They say the first billion is the hardest

Plus you still shouldn't sell Sam Altman your eyeballs.

In this issue:

They say the first billion is the hardest

Behold the Zuckerverse

You still shouldn’t sell Sam Altman your eyeballs

They say the first billion is the toughest

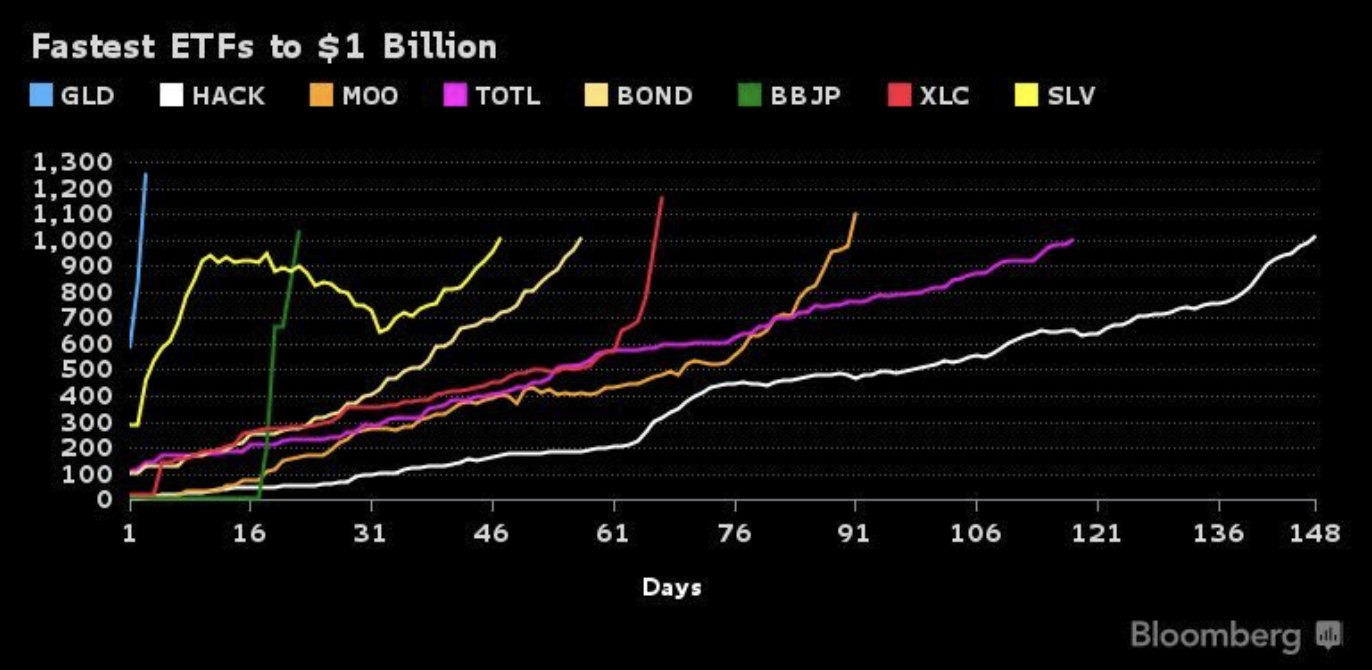

On Tuesday the ProShares Bitcoin Futures ETF ($BITO) became the first publicly traded Bitcoin ETF in the US. We talked that morning about how the market was clearly anticipating a surge of new demand for Bitcoin being unlocked — and the market was correct. There was enough buying in the first 48 hours to make BITO the fastest ETF to reach $1B in assets under management, beating out an 18 year old record held by (appropriately enough) $GLD which took a leisurely three days to reach their first billion. They say the first billion is the toughest.

This was good news for a lot of people! It was a bit more disappointing if you are Grayscale, who owns the Grayscale Bitcoin Investment Trust (GBTC). Prior to the launch of the ProShares fund GBTC was the closest approximation investors had to a US equity wrapped Bitcoin. That meant for much of GBTC’s history its shares traded at a premium over the bitcoin the fund actually held, in spite of the fact that GBTC charged relatively steep fees for their management services.

We’ve talked quite a few times about the GBTC premium on Something Interesting. Back on February 20th I said this:

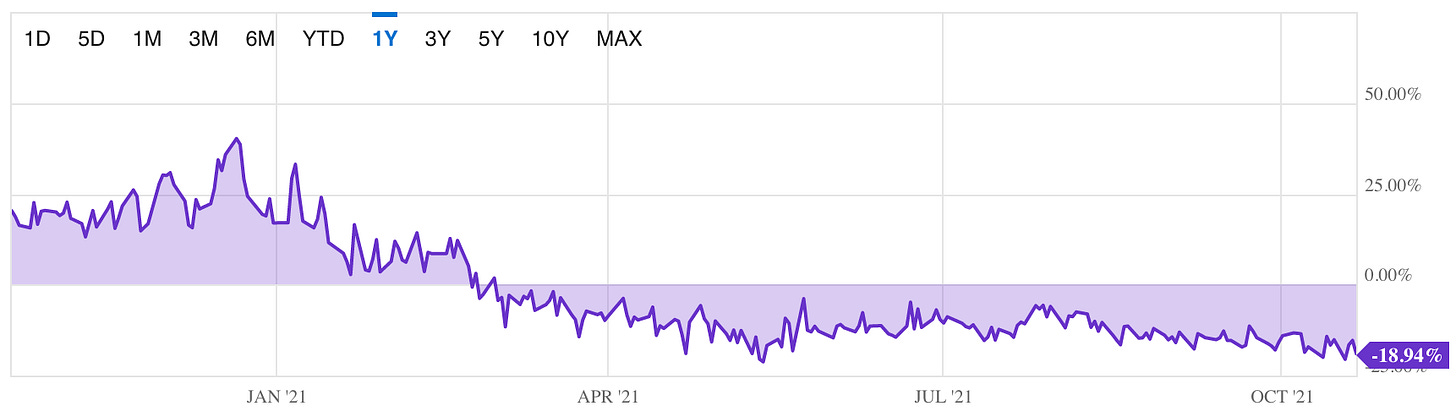

GBTC has historically traded at a significant premium to Bitcoin in spite of having relative high fees. As we talked about back in January that premium has mostly evaporated. The launch of a real ETF (and the ones that will likely follow) means that premium is probably never returning. Going forward we might even expect GBTC to trade at a slightly trailing price reflecting the cost of its management fees.

By February 23rd the premium turned into a discount and never recovered. Shares of GBTC now trade at ~19% less than the BTC they represent:

GBTC (~$57B AUM) is still much larger than BITO (~$1.1B) and has actually outperformed it in the market since launch, but the competitive pressure is rising. Barry Silbert (Founder and CEO of the Digital Currency Group, which owns GBTC) was clearly feeling a bit salty:

The obvious play for GBTC is to convert itself into an ETF — it would instantly be the market leader. In fact it would be difficult for BITO to get to the size of GBTC because it would overwhelm the markets for Bitcoin futures, which simply aren’t that large. The trouble is that so far the SEC has only approved ETFs based on Bitcoin futures and GBTC holds actual Bitcoin. It would really only make sense for them to convert into a spot ETF - which the SEC has been reluctant to approve.

On Tuesday Grayscale announced their application to convert GBTC into a Bitcoin Spot ETF that would trade under the ticker $BTC. If GBTC became an exchange traded fund arbitrageurs would be able to trade away any discount or premium to the underlying assets - the fact that GBTC is still trading at a ~19% discount suggests the market is skeptical.

I’m inclined to agree - Grayscale obviously knew this moment was coming. They’ve almost certainly been lobbying (unsuccessfully) to make this transition for quite a while now. This isn’t their first application - it’s a bid for public sympathy seeking to increase the pressure on the SEC.

Behold the Zuckerverse

We talked last week about the Metaverse the vague sprawling term for the future of the Internet, especially as it intersects with VR and crypto. There is perhaps no company more committed to the strategic urgency of the Metaverse than Facebook, which is apparently planning to change its name to demonstrate how committed it is to building the Metaverse and also to not being named Facebook anymore. It makes sense - if Facebook wants people to be excited about their new digital world probably better not to remind them of their impact on the actual world.

The Metaverse is, by definition open and universal - a Facebook-owned metaverse can’t actually accomplish that. But you can make the same arguments about the Internet and for an enormous section of the world population Facebook functionally is their Internet - particularly in developing nations where Internet access is expensive and Facebook is able to subsidize it. If the real Metaverse is expensive and the Zuckerverse is artificially cheap (which seems totally plausible) then many citizens of the Metaverse may never actually leave the walled garden.

The ultimate question is whether there will be a way to make engaging with a decentralized Metaverse cheap enough to compete. If the majority of the world can’t afford to engage with a decentralized Metaverse then a centralized metaverse will inevitably win by a combination of volume and inertia.

You still shouldn’t sell Sam Altman your eyeballs

We talked back in July about Sam Altman’s alarmingly ill-advised plan to solve world poverty by building a database of everyone’s eyeballs. Regrettably it appears Sam Altman is not a subscriber (yet) because he is following through with his threats:

The idea is that Worldcoin plans to give everyone a 'fair share' of Worldcoin. Everyone except the VCs. Presumably they get an extra fair share. Some animals are more equal than others. To make sure no one is putting on a fake mustache and getting back in line to double claim their 'fair share' Worldcoin will scan everyone’s irises and keep a record of their eyeballs. Simply gaze into the Orb to receive the coin. Confess your secrets to the Orb. You can trust the Orb.

You may think I am being unfair by calling it the Orb but that is actually their term for the device (technically the italics are mine). Worldcoin doesn’t have its own blockchain, it will be an ERC-20 token running on top of Ethereum. I’m assuming no engineering resources could be spared. All must be in service of the Orb.

Other things happening right now:

Historically in Bitcoin returning to a previous all time high after a significant drawdown has been followed by a huge run up (~7.25x on average). That implies a near term Bitcoin price comfortably into the six figures.

There have been a lot of rumors recently about Ethereum accounts being hacked and drained when they are given malicious tokens or NFTs and attempt to sell them. It is difficult to say with certainty what is possible with smart contract security but at the moment it looks like plain old social engineering is the more likely explanation. People would just rather believe they were hacked than that they were scammed.

A public firefighter’s pension fund in Houston has acquired a $25M position in Bitcoin and Ethereum, based on it being an uncorrelated asset - i.e. one that moves at different times and directions from other markets. Uncorrelated assets let portfolio managers reduce risk even if they are skeptical about the asset itself. If the unfathomably large pension market decides holding Bitcoin reduces risk, the resulting demand for Bitcoin would be enormous.