Should America worry about a Chinese CBDC?

Plus the NFT market is surprisingly small and some novel investing advice from the NYPost

In this issue:

Prices are knowable, value is not

Is China’s new Digital Yuan a threat to USD? (reader submitted)

Live Q&A session Monday May 3rd 2:00PM PST [register here]

Prices are knowable, value is not

In 2005 in North Carolina then four-year-old Zoe Roth stepped out of her home with her father to watch a neighborhood home ablaze. As her father took photos Zoe turned back and gave him a mysterious, Mona-Lisa-esque smile. Thus Disaster Girl - one of the earliest viral meme images - was born. Seventeen years later (i.e. earlier this week) an NFT representing Disaster Girl sold for 180 ETH (~$0.5M).

We mentioned earlier this month when Overly Attached Girlfriend sold her NFT for 200 ETH (~$405k at time of sale) and poor Bad Luck Brian sold his for only 20 ETH (~$36k at time of sale). We did not actually mention an NFT representing a NYTimes article about NFTs sold for 350 ETH (~$560k at time of sale) or when a cherry-blossom version of Nyan Cat sold for 82.5 ETH (~$150k at time of sale).1

One thing that connects all of these purchases is that they are stunningly large. Another thing that connects them is they were all sold to one person - Farzin Fardin Fard, or more precisely to his music studio 3FMusic. Here is 3FMusic’s collection of NFTs - most purchased for between 0.2 and 20 ETH but with a handful (like the ones above) having sold for quite a bit more. I’m a crypto commentator not an art critic but I do think the taste in the art 3FMusic is collecting is … unconventional. This piece for example (titled Trouble) sold for 15 ETH (~$41k at the time).

People ask whether the prices for NFTs are 'real' and this is a good example of how difficult that question can be to parse in the limit. Did 3FMusic really exchange 15 ETH for ownership of a token representing Trouble as above? Yes. Would 3FMusic be able to get 15 ETH in exchange for selling that token today? Probably not, although it is impossible to really know without selling. To me the most interesting and difficult question is - does 3FMusic think Trouble is worth 15 ETH?

It might seem obvious that if you pay a high price for something you must think it’s valuable, but there are other possible motivations. Maybe you want to overpay for an NFT because you own other similar NFTs and you are hoping someone else will overpay you for them. Maybe you want to overpay for an NFT because you are secretly selling it to yourself and you plan to keep the money and then donate the NFT to collect tax shelter on the artificially inflated price. Maybe you want to pay me to do crimes2 and we both want a cover story for why you sent me money. Maybe you just own a lot of ETH and are willing to treat overpaying for NFTs as a marketing expense to keep the hype cycle on ETH going. Or maybe you like the art?

We can only observe the prices of art in the market - the value that participants in the market place on that art is not knowable. But sincere or not the fact that so many of the high-end NFT sales are originating from such a small pool of buyers does raise doubts about how seriously to take those prices. The vast majority of NFTs either never sell or sell for almost nothing3, so those occasional blockbuster sales are almost all of the volume. The NFT market today is basically a very small number of buyers making huge purchases from a very small number of artists.

Is China’s new digital yuan a threat to USD?

"I would be curious to hear your take on China's digital currency, and the claims folks are making that it might disrupt the US dollar." - LH

Bitcoin is an intrinsically subversive technology - it enables freedom and eliminates centers of power. So Bitcoin has always invited speculation about how governments might undermine, oppose or compete with it. One of the earliest lines of speculation centered around the idea of "Central Bank Digital Currencies" or CBDCs.

The idea of a CBDC is to make an official government approved cryptocurrency that could leverage proof of work technology to allow for trustless exchange but let the government set its own rules for monetary policy, privacy and censorship. Governments could use tax policy and other incentives to drive economic activity out of the Bitcoin network and into the CBDC network. Technically you could build a freedom-loving CBDC that protects citizens privacy and autonomy, but as you can probably imagine that’s not what China is doing.

China has been developing the digital yuan since 20174 and started lottery trials in the second half of 2020. Mu Changchun (head of the People’s Bank of China’s digital currency research institute) says the digital yuan will offer "controllable anonymity" that will protect "reasonable" anonymity needs. From the perspective of the Chinese government the CBDC digital yuan will be much like the old yuan but with even more fine grained surveillance and controls. From the perspective of the average Chinese citizen it will be strictly worse.

So far Fed Chairman Jerome Powell has been clear that the US had no plans to develop a CBDC and would not until it was clear they were "a good thing for the people." On Thursday after the Fed policy meeting he said this:

“Far more important to get [CBDCs] right than it is to do it fast. The currency that’s being used in China is not one that would work here. It’s one that really allows the government to see every payment for which it is used in real time.” - Jerome Powell

I think a good way to conceptualize CBDCs is that they formalize (and in some ways entrench) the rules of banking law into explicit code. Formalizing rules is neither good nor bad - it strictly depends on the nature of the rules themselves. You could formalize rules that reduce individual freedom, which China is doing and America is reluctant to do. Or you could formalize rules that reduce government power, which it turns out America is reluctant to do as well. The wait-and-see strategy that Powell proposes is really more lawful-neutral than it is neutral-good.

The reason that people worry that a Chinese CBDC might pose a threat to the dollar is not as a direct threat to its status as the world’s reserve currency, but as an alternative payment infrastructure that could allow countries and companies to route around American sanctions and evade American financial regulations. Today global banking is essentially an American monopoly, so to move large amounts of money around globally you have to contend with American financial law.

If China is able to develop robust payment channels then American jurisdiction will become a matter of convenience rather than necessity. China would presumably have no interest in enforcing American jurisprudence - so countries and companies seeking to do international payments would be able to choose the most convenient payment network for their purposes. That could diminish American geopolitical power without necessarily threatening the dominance of the dollar - even a fringe Chinese payment network would allow North Korea to bypass American sanctions, for example.

A thriving CBDC poses legitimate threats for retail banks because it effectively means the Central Bank is competing directly against them for customers. I don’t think it especially changes the strategic dynamic between countries though. What rules are enforced and what surveillance is done ultimately matters more than whether those rules are enforced through banks or directly on a blockchain.

So should America worry about China attempting to build a parallel payment system on top of a CBDC? Maybe. But not because of the CBDC part.

Intro to Crypto Q&A: Monday, May 3rd 2PM PST

I’ll be doing an "Introduction to Cryptocurrency" event for Product School this coming Monday (May 3rd) at 2:00 PM, PST. If you are interested you are welcome to join. The talk itself was filmed in advance and will be playing alongside a live chat room where I will be answering questions. If you’re a regular reader of this newsletter chances are the content here will already be familiar to you, but you may still find it useful for teaching others about crypto or you are also free to ask more advanced questions in the chat. You can find more information here!

Other things happening now:

The IRS is preparing for a world of cryptocurrency enabled tax evasion by hiring contractors to try to jailbreak hardware wallets. The arms race between hardware wallets manufacturers and jailbreakers will last for a little while but there is a reason governments still can’t hack iPhones - encryption is asymmetrically defensive. Hacking hardware is a very short term strategy - it basically relies on the manufacturer screwing up somehow.

