This post has >$76M worth of art

And the words in it are pretty good, too.

In this issue:

NFTs are some of the world’s most valuable art

Systemic Risk and the Grayscale Premium

What happens when the block reward runs out? (reader submitted)

NFTs are some of the world’s most valuable art

Yesterday CryptoPunk #7804 (one of the nine alien CryptoPunks) sold for ~$7.5M making it briefly the most valuable digital art ever sold.

It held the title of most valuable digital art for around 12 hours or so until the Christie’s auction for Beeple’s first 5000 everydays closed at $69M. That sale officially making it the third most valuable piece of art ever sold by a living artist, after David Hockney’s Portrait of an Artist (Pool with two figures) at $90.3M and Jeff Koons’ Rabbit at $91.1M.

There is a token called B20 that represents fractionalized ownership of twenty previous beeple works. Interestingly, it does not seem to have responded especially to the news of his record-breaking sale. Here is the 7 day price action:

Maybe the market hasn’t responded yet - or maybe people place less value on owning a tiny fraction of a concept than they do on owning a concept in its entirety?

Systemic Risk and the Grayscale Premium

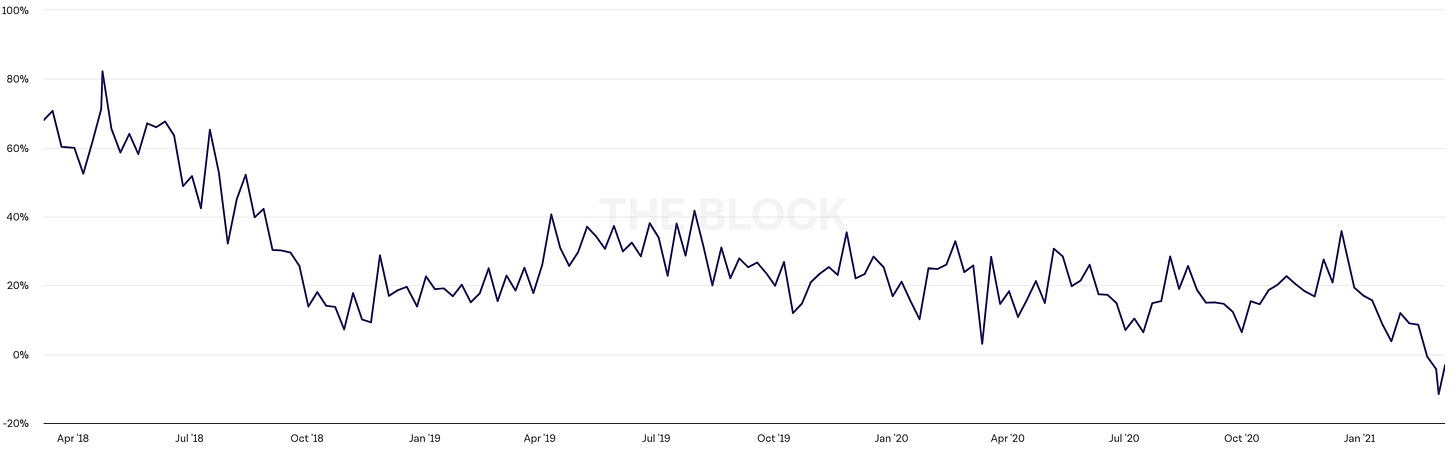

Grayscale is the company behind GBTC, a Bitcoin investment fund that was (until recently) one of the only ways for institutions to get exposure to Bitcoin without having to hold Bitcoin directly. As a result a lot of institutions were willing to pay a premium for shares of GBTC because they had no other options. Towards the end of January we talked about how that premium was likely going away.

With the launch of a Canadian Bitcoin ETF and MicroStrategy offering indirect exposure because of their strategy there is more competitive pressure on GBTC and the premiums have dropped to an all time low of -15%.

