Only the SEC can prevent forest fires

Plus you used to call me on my SOL-phone

In this issue:

Only the SEC can prevent forest fires

You used to call me on my SOL-phone

25 short stories about Bitcoin and Freedom

The parable of the Lemonade Stand DAO

Only the SEC can prevent forest fires

For the last month and a half or so the biggest story in crypto has been the fall of Terra/Luna in May and the ongoing cascade of liquidations and defaults that it unleashed. The fires are still burning, new stories are still coming to light.

Centralized crypto lender Hodlnaut seems to have millions in undisclosed losses from UST. There are so many rumors around Nexo they converted their "cease & desist" letter into a blog post for convenience. Celsius Networks founder Alex Mashinsky was detained at the airport trying unsuccessfully to leave the country. Three Arrows Capital has now formally defaulted on ~$670M worth of loans to Voyager Digital and seems to have been committing significant fraud.1

Goldman Sachs has been raising funds to buy Celsius Assets off of them in a bankruptcy and FTX has offered loans to BlockFi and Voyager Digital assets. It’s important to remember that neither FTX nor Goldman are charitable organizations and these offers are absolutely not bailouts. This is more like shopping at an estate sale or bidding on a foreclosed home.

The terms that Goldman is pursuing aren’t known but the terms of the FTX agreement are extremely onerous. If BlockFi is forced to use the loan from FTX it will essentially zero-out existing equity. It’s not so much a loan in the traditional sense as it is an open offer to buy BlockFi as a business for $0 if they run out of money. BlockFi’s existing investors are frantically trying to raise capital so they don’t need to wipe themselves out entirely.

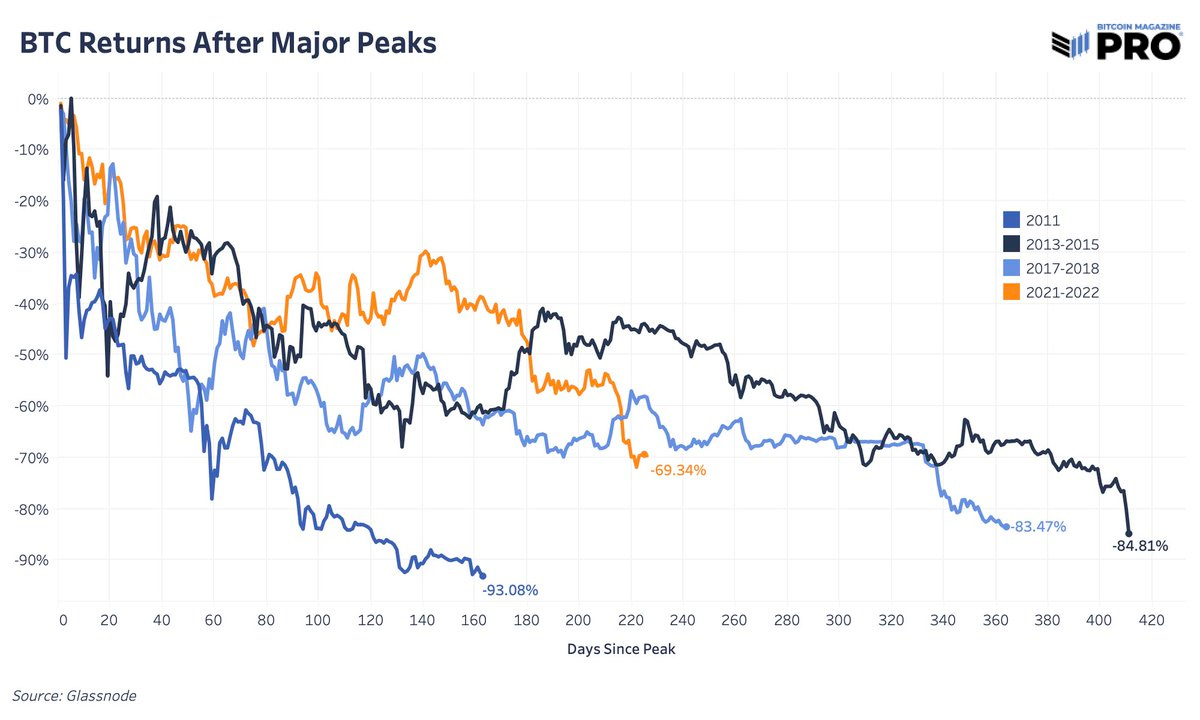

There is certainly still plenty of room for Bitcoin to keep dropping:

The beginning of this deleveraging cascade was the explosive bank run on Terra/Luna but outside of the collapse in UST the majority of the damage has been in traditional centralized organizations, not in DeFi. DeFi lending operations (Aave, Compound Finance, MakerDAO, etc) have all weathered the bear markets fairly well. Loans in DeFi are almost all over-collateralized, which mitigates the risk of market movement. Many of the loans between CeFi crypto lenders on the other hand are turning out to have been under- and in some cases un-collateralized.

The problem, counter-intuitively, is the SEC. We’ve talked before about how the SEC has failed to provide regulatory clarity to the industry — it is clear that they hoped to discourage significant growth in the crypto lending space by making it unclear how to actually stay compliant. But that didn’t actually shrink the size of the market, it just shaped who was selling the products. Ambiguity kept risk-averse companies from competing but it didn’t deter riskier operations at all.

The SEC also set the stage for a massive liquidity crisis by refusing to approve any applications for a Bitcoin spot ETF.2

We’ve been talking about GBTC (the Grayscale Bitcoin Investment Trust) and the associated premium and/or discount since literally the very first post of Something Interesting back in December of 2020.3 GBTC is like a traditional equity wrapper that lets investors hold exposure to Bitcoin without actually needing to own Bitcoin directly.4 Because GBTC is not actually an exchange-traded fund (ETF) the process of converting between shares of GBTC and the underlying BTC asset is clunky, slow and not available to everyone.

That means the price of GBTC doesn’t do a great job of tracking the value of the underlying bitcoin it represents. When GBTC first appeared the convenience it offered was unique and the premium it commanded was enormous (it sometimes traded ~2x higher than the underlying BTC it held). Pseudo-banks like BlockFi rushed to convert customer BTC deposits into shares of GBTC so they could harvest that premium when the shares vested and could be sold. But as more ways to own Bitcoin appeared in the market the large fees GBTC charges became less appealing and the GBTC premium collapsed into a steep discount (~30%). Crypto-lenders who had been collecting that premium were left holding the bag.

The SEC created that initial GBTC premium by refusing to allow Bitcoin ETFs and channeling demand for Bitcoin exposure into alternative vehicles. Then the SEC destroyed that premium by refusing to let GBTC become an ETF itself. If GBTC was allowed to convert into an ETF (as they applied to do years ago) investors could convert their shares of GBTC into BTC and avoid the discount. But without a path forward to an ETF redemption for the underlying is not available — their only option is to sell their GBTC shares into the open market at a significant loss.

Rather than providing a compliant path forward for banks and other companies to provide the crypto-financial services the market is demanding, the SEC is burying its head in the sand and hoping everything will go away on its own. Refusing to properly regulate crypto didn’t reduce risks to cryptocurrency investors — it just pushed those risks out of sight and into the shadows. If anything it made them worse.

Blaming Terra/Luna for the market collapse is like blaming a forest fire on the stray spark that happened to start it. Reckless entrepreneurs can and should be held accountable for playing with fireworks. But it was the SEC that caused the drought that turned everything into a tinderbox.

You used to call me on my SOL-phone

On Thursday of last week Solana Labs (the company behind the Solana blockchain) announced a new Android-based crypto-focused mobile development platform called the Solana Mobile Stack (SMS), along with a flagship cell phone called the Saga, available for pre-order now.5

I find this pretty compelling as a strategic play. Most internet users are mobile-first and the mobile crypto experience today is difficult, dangerous and awkward. The problems aren’t trivial to fix, either. Securely managing private keys that are themselves managing actual user funds is not something existing hardware is built to do. App stores on Android and iOS are also actively hostile to crypto applications — both by policy and by virtue of the in-app-purchase economic model.

This is a classic innovator’s dilemma: Android and iOS could adapt to support these use cases, but doing so would undermine their lucrative existing revenue streams and require an expensive redesign of their product and business for a niche audience. That gives Solana time to build out user trust and a developer ecosystem focused on cryptocurrency and cryptography as a central use case.

Launching a flagship hardware product like the Saga is likely not profitable per se but instead is better thought of as a kind of indirect R&D investment. By demonstrating their commitment to the mobile ecosystem they can attract the attention of mobile web3 developers. If that developer ecosystem improves the mobile Solana experience it will give Solana a meaningful edge in onboarding the next 100x users, many of whom will be mobile-first or possibly mobile-only.

Other things happening right now:

People often dismiss Bitcoin as useless by those who are blind to their own privilege, but humanitarian activists have already realized that Bitcoin is a powerful tool for human freedom. Below are 25 short clips where human rights activists from around the world talk about how they use Bitcoin to defend themselves from financial censorship.

The parable of the Lemonade Stand DAO:

The SEC worries a spot Bitcoin ETF would be too volatile, but don’t worry — an ETF for shorting Bitcoin is fine. The BTC chart is less volatile when you hold it upside down.

The price of Bitcoin was about the same back then, but people were much more excited about it. It was a simpler time.

That’s basically the service that Microstrategy is offering too, in a different way.

The Saga is priced in traditional fiat dollars ($1000) rather than SOL, but the pre-order does require customers to pay using USDC on Solana.