How to go broke in style

Why I always recommend ordering your fugitive superyacht early

In this issue:

How to go broke in style

When banks go bankrupt

On Infinite Ethics

Tesla has paper hands

How to go broke in style

Documents from the ongoing liquidation proceedings for defunct private equity fund Three Arrows Capital (3AC) are leaking and the details are fascinating. Creditors of 3AC have filed for at least ~$2.3B in claims, with some claiming only $1 for now to reserve the right to increase their claim later.

The largest claim so far is for ~$1.2B from DCG/Genesis (which we’ve talked about before). The funniest claim so far is from 3AC co-founder Zhu Su for $5M.1 It is the paperwork equivalent of sneaking out a side door of your failed bank and joining the mob protesting out front. Absolutely legendary.

3AC co-founders Kyle Davies and Zhu Su have fled Singapore and are whereabouts unknown, which makes sense because it seems increasingly likely they are guilty not just of poor business judgement but of actual crimes. Borrowing money, spending it foolishly and then going bankrupt is ill-advised2 but not (inherently) illegal3 provided that it happened in that order — but going bankrupt has to come last. If you realize your company is about to go bankrupt and you dodge creditors’ calls to spend ~$50M on a superyacht, that is probably going to raise a few eyebrows:

There are other troubling details. 3AC went into liquidation silently, by ghosting their creditors and locking their doors. They abandoned their corporate offices and have not allowed liquidators in to access records. Supposedly Davies and Su have dialed into calls with the liquidators but they stayed muted with the video off, even when questions were asked of them. Even more damning is how millions of $ worth of stablecoins and ETH were mysteriously transferred right before news of the 3AC insolvency became widely known:

The yacht that 3AC ordered was due to be delivered in Italy in a few months — just a little too late to be useful. One imagines Davies and Su are kicking themselves for not having placed their order sooner.

