Do not sell your eyeballs to Sam Altman

And other advice I never expected to give.

In this issue:

Crypto sets Congress on F.I.R.E.

Do not sell your eyeballs to Sam Altman

Non-fungible tokens are not going anywhere

Crypto sets Congress on F.I.R.E.

Bitcoin is a technology designed to prevent control and defend freedom, which makes it inherently threatening to governments - but until recently the most common strategic response to Bitcoin was to ignore it and hope it went away. So far this year that is shifting as more and more governments seem to have realized that Bitcoin is real and can no longer be ignored. Some are reacting with enthusiasm (El Salvador) some with suspicion (UK) and some with outright hostility (China) - but governments everywhere are starting to take Bitcoin seriously.

In America yesterday the U.S. House Committee on Financial Services held a hearing yesterday under the headline of "America on “FIRE”: Will the Crypto Frenzy Lead to Financial Independence and Early Retirement or Financial Ruin?" to discuss the increasingly urgent belief that Something Must Be Done. Illinois Democrat Bill Foster and member of the 'blockchain caucus' put it this way:

"There’s a significant sentiment, increasing sentiment, in Congress that if you’re participating in an anonymous crypto transaction that you’re a de-facto participant in a criminal conspiracy."

Let’s start with the obligatory reminder that Bitcoin is mostly used for saving, not doing crimes. Blockchain analytics company Chainalysis estimates that <0.1% of all Bitcoin transactions are criminal. Contrast that with how Ohio Republican Anthony Gonzalez describes the traditional financial system:

There are of course criminals using Bitcoin because anyone can use Bitcoin. Peter Van Valkenburgh of the Coin Center policy non-profit gave a passionate defense of how the freedoms Bitcoin creates are an expression of American values:

Unfortunately explaining complex and nuanced topics to congress is like reading the tax code to a classroom of fourth graders - they aren’t really listening. California Democrat Brad Sherman unironically recommended that Americans invest their money in the California lottery instead.

Do not sell your eyeballs to Sam Altman1

In theory we all know the future will be strange and alarming but then one day you wake up and the future is here it is strange and alarming and I don’t know what to tell you but here we are. Former president of Y Combinator and aspiring Bond villain Sam Altman has developed a plan to use orb-shaped devices to scan human eyeballs in exchange for his new cryptocurrency.

Iris recognition is like facial recognition on steroids. The fine patterns in a human iris are stable over decades and across eye surgeries. Iris recognition can be performed several meters away on a person wearing sunglasses in a dark room. It can distinguish between identical twins. It is difficult to hide and it can never be changed. It is like being able to take someone’s DNA with a photograph.

Worldcoin intends to use people’s iris scans to prove they are unique human beings, which in theory will enable them to pursue the otherwise laudable goal of enabling Universal Basic Income.2 Simply gaze into the orb to collect your Worldcoin. As long as nothing is hacked and no one decides to harvest anyone’s eyeballs it should all work out fine. It’s probably all fine.

I guess what I am saying is be very careful who you sell your eyeballs to even if they promise to keep your eyeballs very safe. It is very difficult to obtain new eyeballs and overall probably not worth it. Even close friends and family may not be willing to share their eyeballs with you if they learn you sold your own eyeballs to Sam Altman.

Non-fungible tokens are not going anywhere

We’ve written a number of times about non-fungible tokens or NFTs, the individually unique tokens that represent ownership of (or perhaps themselves are?) works of digital art. Over the last few months crypto markets generally have receded and some outlets have taken the opportunity to take a premature victory lap:

