What happens if we run out of Bitcoin?

Plus mining isn't as decentralized as anyone would like yet

In this issue:

Disintermediating banks is only ok for banks to do

Is Bitcoin mining already centralized? (reader submitted)

What happens if we run out of Bitcoin? (reader submitted)

Disintermediating banks is only ok for banks to do

On Monday the President’s Working Group on Financial Markets released a report on stablecoins titled (appropriately enough) Report on Stablecoins. The paper is about 25 pages and lays out the PWGs formal recommendation about how the US government should approach stablecoin regulation. The group lays out three major risks and makes three corresponding recommendations about how to handle them:

To avoid bank runs on stablecoins, legislation should be passed requiring all stablecoins to be issued by insured depository institutions — i.e. banks.

To avoid weakening know-your-customer / anti-money-laundering controls, legislation should be passed establishing a new Federal stablecoin regulator.

To avoid giving anyone too much economic leverage, legislation should be passed requiring standards of interoperability and limiting stablecoin associations with commercial entities and on use of users’ transaction data.

The goals and concerns aren’t intrinsically unreasonable but taken as a whole the recommendations are pretty aggressive, especially considering how many traditional financial instruments attempt to mimic the value of a dollar without needing to be issued by banks. It’s not even clear stablecoins are able to get FDIC insurance — especially algorithmic/experimental stablecoins.

It seems unlikely that any of this recommended legislation will actually pass because passing legislation is not a thing that Congress does any more, but if this legislation did pass as recommended the obvious winners would be big banks since they would be the only ones allowed to participate in the lucrative market for stablecoins.

Jeremy Allaire, CEO of Circle (which owns stablecoin $USDC) pushed back on some aspects of the report but was overall positive:

More interesting are the implications of recommendation (3). Here’s the full text of the recommendation from the report:

To address additional concerns about systemic risk and concentration of economic power, legislation should require stablecoin issuers to comply with activities restrictions that limit affiliation with commercial entities. Supervisors should have authority to implement standards to promote interoperability among stablecoins. In addition, Congress may wish to consider other standards for custodial wallet providers, such as limits on affiliation with commercial entities or on use of users’ transaction data.

It seems pretty clear that Facebook (now Meta) and their stablecoin Libra (now Diem) was the primary target the committee had in mind with this language. It is easy to forget but it was Facebook’s announcement of Libra that started the wave of interest in stablecoin regulation in the first place. Tether collapsing might be a little worrying to regulators but it is the thought of Facebook launching a parallel financial system that really keeps them up at night. I don’t blame them.

Is Bitcoin mining already centralized?

Igor Makarov and Antoinette Schoar of the National Bureau of Economic Research (NBER) published a paper titled Blockchain Analysis of the Bitcoin Market where they carefully scrutinize Bitcoin mining transactions to understand the concentration of power and control among Bitcoin miners. They have three basic criticisms of the current state of the Bitcoin network:

Bitcoin miners are economically centralized

Bitcoin miners are geographically centralized

Most Bitcoin is held on exchanges (and is therefore centralized)

Let’s start with the last complaint because I think it’s the simplest. I don’t agree with the premise that Bitcoin only succeeds if the majority of Bitcoin is held by individuals instead of businesses like exchanges or banks. There are advantages and disadvantages to self-custody and I don’t think universal self-custody is something we should expect or aspire to — storing bitcoin in your home is like stuffing gold bars in your mattress.

Most of the world’s bitcoin will probably always be held in third-party services and that’s fine. The option to self-custody will still put competitive pressure on the businesses whether or not the majority of consumers ever choose to exercise it. Government seizure of assets (or imposing of restrictions) is definitely one of the risks of third-party custody but that is a threat to bitcoin held by a particular business, not an existential threat to Bitcoin itself.

The first two criticisms about concentration among Bitcoin miners I think are much more justified. Makarov and Schoar seem to have done some novel work to identify the addresses that represent actual miners themselves rather than just the mining pools they coordinate hashing through. I don’t know enough about the modeling algorithm they used to endorse or reject it, so I don’t know if their estimates about the number or size of miners are reasonable, but I would have made similar guesses.

Most people don’t care about Bitcoin, some people despise it and a handful of people become enamored and immerse themselves in it. It is not surprising to learn that Bitcoin mining has the same distribution where a small number of people believed in the potential a lot and made large investments early. Bitcoin is polarizing. It would be surprising if Bitcoin mining wasn’t!

Concentration of mining power is a legitimate cause for concern even if it isn’t surprising, and anything that improves the viability of small-scale, decentralized mining is a healthy thing for the network. That’s why I thought China banning Bitcoin mining would be bullish in the long term. Mining was heavily concentrated in China - the ban scattered those assets all over the globe.

