Blood in the streets and financial sheets

Plus Coinbase insiders selling, hashrate dropping and how to know when you are entering the Snow Crash era

In this issue:

Blood in the streets and financial sheets

Rich people are starting to love Bitcoin

Blood in the streets and financial sheets

Over the weekend Bitcoin crashed from ~$62.5k/BTC to a low of ~$50.6k/BTC before recovering to stabilize around $55.6k/BTC - a ~20% drawdown, mostly over the course of a single hour. Things were equally ugly for the rest of the cryptocurrency market - except for DOGE, obviously.

That one hour drop liquidated over ~$7.6B in leveraged longs across all of crypto. Over the course of the day that number climbed to ~$10.1B, roughly half from liquidated Bitcoin longs. That’s the largest single day volume of liquidations in Bitcoin history - more than twice as large as during the March 2020 crash after the covid lockdowns.

We’ve talked before about the cryptocurrency market’s insatiable appetite for leverage. All those leveraged trades are essentially dry tinder - when the market turns against them they are forced to close at a loss, driving the price down even further. Much of the capital inflows driving the recent rise from ~$60k -> $65k went to futures exchanges, especially those that offer high leverage. Funding rates and future premiums were all quite high, powering the basis trade that we talked about. So once the price started dropping it makes sense that a lot of traders were wiped out - but it doesn’t necessarily answer why the price started dropping in the first place.

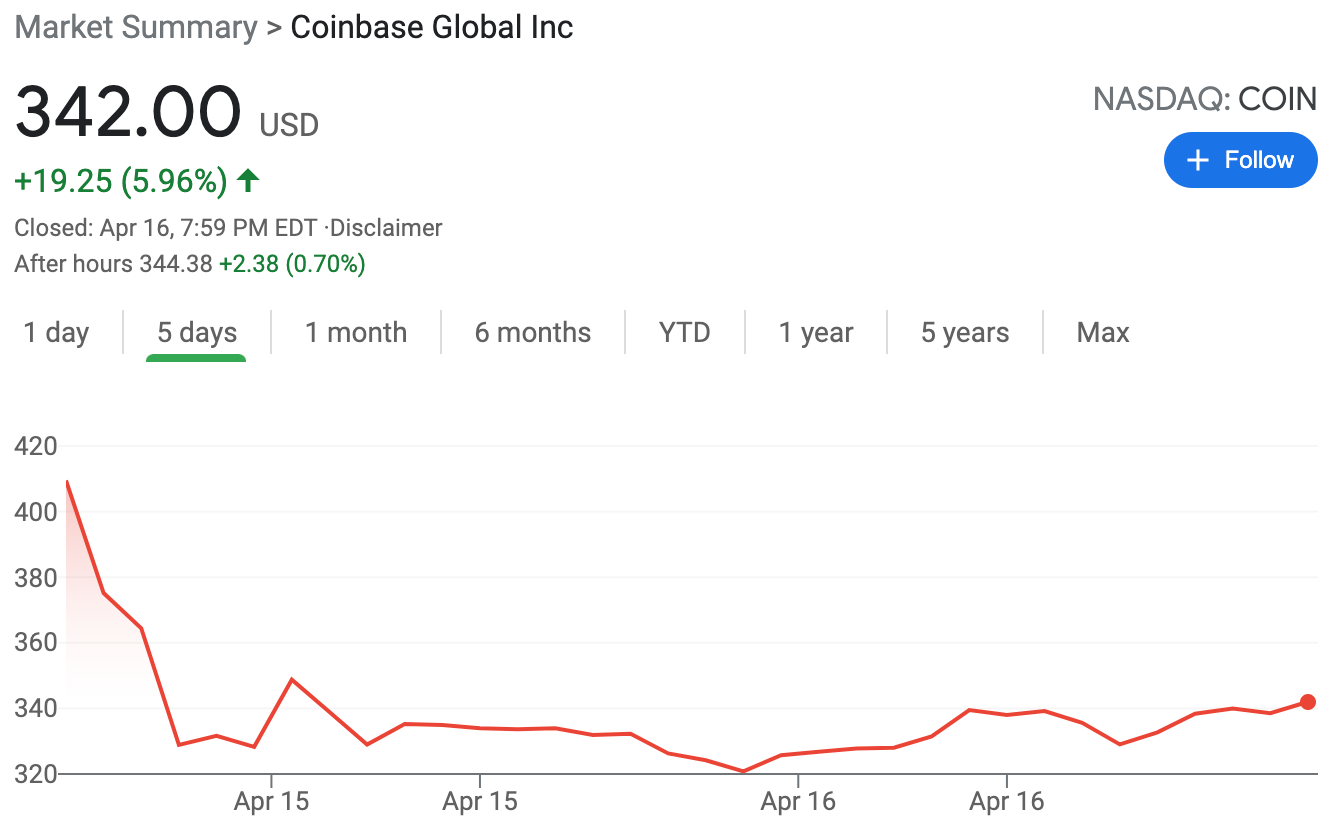

There isn’t any way to really know why people started selling, but personally I blame Coinbase.1 Much of the world is likely using COIN as a proxy for the success of Bitcoin (and other cryptocurrencies). When it launched to reasonable but not spectacular performance the market was disappointed and prices sagged.

In this case the drop after COIN launched collided with the many leveraged long positions counting on a rally and the price collapsed. That’s still an unsatisfying answer though - if BTC dropped because investors view COIN as a proxy for BTC, why did COIN drop?

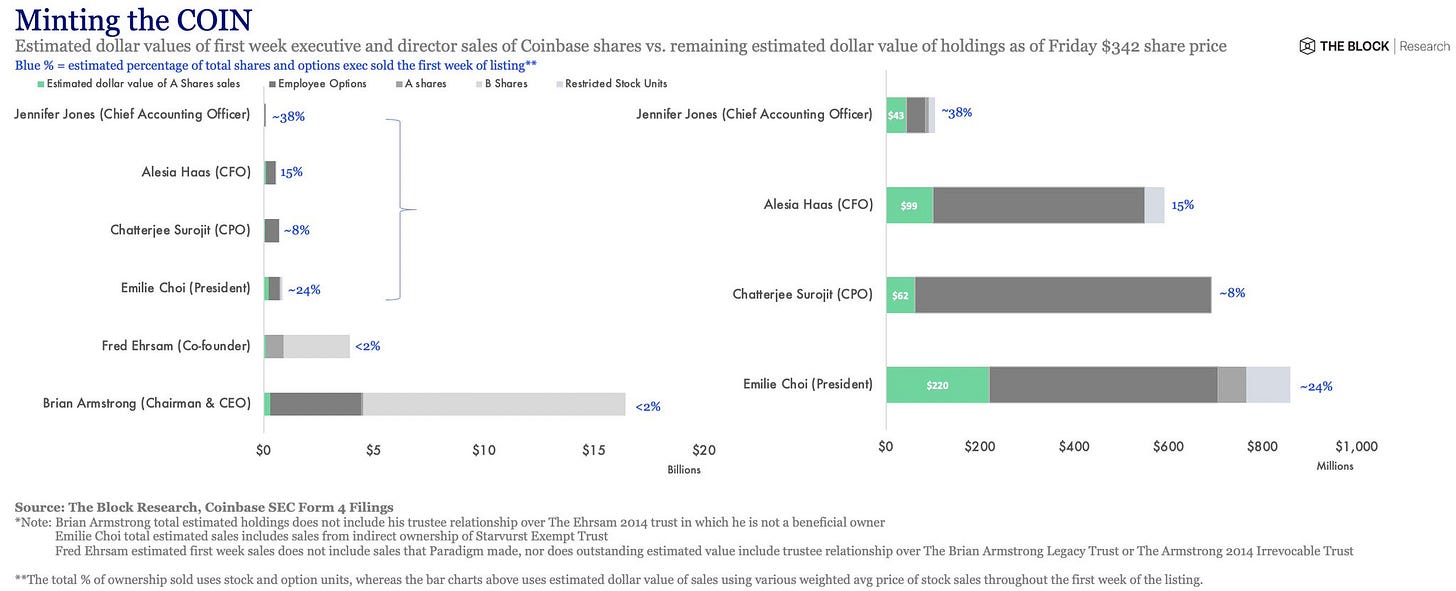

The simple answer of course is that there were more sellers than buyers. I speculated that Coinbase might still have lockups preventing insider sales in spite of the fact that they did a direct listing, but in this case I was mistaken - several readers reached out to let me know anecdotally that people they knew who work at Coinbase were able to (and did!) sell their equity.2 Even more prominently, the paperwork that Coinbase is now obligated as a public company to file revealed a lot of equity was sold by senior Coinbase management:

These numbers by themselves are pretty misleading. This form doesn’t account for their entire comp package - most notably unvested shares and unexecuted stock options. The CFO for example sold 100% of the ~255k options that she chose to exercise, but she still owns ~1.1M worth of options. So in reality she sold something more like 15% of her stock options and presumably has more unvested equity in her comp package as well. It's also important that somebody sell into a direct listing otherwise there will be no shares to actually trade and it is a sign of strength the company felt no need to leverage their moment in the spotlight to fundraise.

So I don’t think this represents senior management fleeing Coinbase - but it might very well represent the sell pressure that pushed the COIN price down to ~$342.

Another popular theory is that Bitcoin crashed because a blackout in Xinjiang causing the largest one-day drop in estimated hash rate since Nov 2017:

This is also pretty misleading. Bitcoin miners only actually broadcast the results of their work to the network when they find a block, and finding a block is a randomized process. That means you can’t actually observe the hashrate directly you can only observe how frequently new blocks are added to the blockchain.

So what the graph above is actually saying is that blocks were appearing ~40% less frequently than expected. Part of that is probably because of the power outages in Xinjiang but part of it is also probably due to random chance. 24 hours isn’t enough time to get a statistically significant sample - to understand changes in the hashrate you need to look at longer timeframes.

On the other hand these changes can be economically significant even if they aren’t statistically significant. The blackout has been news in China since at least April 15th. On April 16th someone sent 9000 bitcoin (~$0.5B at the time) to Binance, presumably with the intention to sell. It seems plausible that seller was motivated by knowledge of how the blackout was going to impact the mining community. After the crash someone managed to withdraw 20700 bitcoin (~$1.1B at time of writing). Possibly a very nice trade for someone!

We tend to think of Bitcoin mining power as being locked to wherever it is located, but actually quite a few Bitcoin miners keep their machinery mobile and migrate it to wherever the power is cheapest. It was already routine for miners to move from Xinjiang/Inner Mongolia in the dry season to the hydroelectric facilities in Sichuan/Yunnan during the wet season. If the outage in Xinjiang is sustained mining equipment will likely just migrate to wherever power is most available. Long term hashrate leaving Xinjiang would be great for Bitcoin: it would decentralize mining and reduce Bitcoin’s carbon footprint.

In the meantime Bitcoin’s network is slower (but not halted) and transaction fees have risen but network fundamentals are unaffected. This is the 87th time that Bitcoin has dropped more than >10% in a single day. Long term holders are unperturbed - addresses with a strong track record of holding aggressively bought this dip:

Rich people are starting to love Bitcoin

Recently there has been a string of famous investors who have publicly changed their stance on Bitcoin, or taken a pro-Bitcoin stance for the first time. None of them are making particularly new arguments, but when celebrities in the investment community start publicly endorsing Bitcoin it greatly reduces the career risk for other financial advisors and Wall St professionals to explore Bitcoin.

Other things happening now:

We have entered the Snow Crash era.

This is about the nicest thing China has ever said about cryptocurrencies:

Edward Snowden created an NFT representing the court decision that ruled the NSA mass surveillance programs he uncovered were illegal. This week the auction concluded and the piece sold for $5.5M to a decentralized autonomous organization (DAO) formed to collect NFTs.

Contrast the People’s Bank of China’s approach with this report from the St. Louis Fed about how "Decentralized finance may … contribute to a more robust, open and transparent financial infrastructure."

This graph compares the miner rewards of the Dogecoin network to the miner rewards of the Litecoin network, which Dogecoin relies on via merge-mining. Arguably at this point the tail is wagging the dog and Litecoin is freeriding off of Dogecoin’s security budget. Its a bit like hiring off-duty cops as security guards and then paying them way more than they could make on active duty. This kind of relationship is entirely unprecedented, so no one knows what it will mean. At time of writing the price of Dogecoin is $0.34/DOGE.

As is tradition.

h/t to readers MS and SS 🙏