Deep dive: Owning Bitcoin

plus a free tracking tool and absolutely no financial advice

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

What does it mean to own bitcoin?

What is a bitcoin actually worth? (reader submitted)

What is the best way to store your bitcoin? (reader submitted)

Tracking your bitcoin holdings discreetly (reader submitted)

How much Bitcoin should I own? (reader submitted)

What it means to hold bitcoin

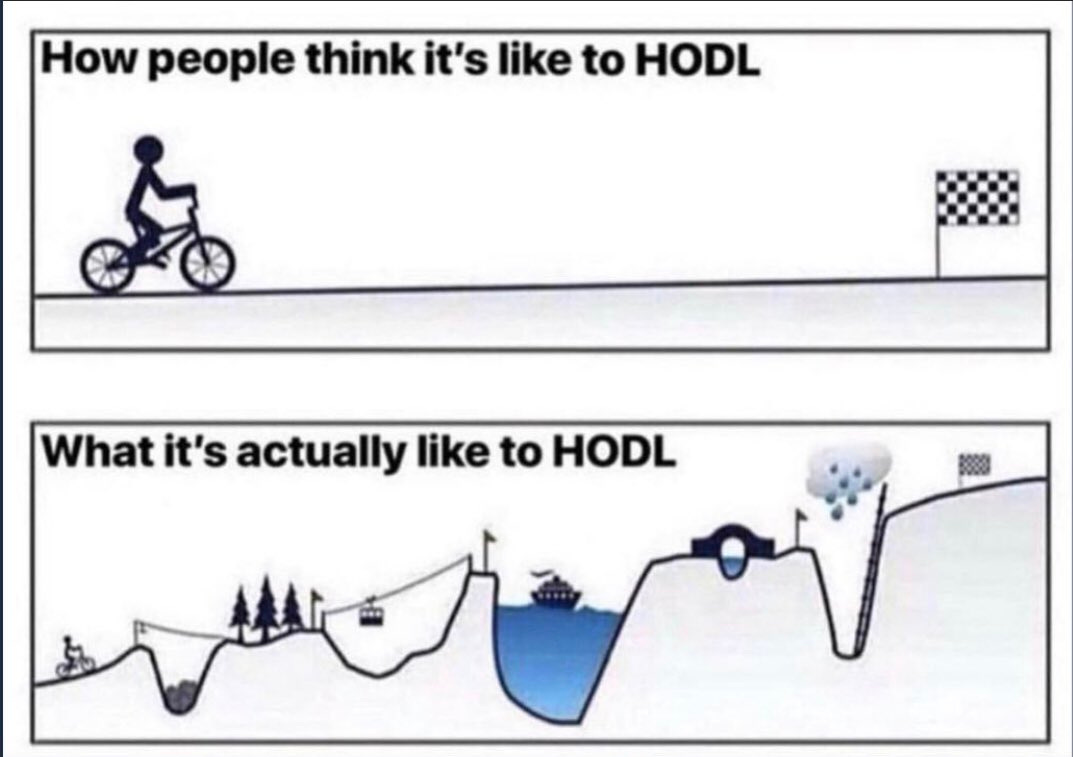

Bitcoin is mostly in the news during windows when it is rapidly appreciating and it also has over its history gained quite a lot of value so you might reasonably assume that means that Bitcoin usually goes up - but this is in fact not true. When Bitcoin does go up it goes up absurdly quickly but what it usually does is go down. Tom Lee of Fundstrat has a really good visualization of this:

Loosely speaking the experience of a Bitcoin investor for the last ~7 years or so as been that for 10 days each year they feel triumphant and smart and for the remaining 355 days they watch as their gains slowly dwindle away at ~25% per year. My point is that even though Bitcoin has served it’s investors very well it doesn’t necessarily feel that way when you’re holding it.

The Bitcoin market is also incredibly punishing to traders who are trying to time the market to buy low and sell high - you can be holding Bitcoin for almost the entire year and still be down if you happen to miss the days when the price goes on a tear. That’s why its important to never invest more than you can afford to lose. Bitcoin is scary and if you invest more than you can afford to lose you will be scared. We don’t make good financial choices when we are fearful. If the idea of the price tanking makes you nervous, you own too much bitcoin.

That’s also why I don’t recommend you buy bitcoin with an intention to sell them later at a higher price. I recommend buying the amount of Bitcoin that you want to own and then ignoring the price for a few years. If you mentally denominate your account in Bitcoin then you won’t worry about the volatile price swings up and down. But if you buy with the explicit goal of selling later for more USD your eyes will always be on the exit and you will eventually get shaken out. Instead of buying bitcoin with the intent to flip it, I recommend buying a smaller amount and making a plan to keep it.

How should you store your bitcoin?

“Do you have any best practices/recommendations on how to store your bitcoin, especially about who should keep it on exchanges vs store themselves?” -SH

I wrote a little about hardware wallets a few issues back but I haven’t covered the subject in general yet. There isn’t a universally correct answer about how to store bitcoin, but here are some thoughts that I think are useful to keep in mind:

When you withdraw your bitcoin from an exchange you are replacing counterparty risk (i.e. the risk the exchange scams you or screws up or gets hacked) with first party risk (i.e. the risk you lose your money or get robbed or hacked). I think a lot of people underestimate first party risk. There is no 'forgot my password' safety valve for Bitcoin. If you aren’t totally confident in your ability to handle bitcoin directly … maybe don’t?

Bitcoin on an exchange is like USD in a bank. Bitcoin on a device or record that you control is like gold in your house. Bitcoin on your phone or internet connected device is like cash in your wallet. You wouldn’t keep all your money in cash in your wallet, don’t keep all your bitcoin on internet connected devices. Only expose bitcoin to the internet that you are (a) ready to spend and (b) willing to lose. Otherwise use offline or 'cold' storage. My current recommendation for cold storage is CryptoSteel. I also recommend at least one and ideally two backups in different locations. If that sounds like overkill to you, consider whether the exchange is the right storage solution.

If you are storing a sizable amount of money (or the amount of money you are storing becomes sizable) then you should consider more advanced storage techniques like splitting the keys up among m-of-n multisigs . Casa is a business that specializes in providing multisignature services for Bitcoin storage. I’ve not used their product but their educational material is excellent.

You may want to consider splitting your holdings up over multiple storage strategies (some on cold storage, some on an exchange, some secured by multisig, etc) so that if one solution fails you don’t lose all your coins.

Whatever you do make sure you are transacting and storing amounts of bitcoin that you are prepared to lose, because losing bitcoin is generally part of the learning process. Do lots of small test transactions to get confident before moving or storing any meaningful amount of bitcoin.

What is a bitcoin actually worth?

“What is the 'intrinsic value' (in the monetary sense) of BTC?” -JR

Without getting too philosophical here, I am a firm believer that there is no such thing as intrinsic value. As my father often said to us growing up: everything is worth what someone will give you for it - no more and no less.

As the US Federal Reserve points out most modern currencies actually don’t have any intrinsic value. The US dollar left the gold standard domestically in 1933 and internationally in 1971. Today there is nothing backing dollars except the goods and services you can buy with them. So Bitcoin are like dollars are like yen are like anything else: they are worth what someone will give you for them. Score one for fatherly wisdom.

A more satisfying and practical answer is that pretty much everyone agrees that Bitcoin is an experiment that will eventually either fail or succeed. If it fails it will be worth $0 and if it succeeds it will be worth $MANY. In some sense you can think of owning bitcoin as a proposition bet on whether or not the Bitcoin experiment succeeds. The 'true value' of such a bet would be:

Value $BTC = $MANY * (1 - Odds Bitcoin Fails) Neither of these variables is really knowable but let’s consider them each in turn.

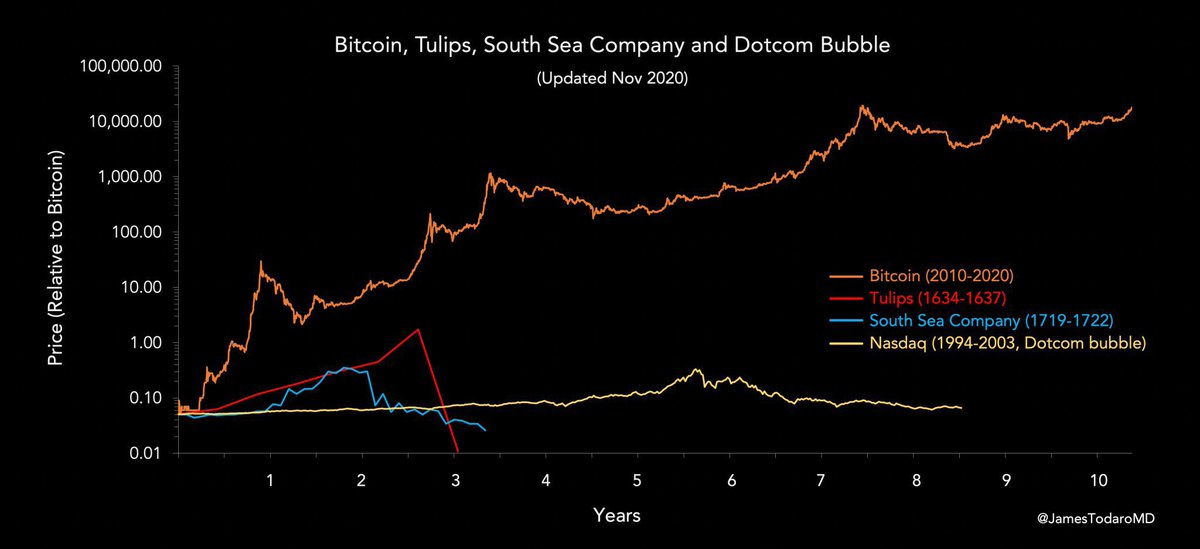

I personally think the case for 100% certainty that Bitcoin will fail, while once reasonable has become difficult to defend. Bitcoin has had 12 years of sustained growth and performance. That may not seem like a lot but remember it’s only been ~50 years since USD left the gold standard. So Bitcoin has almost ~¼ the Lindy effect that fiat currency has. That’s far from enough to call the experiment a success but I think it’s more than enough that responsible thinkers need to start planning for the possibility that Bitcoin is real. Bubbles don’t usually last twelve years.

