It's different this time ...

[Something Interesting Issue #1]

In this issue …

The difference between now and 2017

XRP is a security (and a scam)

What to do if you are exposed by the Ledger hack

It’s different this time …

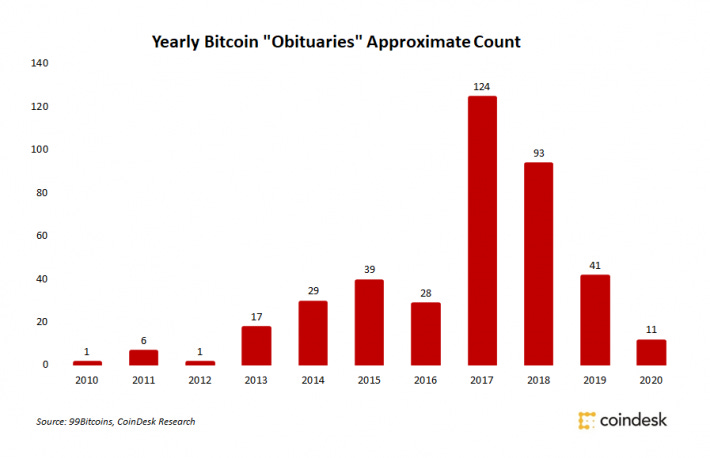

Bitcoin has had at least three major bubble cycles in its brief history, depending on how you choose to define a bubble. Each has been accompanied by slew of detractors announcing its imminent or presumed death. 99Bitcoins playfully tracks these obituaries and has collected 390 and counting so far. Sadly this rich vein of amusement may be starting to run dry:

After ten years of failing to die even the Bitcoin skeptics still willing to go on record are starting to caveat their predictions of doom in very telling ways:

When the skeptics in the room are suggesting the price will double, something has changed. More interestingly things appear to be different not just in narrative land but down in the world of fundamentals as well! Here is a good thread describing some of the ways coins are moving differently this time around:

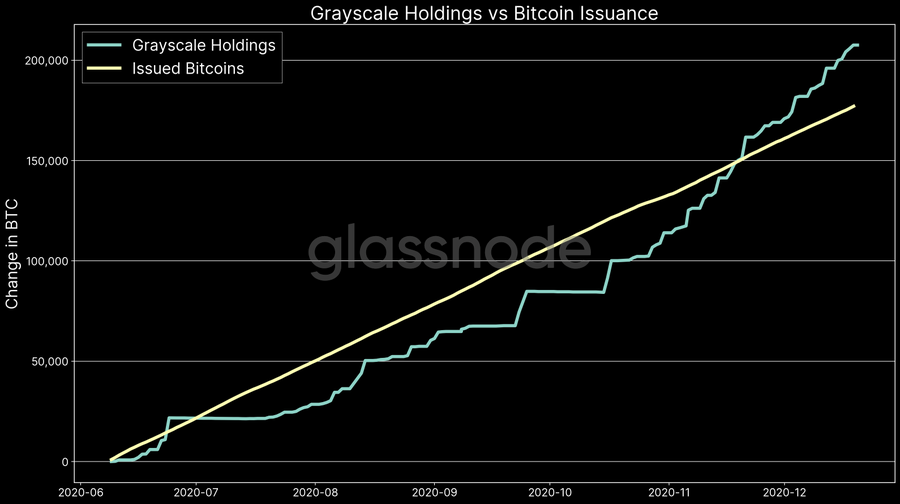

Of particular interest to me was the comparison of GBTC with BTC issuance:

The Grayscale Bitcoin Trust (GBTC) is a kind of pseudo-ETF for Bitcoin. It is essentially a wrapper that allows exposure to Bitcoin price movements without holding Bitcoin directly. GBTC price typically has a large premium over BTC spot price and they also sell 2% of their holdings annually to cover fees, so it is strictly worse than holding Bitcoin itself - unless you literally can’t. Many institutions and funds have policies that prevent them from holding investments not listed on major exchanges - GBTC is one way to get around that restriction. So demand for GBTC is one interesting approximation for so-called ‘institutional’ demand - and as you can see from the graph above, Grayscale alone is acquiring Bitcoin at a faster rate than miners are able to produce them. At time of writing Grayscale holdings represents approximately half of all publicly disclosed corporate Bitcoin holdings.

There are incredibly few Bitcoin. Institutions have begun to notice.

XRP is a security (and a scam)

XRP is a cryptocurrency created by the company Ripple. Ripple presents itself as a banking company leveraging XRP as a commodity to aid interbank forex transfers and remittance channels. In reality >90% of Ripple’s revenue comes directly from selling XRP to naïve retail investors and the companies actually using Ripple technology are only doing so because Ripple literally pays them (in XRP). In total Ripple has unloaded ~$1.3B worth of XRP onto the unsuspecting retail market since 2017.

As you might imagine, it is rather illegal to sell a billion dollars worth of unregistered securities to American investors. To be clear, Ripple is not alone in having taken advantage of the 2017 ICO (Initial Coin Offering) boom to raise capital from unsophisticated investors - EOS, Tron, Cardano and dozens of other tokens were launched as bad faith attempts to extract capital from the uninformed. With most of these ICOs the SEC has been a surprisingly hands-off and a light touch with enforcement when it has stepped in. Block.One for example raised >$4B in the launch of EOS but was only fined $24M by the SEC.

Ripple on the other hand has been especially egregious. Where other tokens raised money in an initial sale in 2017 they have been continuously unloading XRP onto the market all the way into 2020. And after three years of this the SEC has finally been stirred to action. Unusually in this case the SEC decided to charge not just Ripple the company but also Christian Larsen (a co-founder) and Brad Garlinghouse (the current CEO) individually. Charges aside the larger implication to the SEC’s position that XRP is a security is that most cryptocurrency exchanges are not licensed to trade securities. Likely XRP will soon be delisted from reputable exchanges:

Coin prices can never really fall to zero, because no one will bother to sell their coins for nothing. So there is some minimum floor for the last traded price, even though liquidity will have entirely disappeared. In other words, de-listing is probably the closest alt-coins ever come to explicit death. By all accounts, XRP is dying. Since the SEC announcement the price is already down >50%.

Don’t buy XRP. If you have XRP, sell it. If friends ask you about XRP gently explain to them that there are bad people in this world and they should be careful with their money. Then subscribe them to this newsletter.

What you need to know about the Ledger hack

Ledger is a company that sells hardware wallets - basically USB sticks with some additional code and a small built in screen that lets you manage cryptographic keys in a way that is theoretically safe from malware on your computer.

(For the record, I’m not a big fan of hardware wallets and don’t recommend them - but that’s not especially relevant to this story.)

The Ledger commercial databases were hacked - the hackers didn’t get access to any of the Bitcoin (or other cryptocurrencies) stored on Ledger devices, but they did get access to the names, phone numbers and home addresses of ~1.3M Ledger customers. Then they leaked those records publicly across the internet. If you bought a Ledger wallet anytime in the last few years, chances are you are affected. You can check whether you are affected here.

It is hard to overstate how dangerous this is for the people affected. Phishing and blackmail attempts have already started. Darker threats are a possibility. Here is a good thread on some steps to consider if you are affected:

Don’t store keys that control a large amount of cryptocurrency in your home for the same reasons that you don’t use your home to store gold or precious gems. If you own a sizable position in crypto, get a safe deposit box or better yet learn about m-of-n multi-sig and split your keys up across multiple locations.

Other things happening right now:

CryptoTwitter is spelling out the Bitcoin whitepaper one letter at a time. No, I have no idea why.

A minor token is embarrassing itself to death by trying to bully a crypto-artist about a bullshit trademark

Rohan Grey and Rashida Tlaib proposed new regulations aimed at stablecoins like Tether and Dai. I don’t like the new regulations but they generally affect banks more than individuals and they probably won’t pass anyway so I think the furor is overblown.

An Ethereum based insurance protocol called Cover was hacked to the tune of ~$3M worth of ETH. Hours later another Defi team Grap.Finance took credit for the attack, described it as a white-hat defense and returned the stolen ETH. Sooooo … I guess the system works?

NFL player Russel Okung has negotiated for half of his $13M 2020 salary to be paid in Bitcoin.

The one letter thing... 🤔