Bitcoin is antifragile, Nassim Taleb is not

Plus the Great Hashrate Migration continues and Bitcoin is working itself into the banking system.

In this issue:

The Great Hashrate Migration (continues)

Bitcoin is working itself into the banking system

Bitcoin is antifragile, Nassim Taleb is not (reader submitted)

The Great Hashrate Migration (continues)

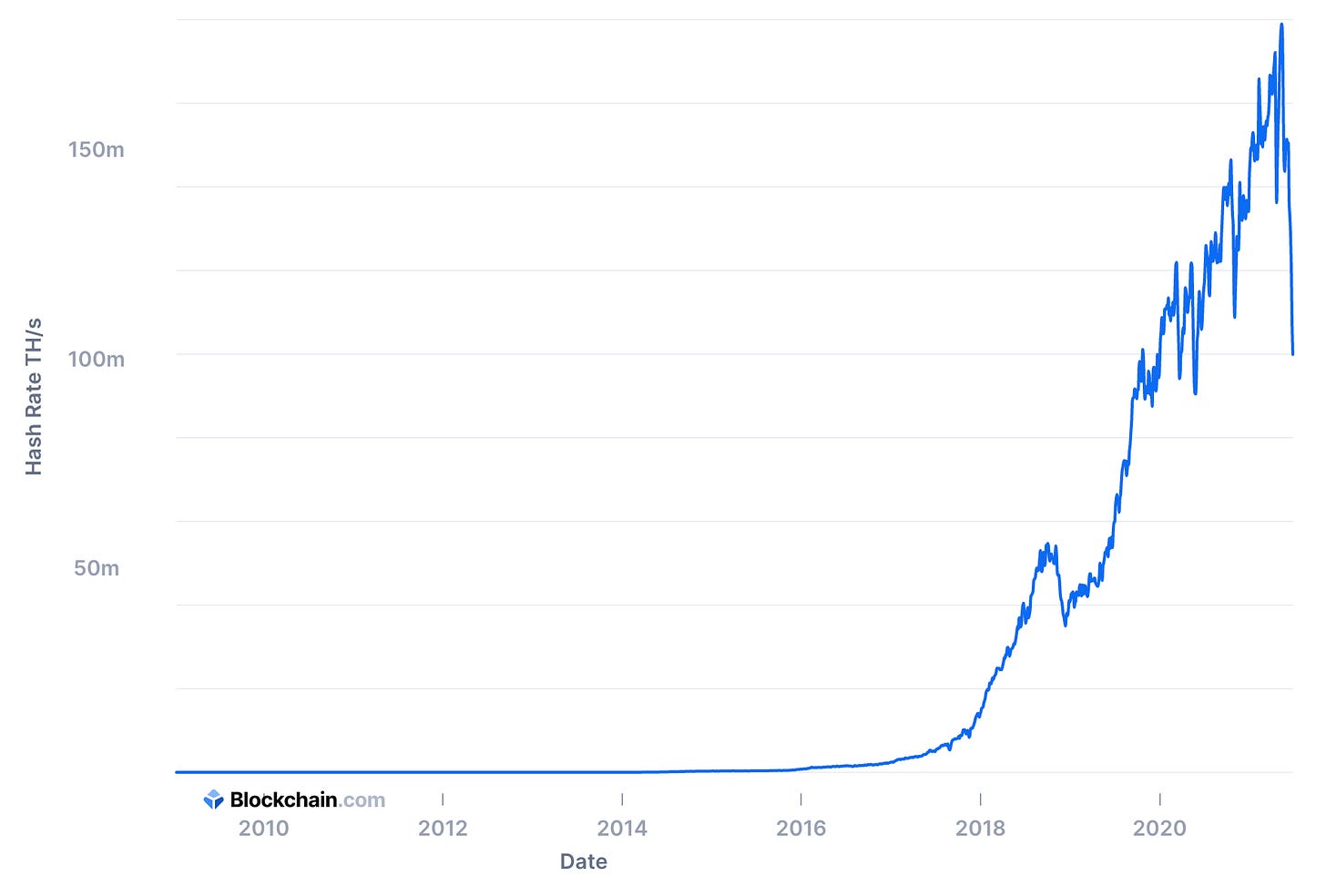

We talked several times recently about China’s most recent ban on Bitcoin mining and the enormous migration of Bitcoin mining power taking place as a result. Hashrate is down by as much as ~45% at the moment - the lowest it’s been in over a year.1

To make sure blocks always arrive roughly every 10 minutes even when the number of miners changes the Bitcoin network automatically adjusts the 'difficulty' (a parameter that defines how hard miners must work to find the next block). Difficulty is already down ~24% from the recent highs but the next adjustment (roughly July 3rd) is currently estimated to be another -25% down, which will be the largest drop in difficulty in Bitcoin history.2

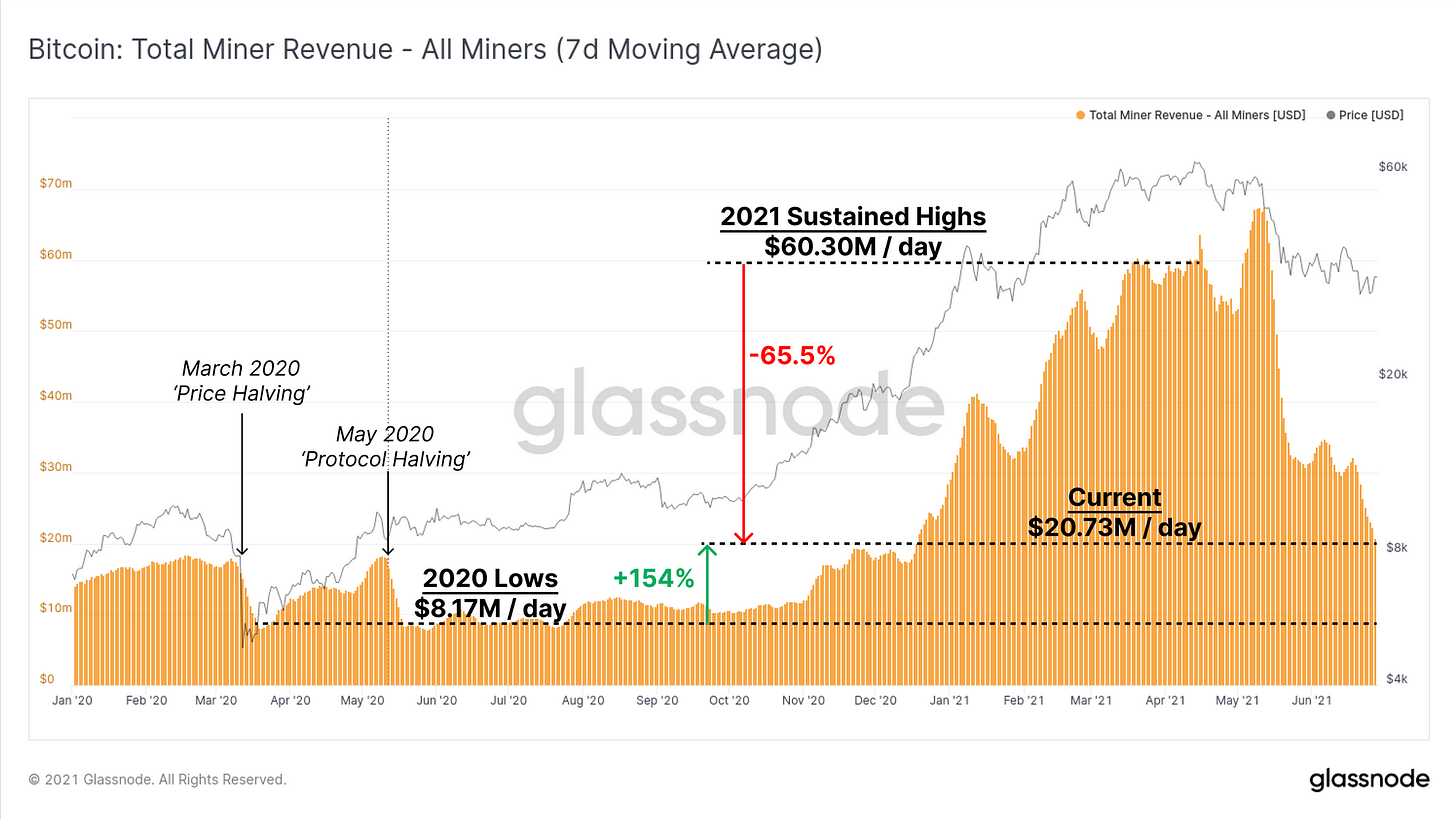

That’s great news if you’re one of the remaining miners. The difficulty parameter determines the odds of any particular miner finding a block, so a ~25% drop in difficulty represents a ~25% increase in revenue. Mining revenue is down ~65% from April highs, but it is still up ~154% from lows of last year. Thanks to the global chip shortage new hashpower has been slow to arrive to the network, so difficulty is up only ~24% in that same period. Any miners still operating on the network are likely very profitable right now.

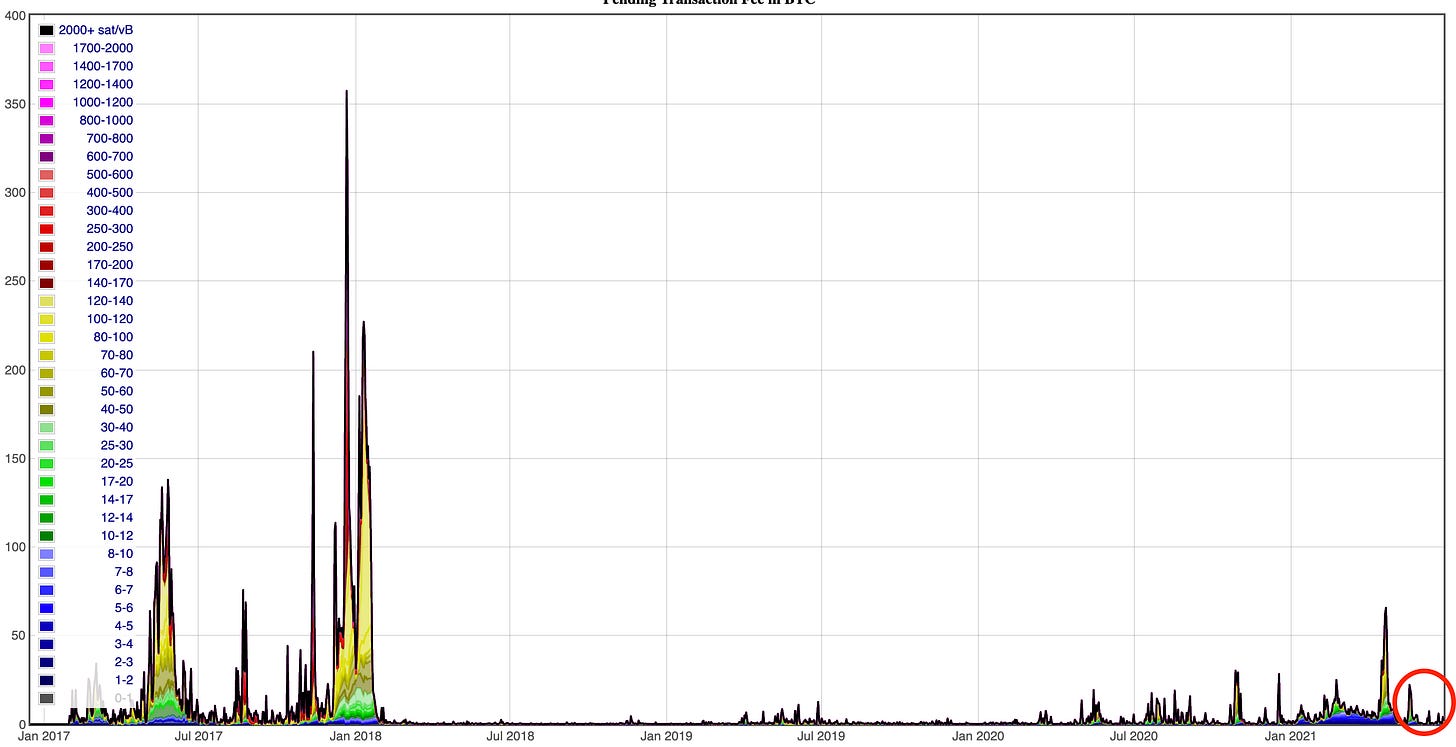

You might reasonably expect that mining power abruptly being cut almost in half would cause some delays or outages on the network but actually that isn’t the case. Blocks are averaging a little longer than the typical ten minutes (that’s why the difficulty is adjusting downwards) but it is not causing any delays for transactions. You can see that by looking at the fees being offered by waiting transactions. The large spikes on the left were the 2017 bull run and the 2018 crash respectively, when speculators raced to send their coins to the exchanges. The period since China’s announcement is circled in red on the right:

In short, Bitcoin is migrating half of its operational infrastructure around the world with no pause or delay in its 24/7 service. I hope Fastly is taking notes.

Bitcoin is working itself into the banking system

The New York Digital Investments Group or NYDIG (a subsidiary of Stoneridge Investments dedicated entirely to Bitcoin) has announced a string of partnerships this week with several of the major infrastructure companies that provide backend financial services to banks: FIS, Fiserve, Q2 and Alkemi. Each of these partnerships is aimed at enabling local bank and credit union customers to be able to buy, sell and custody Bitcoin as part of their normal bank account. Across these partnership NYDIG is aiming to support Bitcoin for ~48.5% of all US retail bank customers.

On the wealth management side Citigroup, Goldman Sachs and Morgan Stanley have launched initiatives to begin offering Bitcoin investment vehicles to their customers. Morgan Stanley also recently announced a ~$1M purchase of shares in the Grayscale Bitcoin Trust (GBTC).

Internationally, Ricardo Salinas, owner of Banco Azteca and Mexico’s third richest man is fully orange-pilled. On Sunday he declared his intention to make Banco Azteca the first bank in Mexico to offer Bitcoin services, although the Bank of Mexico quickly released a statement saying that banks were not authorized to do that. For now.

Bitcoin is antifragile, Nassim Taleb is not

“Have you seen Nassim Taleb’s paper criticizing Bitcoin? What’s your take?” - IS

Statistician, author of Antifragile and angriest man on Twitter Nassim Nicholas Taleb recently published a five page paper titled "Bitcoin, Currencies, and Bubbles" laying out his case for why Bitcoin "can be neither a short nor long term store of value." I think George Selgin of the Cato Institute summarized it best:

In fairness to Professor Taleb the paper is clearly marked DRAFT but the reasoning in his arguments is shockingly weak. His central thesis is that any asset that doesn’t pay dividends must 'by backward induction' be worthless, or as he puts it:

“If any non-dividend yielding asset has the tiniest probability of hitting an absorbing barrier, then its present value must be 0.” - Nassim Taleb

That statement is directly at odds with observable reality. As a trivial example oil pays no dividends and briefly traded at -$37/barrel in April of 2020 but it is ~$73/barrel today. Taleb asserts that gold is exempt from his model because it pays a kind of aesthetic dividend in that it is shiny and presumably nice to look at, but it is pretty hard to fathom the aesthetic purpose of the giant piles of gold bars in Fort Knox. That argument also implies the "true" value of non-dividend paying stocks like GOOG ($2536/share), FB ($355/share) and AMZN ($3443/share) is actually $0.

Anyone who has taken an Economics 101 course should already know there is no such thing as a "true" or "intrinsic" value. Everything is worth what someone will give you for it. No more, no less. Saying you have a mathematical model that calculates what an asset "should" be worth is like saying you have an equation that proves music you don’t like is too popular. That’s not how it works.

Taleb makes other less important but in their own way weirder claims in the paper, my favorite of which is when he declares without explanation that 99% of all technology is replaced by something newer. He takes a strange detour into his conception of Libertarianism before concluding with a joke about a cucumber vendor in Damascus. It is a messy and rambling screed.

Here is a thread collecting various rebuttals if you are in the mood to see Taleb get dunked on over-and-over:

Other things happening right now

The SEC is allegedly slowing down Robinhood’s IPO over concerns about its growing cryptocurrency business. That’s a funny place to focus considering Robinhood’s recent track record in traditional markets and considering freshly IPO’d Coinbase is off listing (and then immediately unlisting) Shiba Inu coin the dogecoin-themed Ethereum fork. Thanks for keeping investors safe from investing in Robinhood itself, I guess?

Most of the recent sell pressure on Bitcoin has come from short term holders who are panic selling at a loss. Sellers booked more on-chain losses this past week than ever before - including the covid-induced crash in March of 2020:

Presented without comment:

Ethereum’s hashrate is also down, although only ~20%.

Interestingly difficulty is allowed to grow or shrink by at most 4x in a single adjustment.