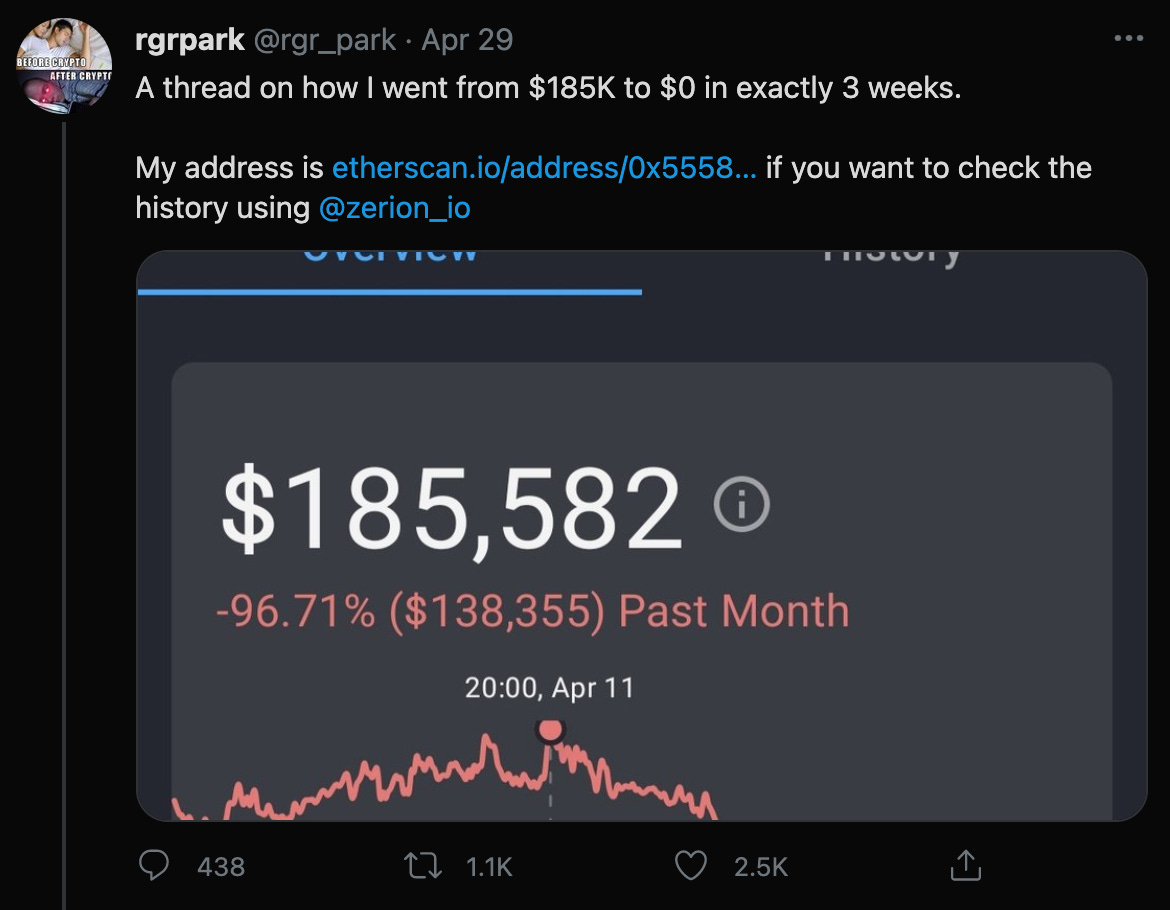

Cryptocurrency prices can be hypnotic. Hindsight makes it easy to retrofit explanations to movements that were impossible to actually predict. Many, many people claim to have gotten rich trading and many offer tips or strategies for how you can get rich trading, too. It is much rarer to hear an honest description of the much more likely outcome - losing money. A cautionary tale:

Presented without comment:

We *did* mention when Edward Snowden’s NFT representing the court case that emerged from his leaks sold for 2224 ETH (~$5.5M at time of sale), but that sale isn’t relevant to today’s story.

Editor’s note: This is hypothetical, I am not actually available to do crimes.

Note that this exempts TopShots which is many ways it's own thing entirely. It’s also the case that the vast majority of NFTs that sell once (artist -> buyer) never sell again (seller -> buyer), meaning almost no one has ever been able to resell their NFTs for a profit. Most NFTs have an effective resale value of 0 ETH ($0 at time of writing).

The exact development story here is pretty murky. Ant Group announced that they had been working with the PBOC since 2017 and have been central to the trials. But the PBOC also stifled Ant Group’s IPO and placed founder Jack Ma under house arrest for criticizing the Chinese financial sector. Ant Group and Tencent have both announced enthusiastic involvement even though the digital yuan will almost certainly disrupt their lucrative duopoly over Chinese digital payments (Ant Group owns Alipay and Tencent owns We Chat pay). Who here is motivated by what is very unclear from the outside.