Autopsy and aftermath

The ongoing consequences of the death of Terra/Luna

In this issue:

Autopsy and aftermath

David Marcus is a Bitcoin maximalist now

Technically anything can be art

Autopsy and aftermath

We first talked about Terra/Luna in response to a reader question on March 15. If you purchased $1,000,000 USD worth of Luna on that day and held that Luna would be worth ~$200 today. Hopefully you didn’t. Unfortunately Luna was the 4th most traded cryptocurrency by volume that day, which means many people did:

At time of writing Terra (meant to be pegged to $1) is trading for $0.17 and Luna (the equity token backing UST) is trading for ~$0.00003. Luna has been delisted from Binance and from several Korean exchanges and the Terra blockchain itself had to shut down and release a patch in order to adjust to the failing economics. The Luna Foundation has been trying to raise additional funds to defend the peg but fully collateralizing Terra at this point would require something like ~$10B USD and even then it’s not clear it would restore confidence.1

In some ways the collapse of a ponzi-like system is nothing new in crypto and in some ways this is wholly unprecedented. Bitconnect wiped out ~$2.4B USD of wealth when it collapsed. PlusToken destroyed ~$3B USD of wealth. OneCoin destroyed around ~$4B USD of wealth. By comparison the collapse of Luna destroyed at least ~$40B USD in wealth — and that’s not even counting the ripple effects.

Unlike the first three examples Terra/Luna was deeply integrated into the DeFi ecosystem. Investment funds held them in their funds, dApps used them as loan collateral, DAOs kept them in their treasuries. The Terra/Luna blockchain was also home to a relatively thriving ecosystem of startups and investments all of whom had exposure to the tokens as well as dependencies on the platform. A frequent comparison is being drawn to the collapse of Lehman Brothers in 2008.

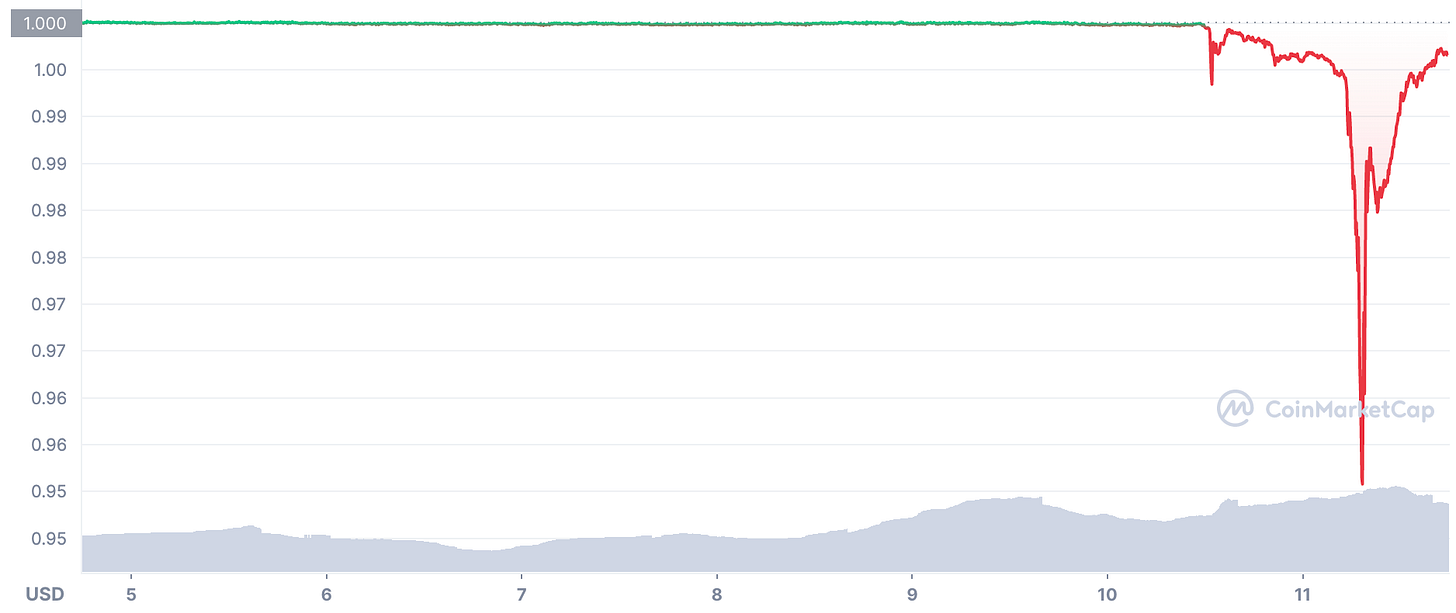

One way to see how hard the crypto economy is shaking right now is to watch another stablecoin, Tether (USDT), attempting to keep its peg:

The price drop above is probably not caused by people losing faith in Tether — more likely it was a side-effect of the market crash in general. Funds caught on the wrong side of the Luna trade abruptly needed to sell off assets to de-risk their portfolios, causing the price of all crypto assets to start crashing. Margin investors were suddenly forced to sell their stablecoins to add collateral so their loans/margin positions weren’t liquidated by the price drop. It all happened so quickly that arbitrageurs couldn’t provide enough liquidity to keep the Tether peg.

Tether (USDT) is not an algorithmic stablecoin like Terra (UST), but instead is a collateralized stablecoin — that means Tether (the company) pinky-promises they will keep ~$1 worth of … stuff … around for every $1 worth of Tether (the stablecoin). How seriously one should take Tether’s promises of collateral is its own complicated story, but the point is that Tether is not at risk from the death-spiral that killed Terra. This isn’t even a particularly significant shock to Tether by historical standards. That tiny blip down on the far right is the graph above:

Tether will probably be fine, at least this time. Terra/Luna is dead. Degenerate gamblers will martyr themselves trying to long the bottom of Luna and offering themselves as exit liquidity to the remaining ~$2B of UST holders. The vast majority of the startups that were building on top of the Terra L1 blockchain will likely die.

Do Kwon (the founder and charismatic face of the Terra/Luna empire) has been silent since posting an optimistic Twitter thread about recovery on Wednesday. That same day Coindesk broke the news that Kwon was also one of the anonymous founders of Basis Cash,2 a failed algorithmic stablecoin from 2020. In other words not only had Kwon run a collapsing ponzi like this before — he immediately went on from that failure to launch Terra/Luna.

Given his experience it is hard to believe Kwon didn’t know how this would all inevitably end — but on the other hand, he literally just named his daughter Luna. Hopefully he has a good nickname picked out.

The consequences of this collapse are still unfolding. There will likely be a domino of failures as start-ups, investment funds and DAOs that had significant exposure to UST or Luna fail. The massive loss of paper wealth will probably trigger a recession in the crypto economy — you can see the effects in the NFT markets already.

Regulators will likely follow, using the failure of Terra/Luna as an example to justify more aggressive regulatory measures for other stablecoins or crypto generally. The SEC was already investigating Terraform Labs (the company behind Terra/Luna) and will in all likelihood expand that investigation given the wreckage this week.

Bitcoin is down (~$29k/BTC), Ethereum is down (~$1900/ETH), monkey jpegs are down (89 ETH), Coinbase stock is down ($58/COIN).

Other things happening right now:

The bonus post from earlier this week has unlocked for all subscribers! Check it out and let me know what you think about that approach to content gating.

David Marcus (formerly head of Product for Facebook/Meta’s failed Libra/Diem currency project) has just announced Lightspark, a new company entirely dedicated to building on top of the Lightning Network. We’ve talked previously about Marcus’s journey through the space and how he concluded from his experience at Facebook that Bitcoin was the superior network/asset. It’s clear that he has committed to following through on that belief.

Whoever wrote these lyrics actually does like crypto:

I wonder why people don’t take NFTs seriously as art? Anyway, here is a collaborative work from musician Madonna and digital artist beeple:

It also radically undermines the claim that Terra/Luna is decentralized in any way.

Basis Cash was actually one of the examples in the 🎶 Don’t start an algo stable 🎶 song from the end of last week’s post.