[News] Dogecoin was the original meme asset

1DOGE=1DOGE but just try telling that to the taxman much wow

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Dogecoin rallies as meme investing goes mainstream

Cryptocurrency taxes and insurance (reader submitted)

Dogecoin was the original meme asset

By now everyone under the sun has heard about r/wallstreetbets, the community behind the ongoing madness in Gamestock’s stock. Given the r/wallstreetbets love of exotic financial instruments you might expect them to be cryptocurrency enthusiasts as well (and as individuals, many of them are) but the community has a long-standing strict policy forbidding discussion of anything crypto under Rule #4, no scams:

#4. No Pump & Dump, Crypto Discussions, Schemes or Scams

No non-reporting penny, microcap (Less than $1BN Market Cap), OTC stocks, low volume options, cryptocurrencies, SPACs, or any other worthless securities that are susceptible to scams or pump & dump schemes.

To be clear I think this is actually a very reasonable rule - a lot of scams happen in the crypto space and there is an unending army of shills that would overwhelm the discussion if they were allowed to. But obviously there was a market for some people who wanted to do the basic WSB thing but with cryptocurrencies - so eventually a splinter community called r/satoshistreetbets formed to meet that need.

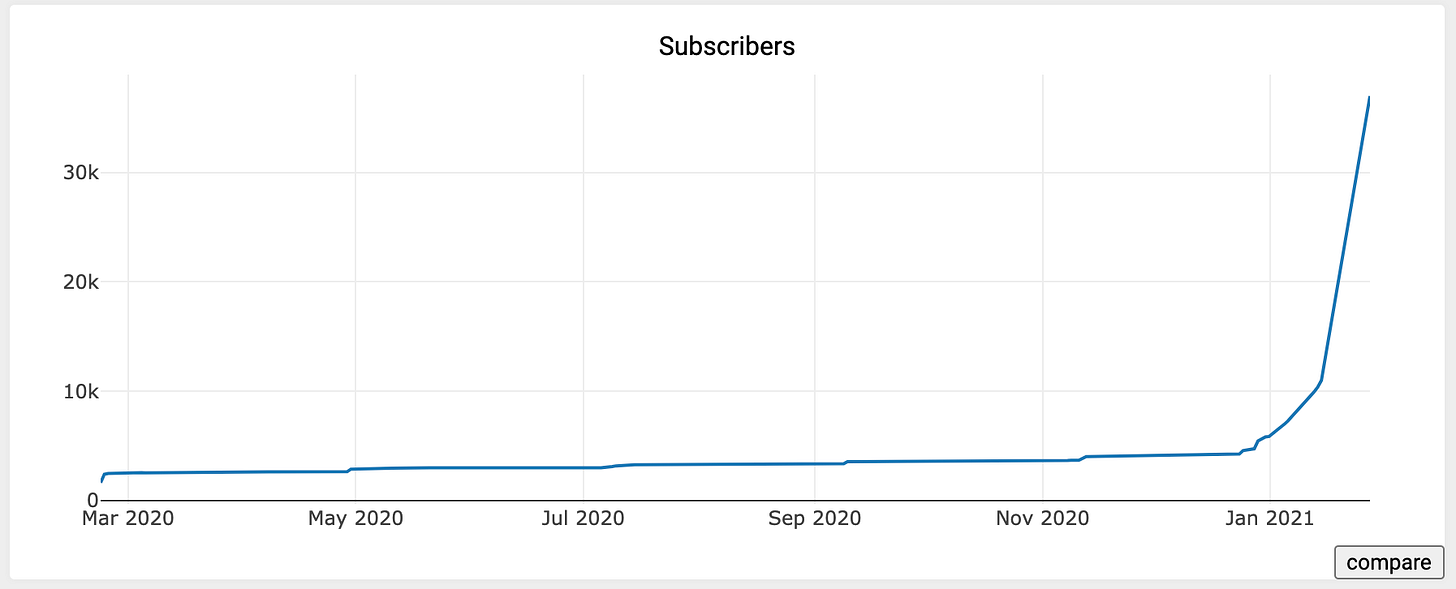

Until recently there weren’t that many people who wanted to denominate their high-stakes gambling in highly volatile assets, so r/satoshistreetbets was relatively small. At the end of last year it had ~5k subscribers or so. But the incredible rise of growth in r/wallstreetbets has had a spillover effect for their crypto counterpart:

As of writing they are up to ~125k subscribers (~50x growth). Eager to replicate the success of their older brother, r/satoshistreetbets quickly converged on what the GME of cryptocurrency would be: the original meme asset, Dogecoin.

