War of the Darknet Markets

also what actually happens when you buy Bitcoin on Robinhood?

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

What do people actually do with Bitcoin? (reader submitted)

When you buy bitcoin on Robinhood, what do you actually get? (reader submitted)

Darknet markets go to war using Tor as the battleground

What do people actually do with Bitcoin?

“What is the typical Bitcoin transaction being used for? Drugs? Arms deals?” -JR

That’s a really interesting question and like so many of the most interesting questions the real answer is we don’t (and can’t) really know for sure. But there are some things we can say.

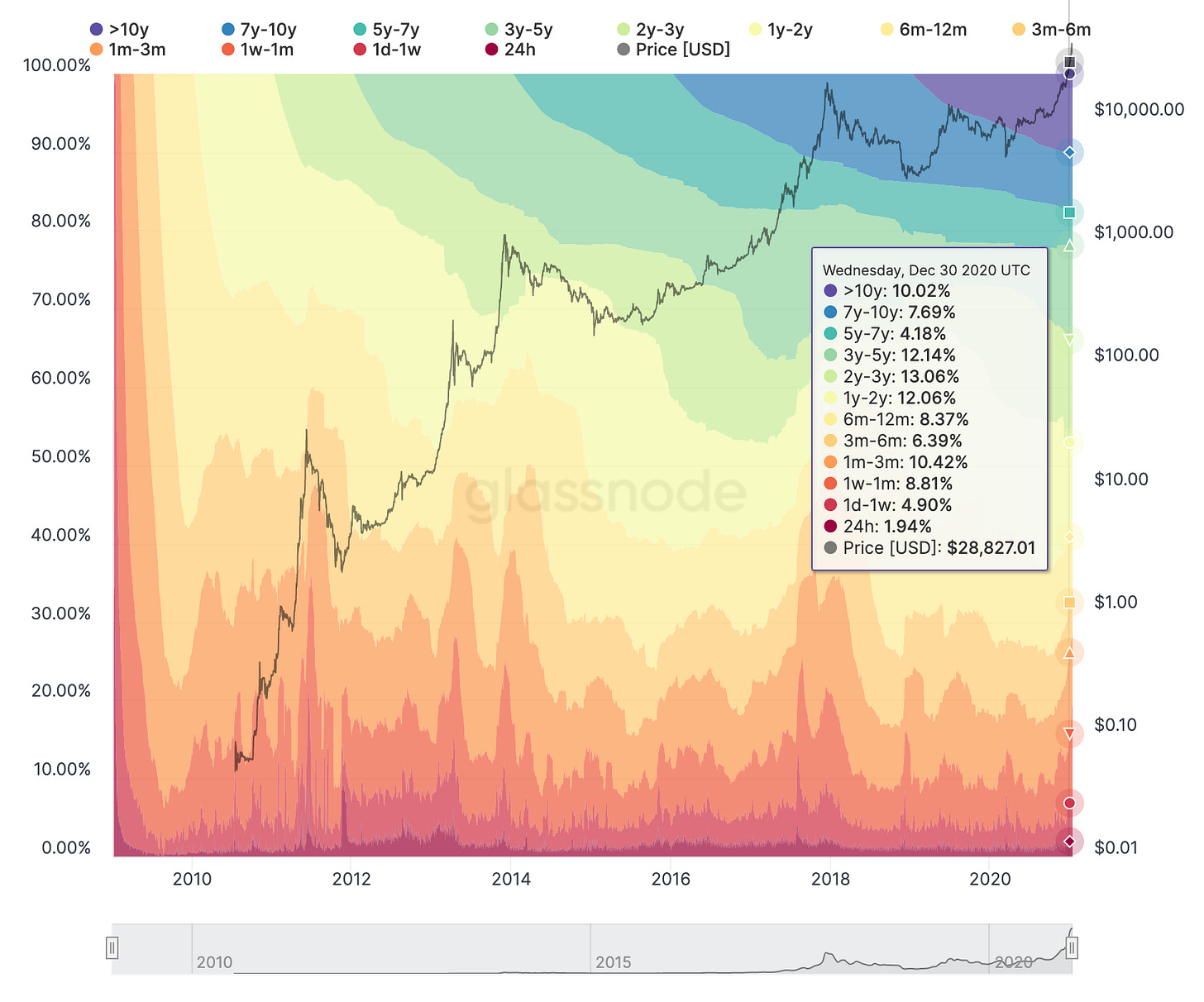

The first thing we can say is that most Bitcoin don’t actually move very often - only ~40% of Bitcoin moved at all during 2020. In fact, ~21% of all bitcoin haven’t moved in the last 5 years (when the price was ~$500/btc).

