Is this a bear market?

Plus the price premium on clean coins and is Bitcoin Halal?

In this issue:

The Great Hashrate Migration

Dirty coins from a clean vendor (reader submitted)

Is Bitcoin Halal?

The Great Hashrate Migration

We last talked about China banning Bitcoin mining near the end of May when the Financial Stability and Development Committee of the State Council released a statement promising to "crack down on bitcoin mining and trading activities." Since then the evidence suggests that a substantial amount of hashpower is indeed leaving the country and migrating to neighboring countries and the United States.

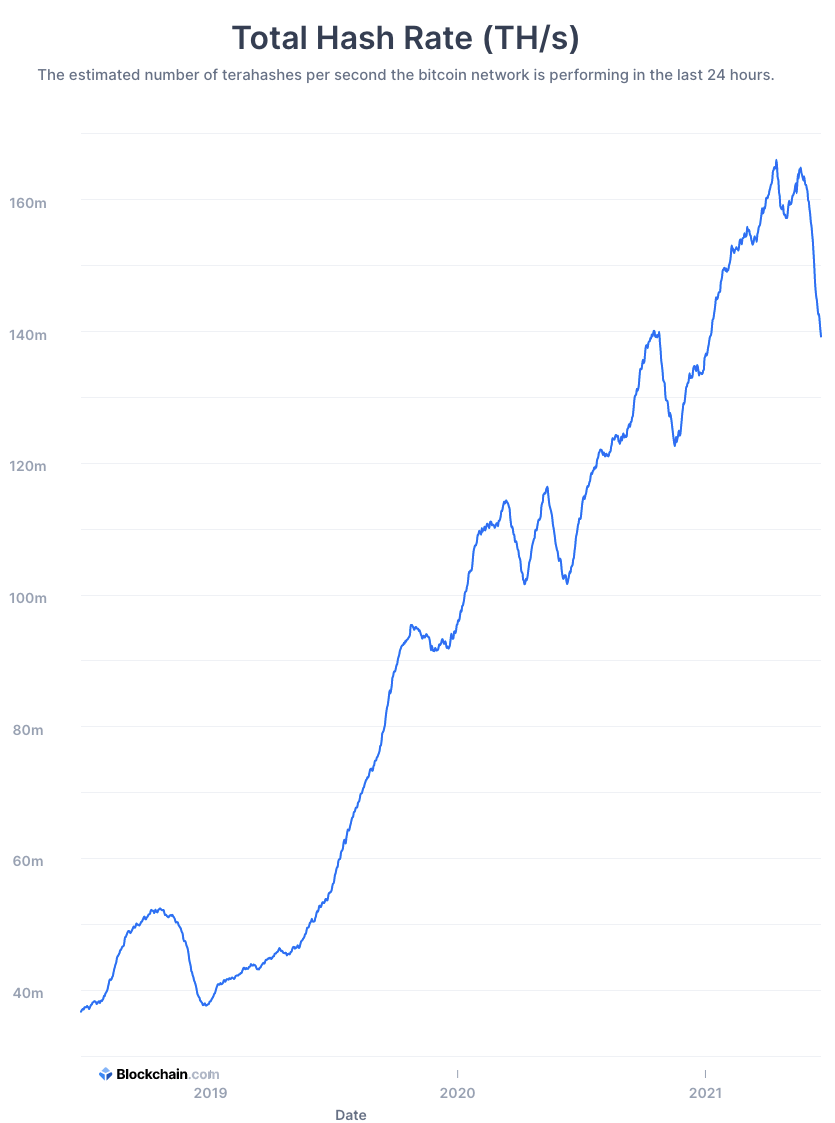

The network appears to have lost around ~20 TH/s (~14%) of mining power for now:

China likely has overlapping motivations here. The official reason is to "prevent individual risks from being passed to the whole society" which implies trading risks, but so far exchanges have not been the focus. Bitcoin has always been in conflict with China’s strict capital controls and is an obvious competitor to their upcoming central bank digital currency. They probably also want to redirect the benefits of government subsidized power away from Bitcoin miners and towards whatever industries they originally intended to subsidize.

Bitcoin may also be enabling some local corruption by monetizing access to electricity - the guidance from Inner Mongolia makes reference to "public officials who use their positions to participate in virtual currency ‘mining’ or provide convenience and protection for them."

Regardless of the motivations the effects so far are clear - now is the beginning of the wet season in Sichuan province when hydro-power typically causes a surge in hashrate. Instead mining power is dropping as mining companies scramble to physically relocate their machines:

Overall I remain convinced that miners exiting China is a good thing for Bitcoin. Two of the oldest and strongest critiques of Bitcoin have been the carbon footprint of Chinese power and the mistaken notion that Chinese miners gave China "control" over Bitcoin somehow.

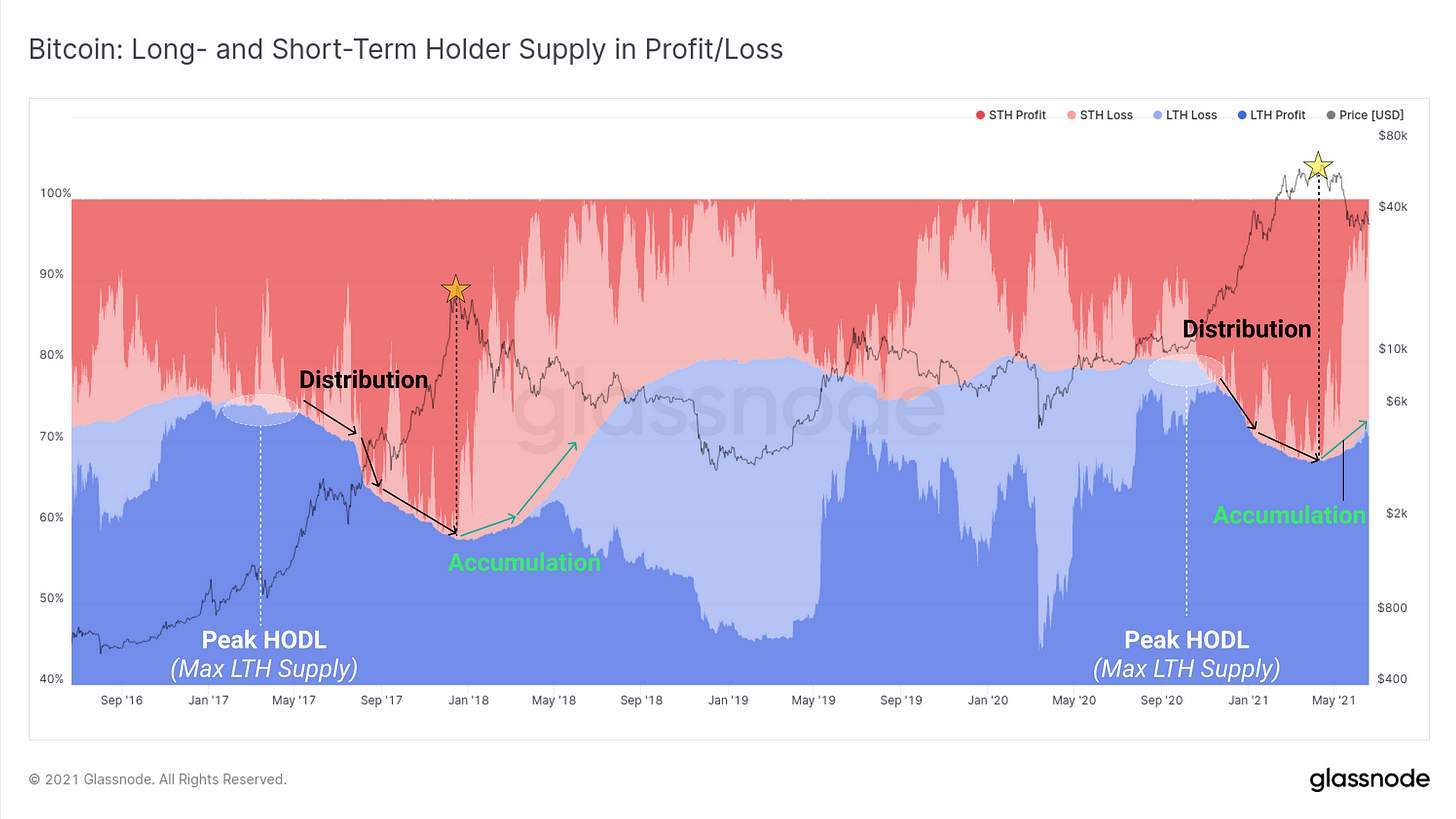

In the short run however changes generally spook markets and the market for Bitcoin definitely looks shaky right now. At time of writing the price has fallen to ~$29k/BTC, down more than ~50% from the all time high of ~$63k/BTC. Most of this movement has been recent buyers selling their losses back to long term holders.

Long term holders are (by definition) patient. As the price swings up and down Bitcoin adoption continues in the background. More people become aware of Bitcoin, more people begin to understand it, more people gain access to it. This may or may not be the end of the current bull run - but it is still just the beginning for Bitcoin.

Dirty coin from a clean vendor

"I saw that the US government auctioned off some Bitcoin recently. Why do they auction it off instead of selling it on the open market? And wtf did it sell above market price?" -SH

The US General Services Administration did indeed auction off some previously confiscated bitcoin. Specifically they sold ~0.7501 BTC for ~$53.1k (equivalent to a price of ~$70.8k/BTC). Market price for Bitcoin at the time was ~$59k/BTC.

The main reason that government property is usually sold at auction is because it ensures that government officials aren’t profiting from the sale, either by offering an uncompetitive price or funneling business to a preferred vendor.

It’s a bit harder to say why the person who won the auction was willing to spend so much more for these coins than they would have needed to on the open market. Perhaps these specific bitcoin have sentimental value? More likely the new owner places an especially high premium on owning bitcoin that are straight-from-the-government and therefore guaranteed free of crimes.

Other things happening right now:

We talked about the Ledger hardware wallet data breach in our very first issue. Hackers didn’t get access to any cryptocurrency but they got the names, phone numbers and home addresses of those who purchased Ledger devices. Here is an example of the kind of attack that opens up: hackers mailing compromised devices to Ledger customers unsolicited in the hopes they use them and give the hackers access to their laptops and private keys.

An interesting thread from a Muslim entrepreneur in Canada about how Bitcoin is uniquely compatible with the rules of Islamic Finance, which forbid interest bearing debt. Bitcoin is a bearer instrument, not a debt instrument - and unlike almost any other modern financial instrument it has no counterparty and so is not connected to anyone else’s debt either.

Tough week for DOGE fans as price drops to ~$0.17/DOGE at time of writing, down ~23% over the week and ~76% from the highs of ~$0.72/DOGE. No word yet from Elon Musk on his work with Dogecoin developers.

Approximately ~$0.9B worth of GBTC1 shares that were purchased during the January run up to ~$36k became "unlocked" in the last three days - meaning the institutions that presumably purchased those shares are now allowed to sell them. Bitcoin itself is down to ~$29k/BTC at time of writing and GBTC is trading at a ~10-15% discount to the underlying value. In other words there is nearly a billion dollars worth of fresh new holders who are deeply in the red and are facing the choice of whether to hodl for the first time.

There have been a number of drops throughout Bitcoin’s history more severe than this one, but only a handful have lasted this long. The first line in this animation is this dip so far:

Decrypt Media had an interesting profile recently about a 13 year old DeFi developer and founder of several dApps managing millions of dollars of capital. Don’t get me wrong, @robogajesh is clearly a really impressive kid - but honestly the fact that a 13 year old can copy another project and capture millions of dollars worth of capital says more about investor’s unrelenting appetite for risk in the DeFi market.

Grayscale Bitcoin Trust, essentially a company that will hold Bitcoin for you and sell you shares that you can hold and trade on more traditional financial rails.