How to flip a Bitcoin

Plus Coinbase's Q1 financials and on the Blockchain everyone can see you.

In this issue:

Coinbase releases its Q1 financials

Do NFTs actually 'do' anything? (reader submitted)

How to flip a Bitcoin

On the blockchain everyone can see you (reader submitted)

Coinbase releases its Q1 financials

As we talked about a few days ago Coinbase released its Q1-2020 financial statements on Wednesday and the numbers are extremely impressive. Coinbase has grown to 56M verified users - larger than any major bank except JPMorgan Chase and more than ~4x the number of users on Robinhood. They cleared $1.8B in revenue in Q1 (more than all of 2020 combined) with ~$730-800M in profit, a profit margin of ~40-44%. Compare that to Citi which last year had a profit margin of ~13% on its $88B in revenue. Coinbase’s is aiming for a $100B valuation, Citi’s market cap is currently $150B.

If you are curious to dig deeper into the accounting, here is a good thread:

There are a couple of ways in which these numbers are significant. First and most obvious, Coinbase appears to be an extremely successful and well positioned business. For many years one of the biggest threats to Coinbase was the possibility that traditional banks and exchanges would launch support for Bitcoin and make them obsolete. These numbers suggest it may be too late for that - Coinbase has already grown larger than many of the traditional incumbents.

More importantly for the broader space these earnings will be impossible to ignore. Investing in Bitcoin is strange and unfamiliar and feels risky even with the staggering gains it has posted for the last decade. But a Silicon Valley tech IPO with blue chip venture capital backing and healthy revenue, growth and margins carries far less career risk. Investors who have been reluctant to embrace crypto will likely be more comfortable investing in Coinbase given its similarity to existing investments. Owning Coinbase will inevitably make them more familiar and comfortable with crypto itself. As Nic Carter put it, Coinbase will act like a gateway drug.

Interestingly, Coinbase itself has not taken a bullish stance on cryptocurrency. According to its S-1 Coinbase started the year with ~$1.1B in cash but only ~$130M worth of bitcoin (~4500 bitcoin at the time) and ~$28.2M worth of ether (~37.6k ether). Coinbase naturally accumulates crypto from trading fees, which means that it has been an aggressive net seller for essentially its entire history.

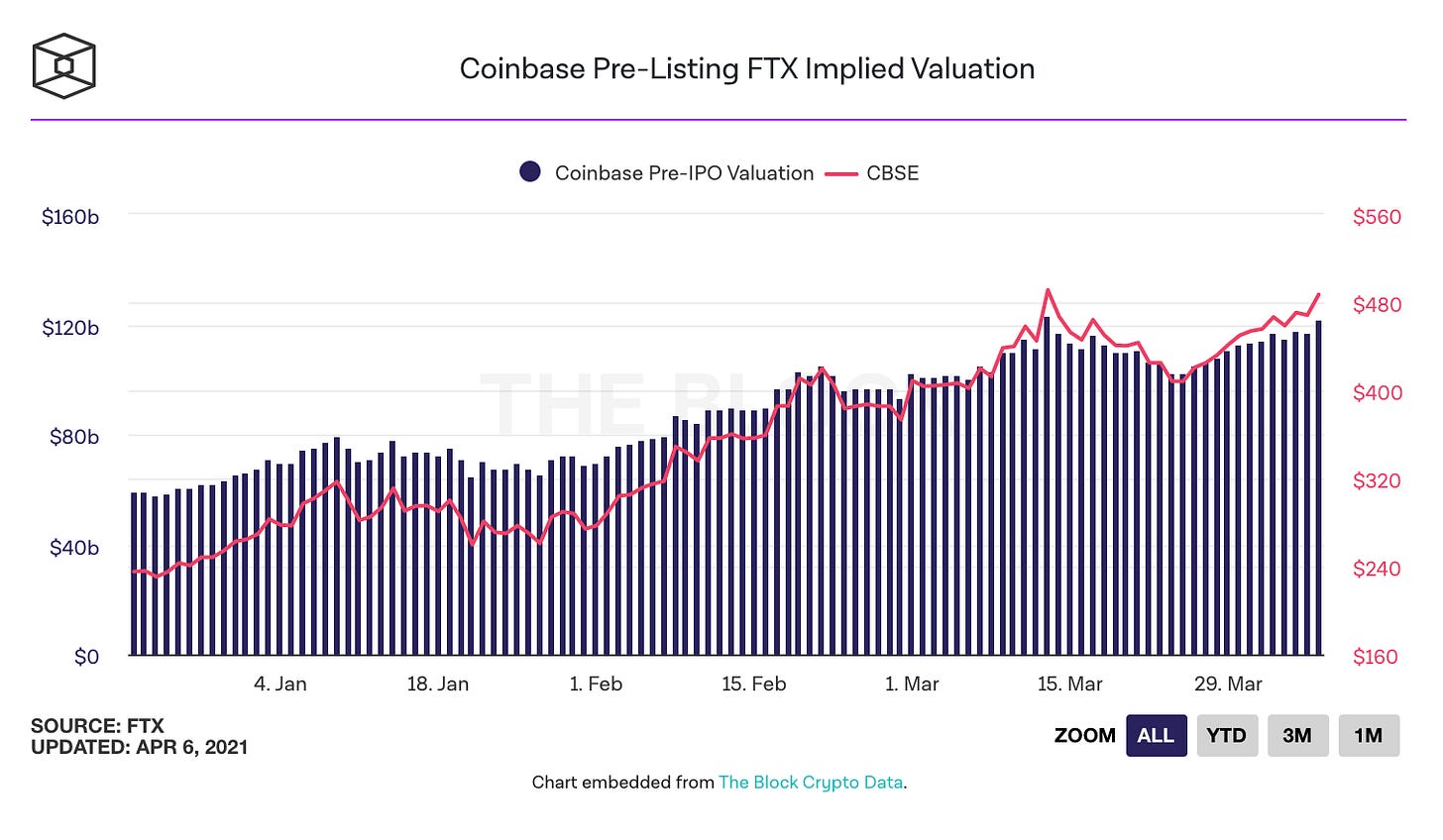

At time of writing Coinbase is pre-trading at an implied valuation of ~$120B.

NFTs don’t usually 'do' anything

“How do NFTs compare to owning licensing rights for digital media? As sold on websites like http://royaltyexchange.com?” -KN

The short answer is that NFTs don’t usually confer any rights at all, royalties included. The two most popular NFT projects for example (NBA TopShots and CryptoPunks) do not entitle you to any copyrights over the images you "own" and don’t allow you to reuse or license them in any way.

There are some NFTs that pay ongoing royalties back to the original artist (b20 tokens pay a percentage of every resale back to beeple, for example) and there are some NFTs that are very explicitly meant to mimic rights in various ways, like EulerBeats. But as a general rule most NFTs are useful only in the sense that you can own them or give them to someone else. They don’t usually represent any legally backed claim to anything yet.

How to flip a Bitcoin

Bitcoin is intended by design to be very difficult to change. That’s good in the sense that it defends the system against attempts to commandeer it, but it is bad in the sense that it is also difficult to make desirable changes. Its ultimately a trade-off: Bitcoin is hard to capture, but slow to upgrade.

Bitcoin’s developers have been working on an upgrade called Taproot for example since early 2018. Taproot replaces the current algorithm Bitcoin uses for digital signatures (the elliptical curve digital signature algorithm or ECDSA) with Schnorr signatures. Schnorr signatures have several useful features but the most important one is that you can combine multiple different signatures into one signature. That means more complex transactions like multi-sig, lightning network channels and CoinJoins will be compressed down to the same footprint as an ordinary transaction.

Schnorr signatures make complicated transactions more scalable (fewer signatures means more transactions fit into the same block), cheaper (smaller transactions don’t need to pay for as much blockspace) and more private (more complex transactions are indistinguishable from simpler ones). Pretty much everyone agrees they are better! The main reason Bitcoin didn’t use them initially is because they were fairly new and not yet standardized when Bitcoin was released.

So the Taproot upgrade itself is not controversial. The majority of the debate for the past year or so has focused on how to upgrade the network. In March David Harding proposed an activation methodology he called "Speedy Trial" that started to gain consensus. There was only one remaining detail being debated: whether to use blockheight to time the update or median-time-past. Jeremy Rubin summarized the general view of the debate on the developer mailing list:

2) On selecting between MTP and Height - There are some benefits to MTPs - There are some benefits to Heights - Both are technically probably OK to use for Taproot

In other words it was kind of six of one, half a dozen of the other. There were reasons to prefer one or the other, but the reasons weren’t especially decisive so it was proving difficult to build consensus. Those who work in the software industry will recognize this as a classic example of bikeshedding. The Bitcoin developers also recognized that and came up with a novel way of breaking the stalemate. From that same email:

3) Timeline + CoinFlip - Many present at the meeting preferred to work together to compromise and reach consensus to stick to the timeline from the last meeting over either height or MTP. - as such a coinflip is being run via `bitcoin-cli getblockhash $((678059+20)) | cut -b64 | grep -q '[02468ace]' && echo MTP || echo height` (that's about 13 blocks from writing). - If it comes up MTP, contributors mentioned below will work towards moving MTP forwards. - If it comes up height, contributors mentioned below will work towards moving height forwards.

This is classic sitcom logic! The devs couldn’t settle their disagreements so they flipped a coin. I assume the next step will be dividing the room in half with a line and agreeing not to leave your side.

I kid, of course! Using random numbers as a way of arriving at a 'fair' consensus is a pretty classic technique in cryptography so this probably didn’t strike the developers as strange in the way that it does many people on the outside. The developers basically agreed that the difference between their preferred outcome and the other option was less important than making forward progress towards Taproot. So they all agreed to use Block #678,079 as a coin flip and abide by the outcome.

The winner if you are curious was median-time-past.

On the blockchain everyone can see you

“If the ledger is public, and I share with you my address so you can send me money, does that mean you can look up all other transactions to my address? Like see how much I get paid, etc?” - JL

The simple answer is yes. You can look up any public address on the blockchain and you can see every transaction to and from that address. For example here is the address that holds the original block reward from the Genesis block. Over the years ~2800 people have sent bitcoin to this address, kind of like throwing coins in a wishing well. As of writing no bitcoin has ever been sent from this address.

That’s one of (although not the only) reason that best practice with Bitcoin is to not reuse addresses. Modern wallet software can generate an infinite number of public addresses from a single private key, so it is possible (and recommended) to generate a new address every time you want to receive bitcoin. That way you don’t need to reveal everything about your finances to someone for them to send you money. Unfortunately that alone is not enough to guarantee your privacy.

When you spend money you combine the leftover money from different public addresses into a single transaction large enough for whatever outgoing payment you are trying to send. Of course when you combine addresses for a payment like that you lose privacy because it is now obvious those addresses were controlled by one person. So the choice of which change addresses you combine for a new payment has very complex privacy implications.

There are whole companies (Chainalysis, e.g.) dedicated to using on-chain observations and statistical inferences to understand which addresses are related. There are some nascent technologies (like CoinJoin) that can help blend transactions together to make it harder to know who is responsible for which part, but for the most part it is very difficult to ensure your privacy on the Bitcoin blockchain.

There are no foolproof or user-friendly solutions yet.

Other things happening right now:

BitClout is the story that keeps on giving. We’ve already talked about how they stole the identity of an SEC commissioner and the Prime Minister of Singapore. It turns out they also upload user’s private keys to their server on literally any call. Every user who has so much as loaded a profile page has given custody of their private keys to BitClout. Yikes.

Bitmex CEO Arthur Hayes has surrendered to authorities. He is charged with violating US know-your-customer/anti-money laundering laws and is currently released on a $10M bond pending court proceedings in New York.

Some entity has been withdrawing Bitcoin from Coinbase in large chunks - more than 12k bitcoin at a time, more than 11 times in the last three months. The latest withdrawal on Tuesday was worth more than $0.5B when they withdrew it.