Some of those coins are probably lost but it seems reasonable to conclude that many of them are being used for saving/speculation. On that basis I would argue that the most common use for Bitcoin is to own bitcoin. You can also make that argument by watching how many coins are held at or sent to exchanges and by the way that transaction fees spike in bull runs when people are eager to sell.

It’s a bit harder to be sure what the coins that are being moved are being used for - it’s like trying to guess what people are buying by only looking at purchase prices. There are companies that specialize in doing that kind of inference but it’s a tricky business and will probably get harder over time.

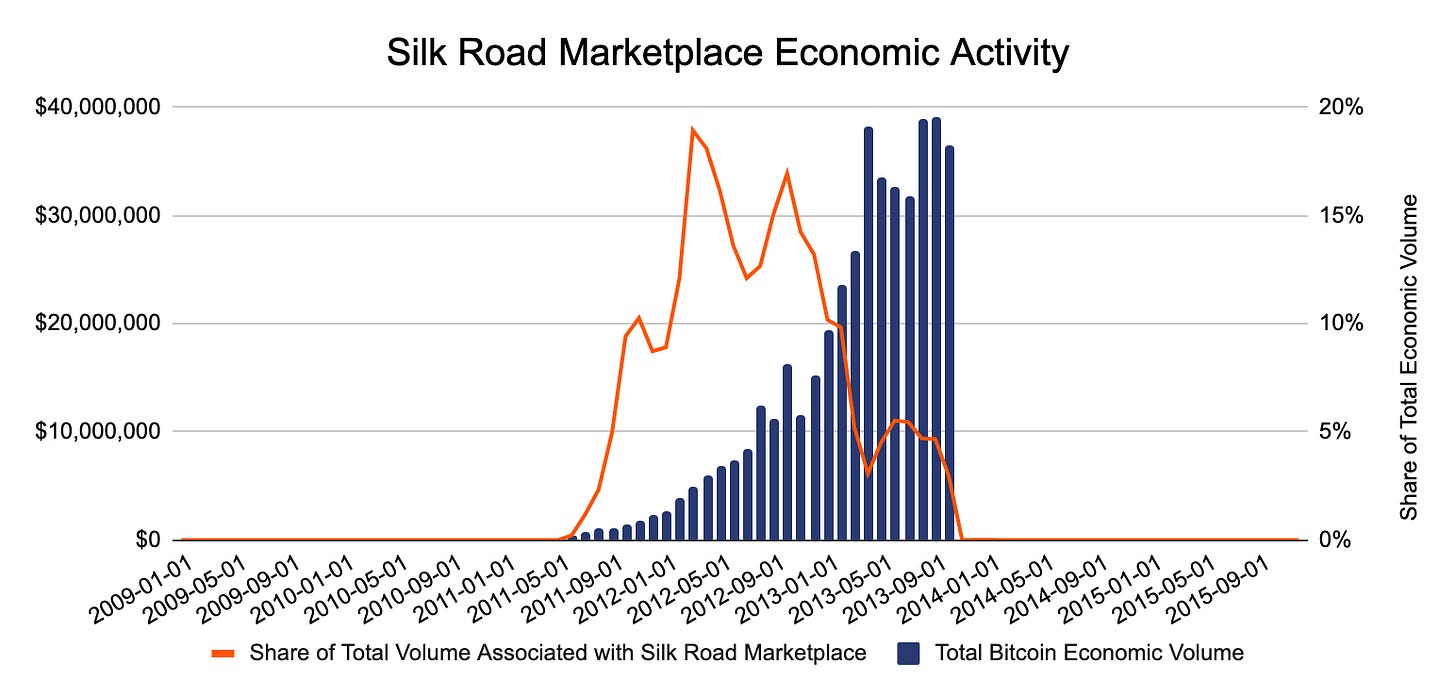

One of the things those companies watch for is bitcoin used to buy drugs on darknet markets. Drugs are one of the most famous use cases for Bitcoin - at one point the Silk Road (the first darknet market) represented ~20% of all network traffic:

