Poly Network hacker saves the Poly Network

Plus a skeptical eye on the Celsius Network and Bitcoin's Realized Market Cap reaches a new all time high

In this issue:

Poly Network hackers saves the Poly Network

The Celsius Network promises a lot and shares very little (Reader submitted)

50th Anniversary of the end of the gold standard

Poly Network hacker saves the Poly Network

We talked last week about the $611M hack of the Poly Network, the largest in the history of DeFi. In particular we talked about how the hacker very likely exposed themselves by accidentally putting the wrong "from" address in one of the transactions they used to try to launder their winnings. The address they accidentally signed with had a history with several legally compliant exchanges, implying it could be linked to the hacker’s legal name and home address.

As of now there seem to have been no arrests and no suspects named. So it is unclear whether it was fear or magnanimity that caused the hacker to return the vast majority of stolen loot - or at least move it to a multi-signature wallet where both they and the Poly Network must agree to distribute funds. As the hacker put it:

IT'S ALREADY A LEGEND TO WIN SO MUCH FORTUNE. IT WILL BE AN ETERNAL LEGEND TO SAVE THE WORLD.

Perhaps you are skeptical about how altruistic the hacker can possibly be, given they stole the better part of a billion dollars and then tried to hide it. "There was no choice!" the hacker breathlessly assures you:

ASK YOURSELF WHAT TO DO HAD YOU FACING SO MUCH FORTUNE. ASKING THE PROJECT TEAM POLITELY SO THAT THEY CAN FIX IT? ANYONE COULD BE THE TRAITOR GIVEN ONE BILLION! I CAN TRUST NOBODY! THE ONLY SOLUTION I CAN COME UP WITH IS SAYING IT IN A _TRUSTED_ ACCOUNT WHILE KEEPING MYSELF _ANONYMOUS_ AND _SAFE_.

They had to steal that money or it might have been stolen by evildoers. You get it.

The Celsius Network promises a lot and shares very little

"Have you looked into Celsius at all? Their rates are better than BlockFi - but I’m unsure if Celsius’s business model and overall transparency" - GO

"I'm hoping you can explain Celsius, and other schemes like it, to me. A friend of mine just put an inordinate amount of money in as a customer, but I smell a scam. How does it work, and please tell me it isn't a scam?" - VN

Celsius is a London based company that in turn manages a cryptocurrency lending platform called the Celsius Network. The founder Alex Mashinsky is a successful serial entrepreneur and the company itself proudly advertises its money transmitter license from FINCEN and the paperwork for the CEL token sale filed with the SEC. So I don’t think Celsius is a scam in the legal sense - but there are definitely still important risks to consider before giving them your money.

Celsius offers two types of service: you can loan money to Celsius to earn weekly interest or you can borrow money from Celsius and pay interest.1 That might sound like a traditional bank - but a traditional bank is matching deposits and loans denominated in a single currency. Celsius operates across ~42 different cryptocurrencies and five different fiat currencies.

The loans Celsius offers are over-collateralized, which means to borrow $100 worth of stablecoins you need to deposit $150 worth of Bitcoin (or some other cryptocurrency). Over-collateralized loans are fairweather products - they make sense in a bull market2 but demand for them disappears when prices drop. Collapsing prices could also make selling the collateral for face value of the loans difficult, which would leave Celsius depositors on the hook for the resulting loss.

Celsius is not insured, either privately or through the FDIC. The money deposited in Celsius is deployed to earn yield, so it cannot be held in cold storage. Celsius is both centralized and custodial. Its terms of use explicitly allow for rehypothecation, which is a three-dollar word that means loaning the same asset to multiple people at the same time. Celsius does not disclose very much about how it manages risks or what investments it is making to generates the yields it offers: "[We do not] discuss our best business practice and the competitive advantage of our business model."

A good rule of thumb in cryptocurrency markets is that interest rates are generally a good measure of risk. The higher the yield on offer, the more you should be wary.

Other things happening right now:

Sunday was the 50 year anniversary of the end of gold convertibility and the beginning of the era of fiat currency. The value of a dollar dropped ~7x in the decades since Nixon made the announcement.

In countries with political and financial stability, it can be easy to forget how many people do not have those luxuries. Some people in Afghanistan are finding out money they thought was theirs may not be there when they need it.

