I regret to inform you that everything is dumb now

Plus Christie's announces a CryptoPunk auction and the Simpsons issue a Bitcoin price target.

In this issue:

Babysitting Bitcoin for fun and profit

I regret to inform you that everything is dumb now

Christie’s to auction off developer CryptoPunks

I’ve gotten some reports that GMail is exiling Something Interesting to the Promotions tab. If you are having that problem you can try adding knifefight@substack.com to your contacts list or using the GMail "mark as important" feature. (h/t to reader TM)

Also! Today is Something Interesting’s 50th issue. Bitcoin decided to reach a new all time high in celebration. I will be minting NFTs to represent the first 50 issues and giving them away to paid subscribers at the Patron of the Snarks tier. Consider subscribing! 🚀

Babysitting Bitcoin for fun and profit

The Bitcoin market is somewhat unique in that almost all the participants in the Bitcoin market agree that the price is wrong. Some people (myself included) think the price should be much higher. Others (like Warren Buffet) think the price should be much lower. Almost no one thinks the natural price of Bitcoin is ~$60k - that just happens to be the point where the tug-of-war between optimists and pessimists balances out right now. That’s part of why Bitcoin is so volatile - everyone knows the current price is wrong, so everyone is ready to move quickly when it changes. But it also has other interesting implications.

If you think Bitcoin is worth $1M and you have the opportunity to buy it for $60k then obviously you should buy as much as your risk tolerance will allow.* The reason that Bitcoin bulls haven’t driven the price beyond ~$60k isn’t because they view ~$60k as too expensive a price - it’s because they ran out of money.

(*) Editor’s Note: Remember that Bitcoin is an experiment and total failure is still very much a possibility. You should never own more bitcoin than you can afford to lose. For more thoughts on this check out What it means to own Bitcoin.

In finance the normal solution to running out of money when you see a profitable trade is to borrow the money you need from someone else. There are a lot of ways to do that but they generally all hang out under the umbrella term leverage. Using leverage in a trade multiplies both the risk and the reward. Bitcoin investors have boundless optimism and finite budgets - so they have enormous demand for leverage. But it is pretty difficult to find lenders willing to give out loans to speculate on crypto so the prices investors end up paying lenders are quite high.

Here’s Sam Bankman-Fried, CEO of cryptocurrency exchange FTX:

In other words Bitcoin investors insatiable appetite for leverage drives the price of Bitcoin futures above the price of Bitcoin itself. Traders call the situation where a commodity’s futures are trading above the spot price contango - and it usually reflects the cost of storage. You pay more for a barrel of oil to be delivered in one month than you would for a barrel of oil today because someone has to pay to store that oil somewhere for a month. Oil is a pain.

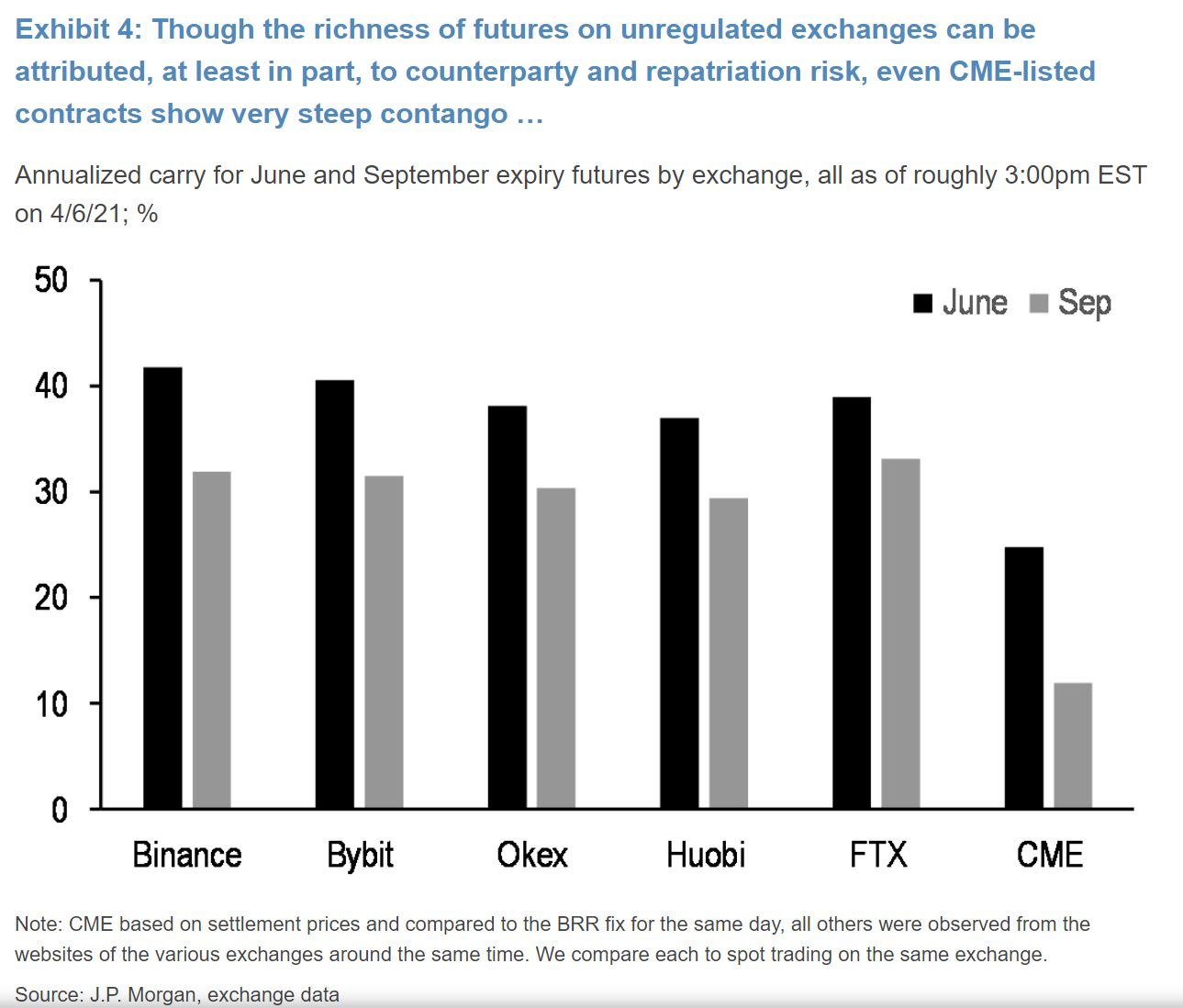

Back in February we talked about how to take advantage of contango in the Bitcoin market by doing what’s called a basis trade. The way it works is you buy bitcoin and sell bitcoin futures at the same time. You can use the bitcoin you bought to cover the futures you sold when they mature and collect the premium. The bitcoin you bought cancels out the bitcoin you owe, so you don’t care what the price does. In effect the market is paying you to store Bitcoin. At the moment it is paying extremely well - between ~15-40% annually according to JP Morgan:

Those are enormous yields at a time when 1-year treasury bonds are paying ~0.05%. Yields of this size means there aren’t very many traders taking advantage of this arbitrage opportunity - if there were, they would compete with each other and bring the premiums down. That raises an interesting question - why?

Unlike barrels of oil there is relatively little cost to storing bitcoin - you don’t even need to custody it yourself, you can leave it on the exchange you bought it at. Your only risks then are the counterparty risk of the exchange and the risk that the Bitcoin network collapses entirely. Those risks justify some amount of price premium, but definitely not ~15-40%. What's actually happening is the Bitcoin basis trade has one more hidden cost: the opportunity cost of not investing in Bitcoin itself. The basis trade is denominated in USD - you are protected from Bitcoin dropping price, but you also miss out on any gains that you could have had.

In other words, if you think Bitcoin will rise more than ~40% in the next year you would rather just hold Bitcoin. To be willing to execute the basis trade you have to simultaneously be familiar enough with Bitcoin to be comfortable buying it and also bearish enough on Bitcoin that you would rather not own it. The continued existence of this premium suggests there are only two types of traders: those who are unwilling to touch Bitcoin and those who are unwilling to let go.

I regret to inform you that everything is dumb now

If you took all the economic articles written in 2021 fed them into a gpt-3 chatbot and then somehow deprived it of oxygen this is probably what you would get:

That screenshot is of a press release from Kronos Technologies (an air purifier company) announcing the formation of a SPAC that will keep its treasury in Dogecoin Cash, a parody fork of Dogecoin (a parody currency). To that end Kronos sold off their BIT (no idea what that is, but it’s not Bitcoin) and used it to buy 600M DogeCash. Kronos has 5 employees on LinkedIn, so that’s ~120M DogeCash per employee. According to the press release DogeCash is an ERC-20 token but I wasn’t able to figure out exactly which one. Let me know if you know!

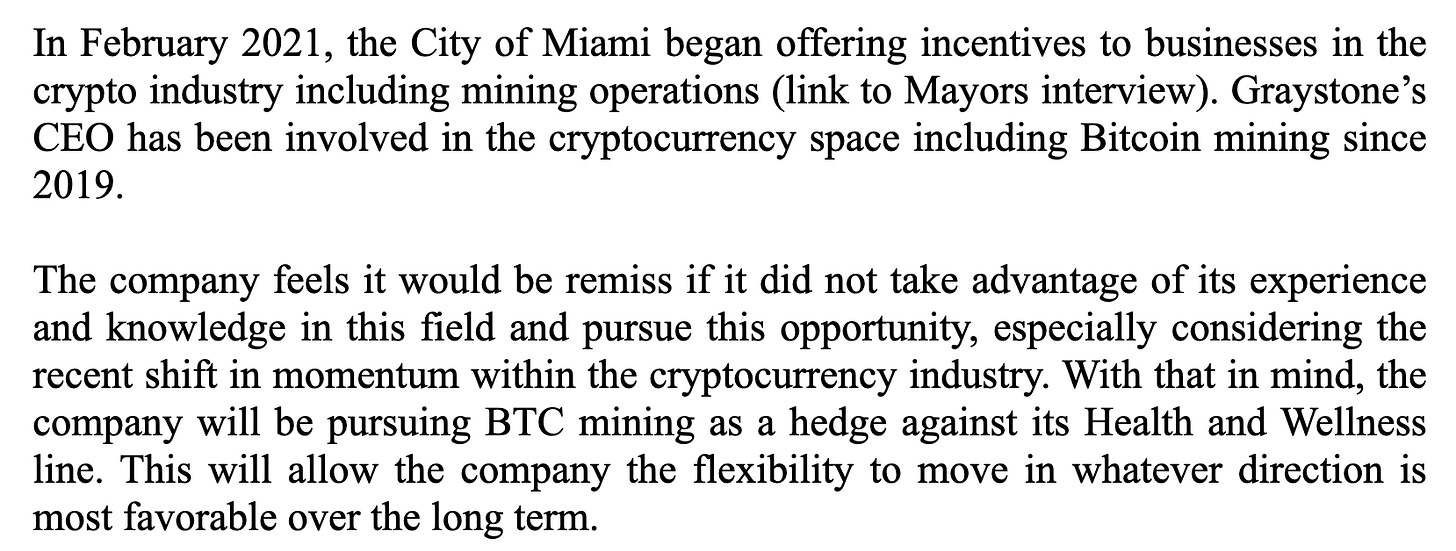

Elsewhere in no-seriously-this-is-real news, fertility and longevity supplement company Graystone has announced plans to hedge its wellness product lines by diversifying into Bitcoin mining. This is motivated in part because Miami is offering incentives to the crypto industry and in part because the CEO got excited about crypto in 2019. From now on Graystone will both mine Bitcoin and manufacture herbal extracts from seaweed and mushrooms. They are 50/50 about which line of business they will end up pursuing long term:

This is the 2021 equivalent of the companies in 2017 who added Blockchain to their names to juice the stock price. It is definitely a sign of froth and will eventually mark the top, but I don’t think we are there yet. Consider for example that GameStop just posted a job listing for an NFT engineer. I’m sure the market will respond in a healthy and measured way to whatever they end up announcing.

Christie’s to auction off developer CryptoPunks

When LarvaLabs created CryptoPunks (widely regarded as the first CryptoArt project) they reserved the first 1000 punks for themselves and gave the remaining 9000 away for free to anyone who wanted to claim one. At time of writing the cheapest available CryptoPunk is being offered for ~20.4 ETH (~$43.4k USD).

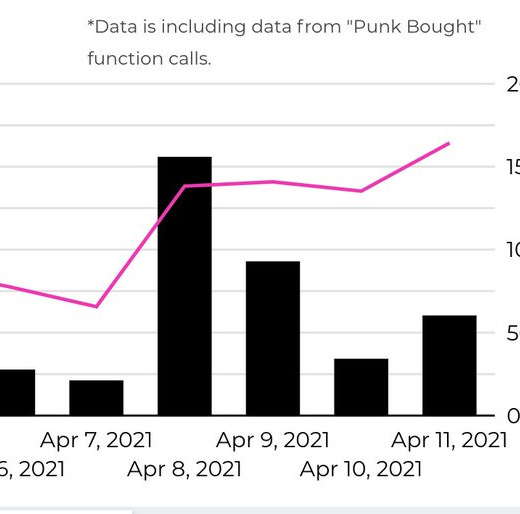

Traditional auction house Christie’s has announced plans to offer a collection of nine CryptoPunks from the developer collection, including CryptoPunk #2 and one of the rarest type of CryptoPunk - an alien. There are only nine alien punks in total and the last two to sell sold for ~$7.5M each (roughly ~$13k/pixel).

A burst of high-end punks sold in the wake of the Christie’s announcement, raising both the average and floor price for punks. Things are settling down, but it is clear the announcement brought new interest to the CryptoPunks project.

Other things happening right now:

Simpsons jokes about the future have often had eerie accuracy. They predicted a future Trump presidency back in 2000. Keep that in mind as you consider your investment positions in Bitcoin, America, Fox and GME respectively.

Back in February we linked to the 3 year old who explains Bitcoin better than most of the journalists who write about it. Here she is doing her first ever interview with Michael Saylor, who recently announced that MicroStrategy would be paying its board of directors in Bitcoin. The gimmick is a bit more forced in this one but it’s still pretty cute.

Coinbase’s long anticipated IPO is happening this Wednesday. On secondary markets they are currently trading at an implied valuation of ~$133B. For reference those prices suggest that Coinbase is ~5x as valuable as the Nasdaq (~$25B) and ~2x as valuable as the NYSE (~$66B). Skeptics used to wonder if Coinbase would be edged out when traditional exchanges started to list cryptocurrencies. Now it looks like traditional exchanges might get edged out if Coinbase decides to start listing stocks.

NYSE: Why are we doing this?

Narrator: For money.