When banks go bankrupt

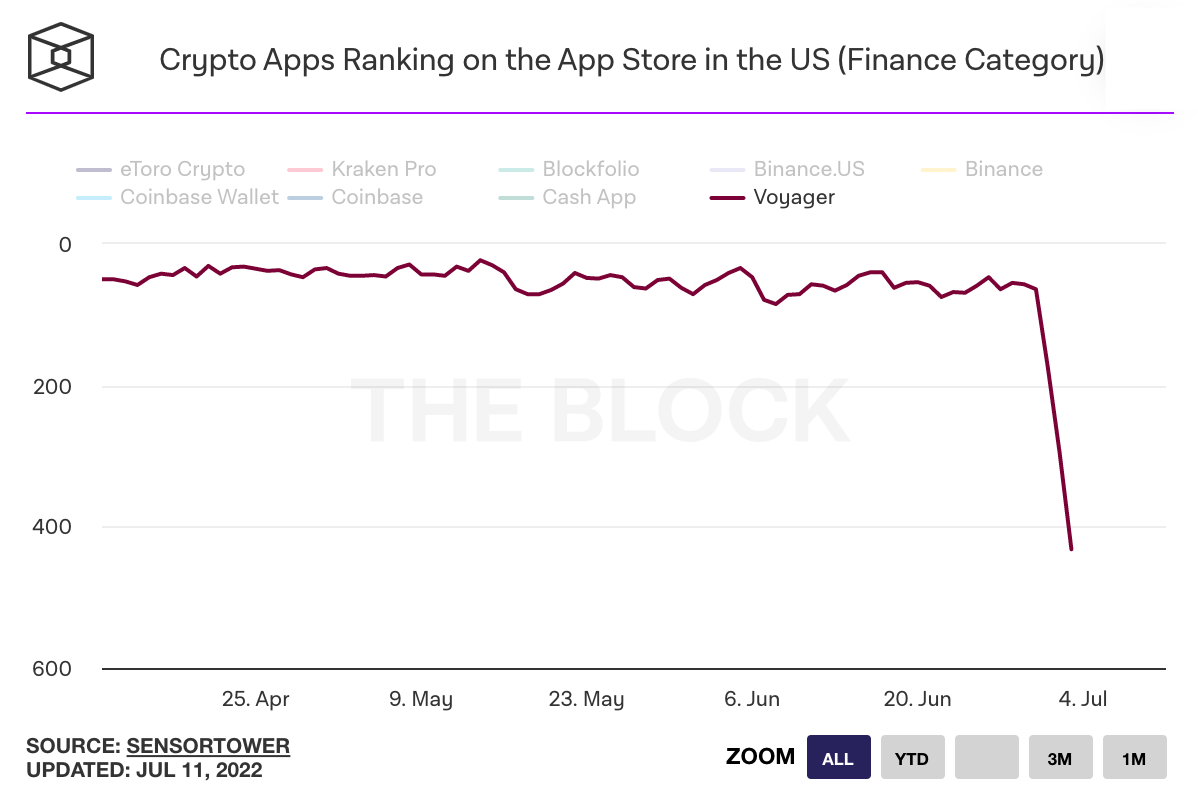

We’ve talked exhaustively recently about the failure of crypto pseudo-banks like Celsius and Voyager Digital recently. Both companies recently filed for Chapter 11 bankruptcy, Celsius on July 13th and Voyager on July 5th.

There are different ways to go bankrupt and they mean different things. When a company goes bankrupt because they weren’t good at making money the new owners will typically close the business and sell whatever it owned to recover as much debt as possible. That’s known as liquidation and is usually handled as a Chapter 7 bankruptcy.

Sometimes a healthy business might go bankrupt for reasons that don’t necessarily invalidate the business itself. They might have temporary challenges outside their control (like a restaurant during the pandemic, e.g.) or they might have taken on too much debt trying to grow too quickly but otherwise be a sound business. In those cases the new owners are better served not by liquidating the business but by keeping it intact and running it for profit. That kind of bankruptcy is a Chapter 11 bankruptcy, also known as a restructuring.

Chapter 11 makes sense for businesses like restaurants or factories where the finances of the business can be cleanly separated from the operations, but it is not allowed for businesses like brokers or investment funds where the finances of the business are the operations. That makes sense! It is possible to imagine a restaurant that has run out of money but can still make and sell food. A bank that goes bankrupt is more like a restaurant that closes because it gave all the customers food poisoning.

In America the Securities Investors Protection Act (SIPA) governs how banks/brokers/exchanges and similar financial businesses are liquidated. It directs failing brokers/exchanges to file a Chapter 7 liquidation bankruptcy and then has a host of protections designed to protect customers by placing them ahead of other creditors in seniority during the liquidation.

By filing a Chapter 11 bankruptcy rather than a Chapter 7 bankruptcy Voyager and Celsius are essentially asserting that customers don’t have accounts with them but instead made unsecured loans. That is equivalent to claiming they own their customer’s assets instead of custody them and their customers aren’t depositors but instead just another group of unsecured creditors. It’s like parking your car at a buddy’s house and finding out he sold it to cover his other debts.

That’s probably illegal and it’s certainly a betrayal of customer trust — especially for Voyager, who very explicitly called themselves a broker in past press releases. Voyager is already under investigation for its misuse of FDIC protections in marketing. Celsius was shrewd enough to avoid calling itself a broker but that’s still pretty clearly the business it was operating.

But even setting aside the SIPA protections it is hard to see how either Celsius or Voyager can make a meaningful case that their businesses are actually viable. Any fractional reserve bank relies on consumer confidence to function. Even if they manage to convince the courts to legally reclassify them as something else it doesn’t matter: nobody wants to bank with a bankrupt bank.

Other things happening right now:

This essay on infinite ethics has nothing to do with finance, economics or cryptocurrency but it is super interesting. Attempting to build a philosophical framework that can grapple with multiple parallel universes creates some disturbingly counterintuitive results. After you finish the essay I recommend watching Everything Everywhere All at Once as a palate cleanser.

Tesla sold ~$936M worth of digital assets (i.e. Bitcoin) in Q2, roughly ~75% of its total holdings. It still holds ~$218M worth of Bitcoin on its balance sheet. That implies an average exit price of ~$29k/BTC, above the market today but probably slightly below their entry price. Fortunately they did happen to sell enough to make Tesla cashflow positive for the quarter! That’s handy.

Here is a dense, thoughtful and graphics-heavy thread explaining how Bitcoin mining subsidizes renewable energy development in the same way that a pioneer species can help ecosystems develop in otherwise barren terrain.

Bitcoin is still impossibly tiny:

Co-founder Kyle Davies’ wife also filed a claim for $65M which is a ~13x larger claim and yet somehow still doesn’t feel quite as shameless as listing yourself as a creditor directly.

Not financial advice.

Not legal advice.