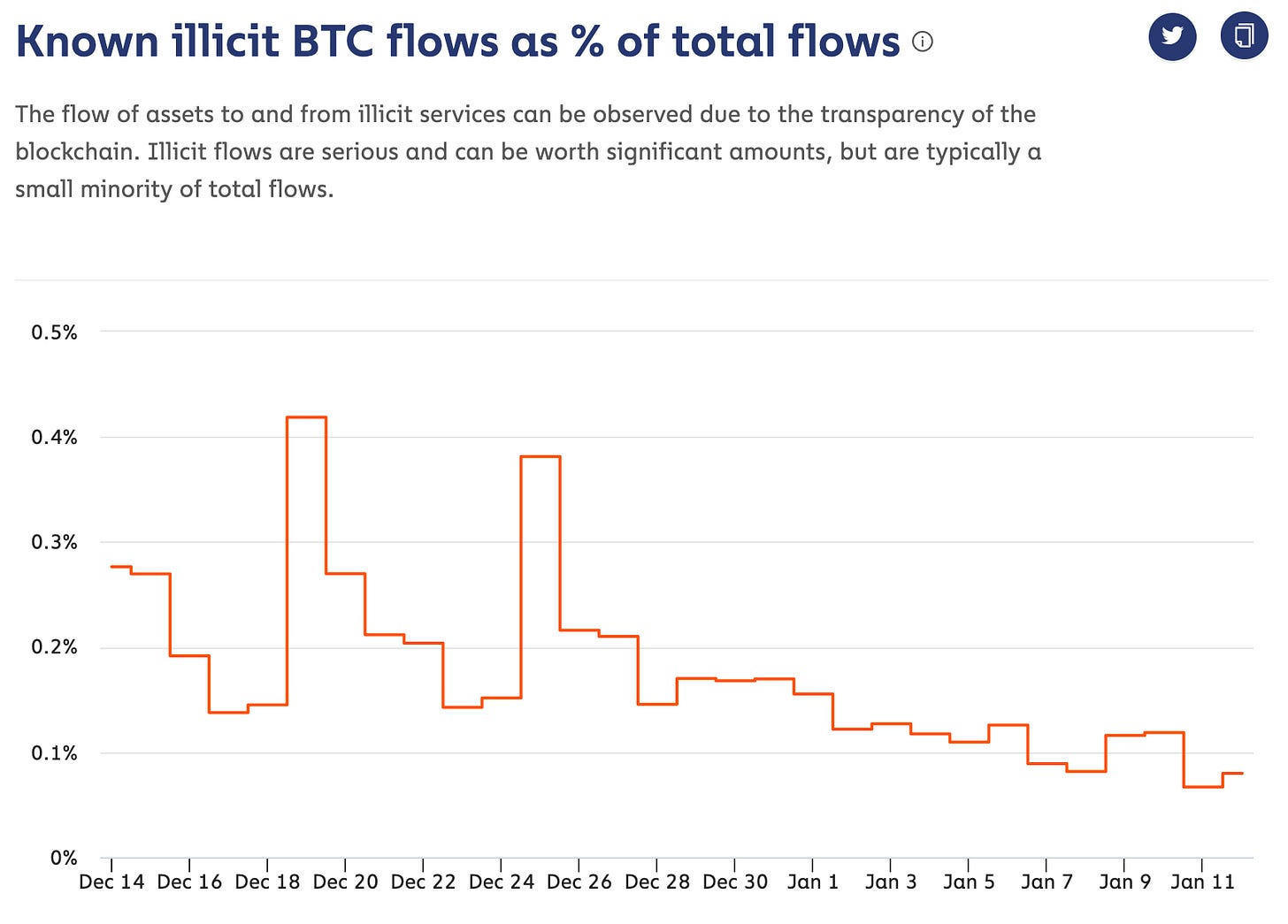

Bitcoin has grown a lot since then though and darknet markets while they still exist have not grown the same way. Chainalysis (a company that does this kind of transaction analysis) estimates that 'illicit transactions' currently represent <0.1% of all bitcoin flowing through the system. Large enough to represent serious value but still small relative to the entire Bitcoin network. (More on darknet markets below!)

Honestly the main reason that this number isn’t larger is because it isn’t that hard to buy drugs with regular money. Bitcoin is still the dominant cryptocurrency used on darknet markets but privacy coins like Monero and ZCash are gaining some traction because of their immunity from the kinds of analysis we’re describing here.

