The Lost Art of Lost Art

Plus be suspicious of sources that would rather alarm you than inform you, and why does the GBTC premium pose a systemic risk?

In this issue:

What happens to an NFT when the art is lost?

Why would discount BTC cause systemic risk? (reader question)

The anatomy of manufactured outrage (reader question)

What happens to an NFT when the art is lost?

If you are not familiar with non-fungible tokens (NFTs) or could benefit from a quick refresher, I recommend starting here: It’s not NFTs you don’t understand, it’s art.

Non-fungible tokens (NFTs) don’t necessarily have to be used for digital art, but that is more or less what they are used for in practice today and it is what most of the dialog about NFTs is focused on. Here is an interesting and pretty common question that people are starting to ask:

The basic answer is that it depends. Some art (Eulerbeats, e.g.) is entirely encoded on the blockchain. For other projects the NFT contains a pointer to the resource - which might be a URL or it might be a kind of pointer called a Content ID or CID which is used to identify files stored on the decentralized files on IPFS, a decentralized file storage service. Finally there are projects where the NFT does not contain any data about itself at all and there is essentially no direct connection between the token and the media it represents ownership of.

Most people tend to imagine that all NFTs are entirely on-chain, but actually storing data on chain is very expensive so the majority of NFTs right now are pointers. Consider for example this beeple video, which sold recently for $6.6M:

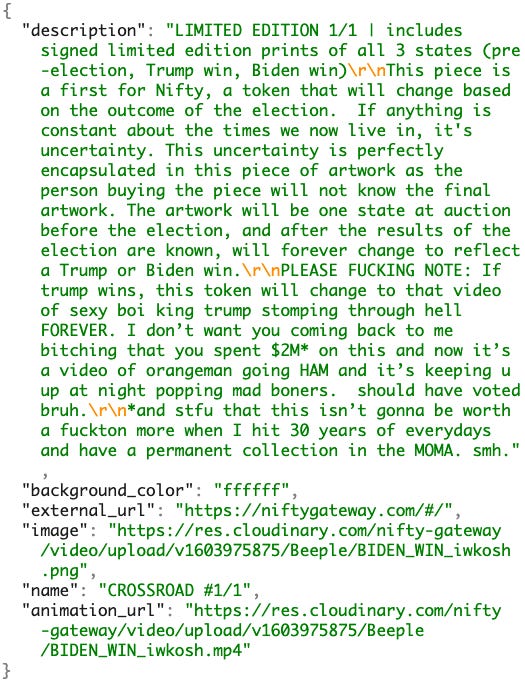

What the NFT that sold literally contains is a URL which points to Nifty’s servers and contains this JSON file:

Which in turn points to the media hosted on Nifty’s Cloudinary gateway. The URL pointed to by the token can't be changed now - NFTs are fixed once minted. So this raises some really interesting questions about the art. If Nifty servers change the media served from that URL, does it change the art? Does it invalidate the NFT? What happens when Nifty eventually runs out of business and their servers go down?

Even the media stored in IPFS for decentralization is still at risk - those contracts have a hash of the media on-chain so you can know the art hasn’t been changed, but someone somewhere still needs to actually store the file somewhere. That isn't free.

If the files are lost most NFTs don’t contain enough information to recreate the art they represent. People often point out that anyone can download a copy of your NFT, but not as many people talk about the risk that no one will. Likely owners of digital art will need to be responsible for maintaining their viability. This isn’t really new to NFTs, of course - as Kyle Tut observes - we don’t expect Da Vinci to take care of the Mona Lisa. Still many of this early generation of NFTs are fragile and will likely break. When they do it will be interesting to see how the market responds.

Is an NFT with a broken pointer more like a certificate of authenticity to a painting destroyed in a fire, or more like owning a Rai stone that has sunk into the sea? Does the center of gravity belong with the token, or the front-ends where the tokens are hosted? How tight does the coupling between the token and the underlying IP need to be? Can beeple mint new NFTs with updated pointers? Can owners insert out-dated tokens into wrapper NFTs with updated pointers? If the original owner and the artist disagree about a future possible migration, which version is the 'real' NFT?

Anyway, here is the NFT that contains all NFTs that are not themselves, an NFT of the Brooklyn Bridge and an NFT representing ownership of an entire year of recorded farts. In case any of you are collectors.

Why would discount BTC cause systemic risk?