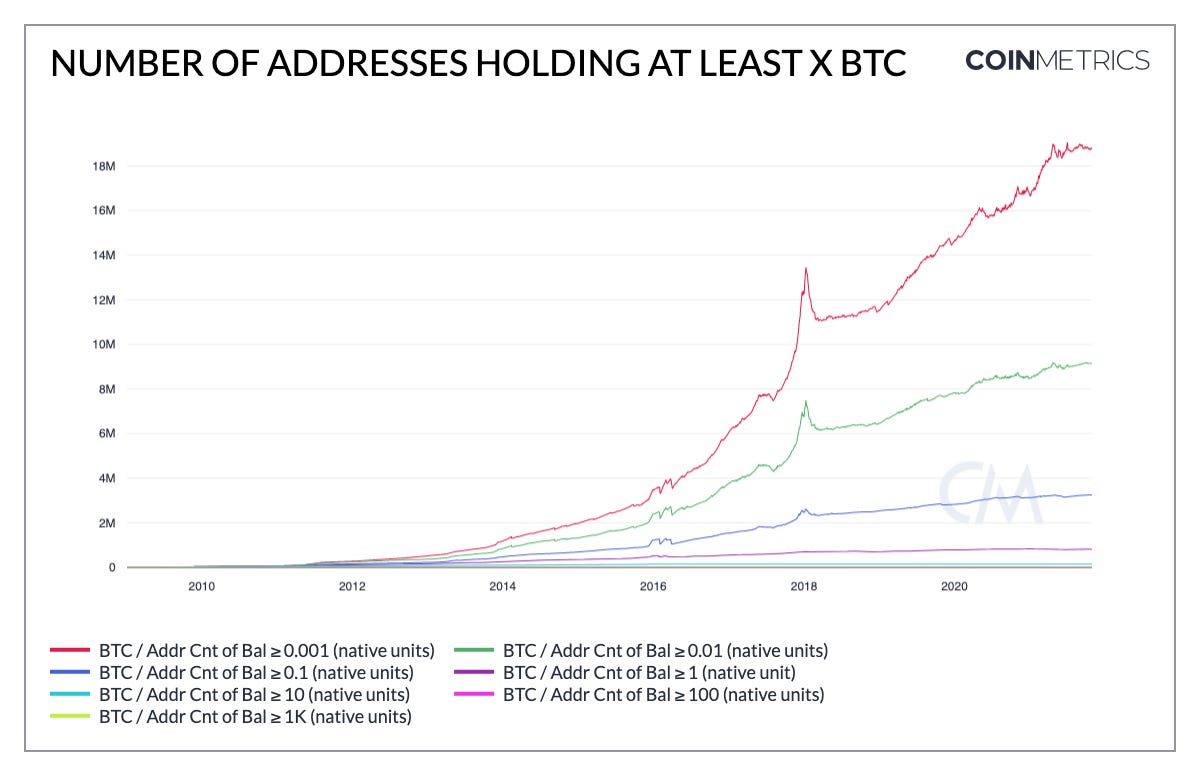

The concentration results they show are alarming but I’d be interested in seeing a version of the miner analysis over time - my sense is that Bitcoin mining operations are probably similar to everything else on the Bitcoin network: relatively few players at first but steadily increasing number of actors over time. Here’s how that looks for how concentration in ownership of Bitcoin has changed over time:

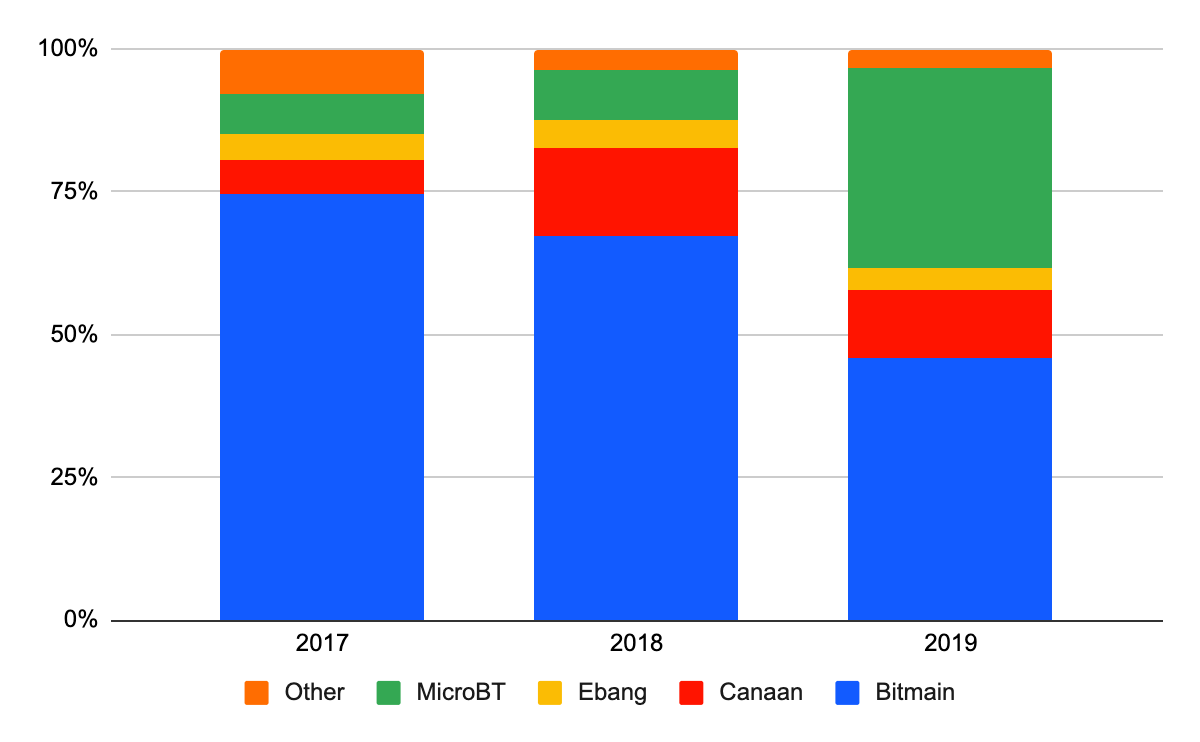

The state of the network today is more concentrated than anyone should feel comfortable about but honestly the owners of existing mining equipment aren’t the point of attack I would most worry about — they are likely very committed to Bitcoin both financially (they have a lot of capital invested in the form of mining rigs) and ideologically (they made those investments back when most people thought it was a crazy thing to do). Rather than trying to commandeer old rigs from existing miners I would focus my attention on capturing all the new mining rigs as they are built. There are really only a handful of manufacturers of ASIC mining equipment:

It is hard to know the actual cost of attacking the Bitcoin network in practice since it would involve changing so many of the incentives for so many of the participants - but by most reasonable estimates it is still achievable by large nation-states like China or the United States.1 The argument in favor of Bitcoin security isn’t really that it is impossible to attack, it is that it is easier and more profitable to defend.

China is actively seeking to disarm itself of mining power which would be a strange prelude to launching a mining-power based attack on the network. In the US officials have been treating Bitcoin as increasingly more legitimate - so they seem to be positioning themselves as more likely to defend the network than attack it. Bitcoin is like the honey badger — it’s not unkillable, but for most animals most of the time it’s just not worth bothering to kill.

What happens if we run out of Bitcoin?

"How could BTC ever possibly be the world's best money when it is so easy to lose? There's no longer 21M available already. How many will remain in 100-200+ years? Will it be enough?" - AA

There is nothing particularly critical about the total number of Bitcoins other than that no one is able to create more. Bitcoin as a system can operate equally well with 21 bitcoin or 21 billion — since bitcoin (the token) can be divided arbitrarily Bitcoin (the network) scales to any size economy and any number of remaining bitcoin. If there was only one bitcoin left and the whole world wanted to use it we would just divide the last remaining bitcoin into very small increments and transact in those - the Lightning Network can already transact down to the millisatoshi.

So if someone loses their bitcoin it is a bummer for them but it is actually good news for everyone else — they have effectively donated their wealth to the rest of the network. Imagine if one of the dozen-or-so known Da Vinci paintings were lost in a fire — the remaining paintings would become more scarce and likely more valuable. The supply of Bitcoin operates in loosely the same way.2

The fact that ordinary people face significant risk of losing their Bitcoin certainly hampers adoption — but the risk is to individual users, not to the network at large. When someone loses their Bitcoin the network loses two things — the tokens and the person who held them (at least the ones too frustrated to buy in again). The tokens aren’t that important but the users are.

Other things happening right now:

We talked a few times about Taproot on Something Interesting - most notably when the developers used the blockchain to flip a coin. Taproot is an upgrade to Bitcoin’s signatures that improves privacy and efficiency that was locked in (with some controversy) earlier this year but officially activates on block 709,631 likely sometime around November 14th. Taproot took approximately four years from conception to activation. (Editor’s note: this paragraph originally misstated the calendar timing of the Taproot activation. h/t to reader PM!)

We joked last week about the wallet that had apparently been diamond-hand holding a ~$5.7B position in SHIB from August of last year but apparently the joke is on all SHIB holders because that wallet is apparently still active and starting to move funds. Curious how much ~$5.7B in SHIB is actually worth? We may be about to find out.

This isn’t strictly crypto related but I found this trucking veteran’s essay about the shipping crisis fascinating. It describes in concrete detail why the breakdown happened, how it is getting worse and why shipping companies may end up profiting from the congestion rather than working to solve it. Buy your Christmas presents early this year.

Aaron Rodgers joins the growing list of NFL stars who have publicly adopted Bitcoin as part of their personal finances.

Crypto51.app estimates the current cost to 51% attack the network as ~$2B/month but that is a pretty naive model. Paul Sztorc who I respect a lot estimates the post-subsidy cost to an attacker as ~$29M/month right now but I’m not sure I totally agree with how he is filtering/categorizing transactions. The costs are almost certainly within reach for a determined international power, though.

The actual supply of lost bitcoin is not knowable in any formal sense because it is impossible to distinguish between lost keys and owners who just haven’t spent yet. Chainalysis estimates that ~3.8M bitcoin are lost (including Satoshi’s ~1M BTC).