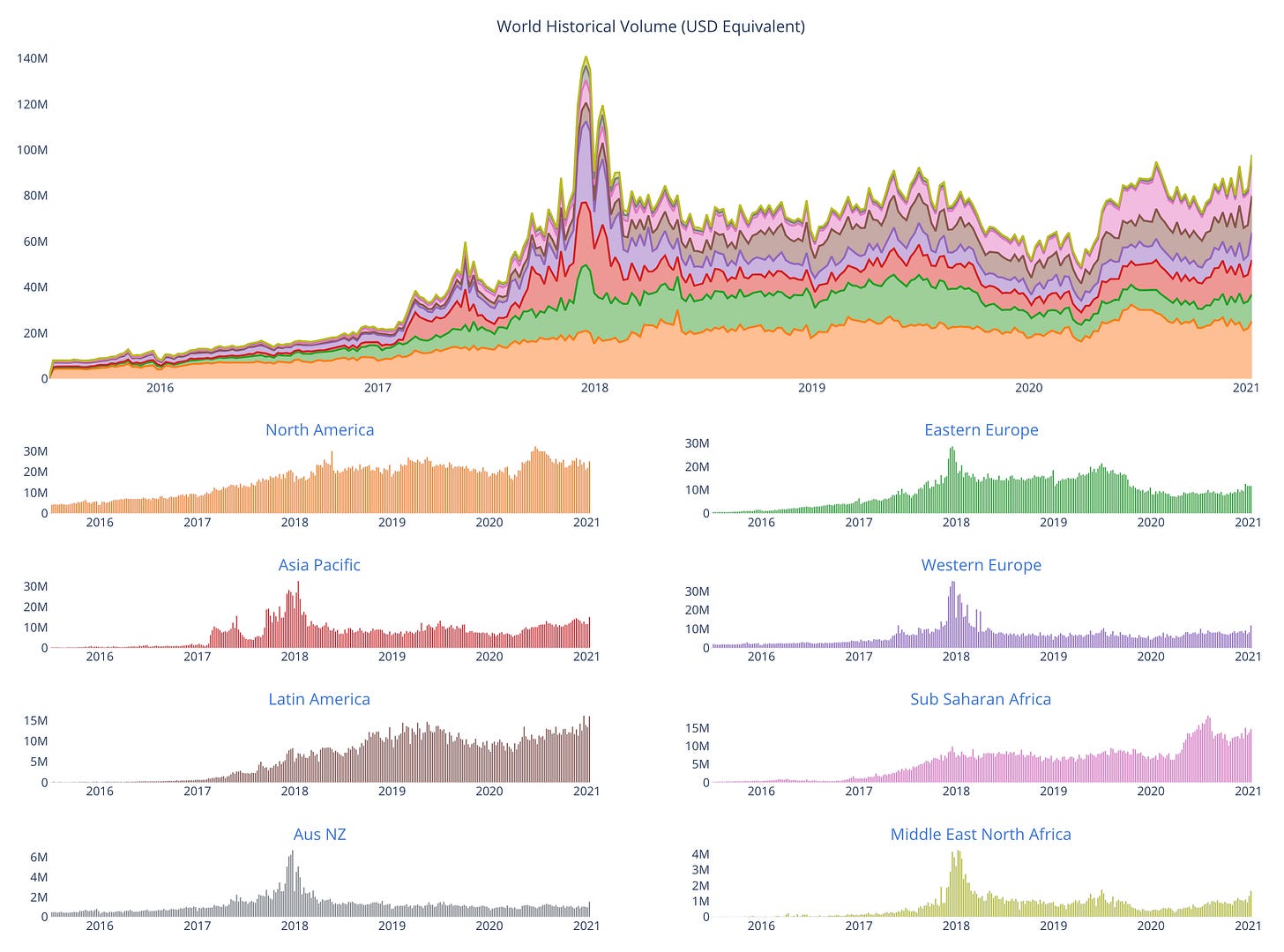

Another interesting metric to watch is the trading volume on peer-to-peer exchanges like Paxful and LocalBitcoins which operate less like Coinbase and more like Craigslist - you make individual trades with other individual humans. It’s not as efficient at price discovery but there are some advantages: you don’t need a bank account, you don’t create a paper trail. Paxful has said in the past that many of their users are sex workers who use bitcoin essentially as cash. Usage of peer-to-peer exchanges has risen to a 3 year high but hasn’t yet returned to 2017 peaks:

Remittance is also often touted as a key use case for Bitcoin but I’m skeptical. As far as I am aware there are some money transmitters that support using Bitcoin as a marketing feature but the businesses that focused on that use cased mostly failed. Let me know in the comments if there is a thriving Bitcoin focused remittance service that I should know about. My current belief is that remittance customers are too price sensitive to deal with the price volatility and transaction fees.

