Deep Dive: Bitcoin and the Environment

Bitcoin uses a lot of energy because it is solving a big problem - but it is not as dire for the environment as critics would like you to believe.

In this issue:

Critics of Bitcoin frequently point to the large and rising energy requirements for Bitcoin mining and make the argument that using or owning Bitcoin is unethical because of the environmental impact - but they often make bad faith and poorly informed arguments that show little interest in understanding Bitcoin. Here we explore Bitcoin’s impact on the environment and how to reason about it.

Will Bitcoin doom the planet?

How much energy does Bitcoin use?

How much energy will Bitcoin use?

What is Bitcoin doing to the energy market?

Bitcoin is not Visa, Visa is not Bitcoin

Don’t feed the concern trolls

Is Bitcoin going to doom the planet?

“Can you do a newsletter about BTC and the planet?” - MH

Sure, happy to revisit! There is a seemingly inexhaustible supply of thought pieces, editorials and tweetstorms about how Bitcoin is an environmental catastrophe and using, owning or supporting it is ethically bankrupt. These arguments are made in bad faith from a position of limited understanding and no curiosity. Bitcoin uses a lot of energy, but its impact on the energy market is a lot more complicated and interesting than just "uses energy."

Let’s explore!

How much energy does Bitcoin use?

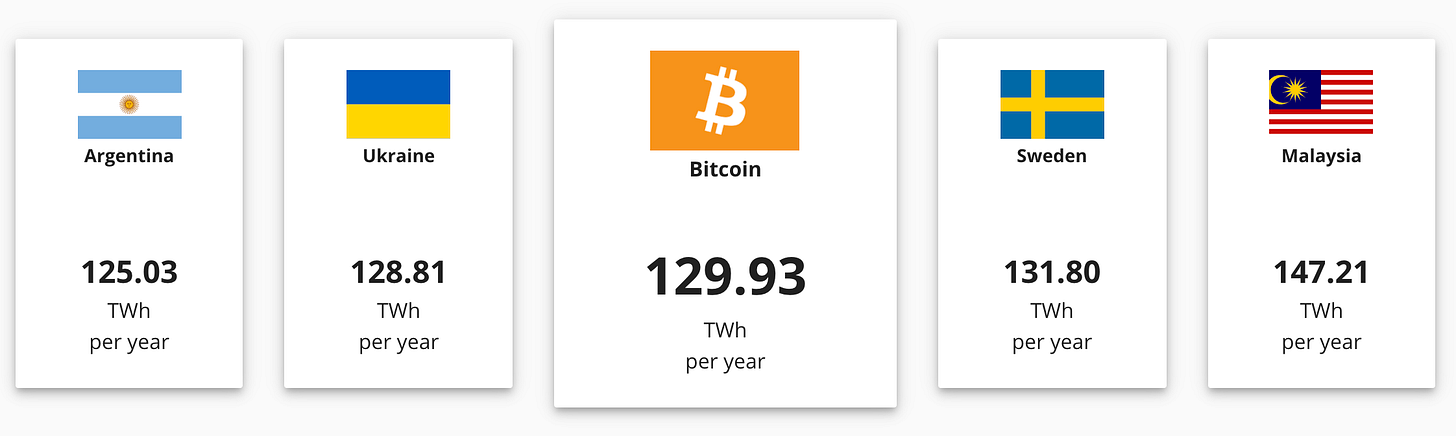

We first discussed Bitcoin’s energy use in our deep dive on Bitcoin mining back in January. If you are curious about why Bitcoin uses so much energy, I recommend starting there. Because Bitcoin does use a lot of energy - at time of writing Cambridge University estimated Bitcoin was using ~0.5% of the world’s energy, slightly more than the Ukraine and slightly less than Sweden.

So lets be clear - that is a lot of energy! But let’s try and contextualize it a little. The US EIA estimates that American households collectively use ~3,516 TWh/year. According to the National Academy of Science televisions consume ~4% of the energy of a typical American household. So collectively American televisions account for roughly ~140 TWh/year, about ~17% more than Bitcoin. Consider that the next time you see a television clip of someone worrying about Bitcoin energy use.

How much energy will Bitcoin use?

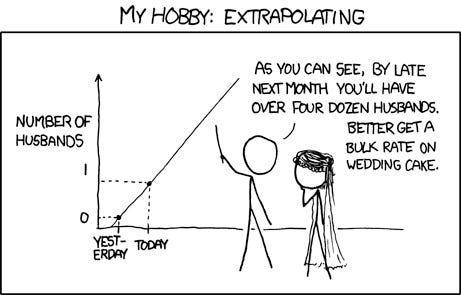

The next argument tends to look like this:

XKCD has a helpful comic on the dangers of extrapolating:

Bitcoin’s energy use is determined by how valuable mining is, which you can model with this simple equation:

BTC Energy Footprint = BTC Price * (Block Reward + Fees)

So Mr. Danger is correct that as price goes up mining becomes more valuable and Bitcoin consumes more energy - but that’s not the only thing that is happening. The block reward is also falling and will eventually be zero. In effect Bitcoin’s security (and hence its energy use) is heavily subsidized today by the creation of new bitcoin. When the supply runs out, only transaction fees will remain.

We don’t really know what long term transaction fees will look - they might replace the block reward or they might not. There is plenty of room to believe that Bitcoin’s energy use may go down after the block reward peters out. One of the very real risks is there won’t be enough security!

What is Bitcoin doing to the energy market?

It’s complicated. Bitcoin mining needs a lot of energy, but it specifically needs cheap energy. In fact most of what Bitcoin miners compete on is price of electricity. Bitcoin is more like a scavenger than a predator - it only wants to use the scraps of energy no one else will pay for.

Making efficient use of energy is hard. It is much cheaper to produce energy than it is to store or transport it and energy demand is spiky and unpredictable so it is tough to know where/when it will be needed. The result is that most power networks are over-provisioned - ready for peak capacity at any time even though much of that energy will be wasted. Basically it’s hard to know exactly when you’ll turn on your television so they run the power plant all day just in case.†

[Editor’s note: As a reader pointed out, this is an unfairly glib characterization of the power system. There are failure modes for underconsumption and a lot of effort is put into trying to match supply and demand as best they can - it’s definitely not max power all the time. Energy demand is spiky second-over-second however, so the broader point that mismatch between production and demand creates was is still applicable. But it’s more nuanced than I made it seem here. You can learn more here, thanks to the reader for the link!]

A lot of Bitcoin’s energy comes from this kind of excess capacity: one of the main reasons that Bitcoin mining is so prominent in China is because the Chinese government heavily subsidized the growth of hydroelectric and coal power infrastructure, creating a surplus of energy the market didn’t need yet.

Another great example of this kind of energy use is gas venting. Oil miners often produce natural gas as a byproduct too far from energy markets for it to be profitable to sell. In the past these vents would be burned rather than put to any productive use - but now portable Bitcoin mining centers are appearing and taking advantage of the stranded energy while also reducing the environmental impact:

Bitcoin actually subsidizes unpredictable forms of energy production like solar and wind because it acts like a buyer of last resort for energy produced at off-market hours. That’s why Norwegian energy conglomerate Aker just launched Seetee (a Bitcoin focused investment company) as part of their broader renewable strategy.

The same Cambridge University that estimated Bitcoin’s total energy usage above also estimates that 39% of Bitcoin’s energy use is renewable and 76% of Bitcoin miners are using some mix of renewable energy. By its nature Bitcoin automatically seeks out and consumes the most efficient energy production possible - by doing so it effectively subsidizes the most efficient energy producers.

So it is easy to see that Bitcoin uses a lot of energy, but it is much harder to know how much of that energy would have been wasted anyway and how much Bitcoin is functionally investing in cleaner forms of energy. This kind of nuance is often lost in the pearl-clutching about Bitcoin’s energy use.

That’s because arguments about Bitcoin’s energy use are usually made in bad faith.

