One weird trick to sell your punk for half a billion

Plus Ethereum hits a new all-time high and Facebook is just, like, so Meta now

In this issue:

Facebook is just, like, so Meta now

One weird trick to sell your punk for half a billion

Don’t worry your money is safe with us

Facebook is just, like, so Meta now

In 2012 I was working as a Product Manager on the Chrome browser when Russian Search engine Yandex.ru released their own competing browser. Yandex was and still is much smaller than Google but they are very sharp competitors and the browser they built was a good one - it was based on Chromium so it launched with almost all the same features Chrome had at the time. We weren’t concerned exactly but we were definitely paying attention.

When the Yandex browser launched they had a problem: most users don’t really know or care what a browser even is. From surveys we knew that almost half of all Chrome users thought their browser was Google and around 1 in 5 thought they were using Internet Explorer. Most people just don’t think about their browser very much, so it is very difficult to convince them to try a new one. To establish a new brand for their browser Yandex had to compete not just with Microsoft and Google but with the monumental indifference of users themselves. So Yandex did something I thought was rather sneakily clever: they named their browser Internet.1

Want to go to the Internet? Click the Internet icon. No need to trouble yourself with building a mental model of what a browser is or which one you want to use. It was honestly kind of genius. They’ve since rebranded to the more traditional but less amusing Yandex Browser2 — I’m not totally sure why. But I’ve never forgotten their launch strategy and how they realized an aggressively generic brand could potentially capture and redefine the meaning of otherwise neutral words.

Anyway, on Thursday the-company-formerly-known-as-Facebook announced it’s much anticipated rebrand to Meta. We talked about the Metaverse a little earlier this month and about Facebook’s vision for the Metaverse last week. The Metaverse is a frustratingly loose term that essentially means "the Internet, only more so." It is the foundational digital universe within which all other virtual worlds are contained. Facebook — pardon me, Meta — would like to own it.

Unfortunately for an enormous number of people around the world Facebook will likely be their first encounter with the idea of the Metaverse and may well be the only part of the Metaverse they ever see. They may well conclude that the Metaverse is whatever Facebook says it is, just as many users already think of Facebook as synonymous with the Internet. Mark Zuckerberg is building a virtual walled garden and inviting the whole world inside.

One weird trick to sell your punk for half a billion

On Thursday the LarvaLabs contract that manages the marketplace for CryptoPunks registered a sale of Punk #9998 for 124,457.07 ETH (~$532M at the time). The purchase transaction embedded the message "looks rare" in the metadata. We briefly mentioned the previous high-water mark in CryptoPunk sales this summer - an alien CryptoPunk (of which there are nine) sold at Sotheby’s for $11.8M. This half a billion dollar purchase wasn’t actually a real one, though.

What happened was this: the buyer listed their own punk for an outrageous price. Then they used a flash-loan to borrow an outrageous amount of money. Then they bought their punk from themselves and used the proceeds of that sale to pay back their flash-loan. The entire transaction cost roughly ~0.19ETH (~$800 at the time). Here’s a good thread that lays out the mechanics in more detail if you are curious.

So for a brief glorious moment it was the largest sale in CryptoPunk history - until the referee stepped in and ruled it out of bounds:

I assume the next step is to sell the punk at market value and realize a half-billion dollar capital loss for tax purposes. Or maybe that punk is priceless now? It’s part of the history of DeFi and NFTs.3

Don’t worry your money is safe with us

Earlier this month the Vanderbilt Law review published a paper titled "The People’s Ledger: How to Democratize Money and Finance the Economy" by Saule Omarova, a public policy advisor and Joe Biden’s nominee for head the Office of the Comptroller of the Currency (OCC). The OCC is the branch of the US Treasury Department that charters, regulates and supervises banks that operate across US state lines.

In the paper Omarova proposes some fairly radical changes to banking in America:

Eliminate the Federal Deposit Insurance Corporation (FDIC).

Migrate all commercial banking accounts from private banks to being directly managed by the Federal Reserve.

Empower the Fed to confiscate deposits in those accounts as necessary to combat inflation.

Empower the New York Fed to respond to "rises in market value at rates suggestive of a bubble trend," by "short[ing] these securities, thereby putting downward pressure on their prices."

Consolidate all banking regulation under the OCC (and hence, Omarova).

So translating that back into humanspeak the proposal is to get rid of deposit insurance for ordinary people, make business accounts subject to arbitrary seizure by the government and invite the Fed to use their infinite arsenal of money to manually override any price trends they disagree with. If it wasn’t so long and boring I would have assumed it was satire.

I don’t think any part of this proposal is especially likely to become law - in part because it is a bad idea and in part because America is barely able to pass laws at all. But I do think it is remarkable to hear views like this being advanced by a major regulatory leader in a contemporary publication. Government seizure of civilian assets and intervention to control prices are pretty radical departures from the traditional American approach to markets.

The paper also touched on Central Bank Digital Currencies (CBDCs). People tend to imbue CBDCs with vague strategic powers and ask why America isn’t building one, but as Omarova points out most of the things that a CBDC could accomplish can be done more simply, cheaply and straightforwardly by just allowing the Fed to provide accounts to non-banks. A CBDC is useful if you want to constrain government but if your goal is to empower regulators it’s mostly redundant.

Other things happening right now:

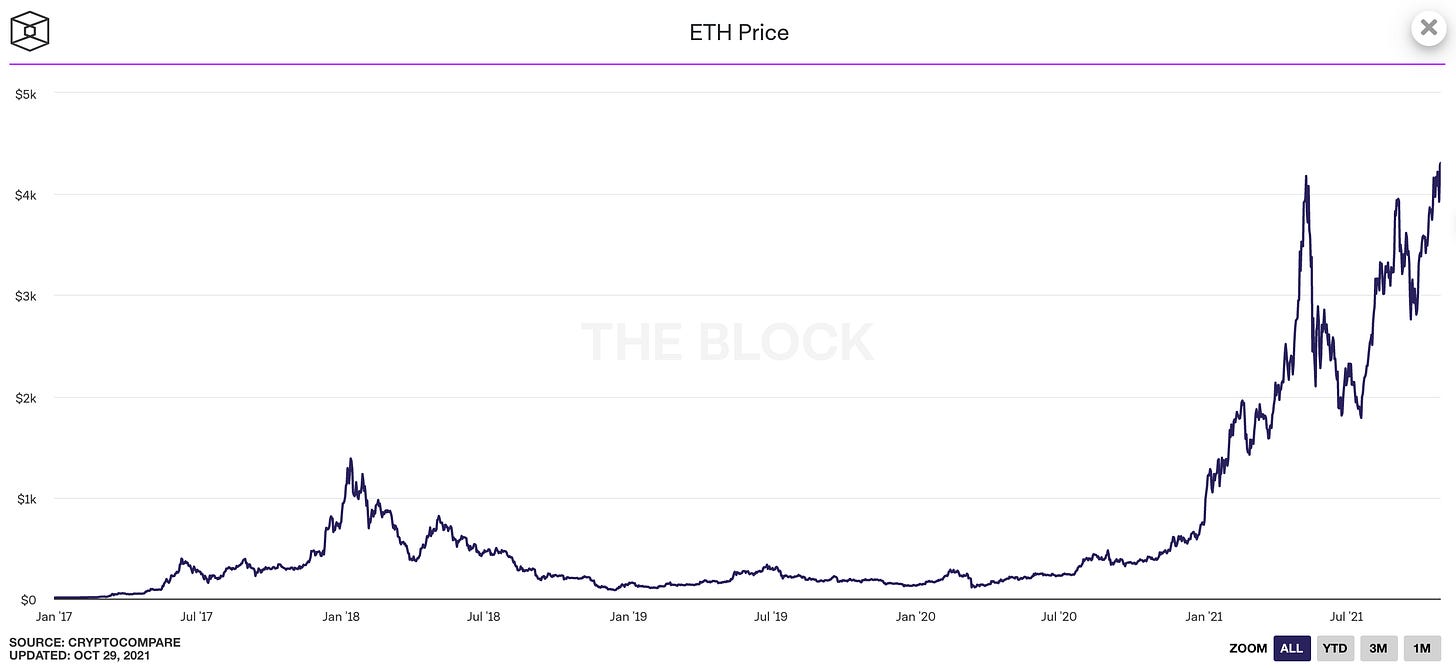

Ethereum’s price has reached an all time high (~$4400/ETH at time of writing). Ethereum’s transaction fees are also surging (~$37/transaction) but have not quite reached all time highs yet.

Here is a long interesting thread accumulating a bunch of market indicators and making the argument that we are still early in the bull market and estimating that Bitcoin will reach between ~$100k-$200k/BTC in the next peak. If you like math flavored hopium, this is of excellent quality.

Presented without comment:

Actually they named it Интернет. Yandex is Russian.

Or rather, Яндекс.Браузер.

It actually isn’t the largest flash-loan powered NFT nonsense purchase in history - in February a HashMask was sold for 139,000 ETH. Fewer people watch the HashMask contracts, I suppose?