Dogecoin was created as a literal joke poking fun at the first generation of altcoins. It’s main distinguishing quality was an absurdly large supply of tokens, meaning that the face value of a Dogecoin was deliberately impractically small. DOGE were not originally meant to be treated as valuable - they were funny money. The community held some as a lark, impulsively gave them away to each other and to various charities and created high quality investment analysis memes like this one:

The thing is Dogecoin was a joke but it was a pretty fun joke that people liked? The community was friendly and welcoming and the price point was low enough that anyone could throw a few bucks in and play along. More and more people joined somehow the joke never quite stopped.

There are some complex elements to this story. The same playful, careless qualities that make the Dogecoin community fun have also made them a target for scammers. The creator of Dogecoin Jackson Palmer has left the community over concerns that the joke is enabling more harm than good.

Still, Dogecoin has persisted and is now one of the few cryptocurrencies to have survived a bear cycle and bounced back. When your investment thesis is "Nothing means anything, wheeeeeeeee!" it is hard to keep you down.

As it happens, now is the exact right moment to have that investment thesis:

I’m not sure what the people are saying exactly but I imagine it is probably misspelled and in colorful comic sans. Obviously Elon Musk took this as an opportunity to use his platform to responsibly educate his audience. As is tradition.

Elon’s loyalty to DOGE proved short-lived, however. Later that day he changed his bio to just the word #Bitcoin and it suddenly became very fashionable:

The price of Bitcoin rocketed up to $38k/bitcoin and there was a great disturbance in the force as ~$258M worth of Bitcoin shorts were instantly vaporized. It was a bad week for shorts.

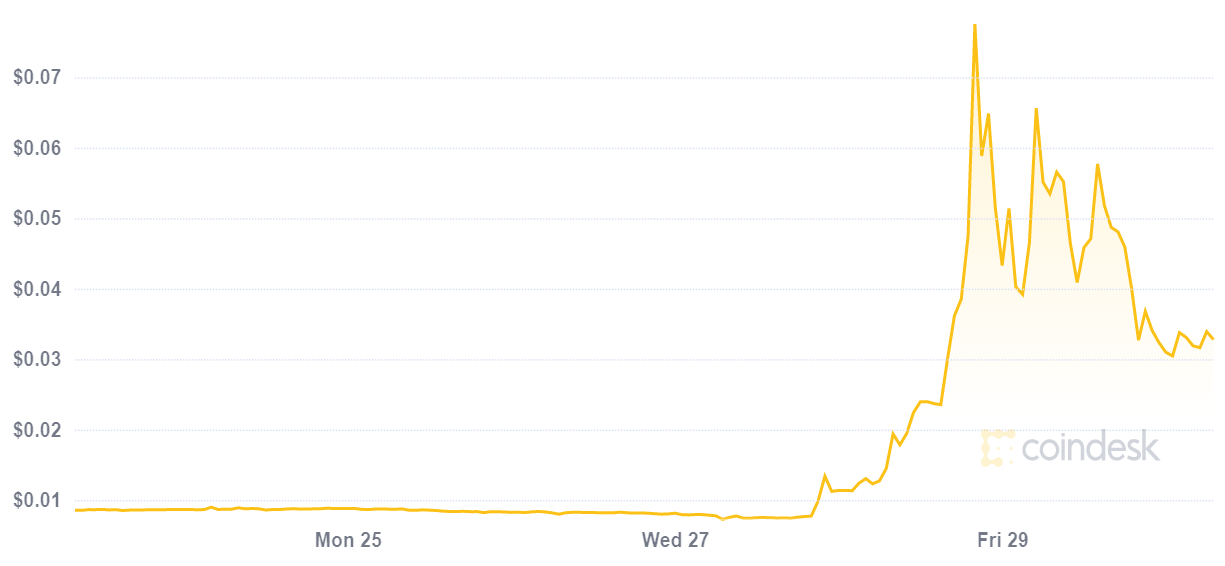

Editor’s note: I hope you all had fun with DOGE! Between writing this piece and publishing it the party seems to have concluded. Here’s the price chart now:

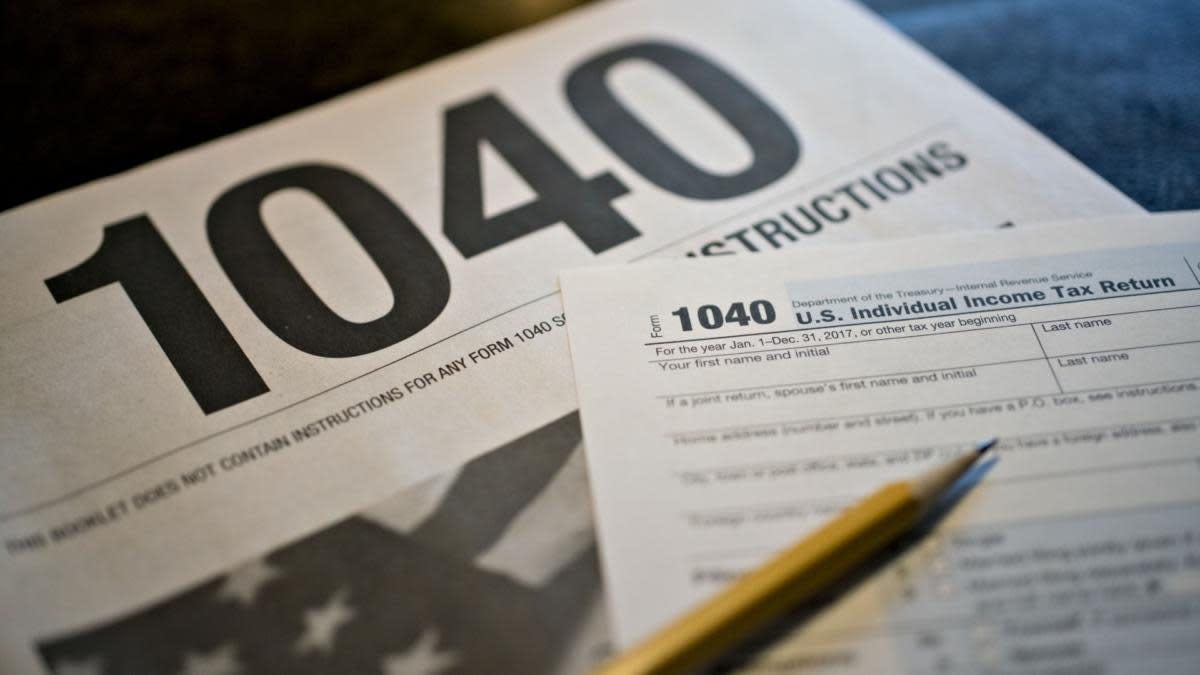

Bitcoin and Taxes

“Have you written about tax and cryptocurrency? Or insuring cryptocurrency?” - JB

Not yet, but now seems like a good time of year to talk about it!

This probably goes without saying, but pay your taxes. The tax authorities are paying close attention to crypto users. Since I am not a tax advisor, that is the only tax advice I can offer - but I do offer it in all sincerity. Everything else I mention here is information but not advice.

For US taxpayers the IRS declared Bitcoin was property which means it is taxed more or less the same way that stock trading is. When you buy/sell Bitcoin you owe taxes on any capital gains - same whenever you spend Bitcoin. The IRS considers buying something with Bitcoin to be equivalent to selling it for dollars. Exchanges will give you a history of your transactions on the platform but the onus is on you to keep track of your usage off the platform. That’s one of a long list of reasons that Bitcoin is better for occasional, high-value transactions than small purchases like your daily coffee.

There are services that will process your transactions and calculate your exposure for you, which is especially helpful if you are trading actively. I personally have used CoinTracker.io for a few years and am happy with their service. CoinTracker is not a sponsor (Something Interesting is ad free) but full disclosure one of the founders is a friend and a subscriber. Hi, Chandan!

Insurance is trickier. Insurance companies generally don’t want to insure things that are easy to steal (obvious) but they also don’t want to insure things that are easy to sell (less obvious). The easier something is to sell once stolen, the more likely someone is to steal it in the first place - so things that are easier to sell are harder to insure. It’s relatively easy to get insurance for priceless art but it is extremely difficult (or at least expensive) to get insurance for the equivalent value in gold bullion because it’s so much easier to sell stolen gold than stolen art.

You can probably tell where I’m going with this - cryptocurrencies are about as arbitrarily easy to sell once stolen as anything imaginable. Insurance companies are (rightly) terrified of them. Let me know in the comments if anyone has had success with this or knows of someone who has, but my impression is that including your cryptocurrency holdings in a homeowner’s insurance or umbrella policy isn’t possible right now. There are companies that specialize in insuring cryptocurrency holdings, but they operate at the scale of exchanges not at the scale of customers.

The good news is you can take advantage of those insurance policies just by keeping your holdings on the exchange you bought them at. They are not covered by FDIC insurance and every exchange’s coverage is different (and probably limited) but it is almost certainly better insurance than you could get independently.

Other things happening right now:

Cryptopunks are still attracting staggering bids. Important to know that to make a bid on the Cryptopunk smart contract you have to actually commit the money. That means the 1876 ether (~$2.46M) bidding for these three NFTs is actually locked into the contract itself just waiting for the opportunity to buy.

People are very upset with Robinhood:

Ray Dalio (billionaire founder of Bridgewater Associates) on Bitcoin:

"It seems to me that Bitcoin has succeeded in crossing the line from being a highly speculative idea that could well not be around in short order to probably being around and probably having some value in the future."

I can’t get enough of watching Soulja Boy relive 2017 in slow motion. Enjoy this real and legit business proposal it could be big idk:

Presented without comment: