Winter is coming to Europe

Governments can subsidize rising energy costs but subsidies cannot alleviate a shortage.

Winter is coming to Europe

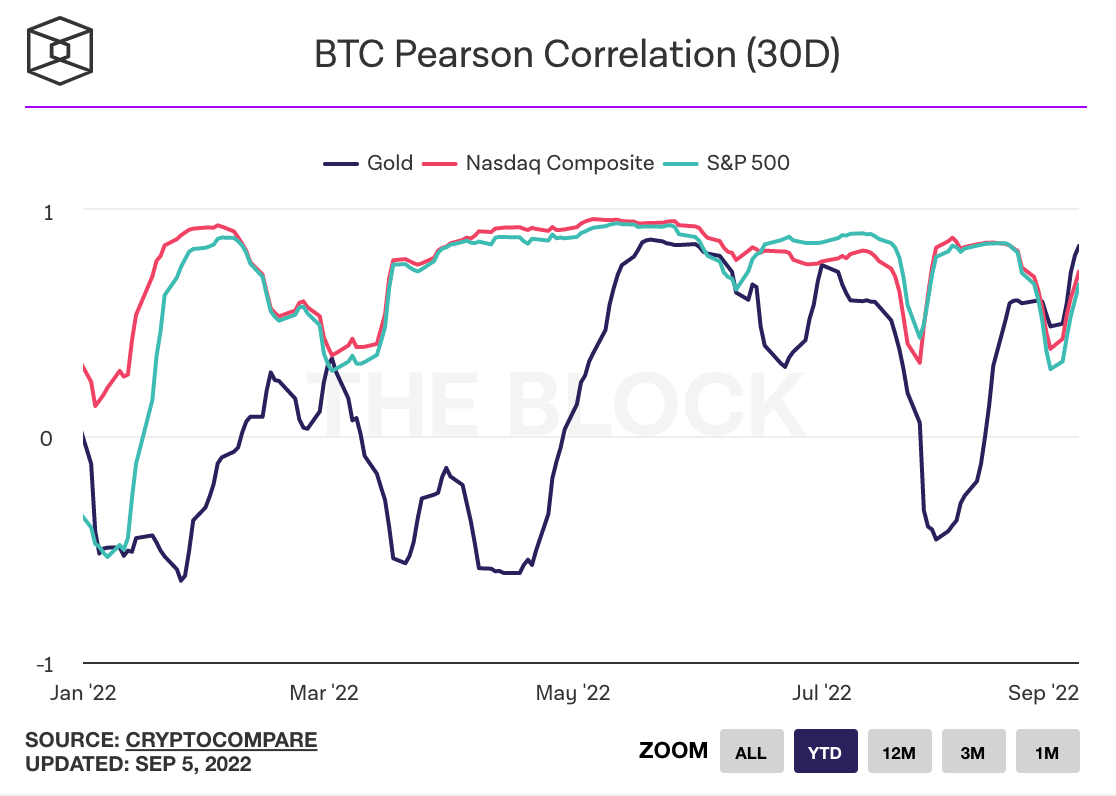

For all the noise and fury surrounding the collapse of Terra/Luna, the violent unwinding of 3 Arrows Capital and the fear/excitement surrounding the Merge those stories have all been largely (and surprisingly) inconsequential to crypto markets. Or more accurately the consequences of those stories have all been drowned out by the sweeping macro forces reshaping the broader global economy. The price of Bitcoin and the S&P 500 are rising and falling together because they are both reacting to the same unfolding events.1

The most important things happening to the crypto market right now aren’t crypto specific at all.

The most important thing happening in the world economy today is of course the ongoing Russian invasion of Ukraine and the steadily escalating economic war between Russia and the economic West.

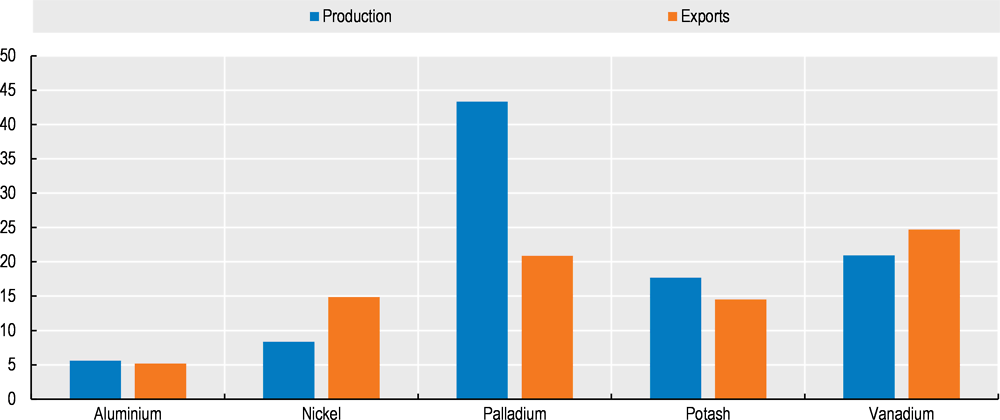

The effects of the war are far-reaching and complex. Russia and Ukraine are two of the world’s largest exporters of wheat and also fertilizer. Russia was a key provider of a number of raw materials, most notably palladium (used in catalytic converters), vanadium (used in electric vehicle batteries) and potash (used in fertilizers).

Russia was also the fourth largest exporter of liquid natural gas (LNG), accounting for around ~8% of the global supply. Germany imported ~55% of their LNG from Russia before the war began. Overall Russian LNG powered ~26% of European energy consumption but only around ~2% of Russian GDP, which means Putin can endure disruption to European gas imports much more easily than Europe can. When the sanctions landed they included a special carve out to allow Europeans to continue buying Russian gas — basically because Europe had no other choice.

