Meme bonds are the new meme stocks

Plus which are the good websites? Asking for a friend ...

In this issue:

Meme bonds are the new meme stocks

Which are the good websites? (asking for a friend)

All your constitution are belong to Ken Griffin

Meme bonds are the new meme stocks

On Saturday El Salvadoran President Nayib Bukele strode out on stage in a backwards baseball hat and announced plans for a "Bitcoin City" in El Salvador, financed by a $1B bond affectionately known on CryptoTwitter as the 🌋 volcano bond after the country’s recent foray into volcano powered Bitcoin mining.

The bond was designed by Blockstream and will be processed by Bitfinex. It pays a coupon of ~6.5%/year — a discount relative to El Salvador’s traditional bonds which pay ~8.5%/year at similar maturity. Bukele plans to invest half the proceeds of the sale in El Salvadoran infrastructure (e.g. building an entirely new city1) and use the rest to buy bitcoin. The government will hold the bitcoin for five years then liquidate in a staggered series of sales. After the initial $500M purchase is paid back any remaining profit is split between the bond holders and the El Salvadoran government.

The structure is a bit like the Microstrategy bond offering back in June (at 6.125%) except that bondholders get to share in potential upside if Bitcoin price continues to rocket upwards. In some ways the volcano bond represents an interesting blend of the downside protection of bonds and the upside potential of crypto:

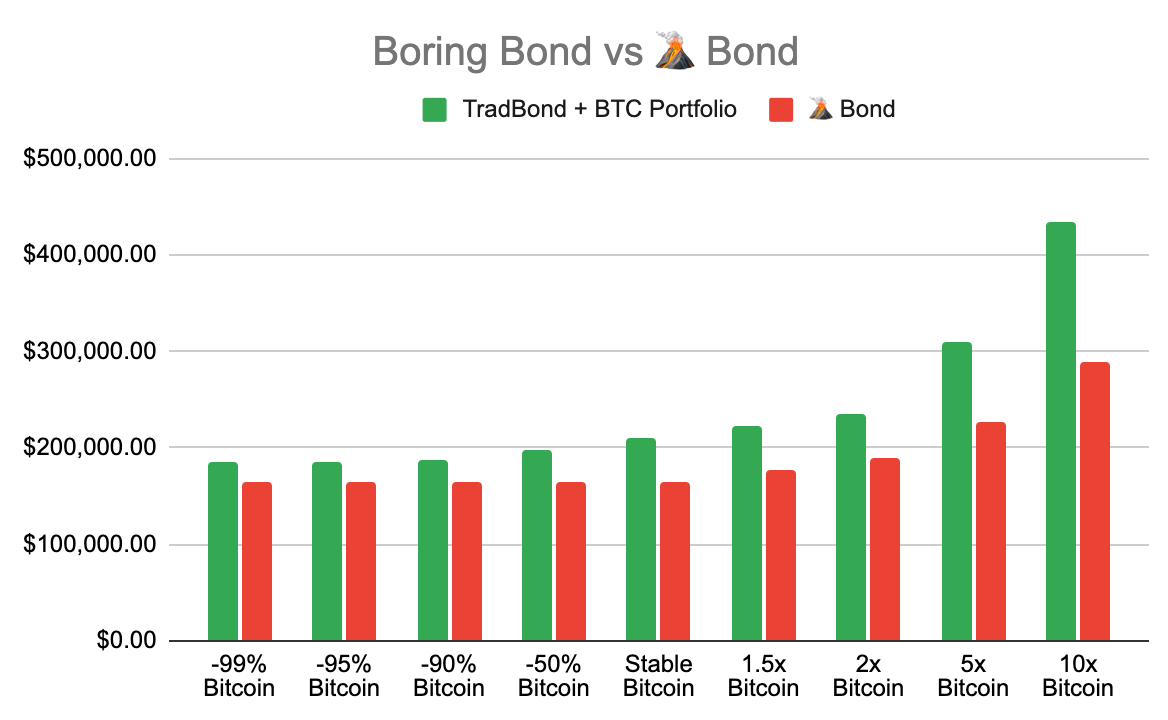

In other ways though you could also get a blend of the investment properties of El Salvadoran debt and Bitcoin by — and stay with me for this — owning a mix of Bitcoin and El Salvadoran debt. Compared to other El Salvadoran debt the volcano bond is expensive — Traditional El Salvadoran bonds have a higher coupon rate (~8.5% at similar maturity) and also trade at a discount (~$0.74 to the dollar) which means you could buy the same amount of debt for less up front investment and spend the remainder on bitcoin you kept for yourself.

I’m not going to belabor the math here but in general it is usually more profitable to own your own Bitcoin than it is to pay someone else to own it for you. No matter how you feel about the risk of El Salvadoran debt or the potential performance of Bitcoin the volcano bond is a gimmick. The people who are likely to buy it probably do not buy very many bonds.2 They want to buy a parasocial feeling of belonging from someone cool wearing a backwards baseball cap.3

Which are the good websites? (asking for a friend)

"Maybe this is a bit like asking what websites are interesting, but what is interesting and fun about web3 stuff? A lot of people seem to think this is the future of the internet. How can I experience this vision first hand? Not so much as an investment but to experience the creativity and the experimentation." — JL

That’s a good question and one I wish there was a more interesting answer to. In my opinion the right answer for most people with cryptocurrency is to buy and hold a modest amount of Bitcoin and spend the rest of their energy reading and learning. There are a lot of interesting things to do in DeFi but almost all of them amount to ways to make money do complicated parlour tricks. If you aren’t interested in them for their investment potential, they probably aren’t interesting.

One of the reasons that people say web3 is the future is because web3 is a marketing term that means all things and yet nothing — sort of like Metaverse. But the main reason people say that web3 is the future is because they think of web3 as being a sort of polite euphemism for the specific set of tokens they own and are hoping you will want to buy. Shilling your own web3 investments is low-rent and embarrassing — shilling web3 itself is thought leadership.

In terms of DeFi there are a host of places you can put your money and hope it will come back as more money. They are all very creative! Creativity abounds, actually. But they are also pretty much all variations on the theme of investment. People are also excited about DAOs but I am maybe less bullish on them? They are fun to think about but not really that fun to use, unless you really enjoy shareholder voting.

Some people treat NFTs as an investment but I think that’s a category error. Most NFT projects are fun if you find the culture they are tokenizing fun but pretty dull otherwise. There are some NFT projects that incorporate game mechanics (e.g. Zed.Run or Axie Infinity) but realistically most users are still motivated by profit. I struggle to recommend the games on their own merits. There are some cool and interesting art projects — I really like Amulets and also The Worm and hey did you know about this NFT museum exclusively for the alarmingly good looking?

Mostly I think the right answer for people at this stage in the cycle is to read a lot, invest very little and temper your expectations. A lot of the people who are telling you how much fun it is are also trying to sell you something.

Other things happening right now:

Hillary Clinton succinctly describes the bull case for Bitcoin:

Hedonic adjustment happening right before our eyes:

We talked twice recently about @ConstitutionDAO, the crowd-funding effort that raised ~$40M in a failed bid to buy an original copy of the U.S. Constitution. It turns out the winning bid was placed by Citadel CEO Ken Griffin,4 probably while twirling his mustache and tying a maiden to some train tracks. Griffin is recently most famous for his ill-fated Gamestop short. Perhaps he wanted a bit of revenge on the common man.

A story in two parts:

A heartwarming video of good Samaritans cleaning up a mess caused by excess money printing by central banks:

Presented without comment:

Insert Bitcoin Citadel joke here

It is probably just a coincidence that the bond will be made available in partial shares with a minimum purchase of only $100, much lower than typical bond offerings.

Or perhaps a literal sense of belonging — bond investors will also be granted residency in El Salvador and be on a track to citizenship. That's one advantage of the volcano bond over the blended portfolio.

Who still has not subscribed. He’s probably a reader though. Hi, Ken!