It’s getting bullish again … 🌋

Plus please don't #MintTheCoin and why Twitter is in charge of art now

In this issue:

It’s getting bullish again … 🌋

Please don’t #MintTheCoin

Twitter is in charge of art now I’m sure it’s fine

It’s getting bullish again … 🌋

Early Friday morning the price of Bitcoin shot up abruptly from ~$43k/BTC to ~$47k/BTC (~9%) in a few hours and then continued to climb slowly throughout the day (at time of writing price is $48k/BTC):

There are any number of things that one could point to as an explanation for the movement. Transaction volume on the network is the highest it has ever been. Twitter recently started rolling out Bitcoin tipping over the Lightning Network. Fed Chairman Jerome Powell just emphasized the Fed has "no intention" of banning Bitcoin or cryptocurrencies. El Salvador has started mining Bitcoin from volcanoes.

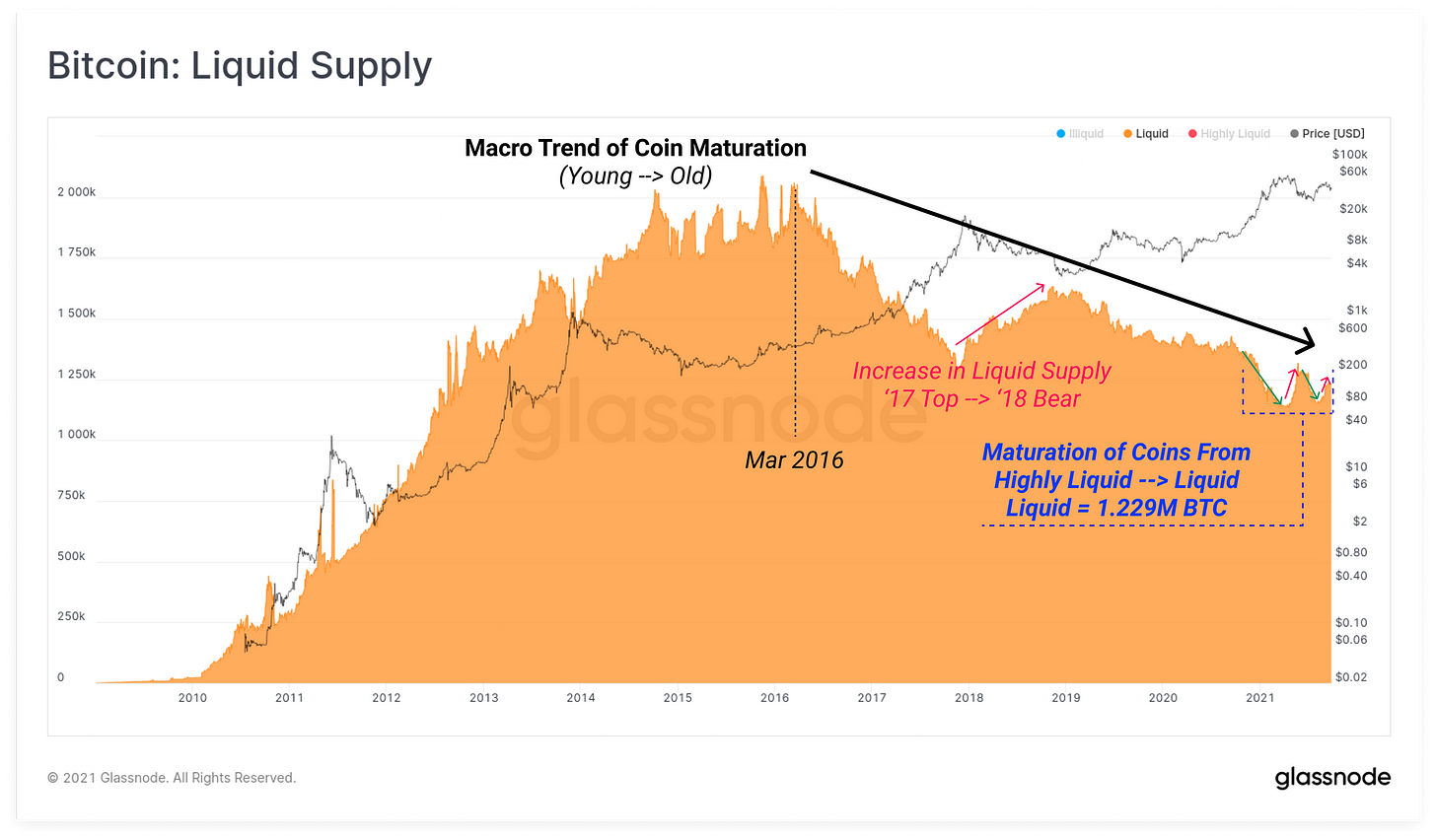

I don’t think this movement is news driven. The sales that drove down the price in the wake of the China announcement were almost exclusively from short term holders to long term holders. The liquid supply of Bitcoin (the amount held by wallets with no history or a history of selling) is the lowest it has been since 2012:

Put another way the percentage of Bitcoin supply held by wallets with a proven long term history of holding is the highest it’s ever been (~80%). The reason the price of Bitcoin is going up is simple. It’s because Bitcoin is very, very scarce and there isn’t very much of it for sale anymore.

Please don’t #MintTheCoin

In America the power to decide government spending (and borrowing) belongs to Congress and the responsibility for carrying out that spending (and borrowing) belongs to the Treasury Department. Until 1917 Congress reviewed every spending and every borrowing decision - but spending is fun and interesting and borrowing is tedious and technical, so eventually they delegated all the boring parts.

Rather than reviewing the details of borrowing plans, Congress directed the Treasury to borrow as needed to fund spending up to a certain amount - known as the debt ceiling. Reasonable people might expect that Congress would limit spending the same way it limited borrowing to fund that spending, but reasonable people are mostly not elected to Congress.

Instead the system we have arrived at is that Congress selects a debt limit, spends beyond that limit and then has a mild constitutional crisis while it decides whether to pay its bills. The most important bill it might not get around to paying is the interest on the national debt - i.e. defaulting on U.S. Treasuries. Regardless of how you feel about government spending it is not a good idea to default on the debt.

In the banking industry everyone owes things to everyone and the sturdier, safer debt acts as a kind of structural support for the riskier, more speculative bets. Riskier bets pay more so you can’t ignore them but they are also risky so you dilute them a bit by mixing in safer but less profitable investments as well. In spite of our recent congressional performance U.S. Treasuries are still regarded as some of the safest debt in the world.

In a saner timeline that would make sense - the U.S. Government can print as many dollars as it likes, it should never run out of money to pay dollar-denominated debt. Congress deciding to default would transform the safest assets in the world economy into something risky or perhaps even worthless - it would be a bit like kicking the bottom of a Jenga tower. The effect would be cataclysmic.

So Congress has mandated more spending than it will allow and we have until October 19th for them to resolve the contradiction. If this all sounds a bit familiar it’s because we have had a debt ceiling crisis every two years like clockwork since 2011 when the U.S. credit rating was downgraded for the first time in history. It’s become something of a tradition at this point.

It is not a popular tradition and many people would like to do away with it. One increasingly popular proposal involves the U.S. Treasury minting a one trillion dollar coin and depositing it with the Fed and using that money to fulfill the spending obligations already authorized by Congress. The debt ceiling doesn’t pose any threat if you can just sidestep it by minting novelty coins.

The idea is that an obscure coinage law from 1996 (31 U.S. Code § 5112 - Denominations, specifications, and design of coins) allows the Treasury to mint platinum coins without actually specifying any particular denomination. Here’s the relevant passage:

The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

This is pretty obviously stretching the fair text reading of the law.1 A bullion coin would require $1T worth of platinum which is both impossible and would defeat the purpose. A proof coin is a collectible, not meant for circulation even to the Fed. Using this passage to infer that Congress had granted authority for an inconceivably high denomination coin is a bit like the "Air Bud" rule:

This crisis is dangerous but it is also stupid and boring, especially after having happened so many times already. So it is understandable that people are grasping for ways to route around congressional dysfunction and solve the debt ceiling problem for good. But that isn’t how American government works - Congress’s authority over spending and borrowing is not conditional on whether the Executive branch thinks they are doing a good job or not.2

Twitter is in charge of art now I’m sure it’s fine

As we talked about on Saturday Twitter is building a feature to let users verify ownership of their NFT profile pictures. The video snippet above clarifies a few details but still leaves open some interesting questions. Rather than attempting to interact with blockchains directly Twitter will integrate with OpenSea and rely on them to fetch NFT images and verify ownership.

The technical changes here are not especially complicated by Twitter standards - but there are still a lot of knotty and interesting product questions. Verifying that someone owns the NFT doesn’t really solve the authentication problem - it proves ownership of the token but it doesn’t prove the token has the right to represent that image. It is trivial to take someone else’s art and use it to mint your own NFT - authenticating art by verifying ownership is like checking whether a painting is a forgery by demanding to see a receipt.

Given that Twitter is already relying on OpenSea the obvious assumption is that they will only authenticate OpenSea verified projects. OpenSea had the same idea! They only verify projects with more than 50k Twitter followers. Both companies seem eager to outsource the actual business of authentication to each other. To label art as authentic someone needs to decide what it means to be authentic art. I’m not sure either Twitter or OpenSea are ready for that responsibility.

The truth is that art has very little to do it. 'Authenticity' in status goods is just a euphemism for exclusivity. What users asking for this feature actually want is for expensive 'real' NFTs to be easy to distinguish from cheap 'knock-offs.' It would probably be simpler just to let users deposit money into an account and display the balance on their profile picture directly.

Other things happening right now:

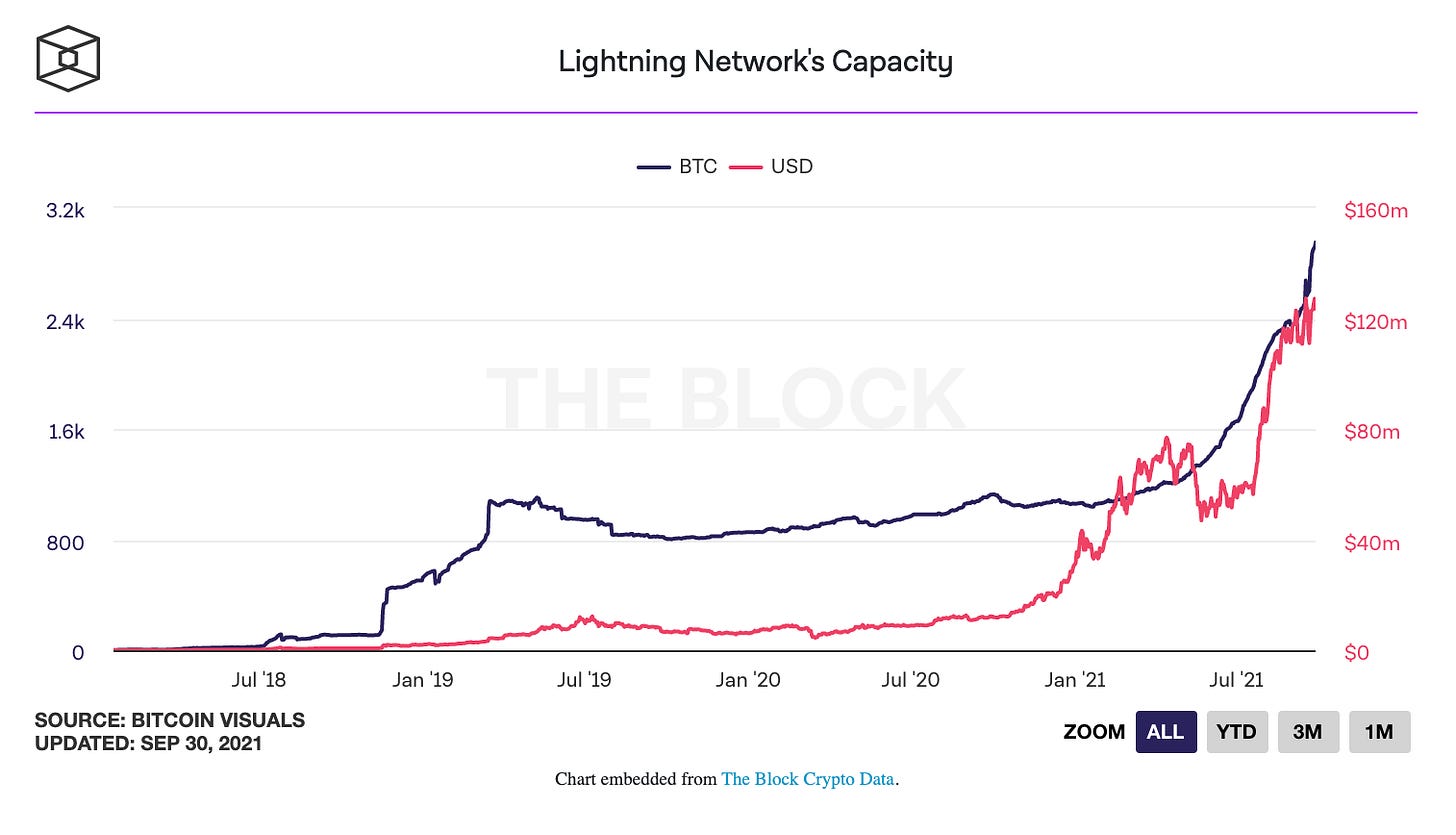

Lightning Network reached an all time high of ~3k BTC in publicly visible capacity3 this week, growing alongside the rollout of Twitter’s new Bitcoin tipping feature and the adoption of Bitcoin in El Salvador. Chivo, the government’s official wallet (which uses the Lightning Network via LN Strike) now has ~2.1M active users or ~1 in 3 El Salvadorans.

Ethereum Developer Virgil Griffith plead guilty to conspiracy to violate sanction laws for a trip he took in 2019 to North Korea to teach them about Ethereum, ostensibly so they could use it to evade international sanctions. He will spend 6.5 years in prison. Decentralization is not a magic safeword. Undermining government authority is a radical act. Plan accordingly.

This sounds impressive at first but honestly outpacing the S&P 500 with crypto is significantly underperforming the market. If I were one of this hamster’s LPs I’d be looking into reclaiming my funds.

You might not be as smart as a hamster, but take heart! You’re definitely smarter than the Wall Street Journal.

There is an interesting quote circulating from Philip Diehl (the director of the US Mint at the time) who helped author the relevant law suggesting that the trillion dollar coin interpretation is right. I’m skeptical. The court will be judging the intent of the lawmakers who voted for the bill not the technocrats who helped author it. As Preston Byrne put it Congress does not hide elephants in mouseholes. I personally doubt that Congress intended this law to eliminate the debt ceiling and I think the courts will doubt that, too.

Even if they are doing an obviously bad job, which to be clear they are.

Private channels on the Lightning Network do not need to be disclosed, so publicly known capacity is only a subset of the actual capacity of the network.