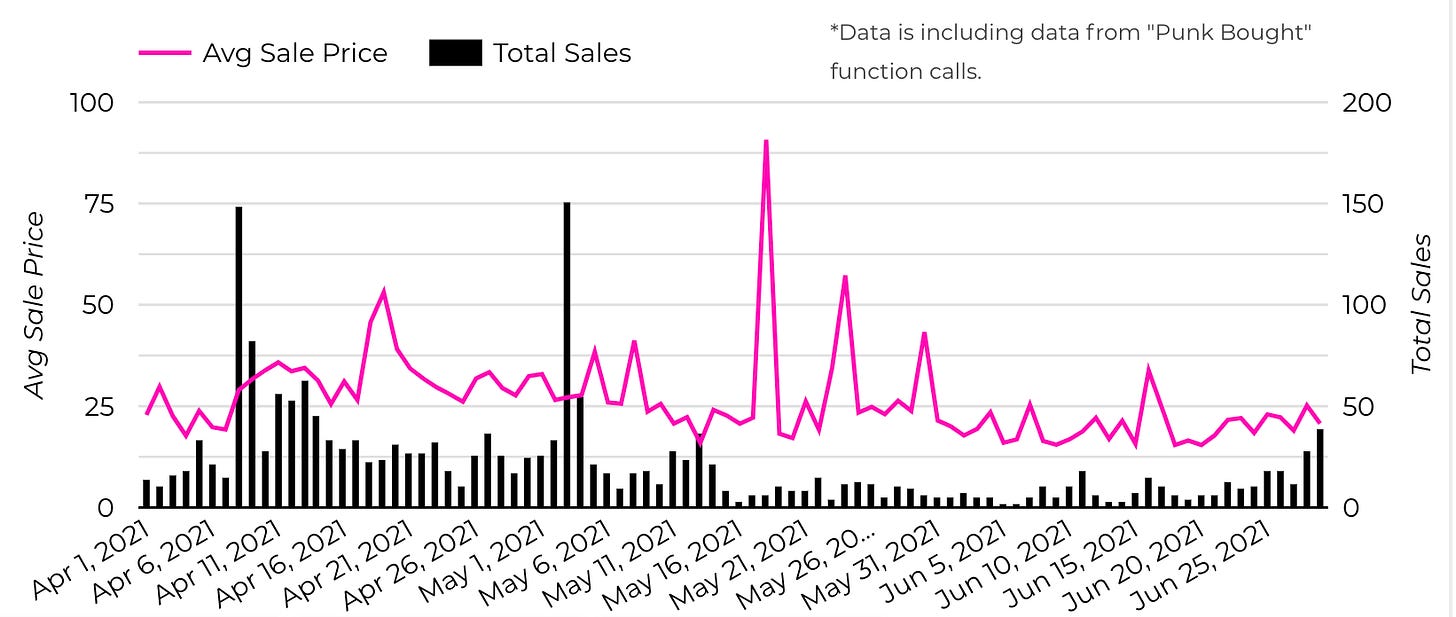

The reality is of course more complicated. Flagship NFT project CryptoPunks saw a dramatic drop in sales but only a modest drop in price, both already recovering:

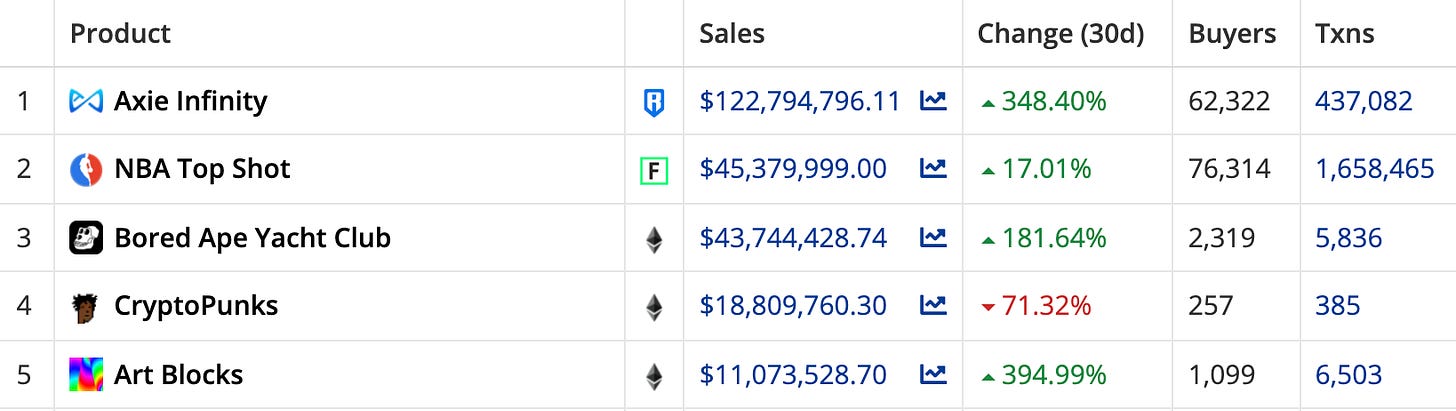

Other projects on the other hand were surging:

NFTs have also continued to capture moments of cultural significance. This week Sotheby’s and Tim Berners-Lee sold "This Changed Everything" a set of NFTs representing the first source code for the worldwide web for ~$5.4M. An alien CryptoPunk (one of nine) wearing a covid mask sold earlier this month for ~$11.8M. NFTs have been (or will be) released by Twitter, Reddit and Burning Man.

We’ve speculated before about how large these markets actually are in practice or whether it is just a very small number of people all bidding each other up. Here is an interesting thread analyzing the on-chain ownership data for a variety of mid-sized NFT projects. For the projects in question (which don’t include CryptoPunks, TopShots or AxieInfinity) there are ~26k unique accounts, which is somehow both larger and smaller than I would have expected.

More interestingly there is indeed a lot of overlap between the projects. If you are the kind of person who owns an NFT, you probably own several.

Other things happening right now:

We talked several times recently about China’s recent ban on Bitcoin mining and the corresponding migration of mining power out of China. The hashrate is now down ~50% and the upcoming difficulty adjustment is currently estimated to be an unprecedented -26.9% step down. Bitcoin users are largely unaffected.

Jim Cramer likes that Bitcoin defended $30k, but he is more bullish on Ethereum than Bitcoin because "people actually use it … to buy things." That’s an understandable confusion, but actually it is not people spending currency that gives it value it is saving. Everyone trying to spend a currency is logically equivalent to everyone wanting to sell an asset. The price would fall to zero. Only the people who want to hold a currency give it value.

This is not financial advice.

Universal Basic Income is a terrific idea. If you want to support UBI but for some reason aren’t psyched to submit to the all-knowing orb I highly recommend GiveDirectly.