In response Grayscale has halted new new deposits and announced a buyback for 250M shares of Grayscale, ~$12.5B worth at today’s prices. They’ve also opened up job listings for nine different ETF-related compliance positions, so it seems clear they are attempting the pivot. Given their existing history of having served the market for institutional Bitcoin exposure they probably have a decent chance of being the first or among the first Bitcoin ETFs approved by the SEC. But if they aren’t the consequences for their business will likely be dire.

The GBTC premium has been so large for so long that it has created a downstream ecosystem of businesses that cropped up to arbitrage it by borrowing Bitcoin, depositing it with GBTC to collect shares and then selling the shares to collect the premium and repurchase the raw Bitcoin to repay their loans. The trouble is that there is a six month lock-up period between creating shares and being allowed to sell them - so many of these businesses are trapped in this arbitrage even though the premium is evaporating and if the premium remains negative when they are able to sell they will have to take a loss to repay the Bitcoin (plus interest) that they owe.

If some or all of the larger businesses that have been harvesting this premium are forced into bankruptcy they will end up liquidating their BTC and GBTC, hammering the market and possibly even causing a margin cascade. BlockFi, one of the largest companies offering Bitcoin-denominated interest, has halted new signups:

Keep an eye on BlockFi - it will likely be a canary in the coal mine for whether GBTC leverage poses a systemic risk to the rest of the market.

What happens when the block reward runs out?

“So far in Bitcoin’s history the price has gone up faster than the block reward has gone down, but the block reward doesn’t go on forever. When the block rewards run out, what happens to the integrity of the system?” - IS

Nobody knows! The block reward is one of two parts of the payment to miners every time they create a new block to add to the blockchain - the other part is transaction fees paid by users. The block reward does two things: it bootstrapped security for the network by paying miners before transaction fees started to emerge and it distributed new coins in an equitable manner so that anyone could get some (at least at first).

When Bitcoin launched the block reward was 50 btc/block but every four years the reward is cut in half - it is currently 6.25 btc/block. When all 21M Bitcoin have been created the block reward will dwindle down to nothing - sometime well after 2100 by current trajectories. What happens then is something we can only conjecture about now, but there are a few basic possibilities:

The Optimistic Scenario

As the block reward diminishes transaction fees rise to replace it and mining revenue remains high or perhaps even grows. Everything more or less works as intended and we all go out for ice cream sundaes.The Pessimistic Scenario

If transaction fees never grow to replace the block reward the amount of mining securing the network will drop as well. The value of mining is a natural cap on the value of the network, because if the value grows too high relative to the fees it will be more profitable to attack the network than defend it. In this world Bitcoin may shrink to accommodate lower security limits or it may just fail entirely.The Nation State Scenario

Today the majority of Bitcoin mining is done by profit-minded businesses, but that doesn’t necessarily have to be the case. In a world where Bitcoin has enough traction to be considered a reserve asset by central banks nations might decide to mine Bitcoin not for the rewards but to ensure access to the network, the way they cultivate domestic steel industries for national security purposes. In that case Bitcoin would be protected even if mining wasn’t profitable.The Eternal Subsidy Scenario

Some people believe that after hitting Scenario 2 (where the network struggles and begins to fail from a shortage of fees) that the Bitcoin community will collectively fork to a version of Bitcoin that maintains the block reward forever - breaking the 21M Bitcoin supply constraint but returning to the era of subsidized mining. I find that scenario difficult to envision but it is definitely one that some people are anticipating.

Transaction fees have already started to contribute noticeably to miner revenue and we have roughly a century left of block rewards to build up momentum before we need to achieve liftoff, so I’m overall not super worried about this scenario.

Other things happening right now:

In the early days of crypto Max Keiser gave Alex Jones 10,000 bitcoin - worth ~$570M at time of writing. Jones lost the laptop. That’s a shame because laptops are expensive. If he had ~$570M he could afford to replace it.