Who invited Floyd Mayweather?

Plus the price of steak in a casino and the benefits of a little inflation

In this issue:

How to price steak in a casino (reader submitted)

The benefits of a little inflation (reader submitted)

How to price steak in a casino

"What are your thoughts on sustainability of the business model around CeFi providers like Celsius? It's hard to understand how this is sustainable and seems prime for a bank run if things dip further. How can the customer acquisition costs be worth it for them, especially without major VC funding?" - @pilosacoin

The Celsius Network is one of a handful of companies promising to pay interest on Bitcoin (and other cryptocurrency) denominated accounts. Celsius is currently offering 3.5-6% APY on BTC and 5% APY on ETH.1 According to the FDIC the average interest rate for a USD savings account is only ~0.06% APY (that’s not a typo) so these interest rates are pretty eye-popping even before you consider how fast the underlying assets have grown historically. Where are companies like BlockFi and Celsius getting the money to pay these rates?

In the early days the answer was that they were arbitraging the premium on the Grayscale Bitcoin Trust (GBTC) - we talked a little about that here and here - but the GBTC premium has been gone since February and even then it only ever explained interest rates for Bitcoin and Ethereum - rates for stablecoins like USDC are actually even higher (~8% or so). More explanation is required.

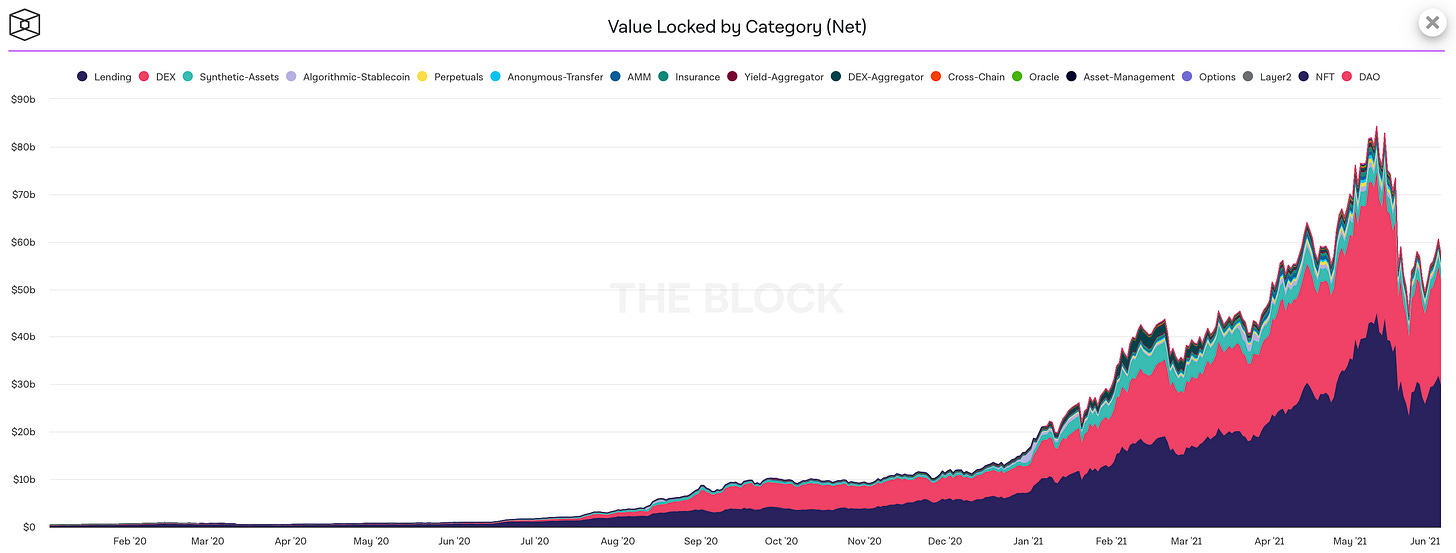

If someone pays you to borrow your money, it’s usually because someone else will pay them even more for it. The someone else in this case is the DeFi market - an umbrella term for the various smart contract applications being built and launched on Ethereum (and also competing platforms). Yields on DeFi applications are incredibly high because the market keeps inventing new projects that need capital faster than it can attract new capital to the market. Imagine a casino that is adding new slot machines faster than it attracts new customers - the machines would have to offer better and better payouts to compete. More money is flowing into DeFi, but not as fast as DeFi is inventing new ways to use it.

