Deep dive: Bitcoin Mining

How large is Bitcoin's energy footprint, and should we be concerned about it?

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

How much energy does (and will) Bitcoin consume? (reader submitted)

What kind of effect does Bitcoin have on the energy market?

“I would love to hear your thoughts about Bitcoin’s energy usage - both now and in the future. That concern definitely hurts my ability to be long.” - BB

Definitely. Let’s talk about energy. First …

What is Bitcoin mining and why does it use so much electricity?

Mining is a complex topic and it would be hard to do it justice here - probably it merits its own deep dive issue at some point. But loosely speaking what Bitcoin miners are doing is packaging up unconfirmed transactions into a block along with some metadata and proposing it to the network as a potential update to the blockchain. If the miner’s block is accepted by the network then they will receive the block reward (currently 6.25 btc) and any transaction fees for transactions they included. All miners are racing to try and be the first one to create a new block and claim that reward.

Just like sending/receiving Bitcoin, mining Bitcoin is anonymous and permissionless. Anyone can mine Bitcoin and no one can stop you. To make sure miners stay honest Satoshi added one more step to the Bitcoin mining process: Proof of Work. In addition to validating the transactions in a block miners must also prove that they solved a pointlessly difficult math puzzle involving a one-way hash. The important thing about a one-way hash is that it is easy to verify if you have a solution but the only way to find a solution is blind guess-and-check. That is what Bitcoin miners are actually doing: frantically scratching off digital lottery tickets looking for winning numbers.

Miners call each guess for one of these puzzles a 'hash' and measure the strength of a mining operation in 'hashpower' - i.e. # of guesses per second. When more computers start mining on the network total hashpower goes up and valid blocks are found faster. To balance that out, the network automatically scales the difficulty of the puzzle up until the network is solving for new blocks approximately every ~ten minutes. That guarantees that new Bitcoin are being mined at a predictable rate even as the mining network grows in unpredictable ways.

Here is a long but exceedingly thoughtful description of how this actually works:

Now you might reasonably be asking “What is the point of making something pointlessly expensive?” and that is a fair question. The answer is that by forcing miners to sacrifice real resources (electricity and computing power) and paying them back in bitcoin the network is basically forcing them to buy bitcoin from a decentralized auction priced in electricity. Bitcoin compels miners to act in the best interest of Bitcoin users by making sure they are Bitcoin users. If they damage the network, they will damage themselves.

Hiring miners to audit the network is how Bitcoin enforces the rules without a central ruler. Paying miners in bitcoin is how it motivates them. Charging them in electricity is how it keeps them honest. This clever combination of incentives is Satoshi’s One Weird Trick. Banks hate him.

How much electricity is Bitcoin using? How much will it use?

