When I dip you dip we dip

Everyone take a deep breath we'll be fine

In this issue:

Michael Saylor bought your bitcoins

Taproot activation should lock in soon

Bonus SI podcast episode

Something Interesting is on YouTube

Michael Saylor bought your bitcoins

Investors are continuing to process their feelings about Elon Musk publicly breaking up with Bitcoin this past weekend. Bitcoin is down ~30% over the course of the week so far, plunging nearly to ~$30k/BTC before recovering to ~$39k/BTC at time of writing. That’s bad news for Bitcoin holders but they were not alone. The entire cryptocurrency market is in freefall.

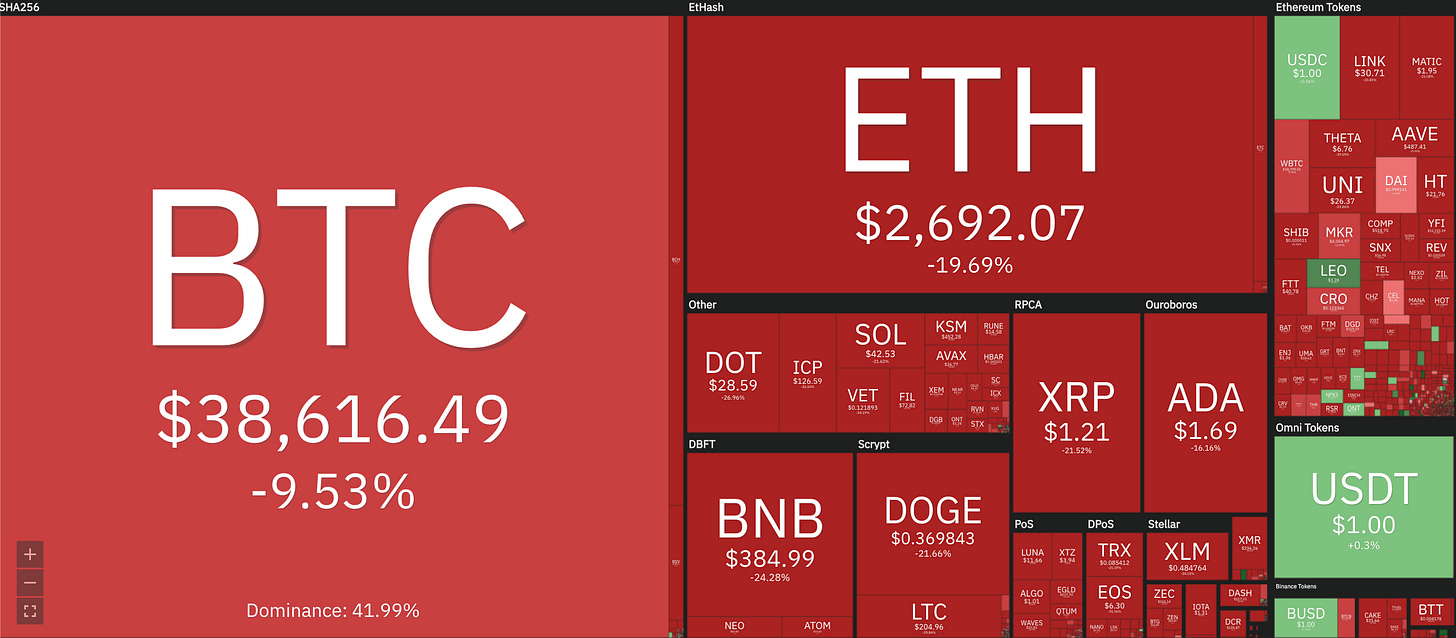

In fact compared to most other cryptocurrencies Bitcoin weathered the storm quite well - Bitcoin’s share of the crypto market rose ~4.5%, the first upward move in many months. Here’s what the market looked like generally:

The three largest green squares (USDC, USDT and BUSD) are all stablecoins designed in various ways to be pegged to the dollar. So this particular drop has been a somewhat universal bloodbath. Not even DOGE was spared.

This movement is probably a bit more than Elon Musk intended1 - I’m sure he enjoys the sense of power but if the antics get out of hand the SEC will be forced to come spoil the fun. Plus the price (at least briefly) dropped below Tesla’s average entry price of ~$34k/BTC, which makes all of this seem a lot less clever. By way of apology Musk offered a firm financial commitment:

Here is a good summary for those having trouble keeping track of the plot twists:

Elon Musk may have wavered in his view on Bitcoin for Tesla’s treasury, but Michael Saylor of Microstrategy has not. He continued to buy more through the dip, even though his most recent purchase (~$43k/BTC) is now underwater.2

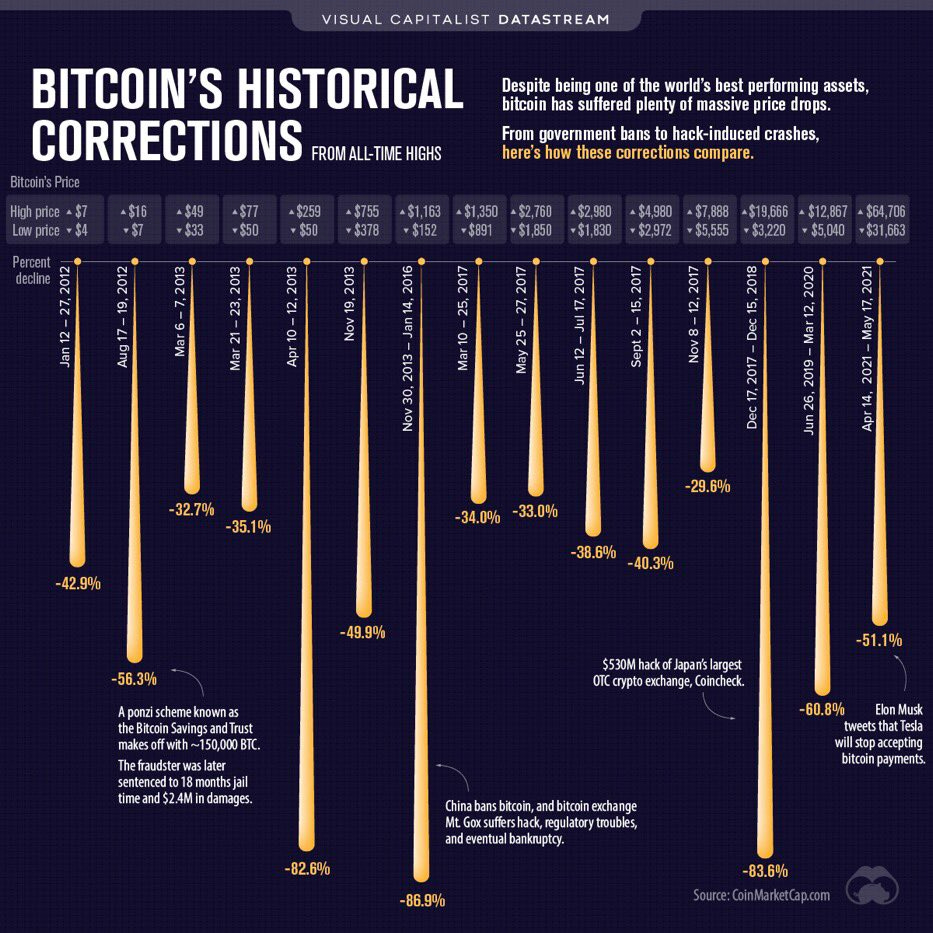

This of course feels like a sharp correction but it is actually pretty typical of Bitcoin movements during a bull run historically. In 2017 Bitcoin fell from ~$3k/BTC to ~$2k/BTC - five months later it had risen to ~$20k/BTC. In March of last year Bitcoin fell ~50% in two days to ~$4k/BTC and now we are "crashing" to 10x those levels. Bill Miller put it pretty well in a statement to CNBC:

"If I liked something at higher prices it is a safe bet that I will like it even more at lower prices. I don’t comment on normal fluctuation in stock or asset prices. The Bitcoin correction, while extreme if it happened to the equity market in such a short period, is right in line with moves we have seen many times in Bitcoin. I came on your show in March of 2020 to comment on the market because that four week drop was historic. This one in Bitcoin is pretty routine." - Bill Miller

This is also the first time since March of last year that Bitcoin’s realized market cap is down. That means the people selling are relatively recent buyers who are selling at a loss, rather than older coins realizing profits. Binance had the largest deposits ever Tuesday and on Wednesday exchanges had the most Bitcoin ever withdrawn in a day, a collective ~$750M worth in just 10m. Some paper hands are learning a hard lesson about volatility, and some deep pockets are enjoying the discount.3

Bitcoin just does this kind of thing sometimes! You have to be ready for it.

Taproot activation should lock in soon

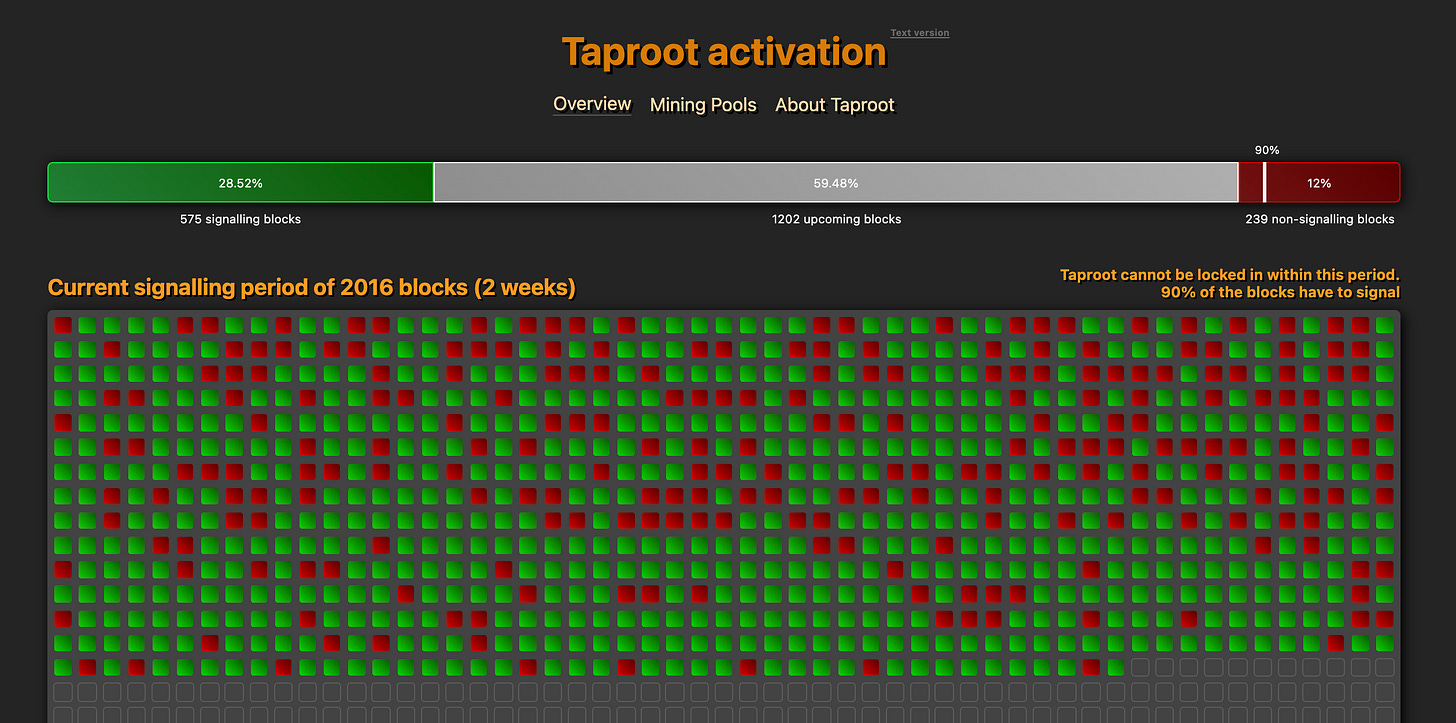

We’ve talked a few times about Taproot, the privacy and scalability upgrade that the Bitcoin network is currently attempting to land. At this point mining pools representing a collective ~94% of total hashpower have signalled readiness for the upgrade at least once, though many have only signalled sporadically. Too many unready blocks have happened for the activation to lock in on this difficulty epoch but the trend is clear:

The next difficulty epoch begins in nine days. Assuming it locks in (which seems likely) that will assure Taproot activation sometime in November.

Nothing is a given, of course. Some miners have reported difficulty in signaling with 100% of their hashpower for various technical reasons and with the last major upgrade (Segwit) there was some late-breaking hijinks with signaling to manipulate futures markets - so nothing is locked in yet. But Taproot is not as controversial as SegWit was by a wide margin so this is a pretty comfortable place to be right now.

Bonus SI podcast episode

As I mentioned last week the Hertz bankruptcy tale has continued to unfold in spite of the fact that I had already released a podcast episode about it, so everyone really should have understood the matter to be concluded. Nevertheless I am indefatigable in my journalistic due diligence and I have released a bonus follow up episode, hopefully the last chapter in the Hertz saga: The Gamblers Were Right. Give it a listen!

Something Interesting is on YouTube

If you are a subscriber to this newsletter chances are you already familiar with much of the content in this “Introduction to Cryptocurrency” talk that I set up for Product School. But chances are you have a friend who is earlier on their journey or maybe just starting and would benefit from a ground-floor introduction to the basic concepts. The talk is ~20 minutes and covers Bitcoin, DeFi and some simple tips for staying safe as you get started in crypto. Please like, subscribe and share it with your friends for 1000 years good luck. Failure to like, share and subscribe will result in a visit from three spirits each with a terrible lesson about the true meaning of Christmas.

Other things happening right now:

India is considering softening its ban on cryptocurrency:

If you are a fan of recursive geometry and confusing financial structures, then check out this Bloomberg article about SPACs eating their own tail: a SPAC founded to re-acquire (at a significant premium) a company previously taken public by a different SPAC with the same founders.

Don’t buy Safemoon and don’t take investment advice from Dave Portnoy. But you can take this video as useful insight into the mindset that is driving a lot of these recent market movements. The nihilists have the wheel.

To be clear, I don’t actually think Elon Musk caused this drop. There were lots of signals of slowing momentum, Musk’s tweets were just the catalyst.

Don’t weep for Michael Saylor, his average purchase price overall is ~$24k/BTC.

Rest assured that NFL Players are unintimidated by this movement. Tom Brady is buying the dip and Russell Okung has diamond hands.

Note: "realized market cap is down" link is broken.