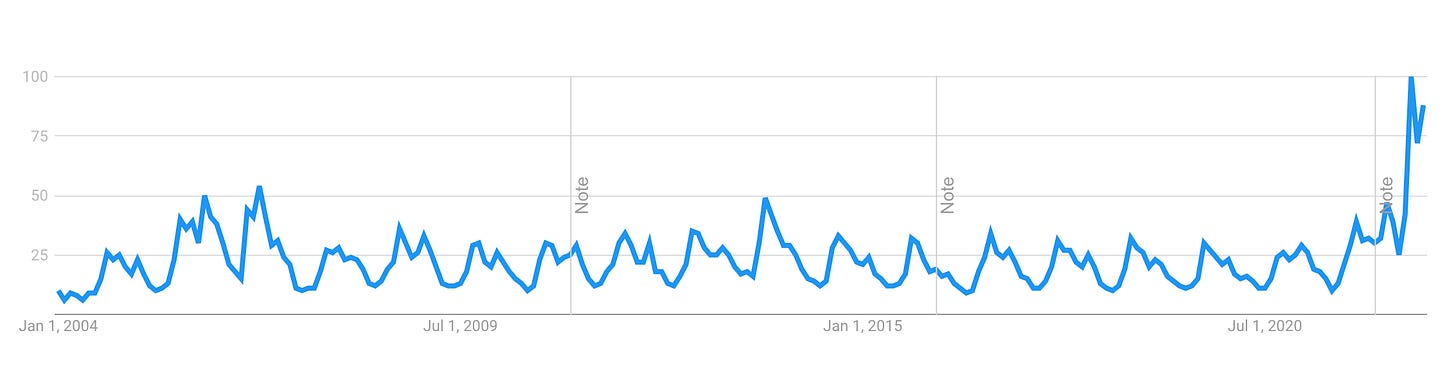

As the war (and sanctions) have dragged on the supply of gas from Russia dwindled and the price rose, pushing up the cost of electricity as well as heating and cooling bills across Europe and the UK. You can see how these rising prices are affecting Germans planning for the winter in the most ominous graph I’ve seen in some time, the Google search frequency for Brennholz, the German word for firewood:

It is dark enough to imagine families throughout Europe resorting to firewood to stay warm through winter — but rising energy costs also have grim implications for the German economy as a whole. Many of Germany’s major industries are quite energy intensive and may not be capable of sustaining elevated energy prices for very long. If those businesses collapse their failures could easily cascade across the German economy and the rest of Europe.

"Minsky moments are triggered by excessive financial leverage ... in Germany, $2 trillion of value added depends on $20 billion of gas from Russia … 24 August 2022 War and Industrial Policy 6 …that’s 100 -times leverage (see the last chart here ) – more than Lehman’s." — Zoltan Pozsar

As part of a misguided attempt to legislate around this supply shock G7 leaders declared support for a price cap "designed to reduce Russian revenues and Russia’s ability to fund its war of aggression whilst limiting the impact of Russia’s war on global energy prices." The next day Russian Gas company Gazprom announced the indefinite closure of the NordStream pipeline.

It’s possible that the pipeline was shut down in retaliation for the G7’s planned price cap or its possible that there really is a leak. Either way the result is the same. Most of Russia’s gas export machinery was maintained by Western corporations like Halliburton or Baker Hughes who are no longer able to ship parts or facilitate repairs. The longer the pipeline is dormant the harder it will be to activate again. Some of that gas is being sold at a premium to China and India and some is being flared into the atmosphere at the Finland/Russia border. But none of it is making its way into the European energy grid — at least not directly.

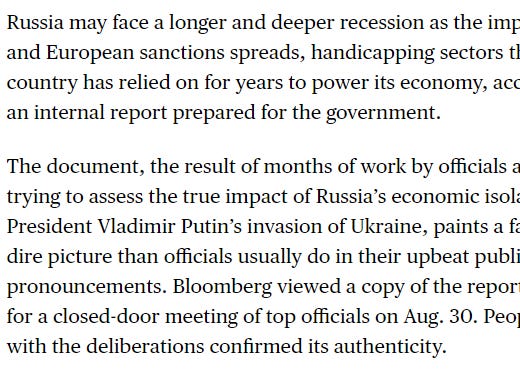

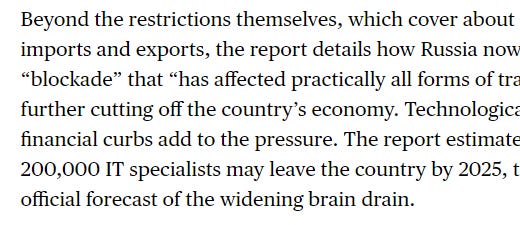

To be clear, this is all coming at a massive cost to the Russian economy:

But the pressure on Europe is still enormous. Protests are breaking out across Germany. The UK is considering an energy subsidy that would amount to more than 5% of its GDP. Governments can subsidize rising energy costs but subsidies cannot alleviate a shortage — and they may only exacerbate inflation. The British Pound is at its lowest relative to the dollar since 1985, the Euro since 2002.

The Ruble on the other hand dropped initially with the launch of sanctions but quickly recovered and is now trading at a ~30% premium above where it was before the conflict began:

Damaging Western currencies is one of Putin’s stated strategic goals in withholding gas from Europe. The cost of that strategy is extremely high — but it does appear to be inflicting real damage. Europe is betting they can endure energy shortages longer than Russia can endure economic isolation. Russia is betting Europe won’t make it through the winter.

The same is true for ETH, which is itself highly correlated with BTC.