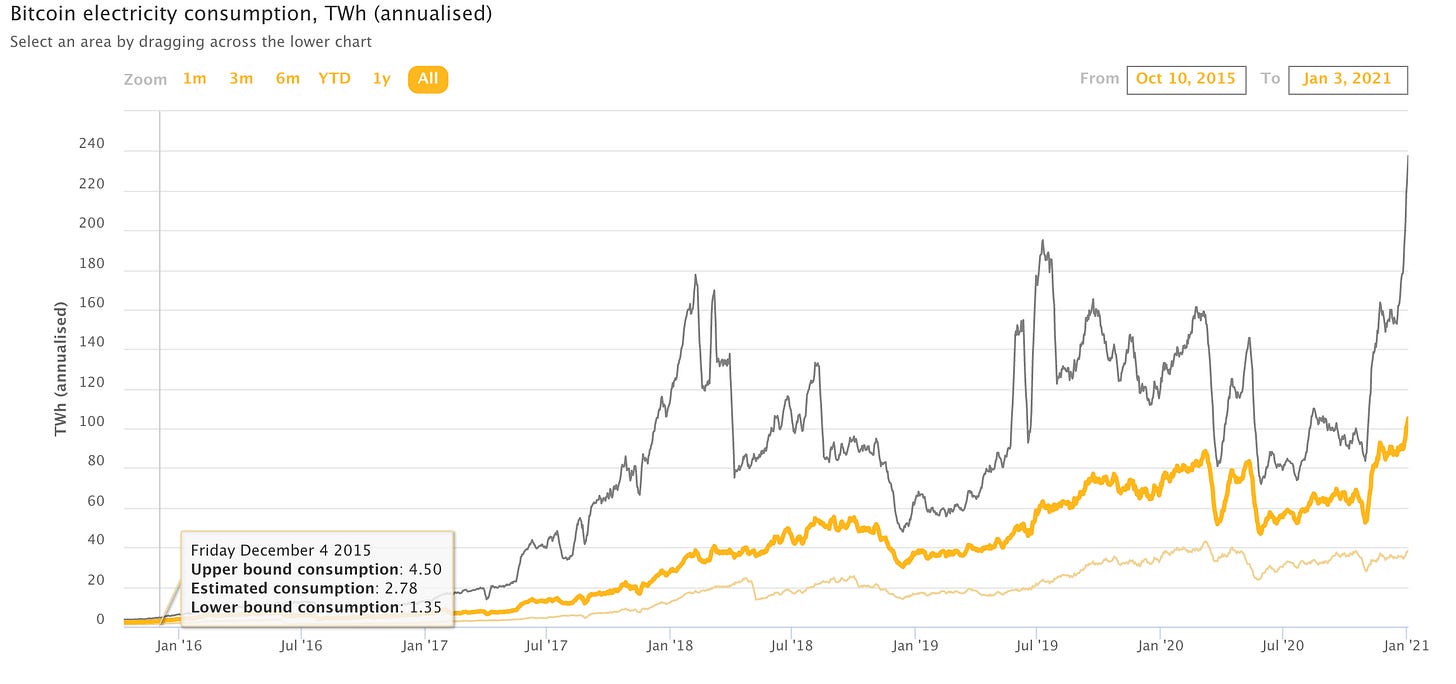

Since the mining reward is priced in Bitcoin, the rising USD value of Bitcoin has also meant an increasingly lucrative prize for Bitcoin miners. Larger rewards mean more miners with more hashpower using more electricity. It’s not really possible to measure directly since mining is anonymous but we can estimate:

To put those numbers into some context, Cambridge estimates that Bitcoin is currently using ~0.45% of total world power, about the same amount used by the Netherlands. That is … kind of a lot. And since Bitcoin’s payments to miners are denominated in bitcoin we should expect the electricity usage of Bitcoin to rise and fall with the price. If the price drops to zero Bitcoin will stop consuming energy, but if it rises in price we should expect it to consume more energy as well. If Bitcoin is always valuable the rewards for mining will always be high.

So is Bitcoin catastrophic for the environment?

Not necessarily. An interesting thing about electricity is that it is much easier and cheaper to produce than it is to transport or store. Unfortunately energy consumption is notoriously spiky and unpredictable (when exactly will you press down on your toaster?) and energy production is generally very hard to scale up or down quickly. As a result a lot of energy is actually lost or wasted because it was produced in the wrong place or at the wrong time. These problems are especially challenging for renewable energy - solar only produces energy during the day, wind and hydroelectric energy are only available in certain (often remote) geographic regions.

Bitcoin is unique among uses for energy because it is completely agnostic about where and when it is used. The Bitcoin network is a completely global 24/7 buyer of last resort - a scavenger that uses otherwise wasted electricity. That actually subsidizes unpredictable forms of energy production like solar and hydro since it gives them a productive use for their excess energy at off-market times. In 2019 CoinShares estimated ~74.1% of the Bitcoin mining network was powered by renewable energy. One particularly interesting example of that is natural gas venting:

Natural gas is a byproduct of the oil industry. When prices for natural gas are high enough the oil producers will sell it to the market. But when prices are too low for the gas to be profitable to transport the gas they don’t sell it any more. They vent it into the atmosphere where it adds to the greenhouse emission problem. As UpstreamData put it on their website:

Producers do not want to release natural gas into the atmosphere, they want to sell it to a market like they are selling their oil … [but] even high volumes of waste gas will not pay out at a measly value of $1-2 CAD/GJ when the pipeline/compressor required to get the gas to market typically cost in the high six figures.

Ohmm data centers are a clever mobile mining operation that can be brought onsite and powered by natural gas that doesn’t need to be transported. Oil manufacturers profit, Bitcoin is secured and greenhouse emissions are reduced. Win-win-win!

Can we do better than Bitcoin?

This is a problem people have been working on since the birth of Bitcoin:

I’m not going to tell you it’s impossible because at one point I would have confidently told you that Bitcoin was impossible and here we are. But I am going to say that it is very difficult and has already been attempted unsuccessfully a number of times. Probably the most well known ongoing attempt to eliminate this electricity use is the work transitioning Ethereum to a Proof-of-Stake platform, often called ETH 2.0. The Ethereum community has been working on that transition since 2014 and is relying on the same system of Proof-of-Work that Bitcoin uses in the meantime.

Personally I agree with Paul Sztorc that Nothing is Cheaper than Proof of Work. When you distribute something of value to the world (like mining rewards) you are creating an economic incentive to compete for that value. That’s kind of the whole point - to motivate auditors to enforce the rules of the network by mining, staking, etc. That competition will create work, whether you account for it on the blockchain or not. If any human behavior can influence distributed value the market will expend that amount of value pursuing it. You can obfuscate that work by driving it off-chain, but you can’t stop it from happening once you paid for it. Better to have that work be visible, measurable and close to the thermodynamic roots of the system.

So is Bitcoin’s energy use worth it?

Whether Bitcoin is wasting energy or using it is a value judgement that ultimately rests on how you feel about the service Bitcoin is providing. All monetary policies have an energy footprint the size of armies, so the scale at which Bitcoin is operating is probably to be expected. You can’t reshape the world without impacting it.

What we can say is that the nature of Bitcoin is to be unstoppable. Whether we approve of it or not, Bitcoin simply is.

Other things happening right now:

The security practices of Bitcoin businesses are improving:

Ethereum is on a tear, up ~44% in the last 48 hours to ~$1070 at time of writing. Bitcoiners be like: