You can't eat a Bitcoin

Visa, PayPal and Chipotle team up to cross-promote crypto.

In this issue:

Visa, PayPal and Chipotle team up to cross-promote crypto

Institutions are absorbing the supply of Bitcoin

Teletubbies for some reason?

You can’t eat a Bitcoin, but it won’t make you sick

This week saw a flurry of crypto announcements from major companies. On Tuesday Visa announced plans to allow settlement on their network with Coinbase’s stablecoin USDC. On Wednesday PayPal announced that customers could now use crypto to checkout at any of PayPal’s existing merchants. Finally and most significantly, Chipotle announced they would celebrate National Burrito Day by giving away $100k worth of Bitcoin and I assume also burritos.

I group these announcements together because they are all essentially marketing initiatives, and I rank the Chipotle promotion as the most significant because "people who enjoy burritos" is the largest potential market. I think a lot of people are getting carried away with the importance of the other two.

The Visa announcement is (predictably) the least significant and the most overblown. They announced a small pilot with Crypto.com that will allow settlement in USDC with the possibility to expand. This announcement is a pretty big deal for Coinbase: integration with the Visa network would be a considerable advantage over competitor stablecoins like Tether (USDT) or Gemini Dollar (GUSD). It’s also pretty handy for Crypto.com since settling payments in USDC will save them fees. It may incidentally benefit Ethereum as a whole in the sense that any transactions on the network increase demand for ether to pay for those transactions. But it is essentially meaningless for ordinary users, whether they care about crypto or not.

PayPal’s announcement is moderately convenient for people who are holding cryptocurrency on PayPal and don’t want it anymore. Previously you would have to undertake the arduous task of selling your [bitcoin/litecoin/ether/etc] for USD and then spend that USD at the merchant of your choice. Now PayPal will be happy to take care of the first step automatically for a small fee. So PayPal announced 29M new ways to spend your bitcoin, but as we’ve talked about before most people use bitcoin to save not to spend.

Outside of darknet markets there really isn’t much reason to use cryptocurrency for small retail purchases so people mostly don’t. It’s nice to have a few more pipes connecting the traditional and crypto economies, but merchant adoption is only really important when they decide to keep the currency - as Tesla and the Oakland As have promised to do with Bitcoin.

Rather than being motivated by user demand I suspect Visa and PayPal are doing the same thing Chipotle is: taking advantage of the public’s fascination with crypto for some free PR. Lots of companies made similar announcements or integrations during the height of the bull market in 2017 as well. It’s cool that cryptocurrency now has enough legitimacy to have companies actively seeking to be affiliated with it - but no need to get swept up in the marketing.

Institutions are absorbing the supply of Bitcoin

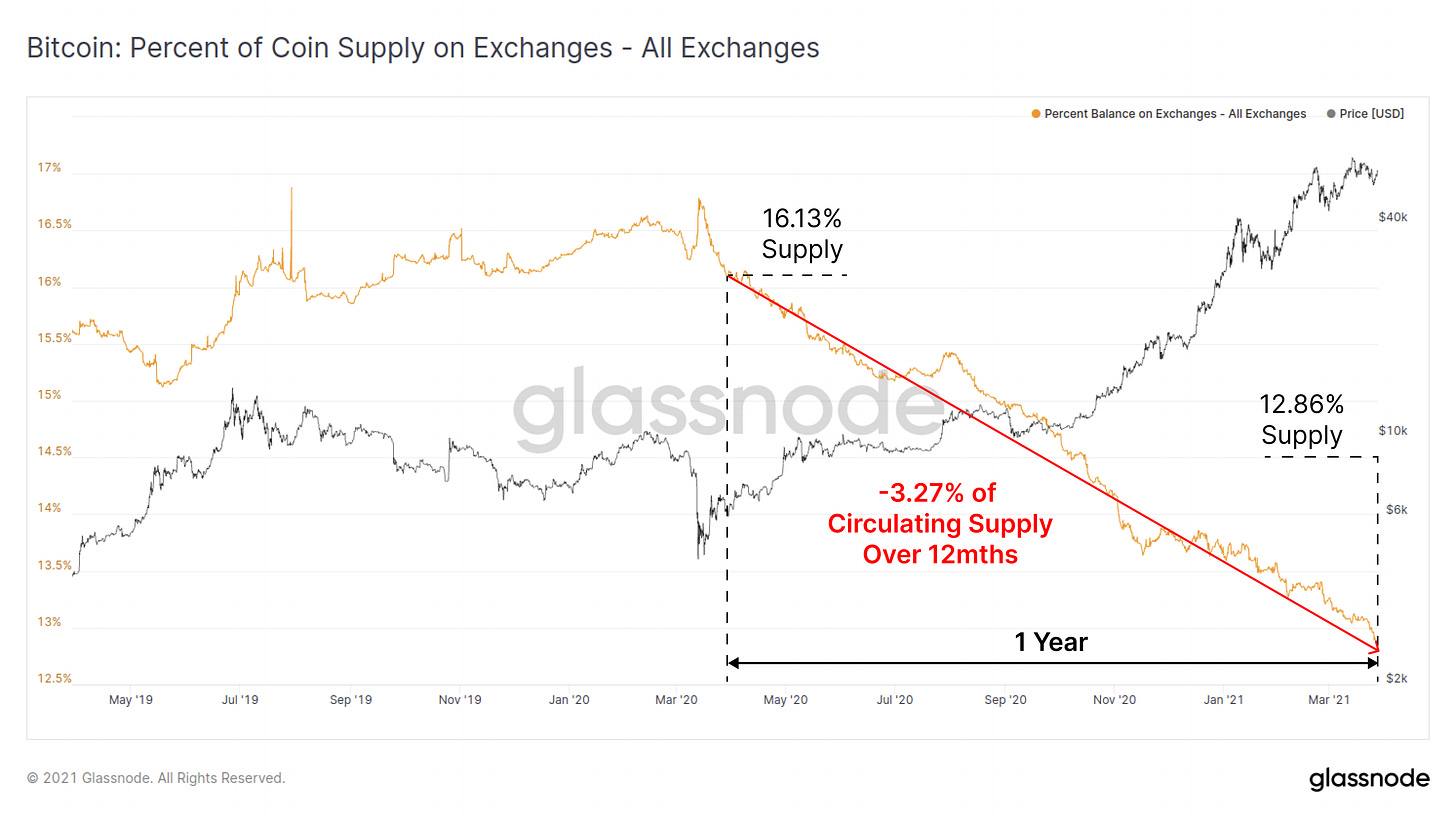

The transparency of the blockchain ledger makes it possible to directly observe things that wouldn’t be visible in the traditional finance world. One of the more interesting things that analytics companies like Glassnode watch is the balance of bitcoin held by various exchanges. Someone planning on selling their bitcoin is more likely to leave it on the exchange and someone planning on keeping their bitcoin is more likely to with draw it. So the total amount of bitcoin stored on exchanges is a decent relative proxy for how many bitcoin are available for sale.

Since the peak last April total exchange balances have dropped ~616k bitcoin, taking the supply of bitcoin held on exchanges from ~16% down to ~13%. The trend does not seem to be slowing down yet:

Zooming in on Coinbase shows an even more interesting pattern - until December Coinbase’s balance was steady around ~1M btc. Then starting in 2021 you can see a steady drumbeat of massive ~40-60k btc withdrawals:

Those are whale footprints! Some large entity or entities started acquiring Bitcoin at the beginning of the year and they are making monthly withdrawals of ~$1-3M worth from Coinbase. This is what dollar cost averaging looks like at institutional scale.

Other stuff happening right now:

In May of last year Goldman Sachs said Bitcoin was "not an asset class" and "not a suitable investment." Cut to today and Goldman Sachs has just announced they will begin offering Bitcoin funds and Bitcoin custody to their high-net-worth clients sometime next quarter. Goldman Sachs defines HNWI as having a net worth >$1M. According to the Global Wealth Report there are ~46.8M millionaires. There are only 21M bitcoin. Get yours while supplies last.

Nic Carter wrote a long, carefully researched essay full of specific quantifiable estimates to argue that Bitcoin consumes primarily nonrival energy (what I have in the past called wasted energy) and leftover semiconductor capacity. Bitcoin is a scavenger. This is the most concrete exploration of how that plays out in practice that I know of:

Presented without comment:

Congratulations to everyone with "Teletubbies cross-promote Bitcoin" on their 2021 Bingo cards. I have to admit, I did not see this one coming.