One exception to this is the desire to evade capital controls. China for example only allows its citizens to move $50,000/year out of the country, which is one reason why wealthy Chinese people frequently purchase expensive foreign real estate. There are people who believe that 2017 bull run from $1k->$19k was due to China cracking down on other capital outflow channels, and that the subsequent crash from $19k->$3k was due to China banning cryptocurrency exchanges. Similar restrictions motivate Nigerians to use Bitcoin to evade Central Bank controls on the naira.

Finally but perhaps most importantly, Bitcoin is a tool of political resistance. Alex Gladstein (CSO of the Human Rights Foundation) has described Bitcoin as an "essential tool for preserving freedom."

This isn’t a hypothetical consideration. Bitcoin is being used today by political dissidents around the world who have been locked out of (or fear to use) the traditional banking system:

The Nigerian Feminist Coalition turned to Bitcoin after having their bank accounts frozen for supporting protests against police brutality.

BYSOL is a Belorussian group that supports people who were fired from their jobs or quit in protest against Aleksander Luvshenko’s regime. When the government shut down their bank accounts and arrested several employees for fraud they switched to Bitcoin as a means of distributing support.

The Hong Kong Free Press accepts donations in Bitcoin.

Political dissidents in Russia including Alexei Navalny (Putin’s main electoral opponent) use Bitcoin as a tool for fundraising.

These use cases are overall probably pretty small in terms of number or size of transactions. But they are morally significant, which is why I include them.

When you buy bitcoin on Robinhood, what do you actually get?

“I bought some Bitcoin on Robinhood, and I noticed you can’t actually withdraw. What does Robinhood actually do under the hood when you buy Bitcoin?” - BB

This is a surprisingly difficult question to answer. Robinhood itself is fairly cagey about the details. Here are some thoughts:

Not allowing cryptocurrency withdrawal is not an uncommon practice. That’s also how SquareCash and Paypal operate. Supporting withdrawals requires figuring out how to apply a bunch of banking regulations to the blockchain. If the majority of your users don’t need withdrawals because they are either speculating on Bitcoin (Robinhood) or transacting in-network (Paypal) it makes sense not to bother because it is a legal pain in the ass.

Robinhood does actually store and hold some crypto on users behalf. From their Cryptocurrency Security FAQ they say the majority of coins are held in cold storage, that all transactions are authorized by a rotating committee of signatories and that they have crime insurance that covers "some portion" of their assets although they decline to say who is providing the insurance. They note in their Cryptocurrency Risk Disclosure that crypto assets are not covered by SPIC insurance and that the insurance policies they carry are not sufficient to cover all possible losses.

For stocks (and I suspect for Bitcoin as well) the way Robinhood makes its money is by listing the price for slightly higher than you could get it on other exchanges and then splitting the difference between them and the brokers who sell the stock - that’s called payment-for-order-flow. It has a bad rap but it’s pretty ethically neutral in my opinion. I don’t know for sure but I assume their crypto business operates the same way. So probably when you 'buy' on Robinhood they are buying at a slightly better rate from an exchange somewhere else.

So that’s the basic answer to your question - Robinhood does claim to hold real cryptocurrency on your behalf but it is not insured and they don’t disclose how they secure it or whether they have enough to cover all their user accounts. Bitcoin held on Robinhood the app amounts to an IOU and you should probably trust it about as much as you trust Robinhood the company.