Bitcoin is not Visa, Visa is not Bitcoin

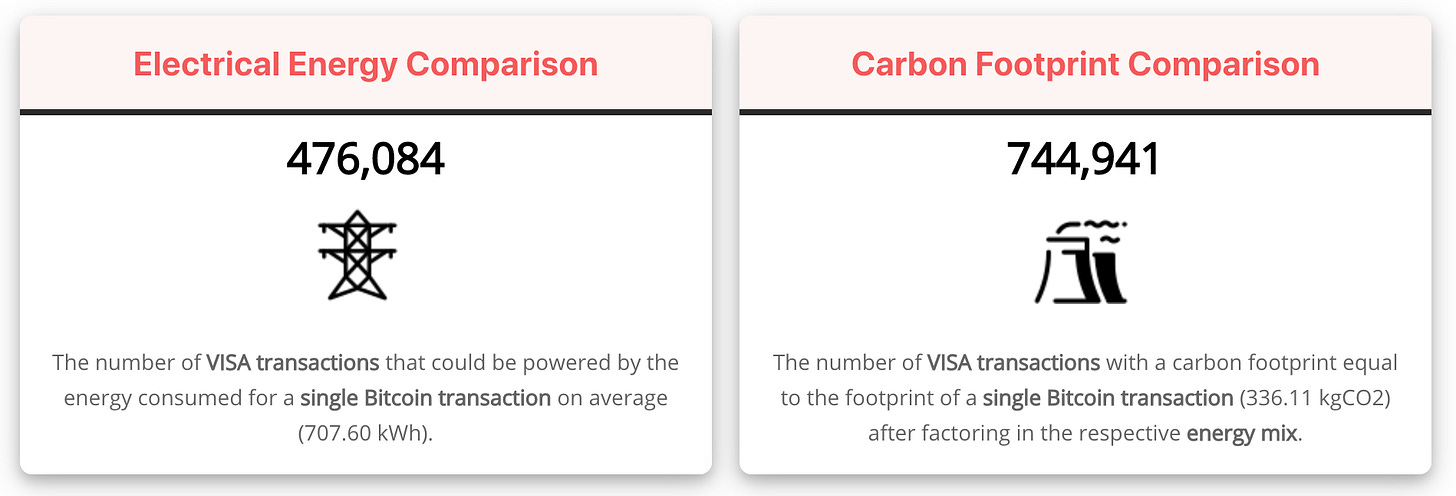

Bad comparisons abound in this debate. The worst and most frustrating one is this sloppy comparison to Visa first popularized by the Digiconomist blog and cited widely by credulous journalists excited about clickbait potential.

This comparison feels very salient but a cursory knowledge of Bitcoin would show why it is not a good one. Transactions on Bitcoin are not like transactions on Visa.

Visa transactions are each a single payment but Bitcoin transactions can (and often do) bundle literally hundreds of payments into a single transaction. Transactions could also be opening or closing a channel on a Layer 2 system like Lightning that would enable unlimited transactions, or they could be between exchanges and represent settlements between an arbitrarily large number of user trades. Comparing Visa and Bitcoin transactions 1:1 would have been ignorant when the website first launched - at this point it is pretty clearly disingenuous.

Even beyond transactions comparing Bitcoin to Visa is a misunderstanding of the problem that Bitcoin is intended to solve. Bitcoin is not a payment system, it is a sovereign monetary policy and settlement network. Visa depends on SWIFT, Fedwire, ACH, the Federal Reserve and ultimately the USD itself to function - and each of those layers take energy to operate. A fair comparison would need to account for all of it - including some share of the energy footprint of the US Military.

But fair comparisons are often not really the point.

Don’t feed the concern trolls

You are much more likely to see Bitcoin skeptics raise environmental concerns than you are to see environmentalists raise Bitcoin concerns. If you search for "Greta Thunberg Bitcoin" you will see headlines like "Here’s why Greta Thunberg might not be a fan of Bitcoin" but you won’t actually see any comments from Greta Thunberg because she doesn’t care about Bitcoin.

If you actually care about energy use and the environment then arguing for a line-item veto of particular human behavior is a distracting waste of time. Total energy use by humanity is always going to go up - the real opportunity is to improve energy production, not to police energy use.

So people who warn about the grave environmental dangers of Bitcoin are simultaneously telling you they don’t like Bitcoin but also that they don’t really care that much about the environment.

Sometimes these declarations are just a pure content engagement strategy, not unlike the political demagogues who deliberately court controversy by tweeting incendiary things knowing the 'debate' that ensues in their comments will boost their visibility to Twitter’s algorithms. The Bitcoin community is noisy and argumentative and all too easy to bait.

Other times it may come from a kind of post-hoc rationalization about past decisions not to invest. The longer that Bitcoin continues to exist and rise in price, the stronger the urge must be to reframe those past choices not as a missed opportunity but as a resisted temptation, a moral test they passed and others were failing.

In a way Bitcoin is actually a kind of moral test - one of humility. Bitcoin is so deeply counterintuitive that almost everyone rejects it at first before eventually realizing why they were wrong. It took around three years from when I first heard about Bitcoin and laughed at it to when I finally started to understand. But those with a willingness to keep learning about Bitcoin eventually come to understand why it is valuable.

The best time to buy Bitcoin was many years ago. The second best time is today.

Other resources:

Nic Carter has three very thoughtful essays about the Bitcoin Energy Debate:

This is a good collection of a lot of essays on the subject