Hell hath no fury like a furry

Plus prices go down, you can't explain that

In this issue:

Prices go down and no one likes it

You wouldn’t right click an NFT

Sorry no you will not buy the Constitution today

Prices go down and nobody likes it

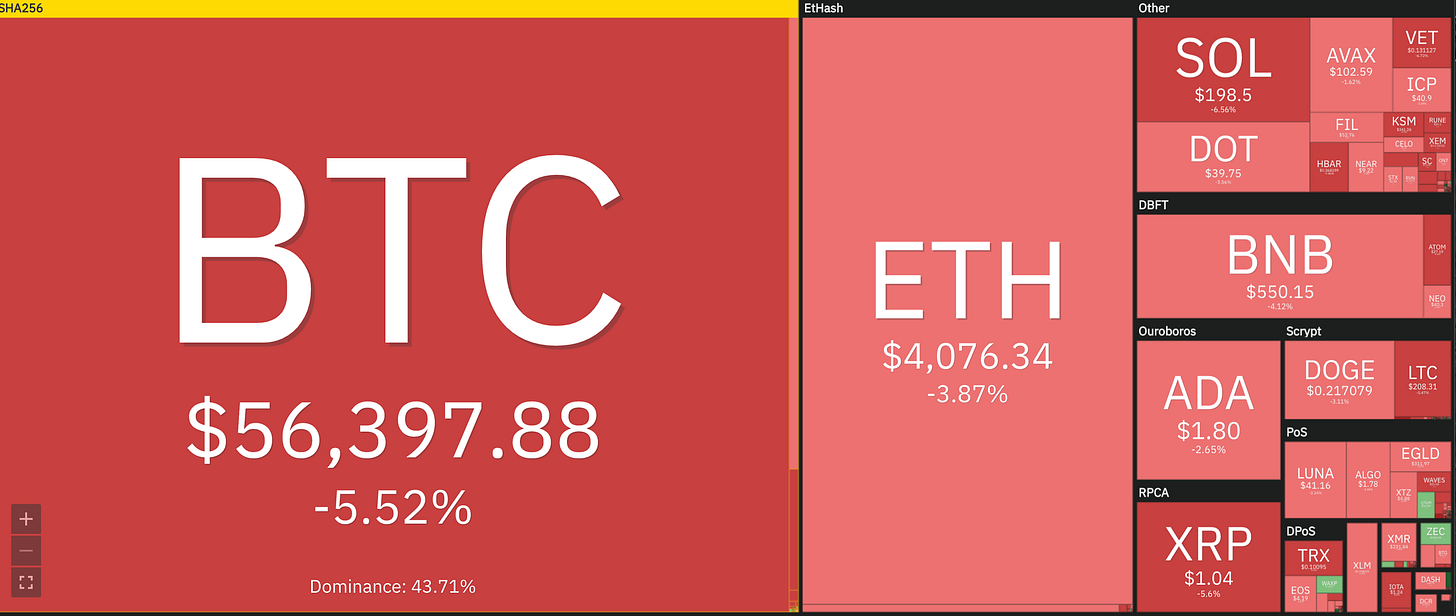

Bitcoin’s price dropped this week to a low of ~$55k/BTC, ~20% down from the recent high of ~$69k/BTC. At time of writing the price of Bitcoin is ~$56k/BTC. It would be nice to lead today’s issue with some satisfying explanation of Bitcoin’s price action, but I don’t have a compelling candidate.

Mt. Gox has announced "final and binding" plans that have restarted rumors they are about to sell the ~$9B worth of Bitcoin they’ve held since their bankruptcy to begin compensating victims. At smaller scale but with greater certainty the U.S. Government is planning to start liquidating ~$56M worth of bitcoin seized from the Bitconnect fraud also to compensate victims. Craig Wright’s clown-show of a trial is taking place in Miami. These are all more things that are happening than reasons for the market to have moved.

As we’ve talked about before, volatility is part of owning Bitcoin. That’s why it’s important to never own more than you can afford to lose.

You wouldn’t right click an NFT

Non-fungible tokens (NFTs) are easily the best and most fascinating thing to have emerged from cryptocurrency aside from Bitcoin itself. The basic idea of an NFT is deceptively simple - an NFT is just a unique token that represents ownership of something - like a deed or a certificate of authenticity. If you’re not already familiar with NFTs you can read more about them here and here.1

NFTs themselves are simple (they are just tradable, digital receipts) but the concept of ownership is not simple at all and in a way the simplicity of NFTs forces us to confront more directly the strangeness of ownership itself. NFTs are confusing and illogical because our feelings about ownership are confusing and illogical. It isn’t really NFTs that are complicated — it’s us.