“I didn't quite follow the bit about GBTC premiums being negative in this issue - if the premiums are negative, why wouldn't people just buy it up? Is it not the equivalent of buying BTC at a 15% off?” -BS

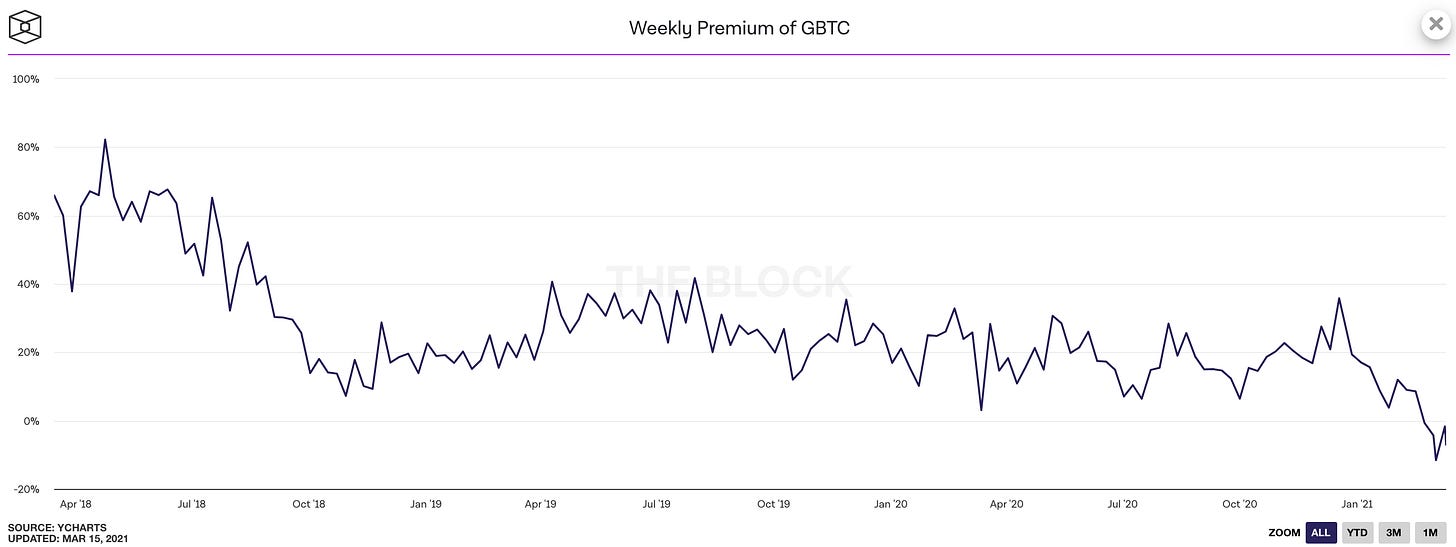

It’s a subtle distinction, but it is an important one. GBTC for those who don’t remember is the Grayscale Bitcoin Trust - essentially just a wrapper to give investors access to Bitcoin without actually needing to buy or secure Bitcoin themselves. That convenience has typically been expensive - Grayscale charges GBTC holders 2% per year in management fees and GBTC shares have traded for as high as +80% over the underlying bitcoin they represent.

Recently, that premium has largely evaporated and even dropped below zero, meaning that it is now cheaper to buy GBTC than to buy actual Bitcoin.

This premium has been pushed down by the arrival of competing ways to wrap Bitcoin exposure into traditional financial products. We talked recently about the launch of Canada’s first Bitcoin Exchange Traded Fund (ETF) - ETFs operate similarly to GBTC but with a more fluid system of arbitrage, meaning the price will track the price of Bitcoin much more closely. MicroStrategy also created another way to get indirect Bitcoin exposure when they converted most of their treasury to Bitcoin - a share of MSTR (~$725) is now effectively exposure to something like ~0.008 BTC ($450).

ETFs also generally have very low fees, so the 2%/yr that Grayscale charges for GBTC is going to seem pretty steep. It might seem like you should just redeem your shares and take the raw Bitcoin out to custody yourself, but you probably can’t. Only a very small list of partners is allowed to redeem GBTC shares for the underlying and only under certain specific conditions - that’s part of why the premium emerged in the first place. In a world with plentiful ETFs the equilibrium price of GBTC probably is a permanent discount, to reflect the cost of those fees.

So investors who bought GBTC when the premium was high (sometimes as high as 80%!) will probably now need to sell when the premium is negative or low. How bad this is depends on your unit of account. If you measure your portfolio in dollars it is mostly fine - Bitcoin rose a lot in that period, so you are probably still in profit even with the premium having dropped. But if you measure your portfolio in Bitcoin the movement in premium is quite painful.

This is where the possibility of "systemic risk" comes from. A number of companies sprang up in the wake of this premium and built lines of business that relied on it. The example I mentioned was BlockFi - the trade BlockFi was making was they offered 6% annual interest to retail investors who deposited their Bitcoin. BlockFi took the deposited Bitcoin and deposited them with Grayscale for equivalent shares of GBTC. BlockFi would then wait out the lockup period for new GBTC shares (6 months) and sell those shares to buy more Bitcoin to redeposit into GBTC, using the premium to pay the interest they owe to their Bitcoin account holders.

BlockFi was a large investor in GBTC - allegedly as much as 5% of overall assets under management. Since they owned a lot of GBTC they likely have a large unrealized loss from the fall in the premium. If the losses were large enough to render them (or other companies like them) insolvent the resulting bankruptcies would force them to liquidate their Bitcoin, possibly crashing the market. That’s the "systemic risk."

For their part BlockFi has shut down new users sign ups and completed a new $350M round of fundraising. That is worrying because it suggests they did in fact need fewer liabilities and more capital - but it is also comforting because it suggests they were able to get more capital fairly easily when they needed it. I’m not all that concerned yet but I am keeping an ear to the ground just in case.

The anatomy of manufactured outrage

“Dismissing environmental concerns as bad faith in this post seems kind of defensive - I don't talk to that many bad-faith actors who are trying to subvert BTC.” - CH

I think the vast majority of people who are worried or wondering about Bitcoin’s energy usage and its implications for the planet are acting in good faith - which is part of why I’ve written about the topic so often. But unfortunately I don’t think the same thing is true of the majority of content producers - I think they are often more directly guided by the need to get clicks and views regardless of the merits of the content. This is what I mean by bad faith.

In the interests of greater clarity let’s unpack one of these arguments and examine it carefully. There isn’t anything especially noteworthy about this example, you could do a similar exercise on any number of similar articles produced on a regular basis since the launch of Bitcoin:

Let’s start with the first sentence!

Cryptocurrency is a notorious climate culprit.

The author has some pretty strong prior beliefs - so strong they don’t feel any need to defend them - they assume you assume the same things. Everyone knows that everyone knows that cryptocurrencies are bad for the environment.

The article quotes from Kjell Inge Røkke’s shareholder letter about their venture to start a $50M company (Seetee) based on the synergy between renewable energy and Bitcoin mining. Then they quote 'digital currency economist' Alex de Vries as saying that Seetee's plan is 'fatally flawed.'

If you are wondering what a 'digital currency economist' is here is Mr. De Vries’ LinkedIn page. For the last seven years up until a few months ago Alex was full time self employed at his own publication, the Digiconomist. The Digiconomist is fully dedicated to raising concerns about the "unintended consequences of cryptocurrency." In other words this seemingly neutral expert actually made a full time profession out of warning about the dangers of cryptocurrency.

Let’s unpack the fatal flaw he identified:

This approach has a fatal flaw, said Alex de Vries, a digital currency economist who authored the Joule article. It assumes that the mining operation can pause when that electricity is needed for other, more socially-beneficial purposes. But mining only works when it runs 24/7 … “Every time you shut down, you lose a level of income that you never get back” and fall behind forever, de Vries said.

As we’ve talked about, Bitcoin is an energy scavenger. It does not displace "more socially beneficial purposes" because it consumes the cheapest available energy which is very precisely the energy that no one else wants to use. You also don’t lose income by mining intermittently. If you have found a higher value using your energy then you aren’t losing income you are gaining it. Mr. de Vries would have you believe that Bitcoin is outbidding and underpaying at the same time. Of course you can turn miners on and off as you need to - that’s the exact reason that companies like Seetee are excited about using Bitcoin to smooth out their economics!

The “battery” analogy is thin, as well, since that same energy could in theory be used to charge actual batteries, hydrogen fuel cells, or other systems that help decarbonize the broader grid once they become more widely available.

Battery technology is in fact very challenging and this assertion is flat wrong. If it were easy to store energy more energy would be stored. It is not. Also note here the phrase "other systems … once they become more widely available." Apparently Bitcoin is stealing energy from use cases that don’t even exist yet.

“If you wait long enough the grid will become greener, but in the meantime, Bitcoin will cause a lot of displacement,” de Vries said. “Renewable energy that we could have used to clean up the grid will go to Bitcoin mining instead.”

Again, Bitcoin does not displace other energy use. Other energy use displaces Bitcoin. The idea that Bitcoin is stealing energy from society is a misconception and for someone who has been engaged full time in the conversation for seven years it seems pretty disingenuous.

Our next expert is MIT professor Roberto Rigobon:

Bitcoin’s approach to mining “is a very bad system where competition to overuse energy determines the winner,” [Roberto Rigobon] said. But, “this is purely a Bitcoin issue, not a cryptocurrency issue.”

Would it be interesting to know that in addition to his work at MIT Professor Rigobon is also the Chief Economics Advisor for Context Labs? Context Labs is an enterprise blockchain services company that markets itself as offering more ESG/sustainable blockchain tech. The author of this article didn’t have a chance to mention it.

The article goes on to make a broad reference to proof-of-stake on Ethereum, a few quotes from public companies and then ends with this quote:

If things get too hot, de Vries said, some governments may choose to just pull the plug … the key, de Vries said, is “making the community realize this is something we need to address.”

Mr. de Vries confidently asserts that something must be done but without specifying what must be done or why or what would happen as a result.

So let’s summarize. The article opens and closes with blanket assertions about how Bitcoin is bad and must be stopped. Both the experts that it presents as neutral have made a profession out of Bitcoin skepticism, and neither conflicts of interest were mentioned. No pro-Bitcoin sources were interviewed. A variety of the claims made in the article are dubious, obviously wrong or at times even internally contradictory. Then that mess of confusion is used as the foundation to argue that public companies that own Bitcoin are ethically compromised.

This is a bad-faith argument. It is constructed to alarm the reader, not to inform them. Be skeptical of sources that make a business out of being Very Concerned Online. They probably don’t have an anti-Bitcoin agenda, but they do have a natural incentive to create controversy they know will drive pageviews they can ultimately sell to advertisers. There will always be a cottage industry in generating alarm and harvesting the resulting attention for ad revenue.

Unfortunately I have not yet seen an article that expressed both genuine curiosity about Bitcoin and genuine concern about its environmental implications. If anyone knows of one, please share it in the comments - I would love to read it.

Other things happening right now:

It is hard to predict the future, so a lot of the times people try it they end up sounding dumb. On the other hand, Amazon Stock dropped ~95% in the two years following this clip, so they didn’t sound dumb for quite a while.

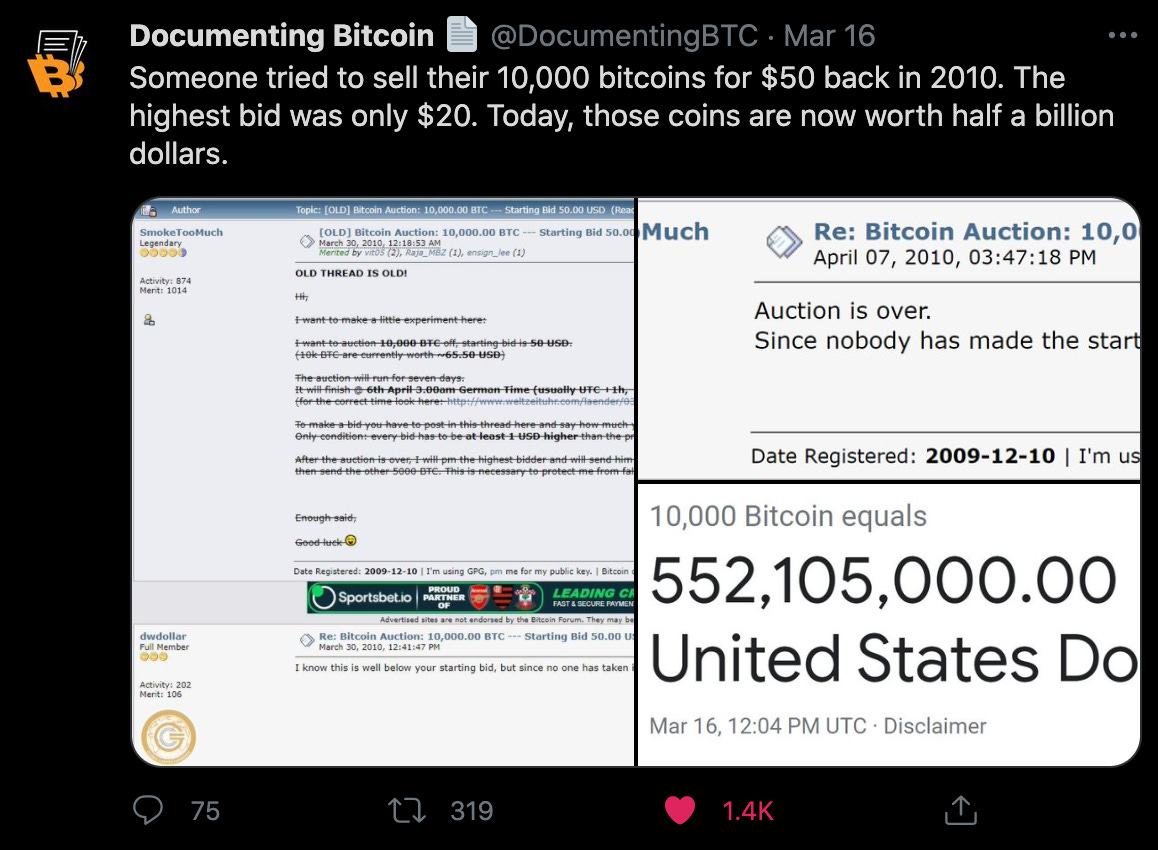

Here’s a great deal if you happen to have $50 and a time machine: