[News] Bitcoin is a perpetual motion machine

also Ethereum is choking on itself and Ken Griffin should read this newsletter

In this issue:

Bitcoin is a perpetual motion machine

Ethereum is choking on itself and BSC is ready

The first Bitcoin ETF in North America launches

Bitcoin is a perpetual motion machine

Imagine for a moment that you are a high-powered captain of industry on Wall St. You have a lot of money and you spend most of your day trying to think of places that you can put your money so it grows into more money. You are very good at it!

Unfortunately times are tough right now. Retail traders are turning the stock market into a random number generator. The Fed has driven yields in the bond market down to practically nothing. If you are going to keep adding to your yacht collection you will need to find something new to do with your money.

Now suppose one of your friends suggests this to you:

This is a neat little trade! Bitcoin has been growing rapidly, so futures have been trading at a steady premium to spot. You can buy Bitcoin and sell Bitcoin futures at the same time - that way you are simultaneously long and short, so you don’t care how the price of bitcoin changes. You can just use the bitcoin you bought in Step #1 to satisfy the futures you sold in Step #2 and collect the difference in price.

As OP points out above, you can harvest ~15% annually doing that right now on the Chicago Mercantile Exchange. If you are willing to go a bit further afield to Hong Kong based exchange FTX premiums are running an eye-popping ~40% annually. You can execute this trade entirely in dollars without needing to care about Bitcoin at all. We’ve talked about this kind of trade before - it’s called a basis trade. It seems to be getting more popular:

The thing about this trade is that it is market neutral for the person executing the trade, but it does have an effect on the market itself. During the window between when a hedge fund (or whoever) buys bitcoin on the spot market and when the future they sold matures they have to keep the bitcoin. The more people there are doing this kind of trade, the more bitcoin is locked up and effectively taken out of available supply.

The result is a self-fulfilling prophecy - optimism about the future price of bitcoin creates an arbitrage opportunity that consumes the available supply of bitcoin which causes the price to rise. Normally producers of a commodity would step up production in response to rising prices but Bitcoin’s supply is fixed and can’t be altered. Short sellers could increase the supply by borrowing, but in a post-GameStop world who is ready to expose themselves to potentially infinite losses going net short against the rising price of Bitcoin?

And what happens when all those arbitrageurs start comparing the ~15% returns on the arbitrage trade to the returns from just holding Bitcoin as it grows?

