How to loan yourself 8 quintillion dollars

In case you think the world economy is great and you'd like to buy 100,000 of it

In this issue:

We are still a long way from the top

How to loan yourself 8 quintillion dollars

We are still a long way from the top

Bitcoin brought back some of that old nostalgic volatility over the last few weeks - rising to a new ATH of ~$58k/btc and then dropping ~25% to a brief wick down to ~$43k/btc. (At time of writing the price is ~$49.9k/btc).

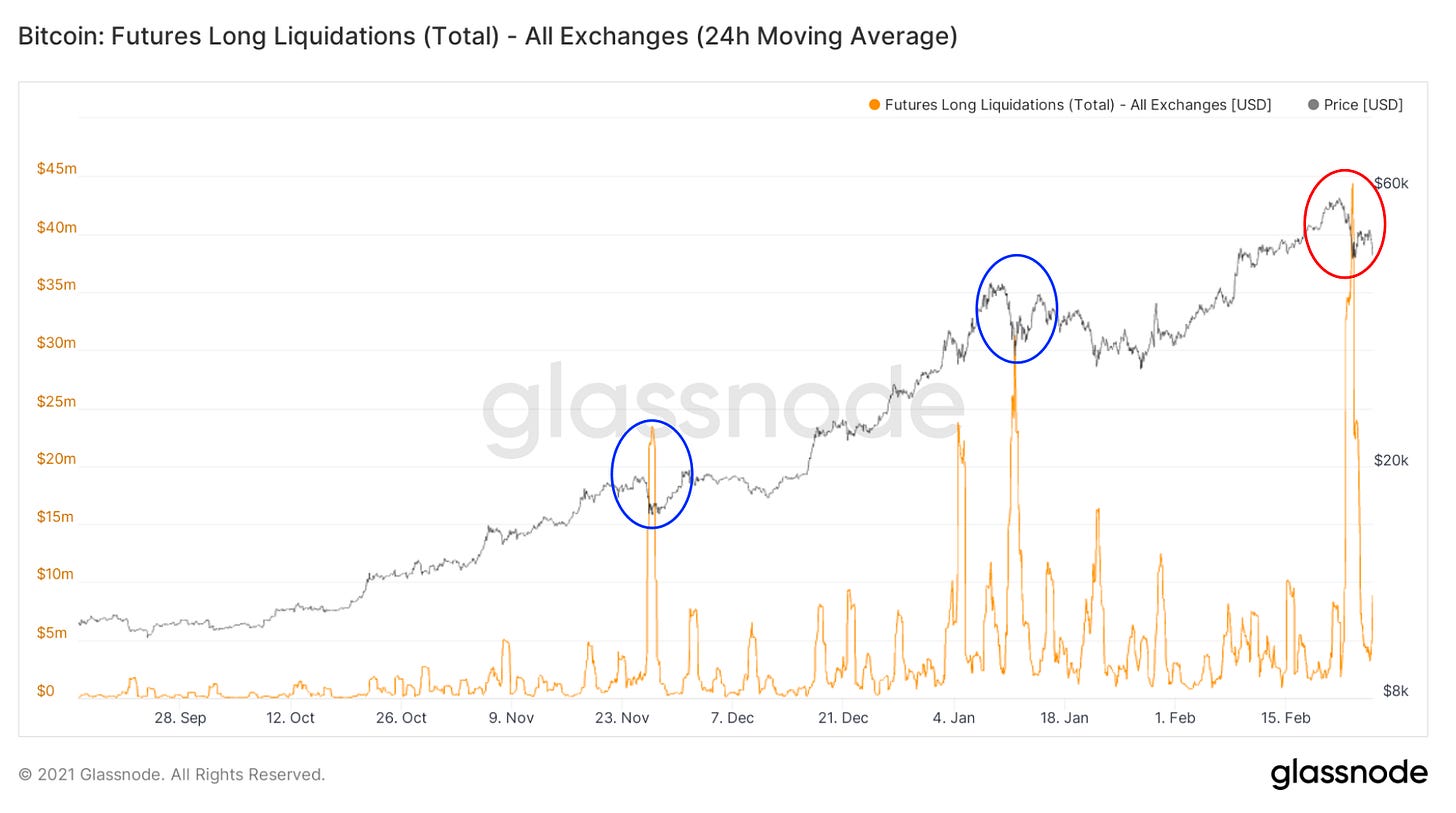

Here is that drop in context:

You can see this is the second big drop we’ve seen in this run up. In previous Bitcoin bull cycles we’ve seen 3-5 drops of around ~30% so I would anticipate a few more knuckle-clenching days still to come before the cycle tops.

What’s happening here is speculators who buy and sell Bitcoin to accumulate more USD (or whatever currency) get out ahead of the long-term buyers, causing their own smaller boom-and-bust cycles within the larger bull run. They get exuberant and start using too much leverage and then the market turns against them and a cascade of margin long positions are liquidated as the market unwinds. This decimation of leveraged long positions has happened three or four times since November. It will probably happen again. Friends don’t let friends trade with leverage.

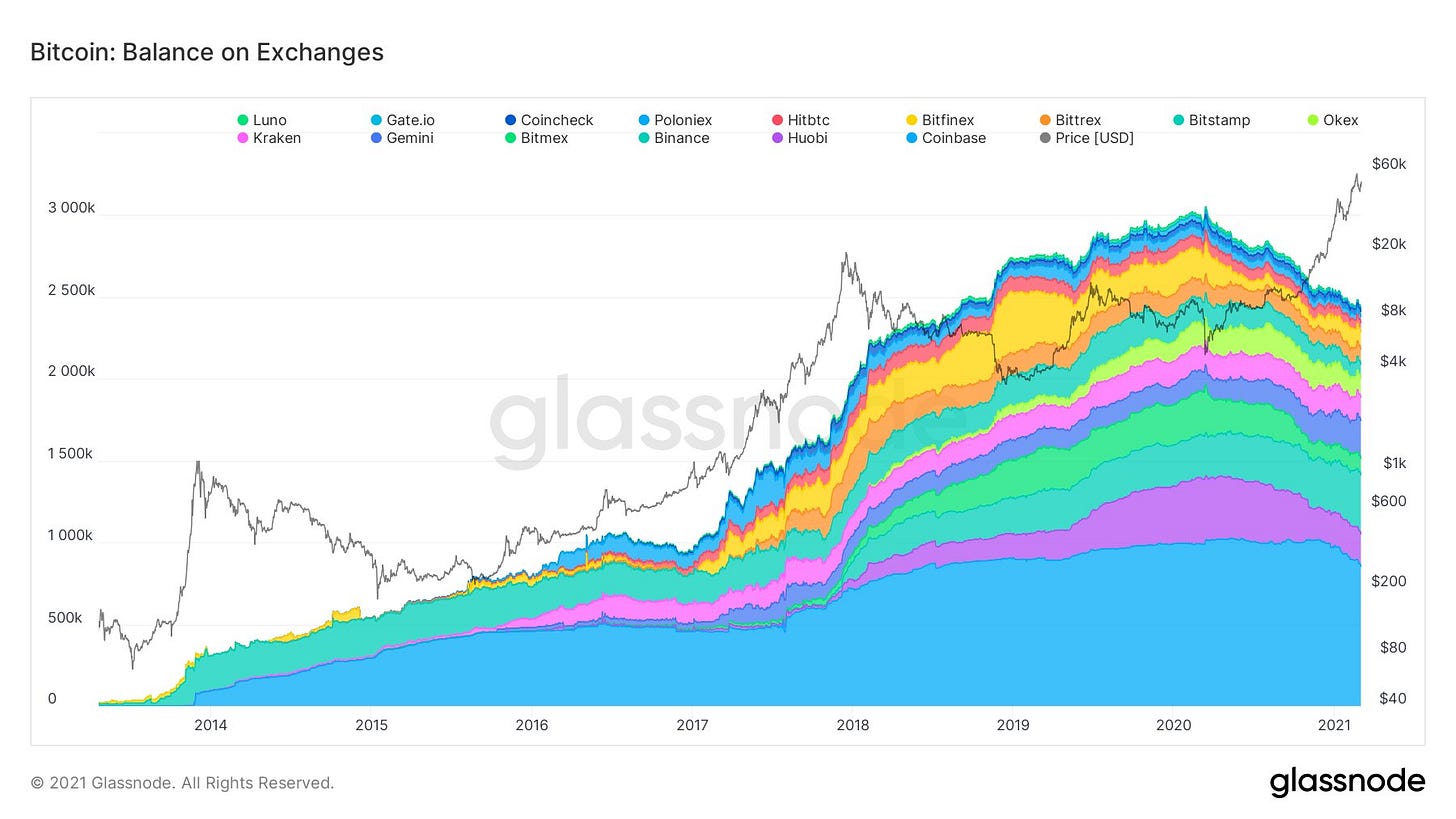

Speculators are as a group more excitable than long term holders - quicker to buy when the price goes up and quicker to sell when the price goes down. But ultimately long term holders set the long term trends and the data suggests that long term holders aren’t selling yet. For starters, more coins are still leaving the exchanges than are being sent there.

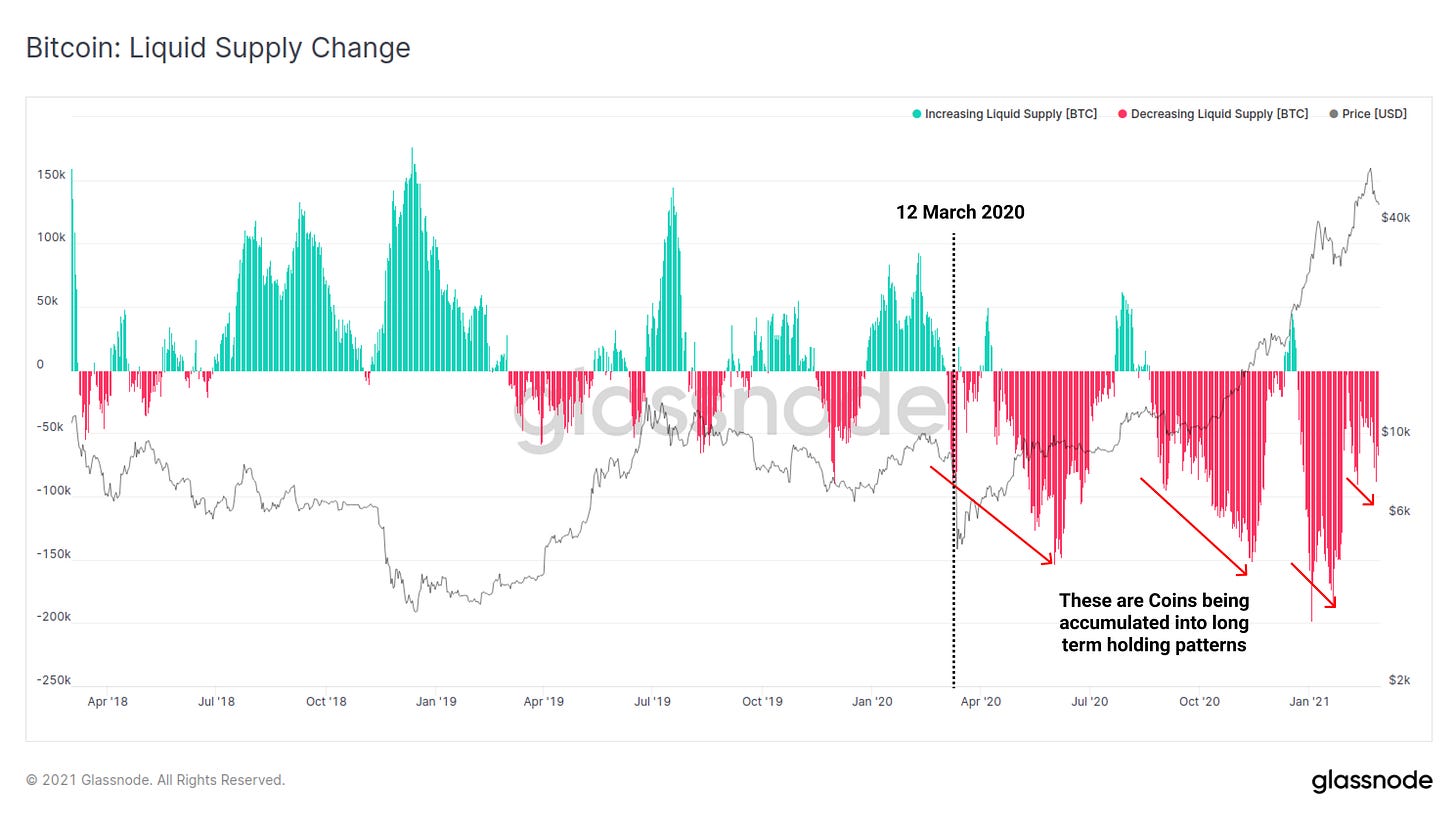

Glassnode also tracks the Bitcoin moving to/from the addresses that are being used for long term storage. Collectively all the bitcoin that isn’t held in long term storage addresses is what they call the "Bitcoin Liquid Supply" - i.e. bitcoin held by an address without a proven track record for saving. Put simply, when the liquid supply is shrinking long-term holders are buying, not selling.

Another group that has not been alarmed by this pullback is miners, who have started to accumulate Bitcoin again.

It would be interesting if there was some way to filter out the price action of speculators so that you could look only at the movements of long-term holders, to better understand the long term trend. One way to do that is to ignore users and coins that stay in an exchange and instead look at the prices when various coins last moved on the blockchain.

People who moved their coins at that point generally intend to hold rather than sell (or they would keep the coins on exchanges), so the prices that they were buying at might act as levels of support. If you were wondering where long term buyers were most actively buying, the answer is at ~$47k/btc..

How to loan yourself 8 quintillion dollars

Here is a great example of how completely otherworldly the new kinds of transactions that are possible on DeFi can be:

A flash loan is a loan that you borrow but also pay back inside a single transaction. So if you see a cool arbitrage trade but you don’t have enough money to do it, you can structure the trade such that you borrow capital from me, use it to execute the arbitrage and then return the loan back to me plus a some interest that you pay out of your profits from the trade. I made some risk free profit, you were able to borrow any amount of money. Win-win.

Flash minting is the same thing but without that pesky step where you have to find money to borrow and then pay to borrow it. Instead you just create however much money you need, use it to perform the trade and then destroy it all in a single transaction. Infinite perfect credit for anyone! The developer above briefly made themselves the first quintillionaire by flash minting an atomic loan of ~$8,000,000,000,000,000,000,000,000,000,000 or roughly ~100,000x the size of the entire world economy.

Also? No paperwork.

Other things happening right now:

Someone subscribe Senator Warren to my newsletter! I voted for her in the primaries. Together we get her excited about Bitcoin.

After Canada’s first Bitcoin ETF had a roaring launch, the push to get approval for an American Bitcoin ETF has started again.