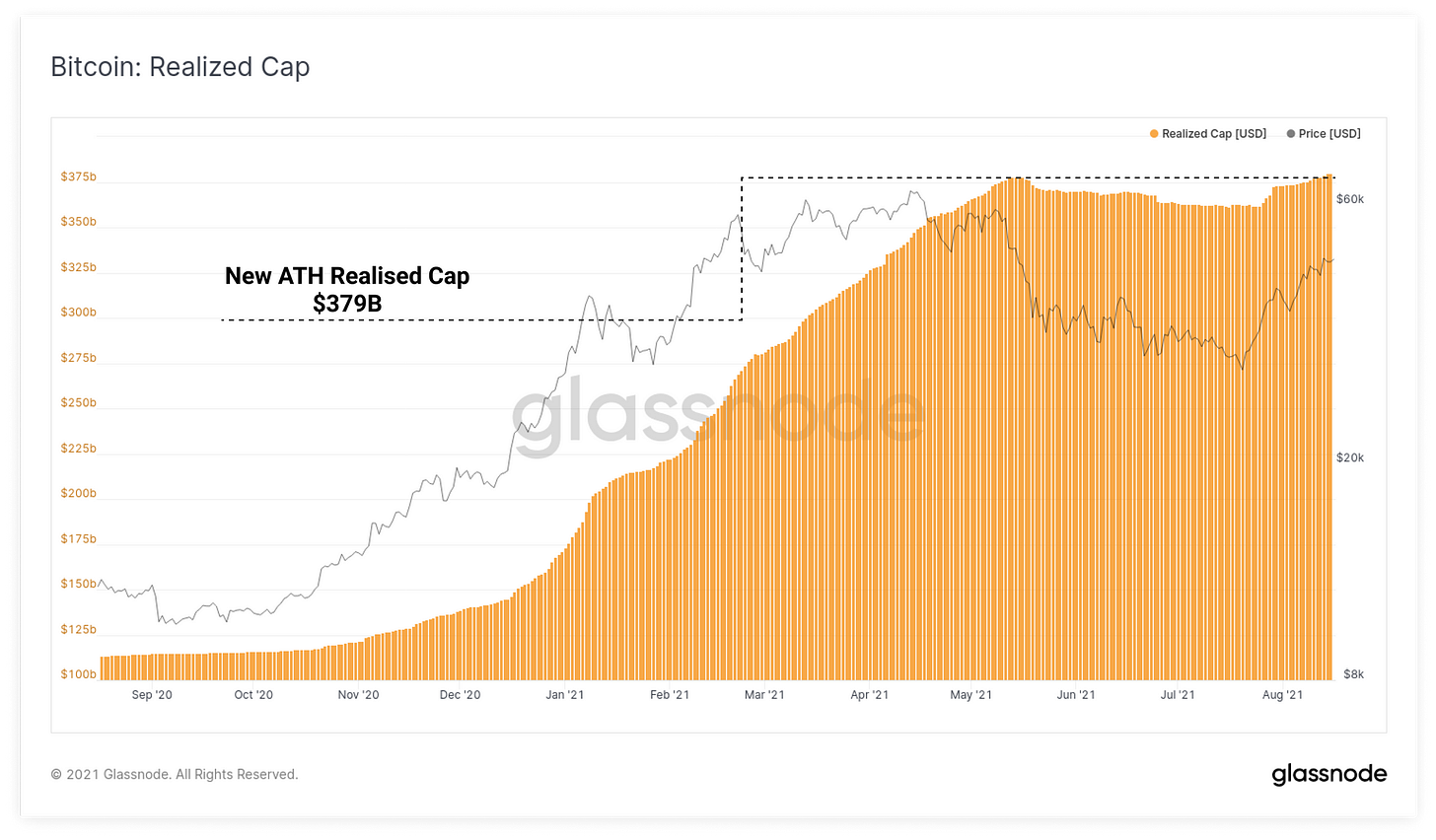

Realized Market Cap (i.e. the cumulative value of all Bitcoin the last time they moved/could have been sold) just hit a new all-time high. That means new investors are buying old investors out. The price has dropped somewhat from recent highs but the market’s confidence in Bitcoin has never been higher.

Presented without comment:

You can also purchase and stake tokens from the Celsius Network itself ($CEL) which act as a kind of rewards program boosting your interest payments. The pricing structure is complicated but generally designed to reward greater levels of investment.

Maybe you want to spend some of your profits without paying capital gains taxes or maybe you plan to use the loan to buy more cryptocurrency and effectively go leverage long.