On the other hand, I also think that it is still appropriate to have a healthy dose of skepticism about the Bitcoin experiment. We don’t know if transaction fees will eventually supplant the block reward. We don’t know if people will one day lose faith in Bitcoin. We don’t know if there are critical unobserved bugs in the code that could allow theft, loss or inflation of coins. Even the devs themselves are very cautious when they describe how fragile the Bitcoin ecosystem might be. It seems equally irresponsible to me to not account for the still quite likely possibility that Bitcoin will suddenly and dramatically drop to zero.

Estimates for $MANY are widely divergent and hotly contested. Here is a list of a number of estimates from various Bitcoin evangelists. Take with a grain of salt obviously, but even JPMorgan recently offered a long term valuation of $146,000/btc based on the thesis that Millennials will hold Bitcoin in their portfolio the way previous generations held gold.

I personally find estimating the long term value of a successful Bitcoin (i.e. $MANY) from the size of existing markets to be like estimating the amount of email using the market for physical mail. Every time I sit down to do it I end up with numbers so cartoonish that I stop bothering to do the math. Seems valuable, though.

You need less bitcoin than you think

“Do you have any advice about how much Bitcoin I should own?” - Lots of Readers

Nope! I am not a financial advisor and this newsletter is not intended to be financial advice. Everyone’s portfolio needs and risk preferences are unique. I don’t know your circumstances and I don’t want to bear responsibility for your choices.

That said, I am more than happy to help conceptualize what different amounts of Bitcoin actually mean. The numbers involved in Bitcoin are larger than we are used to as humans but astonishingly small compared to the world economy. Let’s do a thought experiment and imagine a future where Bitcoin is the world’s preferred currency and everyone in the world wants to hold bitcoin. Let’s further assume that our hypothetical future world has ~roughly similar inequality to the world as we know it today.

In our hypothetical world owning ~0.026 bitcoin would put someone in the top 1% - the top 0.1% would hold only ~0.027 bitcoin. If you own more than 0.03 bitcoin, you probably have more than you need. I gave a presentation in 2017 that goes into this in a bit more detail if you are curious:

Tracking your bitcoin holdings discreetly

“I would love to be able to incorporate my Bitcoin portfolio into financial tracking software like Mint but I don’t like the OpSec of sharing my position. Is there any tracking spreadsheet or similar that you recommend?” - KC

There are some dedicated services to tracking Bitcoin (and other crypto) holdings specifically such as Cointracker.io. To be honest if you bought from an exchange in the first place you’re probably not taking on a huge incremental OpSec risk by using a service like Mint or Cointracker. But it’s not zero risk, so it’s reasonable to want a totally sovereign solution. I cleaned up and extended my own personal tracking spreadsheet so I could share it. You can get a copy for yourself for free right here.

It is not set up to track selling Bitcoin or holding any other currencies besides Bitcoin, because those are not things that I recommend doing. But it does let you set a price for your own personal moon price and watch how the current trajectory that Bitcoin is on maps towards that threshold. Enjoy!

Other things happening right now:

Morgan Stanley now holds an ~11% stake in Microstrategy worth ~$421M. Recall from previous discussions that MSTR is effectively ~2/3rds bitcoin by value. So Morgan Stanley has effectively taken a ~$280 million position in Bitcoin.

The Economist has a very stale take begrudgingly admitting that Bitcoin has accumulated some value and simultaneously claiming 'it would be wrong to dismiss bitcoin’s [sic] surge out of hand' while also referring to it as a 'mania' and describing enthusiasts as 'basement dwelling libertarians.' 🙄

Check out this neat visualization of Bitcoin’s transaction history:

China's recent crypto ban is presumably part of a short-term strategy to stop Bitcoin competing with its current CBDC role-out. Many think China's current attitude to Bitcoin is a serious miscalculation. However, given that the Chinese mindset is essentially "control what can be controlled & destroy what can't be controlled", I'm now left wondering about China's longer-term Bitcoin strategy. Could they be contemplating a future without Bitcoin, brought about by a concerted attack using weapons based on EMP technology? Many articles have discussed diverse potential threats to Bitcoin, but so far I've not seen any evaluation of potential threats to Bitcoin resulting from a global EMP attack. Is this a real possibility?