There are a long tail of different things that capital can do on DeFi but by far the two largest categories are providing liquidity to decentralized exchanges and funding collateralized loans. The people who ultimately pay for those exorbitant yields are the traders who market buy/sell coins on decentralized exchanges and the speculators who borrow against their crypto holdings to go margin long. Basically crypto right now is like Las Vegas: none of the prices are real because the gamblers are subsidizing everything.

A big crash in the crypto market could definitely cause the DeFi market to collapse in on itself - which would probably lower interest rates across the board, but I’m not sure that would automatically spell doom for banks like Celsius. Paying interest on BTC/ETH denominated accounts is functionally a short position - falling prices would make their future obligations cheaper to pay off.

More importantly I believe Celsius (like most banks) retains the right to adjust interest rates to changing market conditions. I imagine they would respond to a collapse in the DeFi market by (a) lowering interest rates and (b) seeking new ways to put capital to work. Celsius has been around since ~March of 2018 so they have already endured a number of fairly steep drops in the crypto market. I don’t think a crash by itself is an existential threat to their business.

The benefits of a little inflation

"As I understand it, one of the benefits of inflating currency is it incentivizes moving value to the most efficient investment. Is it bad for society to have a store of value that doesn't inflate?" - DS

That is a pretty profound philosophical question, to be honest. Many intelligent people disagree. Conventional wisdom - especially among central bankers - is that a low steady degree of inflation is good and helps to keep the economy moving. The idea is that inflation does two things:

It makes it easier for businesses to lower real wages because workers won’t understand that flat nominal wages are an effective wage cut.

It encourages money holders to seek out and make investments (or purchases) they otherwise would not have made, 'stimulating' the economy.

I do think that (1) is true in the sense that most people don't understand inflation, so you can trick them into thinking they are treading water when actually they are slowly sinking. Whether you think that is good for society I suppose boils down to whether you worry more about how difficult it is for companies to lower wages or how difficult it is for employees to defend them. I personally worry more about the latter.

For (2) the question is basically is society better off if people are forced to invest or if they are able to invest at their own discretion? Inflation punishes people for not investing (or consuming), so it will result in more investments (or consumption) but they will be worse on average. Reasonable people can disagree about the trade-offs here, but I don’t see "more low quality consumption" as a net win for society. In the short run inflation creates more transactions, which boosts artificial measures like GDP and can look like they are stimulating the economy. But if those transactions are not productive investments helping to grow the underlying economy the results will be temporary - like using caffeine to replace sleep.

In my opinion money is a technology that transports cooperation across space and time. We exchange favors for money and then later money for favors. Money is good for society because it enables cooperation. Money that loses value over time encourages us to delay doing favors for as long as possible and demand favors in return as quickly as possible. Money that gains value over time would allow us to trade favors over longer spans of time and cooperate together in new ways.

To me that sounds like a better society.

Other things happening right now:

The non-profit organization charity: water just announced the foundation of the Bitcoin Water Trust Initiative. The trust will accept donations and hold its funds in Bitcoin until 2025, after which it will seek to fund water projects and construction in bitcoin directly. The explicit belief here is that Bitcoin will rise in value between now and then - in the announcement charity: water talked about having sold past Bitcoin donations that have since risen >100x in price. The implicit, but equally exciting idea, is that by eventually seeking to fund projects in bitcoin they may help stimulate a local circular Bitcoin economy in the regions where they work.

According to Jack Dorsey square is considering helping to develop an open-source hardware and software standard for hardware wallets. A widely reviewed and open-sourced (i.e. decentralized) standard for hardware wallets is a really important precursor to cryptocurrency being ready for mainstream adoption. Transparent standardized easily verified hardware will be critical for helping ordinary people actually protect their private keys.

In 2018 boxer Floyd Mayweather paid a little over $600k in fines to the SEC for "unlawfully touting" a string of ICOs. For some reason apparently this qualified him to be a keynote speaker at the Bitcoin 2021. Here he is getting booed for predicting that Bitcoin will one day be overtaken by another currency one day. Honestly I’m not sure what anyone expected, really.

Full disclosure: I have an account with a competing company called BlockFi whose services are broadly similar although prices and specifics differ. I am not sponsored by BlockFi or Celsius. Something Interesting is ad-free and has no sponsors.