War.

Non-state currency in an era of conflict.

In this issue:

What is happening in Ukraine?

Why is this conflict significant?

What will happen next?

What does that mean for Bitcoin?

This issue will be a short one. My role is more of commentator than that of journalist and now is a time for witnessing events more than commenting on them. I do not think this moment in history is about or should be made to be about Bitcoin or crypto. The vastly more important implications are for the people of Ukraine and of the free world. But this newsletter is about Bitcoin and crypto and the cryptocurrency markets will be affected. Several readers reached out to ask my perspective, so I am sharing it here.

What is happening in Ukraine?

Former KGB operative and current violent dictator Vladimir Putin has begun an invasion of Ukraine. US Intelligence has been anticipating and warning about this intention for some time as ~190k Russian troops assembled on the Ukrainian border. On Monday Putin formally "recognized" two regions in Eastern Ukraine (Donetsk and Luhansk) as independent nations. On Wednesday he began sending Russian troops into those regions on "peacekeeping" missions to "defend against Ukrainian aggression." Peacekeeping in this case involves missile strikes on Kyiv and other Ukrainian cities as well as active cyber warfare.

Why is this conflict significant?

One major undercurrent of these operations is the tension between Russia and the North Atlantic Treaty Organization (NATO), and by extension Russia and the US. NATO is a mutual defense alliance whose original purpose was (among other things) to defend against possible Soviet aggression, so Russia has always viewed it with hostility. Ukraine has been seeking to join NATO, which would allow NATO forces to be stationed directly adjacent to Russian territory.

That would put NATO missiles within striking distance of Moscow and NATO soldiers uncomfortably close to the naval base of Sevastapol and the oil-rich regions of Volgograd. A NATO presence in Ukraine would represent a significant advantage in a conflict with Russia. The invasion into Ukraine is meant to punish and disrupt their attempts to join the NATO alliance.

That leaves NATO in a delicate position — Ukraine is strategically significant but not a member of the mutual defense pact. The Biden administration wants to limit Russian aggression but doesn’t really have political support to commit ground troops to yet another foreign conflict — and Putin knows it. Neither side is excited about the idea of direct conflict between nuclear superpowers, but Putin is gambling (almost certainly correctly) that Russia cares more about Ukraine than the US does.

What will happen next?

Direct conflict between Russia and NATO states would almost certainly lead to WW3 so it seems unlikely for now that America will step into Ukraine or that Russian forces will go beyond it. Biden has already enacted economic sanctions against Russia and has promised more and sterner sanctions to follow. Ukrainian defense forces are not equipped to stop the Russian military and it seems unlikely the international community will intervene. Likely Kyiv will fall to Russian forces.

At that point a lot of things could happen but I agree with this analysis from former CIA analyst Ron Aledo that Putin will probably use relinquishing control of Kyiv as a bargaining chip for some combination of delaying or denying Ukraine entry into NATO and easing or removing the economic sanctions on Russia. Putin may also decide to keep some portion of Donetsk and Luhansk as well and he will almost certainly seek to cripple Ukrainian defense infrastructure before withdrawing.

What does that mean for Bitcoin?

War is bad for the economy. The threat of violent conflict makes people less willing to invest in productive businesses (which could be disrupted or destroyed by war) and more willing to invest in so-called safe-haven assets. Safe-haven assets are anything seen as low risk during market turbulence — traditionally things like gold, treasury bills and cash. When global risk is up people balance that out by lowering the risk in their portfolio. Spoiler: that’s not good for Bitcoin.

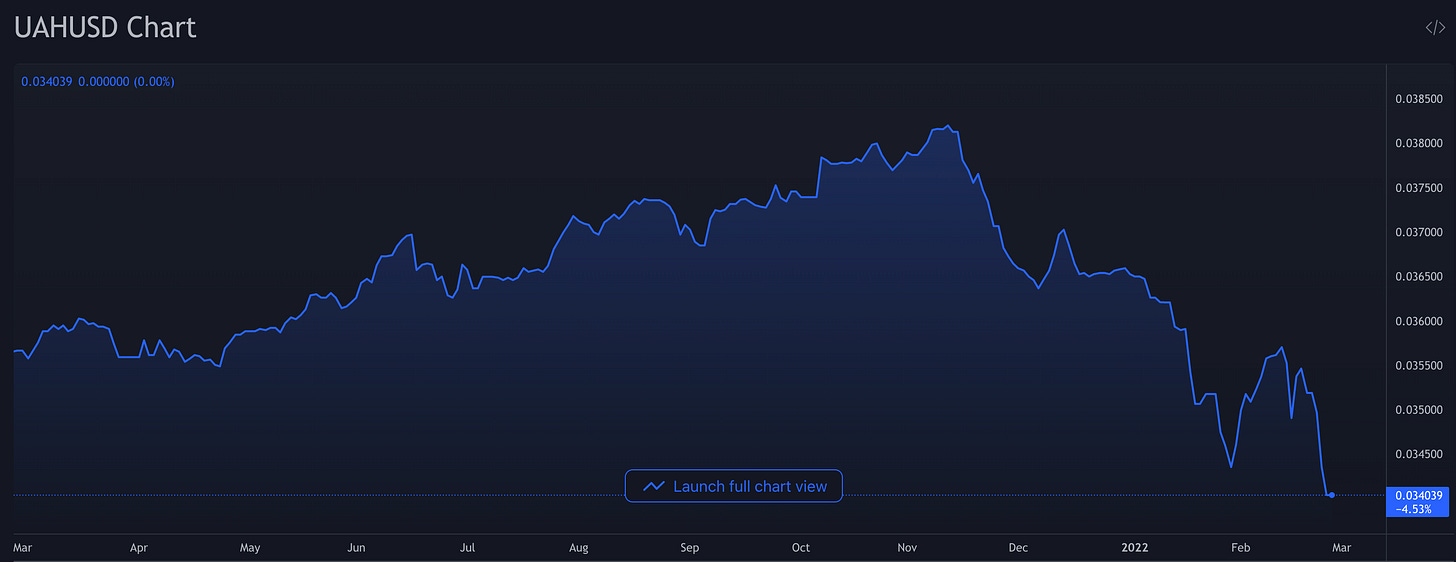

In theory Bitcoin aspires to be digital gold, the ultimate safe-haven asset. It can store and transmit value even in a war zone and might be a useful tool for people hoping to raise funds internationally or preserve their wealth through a possible currency collapse. The Ukrainian Hryvnia is down ~9% against the USD since Russia began amassing troops on the border in November.

Given that the primary US response to Russian actions is weaponizing the SWIFT banking network to enact economic sanctions there is also obvious impetus for Russia (and other countries concerned about sanctions) to be more open to promoting and adopting censorship resistant networks like Bitcoin.

In practice though the market has not adopted Bitcoin as a safe-haven asset because the market still (perfectly reasonably) considers Bitcoin high-risk. A typical investor today will reduce risk in their portfolio by selling Bitcoin, not buying more. For most people in the world Bitcoin is basically a baffling high-risk tech stock. It’s definitely not a place of refuge in a time of danger.

To reiterate: this moment is not about Bitcoin. Tasteless co-opting of these events to market Bitcoin is already starting and it is wrong both ethically and factually. This conflict is not good for anyone, Bitcoin holders included. Our humanitarian and fiscal impulses can be fully aligned in wishing for a swift and peaceful resolution. In the meantime here is a list of ways to help those affected.

Well written Tyler!