Are you there Hacker? It's me, Poly Network.

Plus $100k pet rocks and a democracy can always get dumber

In this issue:

Dear Hacker, please reply

Cool democracy, bro

Dear Hacker, please reply

On Tuesday a hacker exploited a weakness in the PolyNetwork to steal ~$600M worth of assets including ETH, DAI, USDC, UNI and several others. That’s almost certainly the largest theft in decentralized finance (or DeFi) so far.1 The Poly Network released this threatening statement, possibly while shaking their fists at the heavens:

The letter is probably right about one thing - that hack is probably too big to get away with. The next step after you steal a big pile of cryptocurrency is to hide it. Normally you would do that by using a "mixing service" where you and a crowd of other people trying to achieve privacy all mix your coins together in various ways to make it hard to tell whose coins are whose - like the digital equivalent of the bowler hat scene in the Thomas Crown Affair. But a $600M pile of cash trying to lose itself in a mixing service is like King Kong trying to blend in with a crowd of children. There just isn’t a practical way to launder that much stolen crypto.

That raises some interesting questions about what you should do. For example, if you can’t find a crowd big enough to hide in, maybe you can make one by giving a portion of your winnings away at random like a bank robber scattering money across the road. Imagine giving ~$6k worth of assets to each of 100,000 wallets, of which 1000 belong to you. That leaves you with a roughly ~$6M payout and the authorities with 100,000 leads they need to track down.

The comments section of the etherscan page for the hacker’s addresses are actually littered with people begging for the hacker to do just that. One user sent the hacker a warning not to use their blacklisted USDT and the hacker replied with a $42k tip. Then they got to work trying to exchange their trackable stablecoins for more suitable escape currencies … but they accidentally screwed up and revealed themselves:

Yikes. That’s like accidentally putting your home address on the ransom note. Afterwards the hacker quickly panicked and sent a transaction with this message:

IT WOULD HAVE BEEN A BILLION HACK IF I HAD MOVED REMAINING SHITCOINS! DID I JUST SAVE THE PROJECT?

NOT SO INTERESTED IN MONEY, NOW CONSIDERING RETURNING SOME TOKENS OR JUST LEAVING THEM HERE

Very considerate of them when you think about it.

Cool democracy, bro

Balancing a government’s budget is not like balancing a household budget for a lot of reasons, but one of the most important reasons is that a government’s budget choices actually change the economy itself. If you decide to buy twice as much fresh produce at the grocery store prices will stay the same and your produce budget will double. If the government decides to buy twice as much produce it might overwhelm the market and send prices skyrocketing or it might allow farmers to reach new economies of scale and drastically lower their prices. It’s very difficult to predict.

Even though it is difficult to know what impact a law will have it’s generally still considered best practice to try. Legislators are not necessarily economics experts but they are usually experts in telling people what they want to hear, so we don’t generally let them make their own predictions about the impact of their proposed laws for the same reason we don’t put salespeople in charge of safety ratings. The office that estimates the costs / revenue of proposed legislation in America is called the Congressional Budget Office, or CBO.

The CBO’s estimates are made by hardworking, non-partisan professionals which means that no one believes them and everyone resents them. They are also just guesses! Thoughtful, intelligent guesses but just guesses. Contemporary political fashion requires that guesses about how much a bill will cost add up to less than or equal to guesses about how much money it will make. None of these numbers are knowable, but it is very important that they match up. Politics is mostly aesthetics.

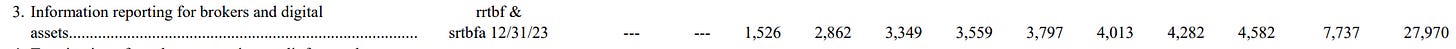

One guess that became contentious this past week was the estimate that increasing reporting requirements for crypto-related businesses would generate ~$27.9B of additional tax revenue (~2% of the cost of the bill over the next 8 years). I could not find any explanation of how that ~$27.9B estimate was produced or where that money is expected to come from. It’s just a flat line item.

Unfortunately the reporting requirements in question are actually impossible for cryptocurrency businesses to satisfy, which means the law as written wouldn’t so much tax crypto businesses as drive them underground or overseas. It is pretty unclear how doing that would generate ~$27.9B worth of revenue. The provision makes no sense as a fundraising mechanism - its actual purpose is to expand the authority of regulatory agencies over cryptocurrency.

After a week or so of intense bipartisan debate Senators Portman (R), Warner (D), Toomey (R), Sinema (D) and Lummis (R) were able to hammer out compromised language that repaired some of the damage from the original bill:

The clock was running out, though. As a result of procedural maneuvering by Senate Majority leader Chuck Schumer (D) to pass the infrastructure bill in a timely manner amendments could now only be considered for a vote by unanimous consent. I’m sure you can guess how that went.

In the end the bill passed the Senate un-amended. Senator Richard Shelby (R) of Alabama is retiring after this term. His top campaign contributors for the last five years have been commercial and investment banks. To summarize: the Senate voted to outlaw a growing American industry with a few sentences buried deep in a +2700 page document in a way that had widespread bipartisan opposition but passed anyway because of a single retiring senator. Democracy!

It’s not hopeless yet. The bill still has to make it through the House and then the courts and even then would only come into effect in 2023. Politicians in the House have seen the hornet’s nest that cryptocurrency turned out to be and a bipartisan group has already started moving to amend the language. Perhaps they will be more successful! Or perhaps a retiree will object for some reason.

Either way Bitcoin investors were unfazed - price continued to climb throughout this unfolding legal drama, reaching ~$46.5k/BTC at time of writing. The headlines might have been all about the problems for cryptocurrency in this amendment - but the real news was that cryptocurrency was making headlines in mainstream media at all. The political constituency of crypto was large enough and vocal enough to represent a force on the national stage.

Other things happening right now:

An excellent graph for putting Bitcoin’s relative energy use into perspective compared to other forms of infrastructure.

If comparing Bitcoin to physical infrastructure feels strange, remind yourself that physically tangible assets are adorably quaint and old-fashioned:

10 of the top 100 Hedge Funds by assets under management are customers of Coinbase according to their Q2 earnings report.

If you have $100,000 dollars and you hate it, here’s an opportunity for you:

If you are wondering why the attack was announced by @PolyNetwork2 it is because @PolyNetwork was already taken by the Polynesian Rainbow Network - a Polynesian LGTBQ group with 15 followers.