Warring darknet markets take down Tor

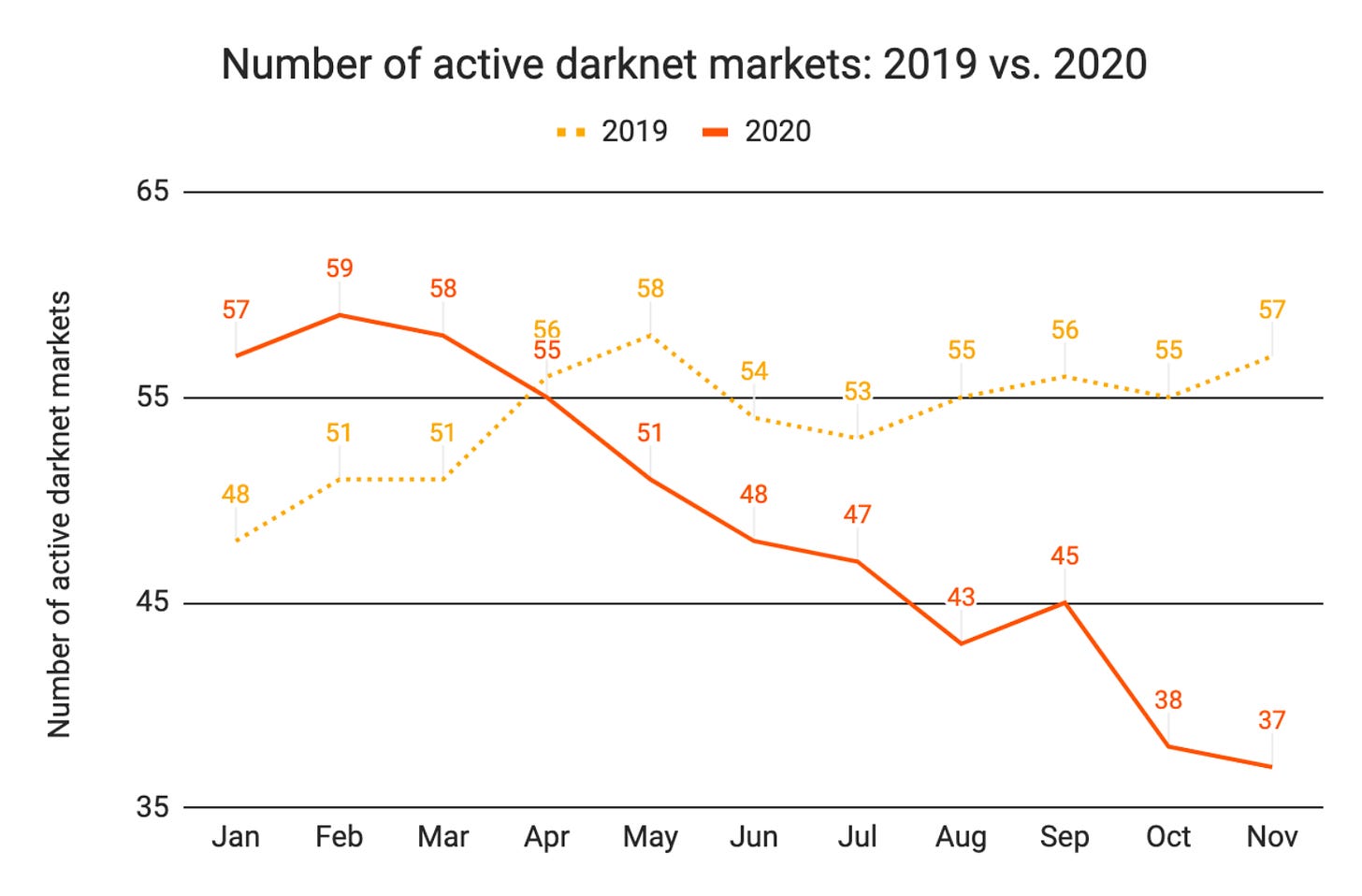

The pandemic has been tough on everyone but truly the hardest hit have been the drug dealers. Quarantines across the world have drastically reduced the number of parties and hence killed demand for party drugs. At the same time costs have soared as travel restrictions disrupt their supply chains. People are smoking more weed but most weed isn’t purchased on the darknet markets because it’s bulky and smelly to ship and usually available locally (often legally). Darknet markets are also just as affected by the delays and errors in shipping that have plagued the postal system this year. The result is the number of darknet markets is decreasing for the first time since 2016:

As the consolidation takes place, competition is getting more fierce. In fact darknet markets have started to pay for denial-of-service attacks on each other’s Tor nodes - the latest of which actually took down the entire Tor network. In spite of how widely used it is and how long it has been around Tor is still a relatively fragile ecosystem. It’s entirely possible that darknet competition may eventually swamp it. :(

Other things happening now:

Retail exchange eToro Ltd. has been fielding so much demand that it has warned its users that it may not be able to handle buy orders this weekend.

Christine Lagarde (President of the European Central Bank) has started to call for global regulation of Bitcoin out of concerns about money laundering:

The New York Times has a profile of people who have lost sizable amounts of Bitcoin. If you are interested in learning about how very rich people could have been even richer, this is the article for you. I found it tedious? As we talked about in the deep dive issue on owning Bitcoin it is a non-trivial risk to hold your own Bitcoins. Make sure you evaluate your storage strategy carefully.

A non-fungible token (NFT) representing ownership of a 24x24 pixel avatar called a Cryptopunk sold on Jan 6 for 140 Ethereum (~$176,000 at the time). You can have it here for free:

Presented without comment: