The Blockchain is a Dark Forest

Even the predators are prey.

In this issue:

The Blockchain is a Dark Forest

Yes, the power grid really does waste that much energy

Coinbase settles with the CFTC

New look, who dis?

The Blockchain is a Dark Forest

If you’ve read Flash Boys or heard anyone talk about the dangers of high-frequency trading than you’ve probably heard the term front-running. The idea behind front-running is this: if I know what you are planning to buy and I can get to the exchange first, I can beat you to the best price and then sell it back to you for a profit. It’s called front-running because traders used to hire small children to literally run through the crowds in the trading pit to place their trades first.

The reason front-running works is because when you buy something, you drive the price up. The more you buy the greater the change in price. Buy a tiny amount of bitcoin and you will have a tiny impact on the price. Buy lots and lots of bitcoin and you will probably clear out the order books and send the price soaring until people have a chance to respond and bring new coins to your exchange to sell. Traders call this kind of price movement on buying or selling slippage.

A front-runner is basically buying at the pre-slippage price, selling at the post-slippage price and pocketing the difference for themselves. In modern equity and commodity markets this has gotten pretty difficult - trades happen in nanoseconds and usually only your broker knows you have placed an order. But time and privacy operate very differently when you are on a blockchain.

Trades made on decentralized exchanges like Uniswap are broadcast publicly to the entire network they are built on - anyone can see them. Eventually miners will add broadcast transactions to a block to confirm them - but miners don’t include transactions in the order they receive them, they include transactions in order from most to least profitable. It is totally possible (and even normal) for new transactions to "cut in line" in front of older transactions by offering to pay miners a higher fee.

So anyone on the Ethereum network can see any Uniswap trade, calculate how profitable it would be to front run it and how much they would need to pay miners to be able to and if there is money to be made execute the trade. In Ethereum trading circles this is sometimes called a sandwich attack since you enclose the original trade in between two trades of your own. An attacker can even bundle the transactions together so if they lose the front-running race the purchases just harmlessly fail instead of leaving them owning coins they never wanted.

If this sounds like free money to you, you’re not alone. There has been a boom in this kind of predatory trading, a natural consequence of the surge in popularity of decentralized exchanges themselves. But there is no such thing as risk-free yield and every predator is also prey. In this case the predator’s predator is Nathan Worsley, who built an elegant little trap to catch sandwich traders in the act:

Mr. Worsley wrote a smart contract called "Salmonella" and set up a small, completely artificial market for it on Uniswap. Salmonella looked and acted like an ordinary ERC-20 token in all ways but one: when it detected sandwich-trading it would silently confiscate 90% of the attacker’s payout while mimicking the logs of a successful attack. He then set up some tempting front-runnable transactions in the market as bait and let the sandwich traders walk into the trap. Over the course of the next few days he captured >100 ETH (~$176k at time of writing) before sandwich traders updated their strategies to detect and avoid his poison tokens.

This is one glimpse into what finance might look like in a truly decentralized world. Without a central arbiter to enforce rules of fair play, the result may look less like a market as we know it and more like a natural ecosystem: wild and predatory, with species rapidly evolving and adapting strategies all the time in response to each other. Even in a world where decentralized exchanges succeed long term most retail traders may still prefer to operate within the safe confines of a centralized exchange. Trading directly on-chain will probably always be dangerous.

Yes, the power grid really does waste that much energy (*)

“Your description of Bitcoin energy coming from excess capacity that would otherwise be wasted does not square with what I have read about the electric grid. My understanding is that supply *must* equal demand. That is, if the demand for electricity goes down, power plants are turned off to match the decrease in demand.” - Several readers

A lot of readers actually had trouble believing that part of the Bitcoin and the Environment issue, which to be honest I was a little surprised by since I thought it was more widely known. Here is the exact quote:

Making efficient use of energy is hard. It is much cheaper to produce energy than it is to store or transport it and energy demand is spiky and unpredictable so it is tough to know where/when it will be needed. The result is that most power networks are over-provisioned - ready for peak capacity at any time even though much of that energy will be wasted. Basically it’s hard to know exactly when you’ll turn on your television so they run the power plant all day just in case.

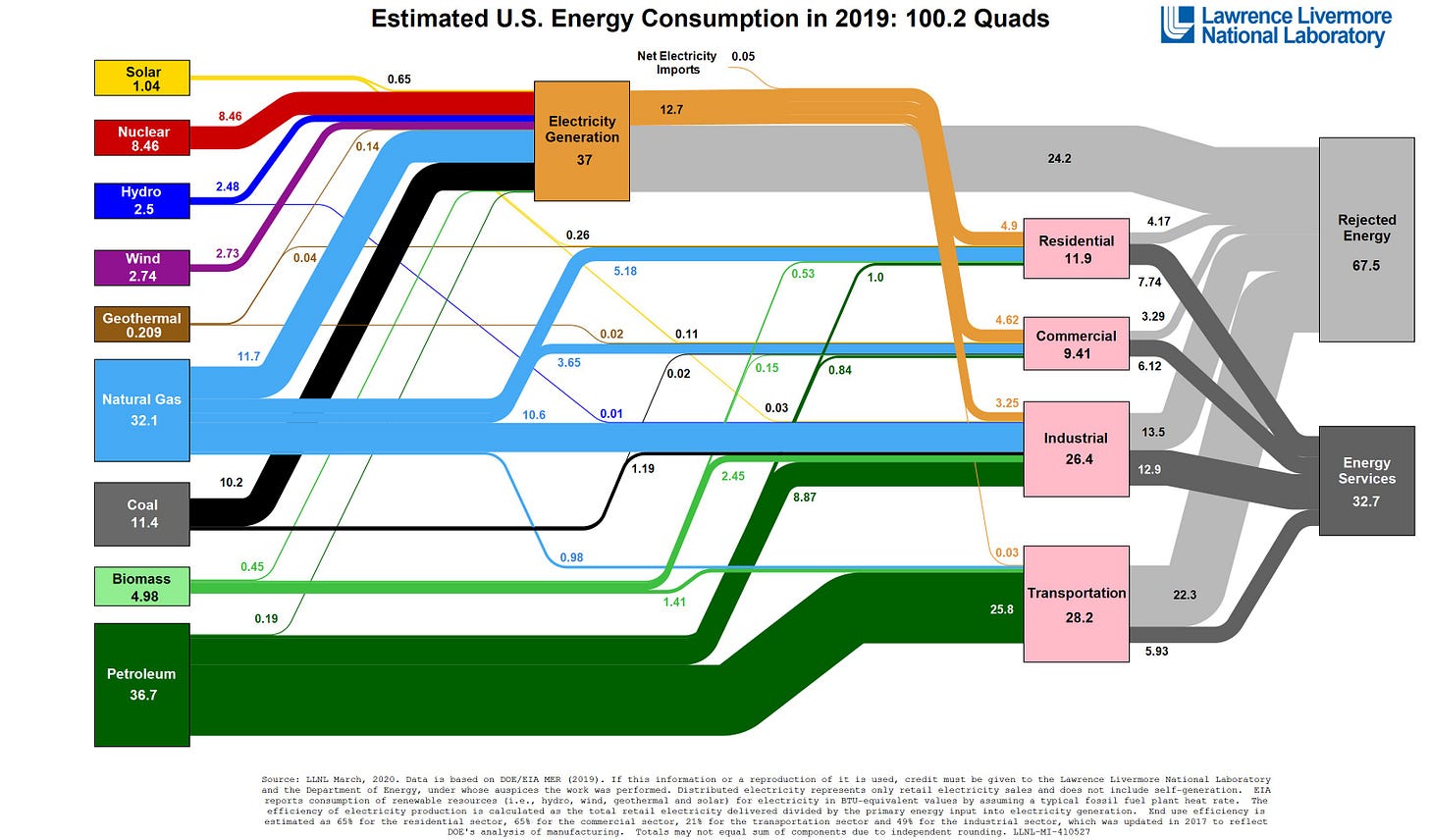

I hope it was obvious that the last sentence was meant to be illustrative, not literal. In reality there are failure modes for under-consumption too and a lot of effort is put into trying to match power load and power production. But to be clear, the underlying point that most energy produced is wasted is literally true. Here is a graphic from Lawrence Livemore Labs about energy use in 2019:

I don’t generally cite my own credentials because I’d prefer you were persuaded by my arguments than by my resume, but for the record in grad school I actually peer reviewed academic papers about load balancing the electrical grid. I’m not talking out of my ass when I say that most energy is wasted. If Bitcoin used only wasted energy it would consume >2/3rds of the energy of the planet.

Editors Note: Ugh … this is the other reason I never mention credentials: Karma *always* hears me. As folks on Hacker News pointed out, rejected energy in the graphic above includes both economically wasted energy and raw heat waste from thermodynamic inefficiency, the latter of which almost certainly dominates. I still believe that Bitcoin captures wasted energy and subsidizes cleaner energy (e.g. Seetee) but this particular example does not actually make that case at all. Mea culpa.

This is why hand-wringing about Bitcoin’s energy use is so frustrating. Bitcoin is pointing at the moon and people are yelling at its finger. The self-congratulatory ignorance I see in this debate is unreal.

Coinbase settles with the CFTC

As part of the ongoing effort to clean house for its hotly anticipated IPO (now delayed to April) Coinbase agreed to a $6.5M fine as part of a settlement with the Commodity Futures Trading Commission (CFTC). The consent order accuses Coinbase of "reckless, false, misleading or inaccurate reporting" and it accuses a former employee of Coinbase of wash-trading.

What Coinbase is accused of doing is self-trading - or more precisely not appropriately disclosing their self-trading. Coinbase was operating two separate automated trading programs called the Hedger and the Replicator. The two programs were created for independent purposes and were not aware of each other, so sometimes when they were making trades it was with each other. The result was artificially inflated volumes for certain trading pairs - basically it looked like there was more activity than there was because some of the activity was just Coinbase trading with itself.

The CFTC is accusing Coinbase of sloppiness, not fraud. No customers seem to have been harmed by the practice and it does not seem to have been intentional. You’re just supposed to be more careful when reporting the numbers for billion dollar markets. The employee allegation is a little more pointed.

Employee A (who is pretty obviously Charlie Lee, founder of Litecoin) is accused of having set up multiple accounts in order to trade Litecoin with himself, as part of a deliberate attempt to make Litecoin markets look more active and liquid than they actually were in practice. This took place over a period of ~6 weeks in 2016. On some days Employee A’s wash-trading was as much as 99% of the trading volume. The intent to deceive investors is much more explicit here and the CFTC found Coinbase "vicariously liable as a principal for this employee’s conduct." No word on whether action will be taken against Employee A.

Coinbase first disclosed this investigation in their S-1 filing for the IPO. They also mentioned previous CFTC investigations into insider trading around the launch of trading pairs for Ethereum and Bitcoin Cash but those seem to have already concluded. In case you were wondering, Coinbase’s revenue was $1.14B in 2020 so a fine of $6.5M should take them a little over two days to work off.

New look, who dis?

We’ve updated the Something Interesting logo and URL in order to fully synergize our dynamic long-term brand paradigms with ongoing multilateral opportunity vectors in a scalable way. Now only the real OGs will remember what KF stands for.

Like the new look? Tell us!

Other things happening now:

Agustín Carstens is the General Manager of the Bank of International Settlements, one of the coordinating bodies of Central Banks worldwide. Here he is explaining that government controlled digital currencies (CBDCs) would give central banks "absolute control" and total surveillance.

Presented without comment:

Reacting to the first paragraphs: on decentralized exchanges, traders (liquidity takers) don't change the price because of something called the constant product formula. Liquidity providers do.

Since trading doesn't impact price, front-running can't be done by sandwiching buy/sell orders but with LP orders.

Also slippage isn't price movement due your own trading (that's price impact). Slippage is difference between displayed price the moment your press trade and current price when order is processed at exchange (due to network delays etc).