Everybody hates BitClout

Plus what does it mean to be a "real currency"?

In this issue:

What does it mean to be decentralized?

You’re not my real currency

Everybody hates BitClout

What does it mean to be decentralized?

“In your first 10 cryptocurrencies you meet article you say it’s important for people to be able to understand the protocol. But isn’t that equivalent to saying that computers can only be successful if people can understand how they work?” - DD

That’s a very fair question. Lots of the technology we use everyday is basically magic and it works just fine. Why should we demand that a cryptocurrency be easy to understand when we wouldn’t have that same expectation for a car or a cell phone? Why do ordinary people need to understand a blockchain?

It helps to start by remembering the problem that Satoshi set out to solve:

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” - Satoshi Nakamoto

The purpose of Bitcoin is to prevent breaches of trust by eliminating the need for trust in the first place. Satoshi did not trust leaders, so he built Bitcoin to enable a leaderless world. You don’t need to trust the leaders of Bitcoin because they don’t exist - there is no one in charge of Bitcoin. That is what it means to be decentralized - there is no center. No person or organization has authority or control over Bitcoin.

The reason that matters is because of trust. You don’t need to trust anyone in Bitcoin, because no one can change the rules. No one can block your payments, freeze your account or dilute your wealth. Not everyone who interacts with Bitcoin is relying on trustlessness obviously - lots of users hold Bitcoin through exchanges or through loved ones. But trust is not required.

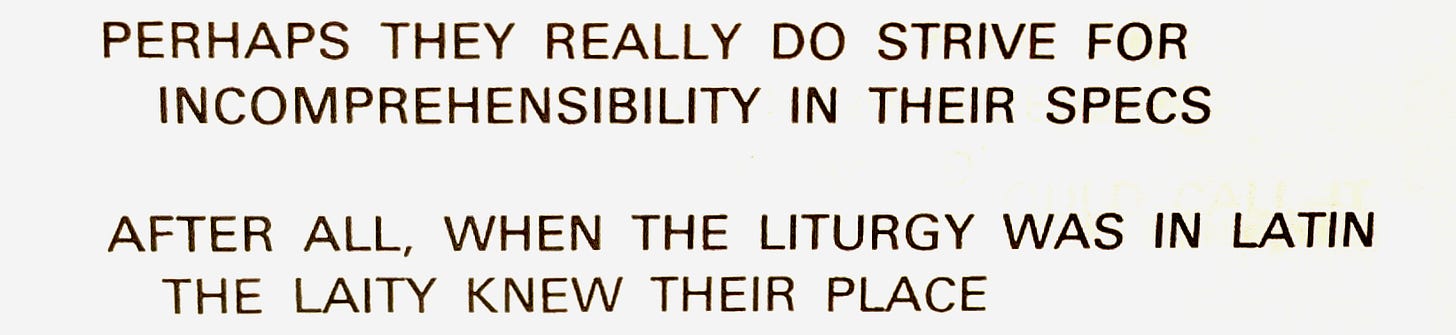

Let’s imagine a superior blockchain named Hypecoin whose only drawback is complexity. Most people can’t understand it but a small cabal of experts who have studied the discipline for years understand it and can attest to its brilliance. The problem with Hypecoin is that even if it really is a superior blockchain somehow it is useless because it does not solve the problem of trust. You still have to trust the experts because they are the only ones who know how the system works.

But if you trust the experts to run the Hypecoin system, why not just trust that same group of experts to run smart contracts for you on a much cheaper traditional database? If no one is able to scrutinize their decisions and hold them accountable they will effectively become a ruling class anyway. In many ways this isn’t so different from the arcane mechanisms of central banks today.

A blockchain is a very expensive and inefficient data structure - it literally copies every piece of data to everyone on the network. In fact it is probably more helpful to think of the blockchain as an undesirable byproduct than a useful tool. The only redeeming quality of a blockchain is the ability to remove trust - if you haven’t used it to remove trust from your system it is an expensive waste of resources. And unless ordinary people can reasonably comprehend the rules of the system themselves, they will have no choice but to trust the class of experts that do.

Satoshi’s goal when making Bitcoin decentralized was to eliminate the need to trust that expert class by eliminating the need for them to even exist.

You’re not my real currency

"One of the most common criticism of bitcoin is that it's not a 'real currency' - i.e. no one actually uses it to buy things, they just hope they can sell it to the next person at a higher price than they bought it at. What kind of path do you see Bitcoin taking to become a 'real currency' (whatever that means)?" - ZK

Often when people describe Bitcoin as not being 'real' they mean something akin to what you allude to: real money is what we use to buy and sell things in the market. If merchants aren’t accepting a currency and customers don’t want to spend it, how can it be considered money?

Economists usually talk about money as serving three main roles: store of value (what you like to save in), medium of exchange (what you like to spend in) and unit of account (how you measure prices). You can use the same money for all three uses but you don’t actually have to - citizens in countries with weaker currencies often use their local currency as a medium of exchange but the USD as their store of value and unit of account. So they use their local currency to buy and sell in the market but store and measure their wealth using dollars as a more stable unit. Even in countries with strong currencies the actual medium of exchange might actually a credit card network like VISA more often than the currency itself.

As we’ve talked about previously, the most common thing people do with Bitcoin is use it to save. Since most of the people who own Bitcoin don’t actually want to spend it, most merchants don’t bother with accepting it as a form of payment - hence Bitcoin is not yet serving as a medium of exchange. When people misunderstand Bitcoin as a spending technology instead of a saving technology, it looks like a failure - but they are assessing a different problem than the one Bitcoin is meant to solve.

Some folks argue Bitcoin can’t be considered real money until it is widely used by retail merchants, but that seems like a strange definition to me. Should we consider gold money? Nobody spends gold to buy coffee but central banks are certainly using it to store their nation’s wealth. Reasonable people can disagree but I would consider both gold and bitcoin to be real money today on the basis of store of value by itself.

That said it is not hard to imagine a world where Bitcoin could become a medium of exchange as well. If Bitcoin was sufficiently broadly adopted its price could start to stabilize instead of growing 10x every few years. In that scenario Bitcoin would be much more widely held and there would be much less pressure to save with it, so merchants would be much more likely to adopt it as a form of payment just as they eventually adopted credit cards.

So it’s conceivable that Bitcoin could eventually graduate to medium of exchange and perhaps even unit of account. The main obstacles preventing that today have to do with how new Bitcoin is and how early we are in the price-discovery cycle. There is no fundamental reason we couldn’t eventually use that way.

Everybody hates BitClout

A new crypto-project has just launched and is already on track to have offended everyone in the universe by the end of the week. BitClout is loosely a crypto-flavored port of failed social-influence startup Klout. The idea loosely is that on top of a normal social network users will be able to speculate on the influence of other users on the network by buying "creator coins" which are meant to rise and fall in value with the prominence of the creator they represent.

Porting over a failed startup and re-pitching it "now with Crypto!" is not interesting. What is interesting is that as part of trying to bootstrap their network BitClout decided to port over ~15k profiles from major figures in CryptoTwitter and make BitClout profiles for them without their knowledge or consent. Nobody liked that.

It’s honestly pretty impressive they were able to individually and personally offend every major influencer in such a scalable way. Fun side note, lots of the people prominent on CryptoTwitter are lawyers and regulators! They even managed to include an SEC commissioner:

This is more amusing but still I still probably wouldn’t have mentioned it here if not for this piece of information:

It appears that the BitClout team has raised a collective $175M from a laundry list of heavy-hitter Silicon Valley investors. So on the one side of the table you have a giant pile of VCs probably ready to defend their investment and on the other hand you have the entire buzzing hive of CryptoTwitter infuriated and out for blood.

Probably not the soft-launch that BitClout was aiming for.

Errata:

In the last issue I referred to slippage as the price impact a trader has when buying or selling. As commenter Axel pointed out (thanks!) slippage includes price impact but also includes other things like delays between placing the order and it reaching the exchange. They also added some additional detail about the fact that specifically liquidity providers (i.e. market makers) rather than traders (i.e. market takers) were the ones vulnerable to sandwich attacks. In my description I didn’t distinguish between maker/taker and just referred to them both as traders.

There was also a lively discussion on Hacker News (welcome new subscribers!) that was overall not super enlightening but did usefully point out that the graphic I was using for rejected energy was actually not very helpful. Rejected energy in this graphic includes both energy economically wasted but also raw heat waste from thermodynamic inefficiencies, and the latter almost certainly dominates. It doesn’t change my perspective that Bitcoin captures wasted energy and subsidizes cleaner power, but it definitely makes the example I provided totally useless as evidence. I put an errata in the original post for future readers.

Other things happening today:

Some things to consider once the NFT collection is complete:

probably founded by a growth *hacker*