Ethereum is choking on itself and BSC is ready

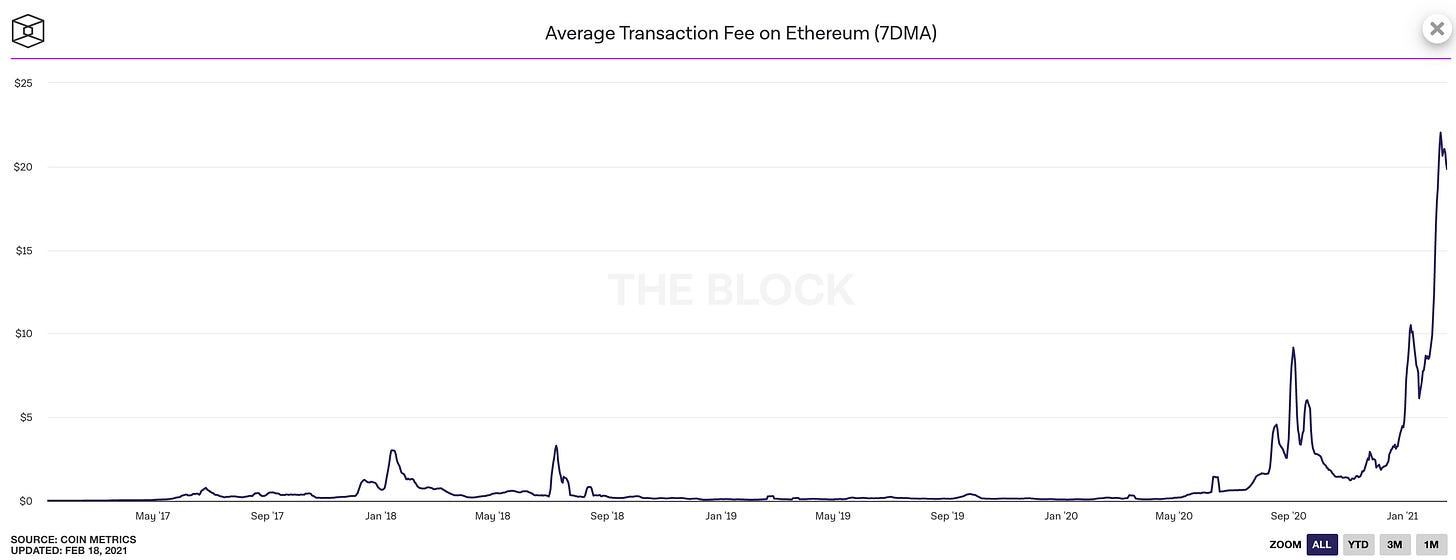

Ethereum’s transaction fees (already at all time highs) have continued to climb steeply. At time of writing they are averaging ~$20/transaction, with more complex transactions like the ones used in DeFi projects costing hundreds of dollars.

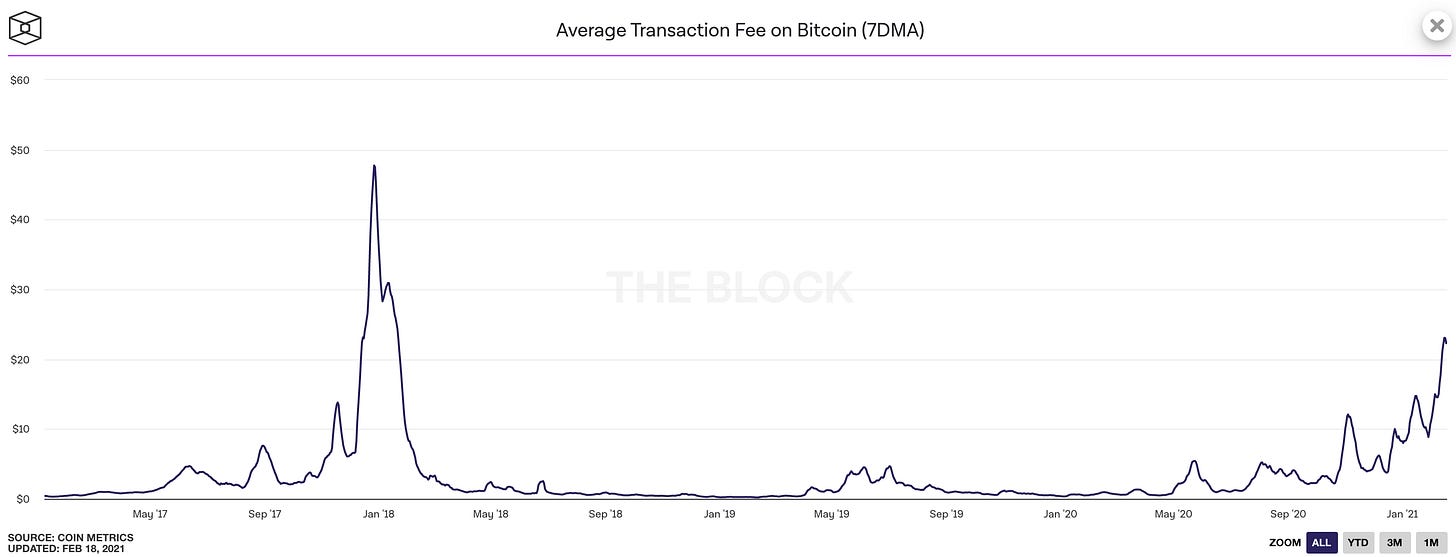

Obviously this is expensive (and therefore painful) for Ethereum users, so there is lots of frustration. Bitcoin fees have also been rising lately, although they have not yet reached the peak of the 2017 frenzy.

Back in 2017 transaction fees were actually a very heated issue in Bitcoin. Much of the dialog at the time was overtaken by the debate about whether to increase the blocksize (which would lower transaction fees) or to keep it the same size (which made it cheaper to run a full node and kept the network more decentralized).

Those who believed the key feature was cheap transactions forked the Bitcoin network and created Bitcoin Cash, an experiment in relaxing the decentralization of Bitcoin but making it much easier to scale. Here is how the market valued their attempt:

Ethereum is now at a similar crossroads where congestion is genuinely starting to price otherwise valid use cases out of the network and the community is confronting the actual cost of decentralization. This is a more complex problem for Ethereum because the value proposition of Bitcoin is simpler.

The value of Bitcoin is inseparable from the network: the only purpose of the Bitcoin network is to move bitcoin and the only way to move bitcoin is the Bitcoin network. The value proposition of Ethereum is more layered: it is meant to be a decentralized computing platform apps can run on. The only purpose of Ethereum is to run decentralized apps, but Ethereum is not the only way to run decentralized apps.

Users of Bitcoin are trying to move bitcoin. Users of Ethereum are trying to accomplish something else - selling NFTs or trading ERC-20 tokens or yield farming or whatever. Ethereum is a tool, rather than the purpose itself. That means competing with Ethereum over transaction fees is different than competing with Bitcoin.

You can fork Bitcoin’s functionality but you can’t fork its market cap - i.e. the set of people who have decided to trust and value it. Making an identical copy with cheaper fees doesn’t mean anything, because the key purpose of Bitcoin is leveraging the accumulated trust in the Bitcoin network and you can’t copy the trust.

Copies of Ethereum are a more serious competitive threat because the functionality is the purpose. Applications built on Ethereum don’t actually care about ether itself - it’s just a tool they are using to accomplish some other goal. If another blockchain can accomplish the same goal more cheaply those applications can easily migrate - or their users can migrate to competitor apps built on cheaper platforms.

Enter the Binance Smart Chain (BSC), an effort very similar to Bitcoin Cash in basic premise - it trades off on decentralization to make scalability easier. They also took special care to make it easy to migrate to BSC from Ethereum:

Without belaboring an already long post BSC has been growing very quickly. That’s not totally surprising given the transaction fees we talked about above.

I actually think the issue is even more subtle than that. The Binance Smart Chain is centrally controlled by Binance - but it does have some advantages over traditional centralized platforms. The apps that run on it can be decentralized even when the platform itself is not - so you don’t need to trust the app developers or the other users. Imagine a casino where you have to trust the casino to honor its chips but you could perfectly inspect the slot machines themselves. It’s not perfect but it’s not nothing - and its a great deal cheaper than Ethereum, at least today.

Bitcoin is trying to become money, so a casino offering tokens doesn’t really compete. Ethereum’s is trying to enable interesting new applications - so a cheaper but more centralized option like BSC creates interesting competition. How much do users value decentralization at the platform layer versus the app layer? How much are they willing to pay for base layer decentralization?

Binance has started the experiment to find out.

The first Bitcoin ETF in North America launches

The first Bitcoin exchange traded fund (ETF) in North America launched in Canada on Tuesday. Canada has historically been a leader in exchange-traded products - the first modern ETF launched on the Toronto Stock Exchange in the 90s. ETFs are interesting because they provide a very convenient channel for larger institutions like pension funds to invest in Bitcoin without needing to handle it directly.

Demand for shares of the Purpose Bitcoin ETF (ticker BTCC) turned out to be enormous. They traded $80M in the first hour, ~$170M over the course of the first day.

Typically there is a drop-off in volume on the second day of trading - but not in this case. Day #2 volumes were up ~40% to ~$350M, roughly ~7x more than GBTC, the closed-end fund that is the closest thing to a Bitcoin ETF available on American exchanges. The launch of a real ETF is good news for Bitcoin holders but probably bad news for GBTC holders.

GBTC has historically traded at a significant premium to Bitcoin in spite of having relative high fees. As we talked about back in January that premium has mostly evaporated. The launch of a real ETF (and the ones that will likely follow) means that premium is probably never returning. Going forward we might even expect GBTC to trade at a slightly trailing price reflecting the cost of its management fees. If you are curious about the details of how GBTC differs from a real ETF Greg Foss has a good explanation thread:

Canada launching an ETF will increase the pressure on the SEC to approve an ETF for American exchanges. A number of Bitcoin ETFs have applied over the years but so far the SEC has not granted approval primarily out of concern about the liquidity and reliability of Bitcoin markets.

If there is demand for Bitcoin ETFs (and the trading volume for BTCC suggests there probably is) it implies that the likely near term launch of American ETFs would be a source of significant new capital inflow into the Bitcoin market. The launch of gold ETFs is widely credited with sending the price of gold on a ten year bull run.

Other things happening right now:

Ken Griffin, CEO of Citadel, acknowledges he is under-informed. If anyone knows his email address consider subscribing him to this newsletter.

For reasons I’m not totally clear on but am still enjoying, Bitcoin Twitter has decided we should all put laser eyes on our avatars until Bitcoin reaches $100k. In an unrelated note here is an account that tracks changes in Congressional Twitter accounts:

ftxarb.com presents all the futures premiums in a neat table, useful for arb strategies.