You don't need to fear growth

Thomas Malthus was an enemy of human civilization

On Thursday January 20th the House Energy & Commerce committee of the US Congress held a hearing entitled "Cleaning Up Cryptocurrency: The Energy Impacts of Blockchains" to explore the impact of cryptocurrency mining on power grids.

We’ve talked about the environmental impact of Bitcoin many times before but apparently not everyone in Congress is a Something Interesting reader yet. Please forward this post to your state + local representatives to help them better understand the role of Bitcoin in the fight against climate change.

In this issue:

Thomas Malthus was completely wrong

Energy use is the hallmark of civilization

Bitcoin doesn’t waste energy

Bitcoin creates energy abundance

There is no such thing as a free lunch

Thomas Malthus was completely wrong

Thomas Robert Malthus was an English economist at the beginning of the 19th century who is most famous for his "Malthusian dilemma" — the idea that human population grows exponentially but food only grows linearly, meaning humanity would eventually be ravaged by famine/disease/warfare/etc unless we engaged in population control, ideally by joining Malthus in religious abstinence.

Malthus feared a world of scarcity where an increasing number of people fought over smaller and smaller shares of diminishing resources. But the doomsday prophecy that Malthus foresaw never came to pass — and it never will. Malthus was empirically wrong: food supply does not grow linearly. It grows combinatorially, which is even faster than exponential growth.

Exponentially more people in the population meant exponentially more mouths to feed but it also meant exponentially more people thinking about ways to farm better. Malthus assumed the only way to increase the food supply was to increase the acreage of farming because he could not imagine the Haber–Bosch process, which radically improved fertilizer. Malthus did not account for improving technology so he saw limits to the food supply where there were none. He was wrong.

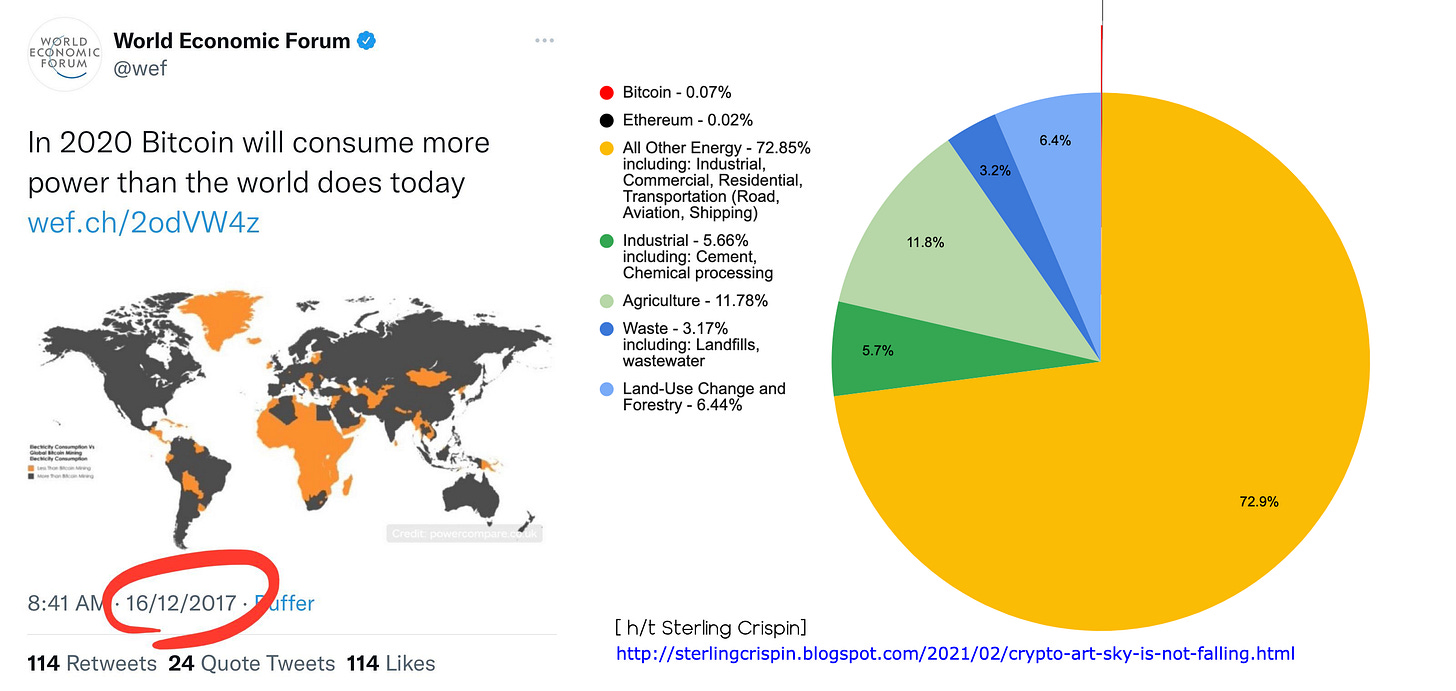

Unfortunately the fear of scarcity is still very much alive today:

Energy use is the hallmark of civilization

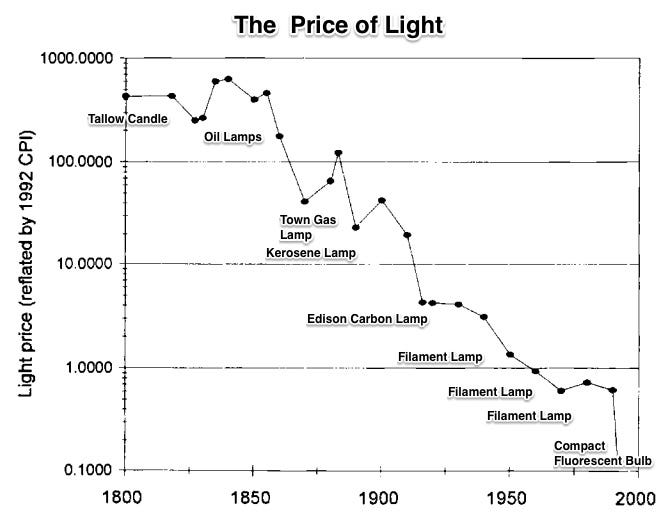

The forward march of civilization is the story of harnessing and using increasing amounts of energy to serve our needs. My favorite way to see this is through the research of Dr. William Nordhaus who studied the price of artificial light throughout history. An ancient Babylonian hoping to light their mud-brick house with a sesame-oil lamp would need to work for almost two days to afford the same amount of light a typical American can afford by working for 4/10ths of a second.

During that same window of history the world’s population grew ~78x but light got ~10,000x cheaper. Rather than fighting over an ever dwindling supply of tallow candles as Malthus might have predicted we invented new and better ways of creating light. More people seeking to create light led not to scarcity but to abundance. The important scarce resource wasn’t tallow or sesame oil. It was human ingenuity.

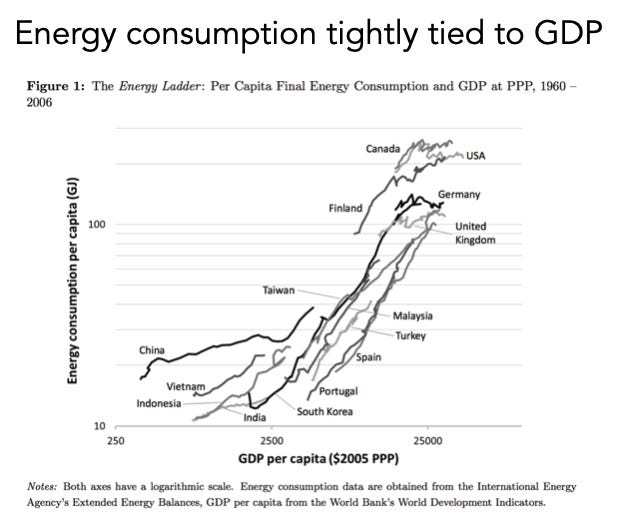

The spiritual successors to Malthus are still with us and they are still wrong. Today they warn that we must stop using energy — but consider what that would mean. The ability to capture and employ energy is the basic hallmark of civilization. Energy use per person is our best proxy for overall quality of life. — it literally measures our ability to cast light into the darkness.

Curbing energy use would mean some combination of limiting the human population or limiting their quality of life. Energy use is not some kind of original sin — it is how we improve our lives. Advancing civilization means making energy more available not less. We should not treat energy as scarce, we should make it abundant.

Energy itself of course is already abundant — enough solar energy falls on the earth every day to power the world for more than a year. What we lack is not energy but rather the technology necessary to bend that energy to our will. Malthusian abstinence is pointless. We don’t need to repent our wicked ways, because we aren’t running out of energy. We just need to figure how to use it.

Bitcoin doesn’t waste energy

There is so much hand-wringing about Bitcoin (and other cryptocurrencies) energy use that you might be surprised how large it actually is (or isn’t) in practice. At time of writing Bitcoin mining uses ~0.55% of the world’s energy. That sounds like a lot, but it is about as much energy as we spend mining zinc and less than the energy we spend mining copper or gold. It uses ~5x less energy than domestic refrigerators and has a smaller carbon footprint than apparel/footwear or domestic pets.

But that’s clearly the wrong way to think about human behavior. First of all those numbers have been completely isolated from their meaning. Evaluating domestic pets by carbon footprint is like judging a marriage by its tax benefits or complaining that Michelangelo's statue of David takes up too much space. We don’t assess the worth of things by how much energy they use because energy use is not sinful. Energy abstinence is a guilt reflex, not a practical plan for improving the world.

Judging activities by their total energy use is also wrong because it treats every unit of energy as interchangeable, which it obviously is not. Some energy is produced by very dirty sources and others by relatively clean ones. More importantly not all energy is equally useful. Energy is notoriously difficult to store and transport, so energy produced at a convenient time and place is a lot more valuable than energy produced at off hours or remote locations.

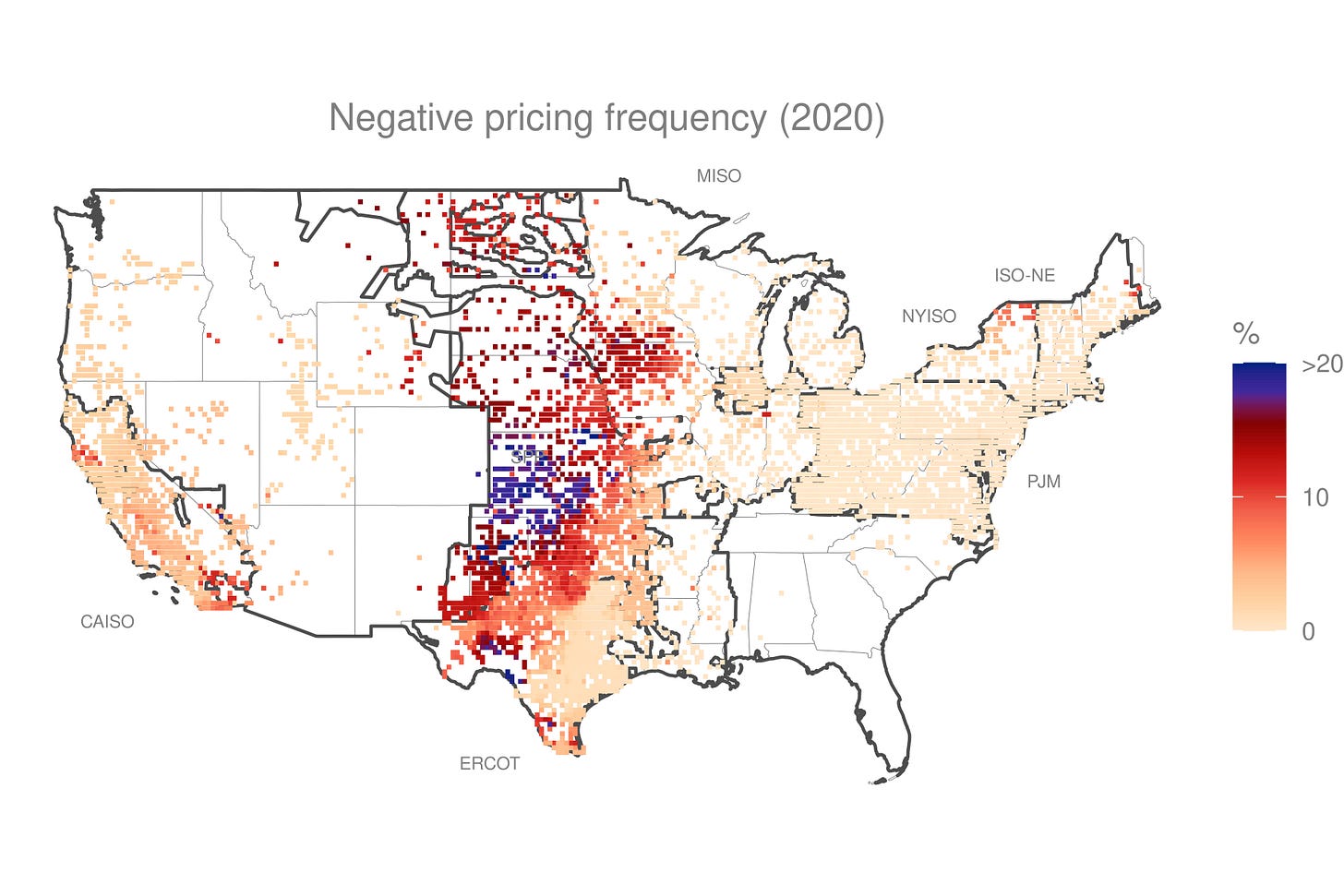

In practice lots of energy is essentially worthless because it was produced at the wrong time or place. There is plenty of wind energy when (and where) the wind is blowing but that doesn’t necessarily line up with when (and where) people want to use energy to run toasters or hair dryers or whatever. Wind energy is so plentiful in the central US that it is not uncommon to see energy prices go negative, where power companies actually pay consumers to take excess energy off their hands.

Using energy in Oklahoma during a windstorm is not socially or environmentally equivalent to using the same quantity of energy in New York City during a heat wave. Evaluating an activity by 'total energy usage' loses sight of the difference. The rhetoric around proof-of-work mining implies that the energy spent on Bitcoin is displacing other more socially desirable uses — but that isn’t how Bitcoin mining works.

Bitcoin (and Ethereum) miners are actually exceptionally price sensitive consumers of power — they want the cheapest power available, which means they want the power that literally no one else wants. Bitcoin mining does not displace other energy use, it is other energy use that displaces Bitcoin mining. Over time miners will eventually migrate to wherever they can find the cheapest (i.e. least useful) power. Proof-of-work miners are energy scavengers, not energy predators.

Ultimately though even that does not matter because in a free society we do not dictate how people choose to consume the energy they pay for. Collectively we spend lots of energy on things that are not strictly necessary for our survival: Hollywood movies, professional sports, EDM festivals, Baltic cruises, Antarctic research. Different people can feel differently about which activities are frivolous and which are pivotal to the human condition.

It doesn’t matter because that isn’t a constructive debate — it is a Malthusian scarcity trap. Any form of energy use that improves the human condition is worthy. The argument we should be having is how to safely and cheaply produce more energy. Not who is most deserving of the energy we have today.

Bitcoin creates energy abundance

Progressing civilization into an energy rich future means embracing renewable energy sources — but renewable energy has a fatal flaw. Energy is much cheaper to produce than to store or transport, which means energy that is produced exactly where and when you need it is much more valuable than energy that is produced in a remote location or at an inconvenient time.

Renewable energy is much cheaper to produce than fossil fuel, but it is much less flexible. Solar energy only works during the day. Wind turbines need to be far enough away from cities to catch the wind. Tidal plants are offshore by definition. Most of the renewable energy available to us today is worthless because there is no one able to use it when and where it is available. It appears on nature’s schedule, not our own.

That means renewable power plants are actually the least profitable when they are the most efficient — when the wind is blowing fiercely it is easy to produce lots of power but that same power has to be sold immediately into a flooded market. Wind power is most valuable when it is difficult to produce and least valuable when it is easy to produce. The same is true of solar power. That’s what causes the periods of negatively priced electricity mentioned in the graphic above.

Bitcoin (and other proof-of-work miners) on the other hand are equally happy to consume cheap electricity at any time or place. They are always willing to buy up otherwise worthless electricity at bargain prices. No matter how brightly the sun is shining or the wind is blowing, you can always keep selling excess energy to the Bitcoin network. Bitcoin is a buyer of last resort.

That doesn’t help fossil fuel producers much because they have the luxury of only producing energy when/where the demand is high. A bargain shopper with limitless pockets but a very low target price doesn’t change their economics. But renewable energy producers like wind and solar have access to enormous amounts of unusable, stranded energy that is creating no value. Being able to sell that energy to someone even at bargain prices materially improves their profitability.

Making renewable energy more profitable means more renewable energy will be produced. More renewable energy produced means a cleaner, more energy abundant future. Malthusians would have you believe that by using energy Bitcoin has somehow taken it away from someone else, but they would be wrong. The energy that Bitcoin uses would otherwise have been wasted and the energy it leaves behind is cheaper, cleaner and more accessible as a result.

There is no such thing as a free lunch

Bitcoin (and the proof-of-work mining that secures it) is quite a bit more energy efficient than it is usually given credit for but it is not free. Nothing valuable is free. Which is too bad, because free is an excellent price. It would be nice if we could keep all the useful qualities of the Bitcoin and Ethereum networks without having to spend all that energy to secure them. What if we could secure them for free?

That’s the basic pitch for proof-of-stake, usually presented as an 'upgrade' to proof-of-work that can accomplish the same things at a fraction of the energy cost. If you are interested I wrote a post called Proof of Stake will not save us that goes into greater detail, but the tl;dr is that proof-of-stake is neither effective nor efficient. A proof-of-stake network will consume more energy than a proof-of-work network of equivalent value and it will provide less security by doing so.

It will always be expensive (in energy terms) to defend a cryptocurrency network because defending the network requires the same resources as attacking it. If it is cheap (or free) to defend the network, it will be cheap (or free) to attack it. A valuable network will need to spend energy to defend itself by definition. There is no such thing as a free lunch. Proof-of-stake is just wishful thinking.

In conclusion:

Scarcity mindset is the wrong way to approach the future

Policing energy use is a Malthusian trap not a way forward

Bitcoin helps bring us closer to an energy abundant future

Proof of stake is an empty promise that will not save us

Congresspeople should subscribe to Something Interesting