[News] The Tragic Innocence of Soulja Boy

also can't stop, won't stop, Gamestop and how to spot institutional arbitrage at 20 paces

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Signs of institutional money in the Grayscale (GBTC) premium

The tragic innocence of Soulja Boy

Can’t stop, won’t stop, Gamestop (non-crypto)

Institutions are eating the Grayscale premium

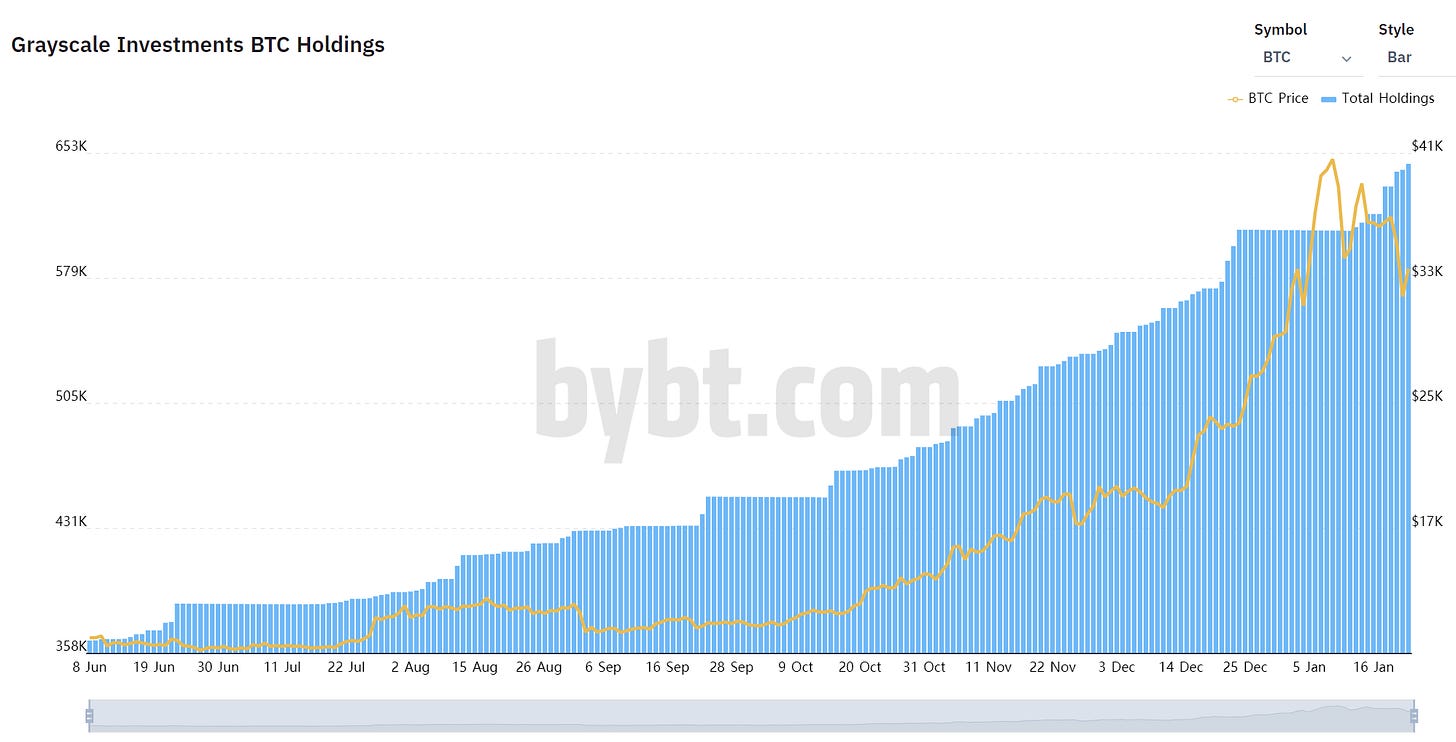

Grayscale Investments, which operates a quasi-ETF Bitcoin fund, has continued to steadily add assets under management. On Monday the 18th they had a record acquisition day of 16,000 bitcoin (~$600M at the time), which represents ~17-18 days worth of mining rewards. To date there has never been a significant draw down in Grayscale’s Bitcoin assets - they currently manage >$20B worth:

Grayscale’s fund (GBTC) exists because there are funds and institutions that want exposure to Bitcoin but are for whatever reason unable to handle bitcoin directly. GBTC trades on your normal exchange alongside traditional NYSE stocks. Since there are lots of people who want the service of exposure to Bitcoin disguised as a more ordinary investment, GBTC has historically traded at a significant premium to the underlying value of the Bitcoin that it holds.

During the last bull run in 2017 that premium spiked over 100% - meaning that people were paying 2x as much to hold bitcoin through GBTC as they would have paid to hold real bitcoin for themselves. More recently that premium has been whittled away to almost nothing:

There are two ways to explain the disappearance of this premium. One possible explanation is diminishing demand for Bitcoin-wrapped-in-an-equity, but given that Grayscale is adding record quantities to its AUM it’s hard to make that case. The other somewhat more plausible explanation is that there are more arbitrageurs buying raw bitcoin and converting it into GBTC shares to sell on the open market.

The disappearing premium coupled with the growth of the fund to me implies the arrival of larger and more mature institutions willing to handle bitcoin directly. It’s like a forest where all the small, easy-to-catch prey are suddenly gone - you don’t have to see the predator to know it is there. Some sizable new body of capital is now capable of turning raw bitcoin into GBTC shares to sell and collect the premium. I suspect that premium will never come back.

The Tragic Innocence of Soulja Boy

No, Soulja Boy noooooo …

It is super unfortunate but also not super uncommon that many people’s second step into crypto after buying Bitcoin is to buy an alphabet soup of different altcoins. There are a bunch of reasons this is tempting. It’s easy to be lured in by the lower unit cost or by hype around new technology or by the many, many shills out talking their books. Some people also convince themselves buying altcoins is a way to diversify and hence perhaps shed some risk by hedging into possible Bitcoin successors.

These are bad reasons to buy an investment. You can buy a fraction of a Bitcoin so lower unit cost is just an illusion. New technology in crypto is quite a bit more likely to discover new security vulnerabilities than new use cases. Shills are shills. And altcoin prices rise and fall alongside the price of Bitcoin which makes them basically useless for diversification. So far altcoins have proven to be a bad bet.

If you price the altcoins in BTC rather than USD, this is easier to see. There are essentially only two categories of altcoins: those that linger and those that die. Willy Woo has a great visual of this phenomenon:

A handful of altcoins (e.g. Ethereum, Dogecoin) manage to achieve escape velocity and stay in low orbit around Bitcoin’s price and most just drop exponentially off forever. So far none have had sustained long term gains against Bitcoin itself. It is possible (though I don’t recommend it) to make money by swing trading altcoins, but holding them is just giving away your Bitcoin with extra steps. Don’t be like Soulja Boy.

Can’t stop, won’t stop, Gamestop

This story isn’t about crypto but I still thought it was delightful.

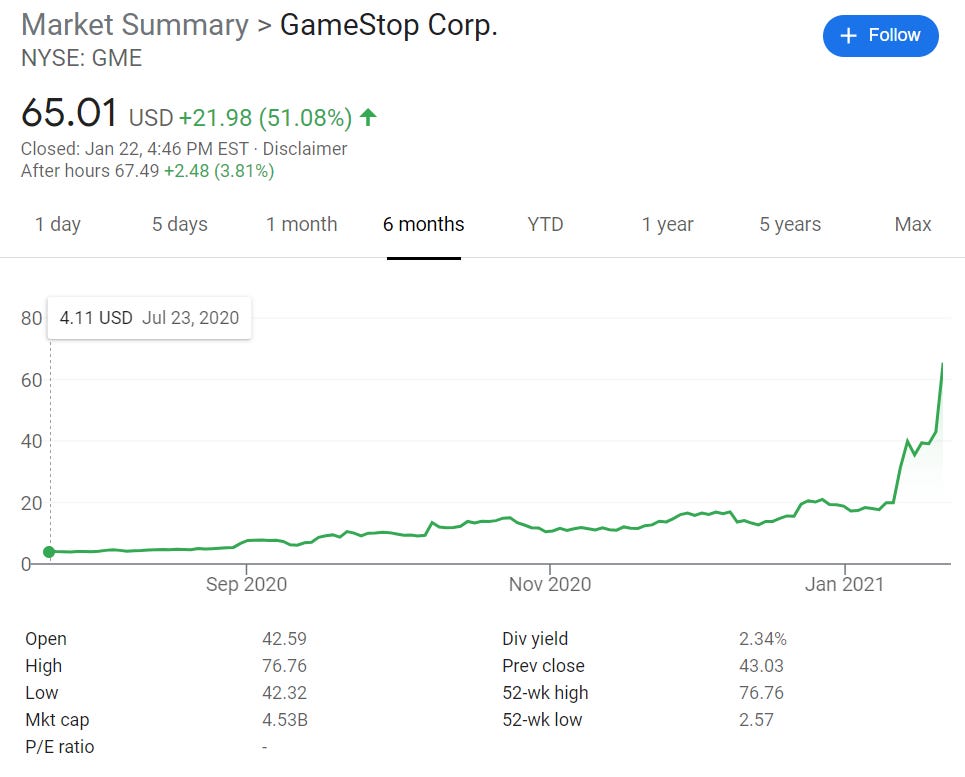

GameStop is an American consumer electronics retailer that operates ~5,500 retail locations globally under the GameStop, EB Games, ThinkGeek, and Micromania-Zing brands. It is … not a great time to be operating a chain of mall stores that sell physical video game equipment. Consumers are moving away from physical malls and to online shopping, video games are increasingly digital rather than physical and Covid has shattered any kind of upside to having a brick-and-mortar presence. GameStop closed hundreds of stores in 2020, their sales are down ~30% year over year and they have accumulated ~$0.5B in debt. This is the chart of their stock price:

If you are thinking "Gosh, that is not the chart I expected for a company in that position" then you are a reasonable human being and therefore not a member of r/wallstreetbets. This chart is very unexpected! Let me explain:

Like you many other reasonable human beings looked at the above facts about Gamestop’s business and concluded the stock price was going to go down. They took out what is called a "short" position, which basically means they borrowed stock and sold it planning to buy it back later at a cheaper price and pocket the difference. This kind of trade is more complicated and riskier than just owning stocks, so most of the people who do it are professionals who do serious analysis before making a trade and tend to put a lot of weight on things like whether the business they are analyzing is good at making money. There were lots of people who thought Gamestop wouldn’t be very good at making money so they borrowed and sold lots of stock and Gamestop became one of the most shorted companies on the market.

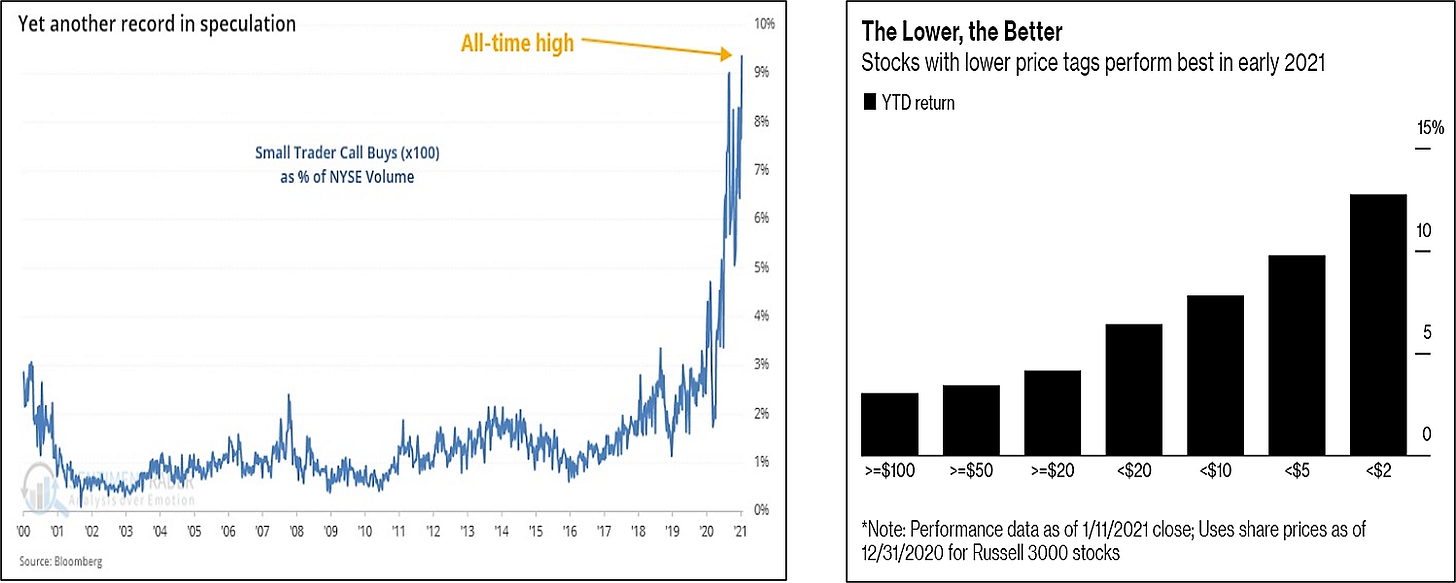

r/wallstreetbets on the other hand is pretty much the opposite of those people. It is a community of self-described degenerate gamblers who gather to share stock tips, memes and screenshots of their absurd positions. It is populated mostly by small, retail investors who tend to trade on long-only platforms like Robinhood. They like to choose stocks to collectively rally behind - sometimes because they think it is a good business that will make money and sometimes because lol stonks only go up. Small retail traders like this have taken over the market recently:

Short sellers and r/wallstreetbets are natural enemies - the former wants stock prices to go down when businesses lose value, the latter want stock prices to go up forever and ever. And on the field of Gamestop stock price the two forces went to war: the citizens of r/wallstreetbets buying to drive the stock price up and the titans of wall street borrowing stock and selling it to drive the price down. The short sellers had the advantage of deep pockets, a wealth of experience and the knowledge that eventually reality had to catch up - so they were understandably confident:

The problem here is that Citron misunderstood the r/wallstreetbets investing model. They assumed that the goal was to buy good companies and sell bad companies, but that is not what r/wallstreetbets is doing. They are buying memes and by presenting themselves as a handy villain Citron had multiplied the memetic potential of Gamestop’s stock. Now you weren’t just getting hilariously rich, you were sticking it to those condescending boomer banks!

Here is a good rule of thumb when you are engaged in a staring contest with an internet hivemind - don’t antagonize them? When Citron posted their tweet Gamestop was trading at ~$41.5/share, it is now up >50% to ~$65/share, and by all accounts seems to still be climbing. Citron has abandoned its Gamestop position. A good reminder of Keynes’ famous quote:

Other things happening right now:

Sentiment seems to have cooled off nicely on this leg down:

Presented without comment: