Elon Musk has paper hands

Plus orange-pilling the NFL and ten years without Satoshi

In this issue:

Elon Musk has paper hands

Bitcoin and the National Football League

Elon Musk has paper hands

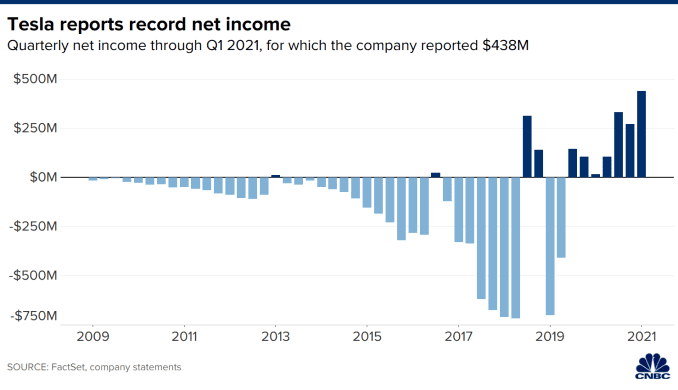

Tesla released its Q1 earnings report on Monday, revealing among other things that they sold off ~11% of their Bitcoin treasury holdings for $272M, booking $101M in profit. Interesting to think what might have happened if this news came out at the bottom ~$47k/BTC rather than after Sunday’s sharp recovery to ~$54k/BTC. Tesla did not sell because it needed money - at the end of 2020 it was sitting on ~$19B in cash and cash equivalents. What Tesla needed was profit.

Tesla’s CFO and Master of Coin Zachary Kirkland described the year like this:

"Year over year, positive impacts from volume growth, regulatory credit revenue growth, gross margin improvement driven by further product cost reductions and sale of Bitcoin ($101M positive impact, net of related impairments, in 'Restructuring & Other' line) were mainly offset by a lower ASP, increased SBC, additional supply chain costs, R&D investments and other items. Model S and Model X changeover costs negatively impacted both gross profit as well as R&D expenses."

Kirkland emphasized that Tesla still had a bullish outlook on Bitcoin and said the liquidity Tesla had found during the sale had actually increased their confidence (liquidity in this context means the ability to buy or sell a large amount without moving the price of Bitcoin significantly). Here is Kirkland again:

"We have been quite pleased with how much liquidity there is in Bitcoin market. When we did the sale in later March, we also executed quickly. Being able to get cash out is exceptionally important."

Kirkland didn’t describe any plans to acquire more but he did reaffirm the intention to accept bitcoin for payments and to keep the bitcoin they receive. SNL host and occasional CEO Elon Musk described the sale as a deliberate test to confirm liquidity was there when Tesla needed it:

If I was a Tesla investor I would be pretty uncomfortable with this. Profit is always welcome but Tesla is supposed to be a car manufacturer not a hedge fund. Buying and holding Bitcoin to keep cash assets from depreciating is novel but at least defensible - but using cash reserves to trade for profit is really not, especially if the goal is to obscure losses in other parts of the business. Either Tesla should only be selling Bitcoin when they need the liquid reserves or they shouldn’t be holding it at all. You don’t want your company management to take up day trading.

Being generous in our interpretations we could assume that this is just a part of rebalancing their portfolio after Bitcoin significantly grew in value. It’s possible they have risk mandates or other portfolio targets that would automatically cause them to draw down on their Bitcoin holdings. But it is disconcerting to realize that almost ~24% of Tesla’s record breaking profits this quarter were from the sale of digital assets rather than physical ones.

As a Bitcoin investor I am mostly indifferent. Tesla sold some Bitcoin but they still hold ~90% of their original purchase (~$2.1B worth). Liquidity was a genuine concern about Bitcoin for a while so it is nice to have confirmation that market depth has developed and institutions can make large purchases and sales without worry about tanking the price. Some people are interpreting it as Tesla losing confidence in Bitcoin but I both don’t see it that way and wouldn’t be especially concerned if it was true.

Who cares if Tesla sells some Bitcoin? Anyone using Elon Musk as a guiding signal for crypto investing is presumably all in on Dogecoin already.

Bitcoin and the National Football League

Number #1 NFL draft prospect and real life Kronk from The Emperor’s New Groove Trevor Lawrence signed a multi-year endorsement deal with cryptocurrency exchange Blockfolio. As part of the deal he received a signing bonus paid out in a portfolio of the cryptocurrencies Blockfolio supports including Bitcoin, Ethereum and Solana - the exact amount and distribution wasn’t disclosed. They were excited to announce that his bonus was worth more today than Friday when he received it.

The hype here is completely manufactured. Lawrence got paid a bonus in crypto by a company that wants to sell crypto - it’s no different from a sneaker company paying an athlete to wear their sneakers. The signing bonus being in crypto is just a ploy to create a news cycle boosting the company and possibly even the assets themselves. Lawrence made no commitment to keep his bonus in crypto (why would he?) and none of the ongoing payments will be in crypto. This isn’t radically different from any of probably a dozen other endorsements Lawrence has made.

There are a surprising number of NFL players becoming orange-pilled, though. We’ve talked before about Carolina Panther’s tackle Russel Okung, who negotiated to have his salary delivered (though not denominated) half in Bitcoin. More recently Kansas City Chiefs tight end Sean Culkin decided to do the same with his entire salary.1

It is interesting to see NFL players become advocates earlier than other major sports figures. Perhaps the relatively short careers of football players (avg. ~2.5 years) make players hungrier for ways to put their earnings to work?

Other things happening right now:

Weapon skins from Counter-Strike: Global Offensive (CS:GO) are one of my favorite examples for helping people understand why digital objects like NFTs can carry real value. This presentation by Valve about how to create an economy around luxury goods was written in 2014, before NFTs existed - but it is a terrific lens by which to understand which NFTs gain traction and why.

A short story in six parts:

In the past year Bitcoin’s overall market cap has gone from ~$100B to ~$1.1T. In totally unrelated news gold’s market cap has gone from ~$10T to ~$9T. It’s probably nothing.

The cheapest CryptoPunks (often called floor punks) are for the first time trading for more than a bitcoin:

10 years ago on Monday was the last time we heard from Satoshi Nakamoto.

~$920k, a fairly average salary for a tight end in the NFL.