Ownership is controversial and cryptocurrency is controversial and so NFTs are also controversial. A week and a half or so ago co-founder and CEO of Discord Jason Citron hinted at an upcoming integration of NFTs into their chat product:

That wasn’t a terribly surprising direction to explore given how active the NFT community is on Discord and Twitter’s announced plans to launch a similar feature. The backlash was pretty striking, though — here’s a typical response:

Take note of the profile picture on this tweet for later. The environmental critique of NFTs is understandable but misguided — if you are interested in the implications of proof-of-work mining for the environment I wrote about them here, here and here and I also wrote about why proof-of-stake will not save us. I personally think the environmental costs of cryptocurrency are often overstated, but whatever you think about those costs blaming NFTs for them is a category error.

The two largest proof-of-work mining networks are Bitcoin (which has no native NFTs)2 and Ethereum (where transaction fees are only ~15% of miner revenue and NFT fees are dwarfed by fees from DeFi trading). Miner revenue (and hence the amount of mining) does not depend on the value or success of NFTs. It depends on the value of Bitcoin and/or Ethereum. If anything most NFTs trade against ETH and hence compete with it for value. To the extent that NFTs capture value that would otherwise have gone into ETH, miners are less well compensated.

That kind of nuance did not reach the discussion above unfortunately and a day or two later Citron realized that, no wait, they would never ship anything like this because actually everyone at Discord is super concerned about crypto, y’all:

OK look there’s no easy way to say this but one of the main groups who were outraged by this potential feature was furries. Two things I did not realize prior to researching this story were that furries as a community (a) love Discord and (b) hate NFTs.3

When Discord teased the possibility of native NFT integration the NFT community was elated. When they walked it back a day later the NFT community was … less elated. The result was a few days of bickering between frog-avatars and anime-fox avatars that ultimately culminated in this piece by NFT influencer VincentVanDough, titled Right Click Save This:

VVD sold the corresponding NFT for Right Click Save This for ~20 ETH (~$94k at the time) which obviously infuriated the people whose profile pictures were used. To add insult to injury VVD offered $5k to anyone who could prove an image used in Right Click Save This actually belonged to them — so far no one has claimed the offer.

The images in Right Click Save This were stolen but for the most part it appears they were stolen from people who had stolen them already. Even though it is satire the NFT for Right Click Save This is the best provenance of ownership that body of images actually has.

Some of the artists whose images were used filed DCMA notices against the various major NFT platforms like OpenSea and Foundation, but it it’s not clear that it matters. Partially that’s because Right Click Save This is probably fair artistic use and will likely end up restored when the DCMA disputes settle. Partially that’s because there are already independent hosts that support displaying or trading the work. But mostly it’s because the point has already been made.

NFTs matter even to people who hate NFTs.

Other things happening right now:

The Swedish Environmental Protection Agency recently put out a statement arguing that Bitcoin mining would consume all available renewable energy and threaten to undermine the country’s commitments in the Paris Climate Accord. In response Sweden’s largest renewable energy producer (also a government agency) then put out their own statement: no, that’s ridiculous. Bitcoin serves as a buffer and a load balancer for the renewable power grid. It is an asset of renewable energy, not an enemy.

Enjoy this heated description of the (significant) technical shortcomings of the Binance Smart Chain. At time of writing BSC is the third largest cryptocurrency with a marketcap of ~$92B. Here is a view of the development activity level recently. BSC investors may not be in it for the tech …

@ConstitutionDAO (which we talked about last issue) successfully raised over $40M to buy the U.S. Constitution but in the end lost out to the cunning strategy of spending $43M. I guess the lesson is maybe don’t plan your auction strategy out in public? It takes some of the mystery out of it. Anyway once again a wealthy individual buys the government away from the people something something metaphor doomed to repeat history.

I even did a (poorly edited) TikTok about NFTs once! Feel free to like and subscribe just in case I ever do a TikTok again. My editing will surely improve!

There are some platforms built on Bitcoin that do allow NFTs (Lightning, Counterparty, Stacks, etc) but that’s not quite the same thing and so far is a vastly smaller market.

I’m not going to attempt a psychological analysis of why furries hate NFTs but I will say it’s probably because of how Lindsay Lohan sold a fursona NFT with no ears.