Marathon bends the knee to Bitcoin

Plus the SEC sues Bitconnect but not for the fraud and the MLB is getting into NFTs

In this issue:

The SEC sues Bitconnect but not for the fraud

Marathon bends the knee to Bitcoin

Good news, gentle reader! A late breaking rally on May 31st meant the Bitcoin monthly candle closed at a mere -35% drop - only the second worst monthly candle in Bitcoin history. The real OGs remember November 2018 when Bitcoin dropped -37%.

The SEC sues Bitconnect but not for the fraud

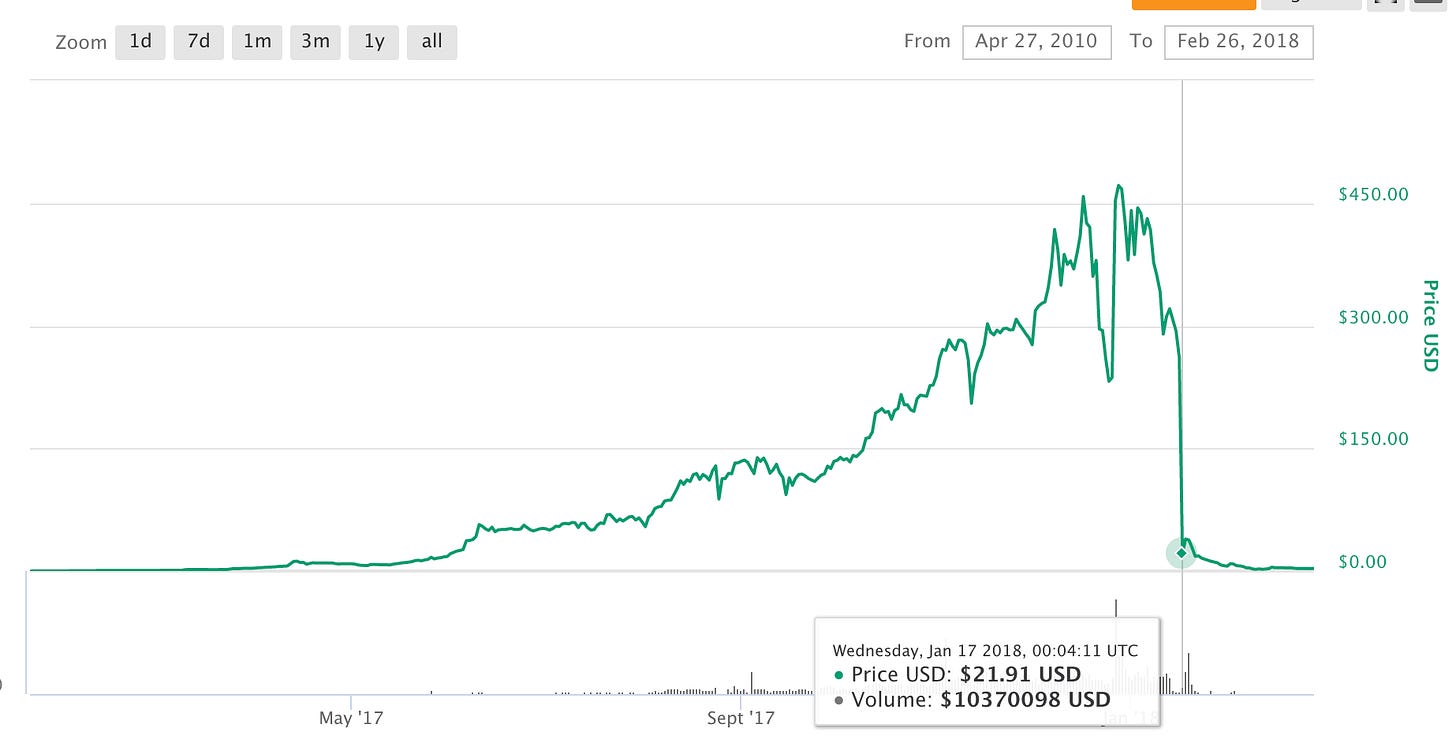

One of the iconic moments marking the end of the ICO craze in 2018 was the collapse of Bitconnect, a ponzi scheme that marketed itself as a cryptocurrency / lending platform. At one point BCC tokens were trading for ~$460/BCC, an implied marketcap of almost ~$3B making it one of the largest cryptocurrency projects of the era.1

In January of 2018 the Texas State Securities board issued a cease and desist against Bitconnect calling it a ponzi and the price dropped ~90% essentially overnight.

Bitconnect promoters in India and in Australia have been arrested, but no criminal charges have been filed in the US - although the FBI has asked victims to reach out to aid in the investigation. This week the SEC filed a complaint against five prominent Bitconnect promoters for "unlawfully [selling] unregistered digital asset securities". The SEC’s action is also not criminal but it does seek return of any profits plus interest and civil penalties.

What is interesting is that the SEC complaint has nothing to do with Bitconnect’s business plan (which was to run an illegal ponzi) and everything to do with how they raised funds from investors (i.e. by selling what the SEC says was an unregistered security to the public). If you plan to raise money to do crimes it is important to register your plans with the SEC.2

This is not an accident - it is the SEC deliberately seeking to establish precedent in the courts by starting with an opponent who is deeply unsympathetic and unlikely to put up a very thoughtful or nuanced defense. Then the SEC can take that precedent and build on it in future enforcement actions against other crypto projects. The central question here is whether the five defendants (who all promoted Bitconnect in various ways and were paid to do so) should be considered 'issuers' or perhaps 'unregistered brokers' of the Bitconnect security.

If the SEC’s theory is ratified by the courts it implies that anyone who is paid to promote a token may also be liable if that token is later found to be an unregistered security. That could potentially have enormous implications for DeFi. If being paid to promote a token makes you an issuer, what about automatic market makers being paid a yield to provide liquidity to a token? What about enabling someone to build a derivative on top of that token? The outcome here may tell us a lot about the direction of future enforcement from the SEC.

Marathon bends the knee to Bitcoin

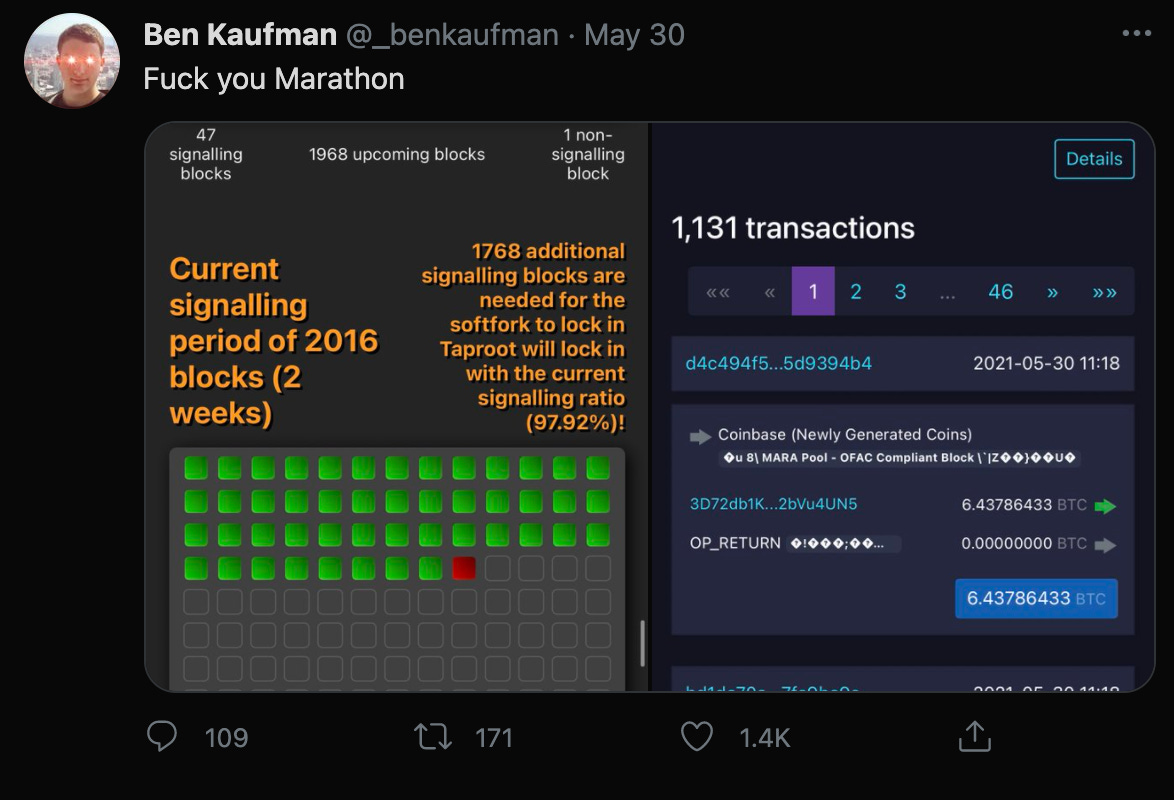

Marathon Digital Holdings is a North American mining company that claims to be operating ~1.5 Exahash of mining power (~1% of the total network). They are most famous for describing themselves as the first "fully US regulatory compliant Bitcoin miners" because they filtered transactions from darknet markets or sanctioned entities like North Korea or Iran.

In practice filtering transactions to make Bitcoin mining "regulation friendly" is essentially virtue signaling. Every block miners add to the blockchain increases the security of every previous transaction and refusing to confirm certain transactions yourself does nothing to prevent them from eventually being included by someone else. Marathon blacklisting transactions from their particular blocks is like enforcing security at just one entrance of a stadium - useless and unpopular.

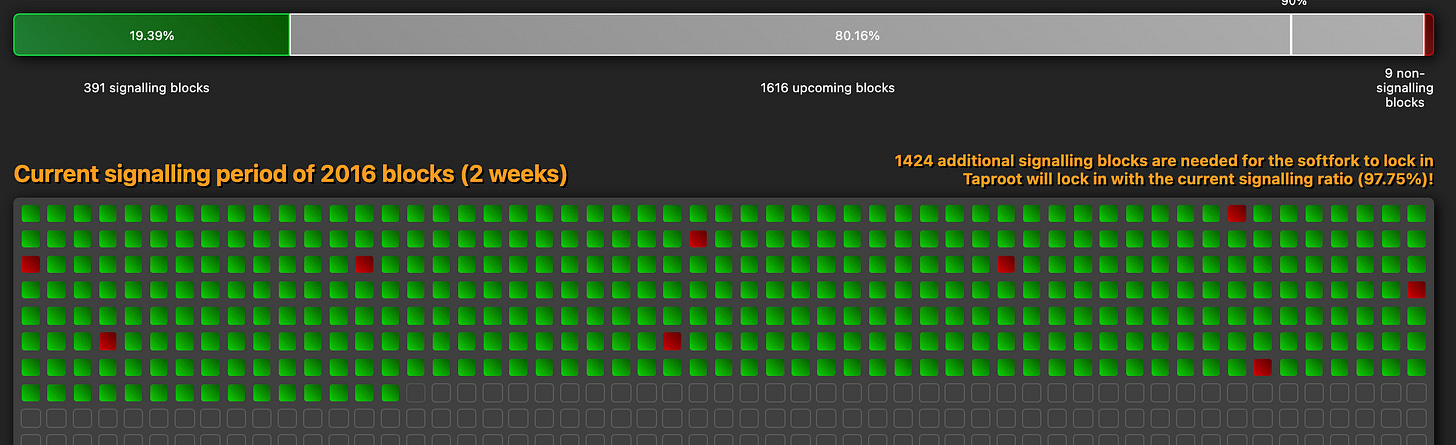

Still, if you are planning on filtering out nefarious transactions it is important to be able to tell them apart from the God-fearing OFAC compliant ones. So it is not altogether surprising that Marathon is one of the only remaining mining pools still signalling opposition to the Taproot upgrade, which (among other things) significantly improves privacy of transactions on the Bitcoin network.

Of the 443 blocks discovered in this voting epoch, only nine voted against Taproot. Four of those nine came from mining companies that support Taproot but have not been able to get all of their mining rigs updated to the latest version yet. One came from an unknown miner. The last four all come from Marathon, which was finding itself increasingly alone in its formal opposition to Taproot.

Marathon does not have enough hash power to actually prevent the activation of Taproot so this gesture is (much like filtering transactions above) largely symbolic. But as we’ve talked about before the effort to activate Taproot is a sensitive subject for Bitcoiners. It is a conversation where symbolic gestures are taken very seriously and where building and enforcing consensus are extremely high stakes.

The thing about censorship in an open network like Bitcoin is that it cuts both ways. Marathon can refuse to confirm any transactions from Iranians, but Iranian miners can also reject Marathon’s blocks or transactions. But since neither Marathon nor OFAC-sanctioned entities represent a very large share of hashpower this largely amounted to a mild, mutual inconveniencing.

The share of Bitcoin mining power that feels strongly about reaching consensus on Taproot is much, much larger than the share that felt strongly about OFAC regulations. It is hard to know if any of that hashpower has chosen to actively start suppressing Marathon’s blocks - but as of writing Marathon had found only four out of the last 443 (i.e. ~0.9%). That isn’t a very large sample size so variance makes it hard to interpret with certainty, but it is slightly less than you would expect from Marathon’s stated supply of available hashpower.

Perhaps they have had a run of bad luck? Or perhaps ~10% of the hashpower has quietly turned against them. Or maybe no action was needed beyond a few stern phone calls from larger mining pools. Whatever the reasons, Marathon is very, very sorry and promises never to do censorship again:

Other things happening right now:

The MLB is joining the NBA in minting and selling NFTs to represent key moments in the sport. The MLB’s effort will launch on July 4th with the sale of a 1 of 1 edition token representing Lou Gehrig’s "Luckiest man" speech.

Jack Mallers of Strike (a Lightning payments company) has sponsored a Bitcoin car in the Indy 500. They have been collecting donations to fund the effort, 30% of which go to the racing team (or local Indianapolis charities) and the remaining 70% donated to Bitcoin’s open source development. The Indy 500 was the largest in-person gathering in America since the pandemic began. The Bitcoin car finished 8th (of 33).

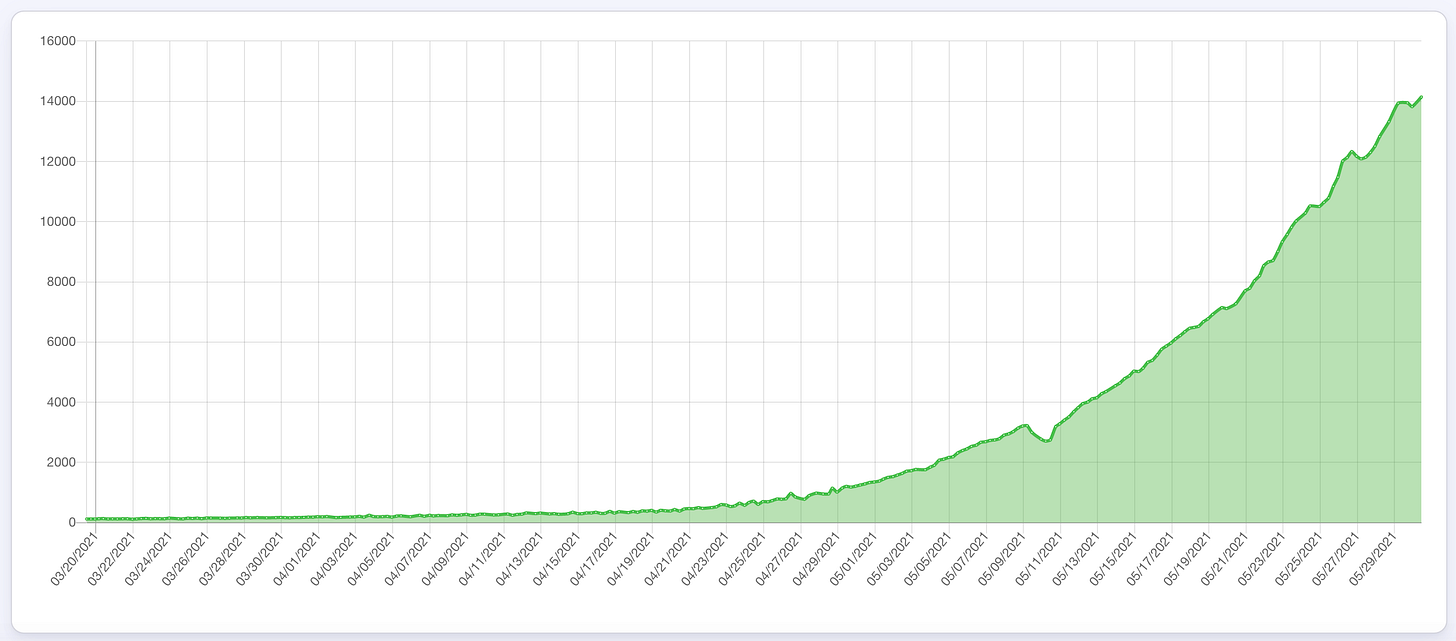

I talked a bit about proof-of-space coin Chia in my article on proof-of-stake as an example of how diverting electrical costs into hardware costs was actually not good for the environment. The footprint of Chia’s hardware costs has grown by ~1.1 exabytes/day for the last week, or ~$27M worth of hard drives per day. The total market cap of Chia is (at time of writing) ~$350M.

Presented without comment:

The rise and fall of Bitconnect, coupled with its shameless and often senseless self-promotion gave rise to some of the more famous memes in crypto, such as Carlos Matos the waso-waso-waso-bitttttccconnnnneect guy or Trevon James (aka Trevon Brown) who coined the phrase "technically … you kinda lost your money." Trevon is actually one of the five defendants named in the SEC suit).

This is not legal advice.