Bitcoin uses energy and so should you

Plus Coinbase sues the US Treasury and the real reason Europe needs bidets

In this issue:

Bitcoin uses energy and so should you

No honest business

The real reason Europe needs bidets

Coinbase sues the US Treasury

Bitcoin uses energy and so should you

Back in March I wrote about Biden’s executive order directing various government agencies to prepare reports on crypto. The due date for that homework assignment is this coming Monday, so a flurry of crypto-related reporting has been coming out of various government agencies this week. Perhaps most notable among these reports is the White House Office of Science & Technology Policy (OSTP) report on the climate implications of cryptocurrency.

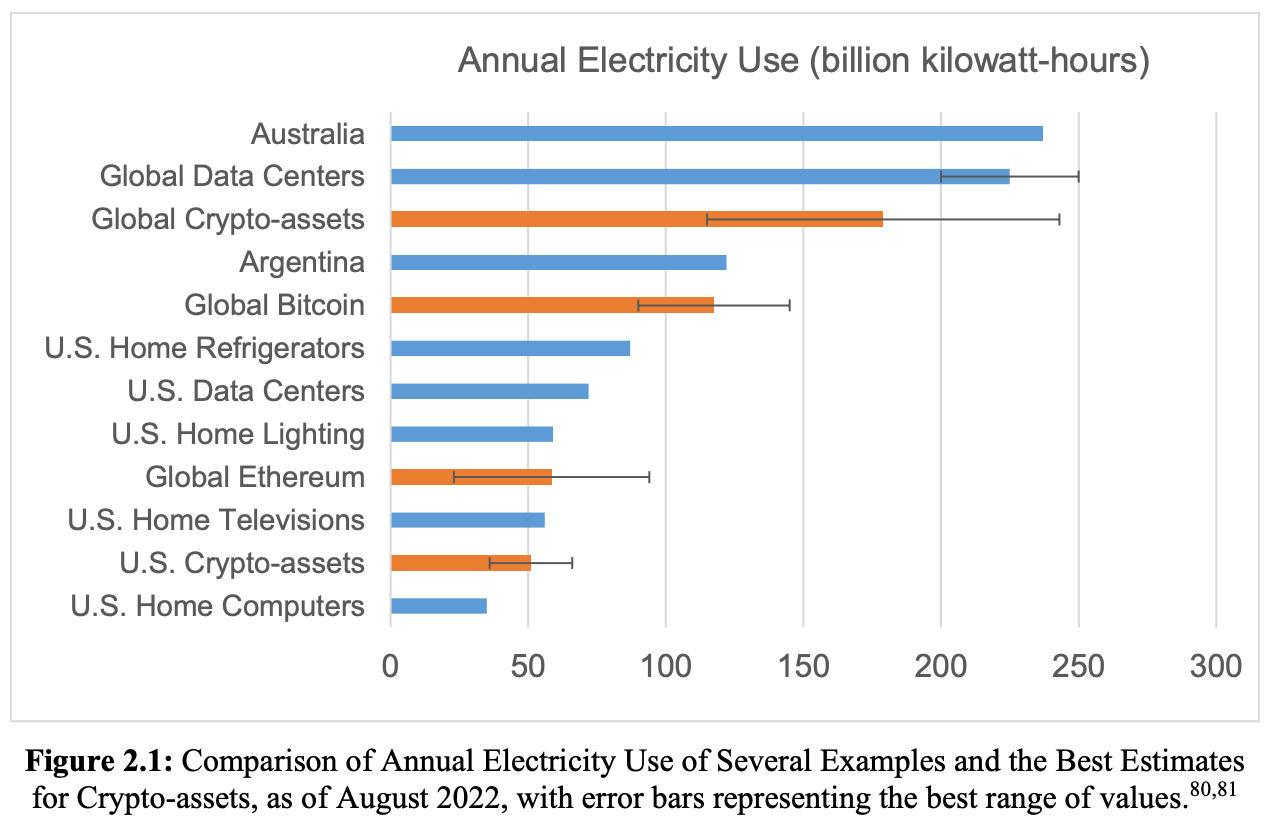

The full report is 46 pages but you can read the White House overview here. Broadly the report concludes that cryptocurrency mining uses a lot of energy (it does), that it has a lot of environmental consequences (debatable) and that blockchain technology might potentially help with carbon credit systems (it absolutely does not). They then recommend further research, some transparency/monitoring measures and rising standards for energy efficiency and grid reliability.

The most striking recommendation in my opinion was this one, which seems to imply the government should consider outlawing proof-of-work consensus:

"The Administration should explore executive actions, and Congress might consider legislation, to limit or eliminate the use of high energy intensity consensus mechanisms for crypto-asset mining." — OSTP

This is a disappointing report for a number of reasons. One reason is because of the dozens of citations from the Digiconomist, an anti-crypto advocate the White House should have known had a long history of spreading misinformation. That’s like writing a 46 page report on 5G networks and repeatedly citing Alex Jones.

Worse, the report materially misunderstands (or misrepresents) the costs and consequences of proof-of-work mining. We’ve talked before about how much energy Bitcoin mining actually uses, how it uses that energy and the complicated impact that Bitcoin has on the environment overall. I’ve also written about how proof-of-stake is actually much worse for the environment than proof-of-work and how proof-of-work actually subsidizes investments into renewable energy. Most importantly I’ve written about why we shouldn’t be policing energy use in the first place. Regrettably it seems no one at the OSTP is a Something Interesting subscriber yet.

