insure, store, and transport the document, and we calculated the absolute max we could go to while still meeting these requirements. The opposing bidder passed that max, and we were unable to go any higher while still ensuring that we could properly care for the document."