Treating the environmental impact of anything as synonymous with energy use is lazy and misguided, but it is easy and politically expedient. So instead of nuanced conversation about the feasibility and potential upside of methane capture for Bitcoin mining at landfills and bio-waste facilities we get the same unhelpful comparisons between the Bitcoin network and Argentina or home refrigerators.

In fairness the report does briefly mention that mining can be done with stranded methane and curtailed renewables, but it describes mining with excess methane as though it is equivalent to flaring (it’s not) and then declares (without evidence) that "crypto-asset miners would not be likely to operate only during periods of curtailment, requiring consumption of grid electricity at all other times."

In reality one of the key advantages of mining is that it can cheaply and easily scale energy consumption up or down to help responsively balance load on the network. Riot Blockchain has been doing exactly that in Texas during the recent heat waves in Texas. Riot has an agreement with ERCOT where they pay discounted rates for power in exchange for flexibility in turning down their usage whenever ERCOT needed to lower demand on the grid. Not only is it possible for cryptocurrency miners to turn off during peak load it’s already normal. Maybe the Biden administration can send someone at OSTP on a fact-finding trip to Texas?

The subtext of the report is that while Bitcoin remains a proof-of-work blockchain for the foreseeable future Ethereum is very publicly and noisily transitioning to proof-of-stake. It’s not a coincidence that the government's preferred consensus technology on environmental grounds is also the one that is easier to control. The groundwork is being laid here to label ETH 2.0 the "good" cryptocurrency full of innovative green tech and Bitcoin the "bad" cryptocurrency for criminal terrorist polluters.

Don’t believe it.

No honest business

Chairperson of the Securities & Exchange Commission (SEC) Gary Gensler gave a speech at a conference this week laying out his perspective on the role of regulators in the crypto markets. He opened and closed his speech with a quote from Joseph Kennedy, the first SEC Chair: "No honest business need fear the SEC."

In the speech Gensler acknowledges that Bitcoin is not a security (which he has said before) and he signaled support for "non-security crypto tokens" to be regulated by the Commodity Futures Trading Commission, or CFTC (which he has not said before). The idea of "non-security crypto tokens" certainly implies there are other tokens that Gensler views as too decentralized to be securities — but contrary to breathless reporting Gensler did not mention Ethereum specifically at all.

It remains to be seen what, if any, non-Bitcoin tokens Gensler also considers non-securities. What Gensler did say was "Of the nearly 10,000 tokens in the crypto market I believe the vast majority are securities." Honestly? I agree with that. Most cryptocurrencies are unambiguously securities. People buy them because they hope to profit from the labor of others. They fail the Howey Test.

The problem with Gensler’s speech isn’t what he says, most of which is fairly obvious and uncontroversial. The problem is with his approach. Gensler’s strategy with the cryptocurrency market has been to aggressively claim regulatory authority and then very deliberately refuse to provide any clarity around the regulations. The SEC has been suing crypto companies since 2017 but in that time has not issued any rulings or put plans for any new rules on its agenda. The SEC has made it clear the rules must be respected but has made no attempt to clarify what those rules actually are.

Matt Levine put it best in his newsletter Money Stuff:

"If you are an ambitious financial regulator who wants to regulate crypto, you have to regulate crypto! You have to put in the work! You have to sit down to try to understand how the crypto market operates, what investors need to know, and what is required to encourage useful capital formation. You have to write rules that anyone can read and that create some plausible path for how crypto developers can register their tokens and how exchanges can trade them. And then you have to focus your enforcement efforts on actual consumer protection, going after the crooks instead of just the people who are naive enough to walk into your office." — Matt Levine, Money Stuff

Under the watchful eye of the SEC we got Bitconnect, OneCoin, PlusToken, HEX, Wonderland, Celsius, Voyager and Terra — each of which promised staggering returns until they finally collapsed.1 Meanwhile, the SEC protected investors from an 8% interest rate account at Coinbase and fined BlockFi $100M for similar products. As I’ve said before the SEC carefully created the conditions that allowed scams to flourish and is now using those scams as evidence that more regulation is needed.

The crypto companies that tried in good faith to work with the SEC have been stonewalled and abandoned. Shameless frauds have been free to do and promise anything they want. The SEC has been treating crypto like an embarrassing fad rather than a growing industry. It’s hard to see the refusal to provide clear guidance for good actors as anything other than a desire to see the entire market fail. Gensler says "No honest business need fear the SEC" but in practice it seems like those are exactly the businesses that should be worried.

If Gensler wants the SEC to be in charge of regulating crypto he needs to start actually doing the work and stop waiting for crypto to go away on its own.

Other things happening right now:

We talked last week about the energy crisis in Europe and its consequences for German industry. As it works out German toilet-paper manufacturer Hakle went bankrupt this week as a result of spiking energy prices. Good thing Europe has all those bidets, I guess?

The Attorney General of the District of Columbia is investigating Michael Saylor of Microstrategy for evading taxes by falsely declaring residency in Florida while actually living in D.C. The accusations don’t have anything to do with Bitcoin but they probably have something to do with Saylor’s repeated and enthusiastic endorsement of tax evasion as a hobby.

We’ve talked a few times about the Office of Foreign Asset Control (OFAC) sanctioning Tornado Cash and the possible consequences for DeFi. The sanctions effectively seized (among others) assets owned and controlled by law abiding Americans — assets that are obviously outside the scope of the Office of Foreign Asset Control. On Thursday Coinbase announced they were financing a lawsuit against the sanctions on behalf of Tornado Cash. I’m often pretty tough on Coinbase, but I’m extremely glad to see them standing up in defense of user privacy like this. Privacy is a human right.

Except for HEX, which is technically still in the process of collapsing.