The bull market has only just begun

Plus the Metaverse is vague on purpose and NFTs split the world of gaming.

In this issue:

The bull market has only just begun

The Metaverse is vague on purpose (Reader submitted)

Harberger taxes harvest your emotion (Reader submitted)

NFTs split the world of gaming

The bull market has only just begun

We talked on Saturday about how the SEC approved the first US based Bitcoin ETF on Monday, making it ready for trading on Tuesday the 19th. For years the launch of a Bitcoin ETF was held up as a symbol of mainstream acceptance and institutional adoption. By now the remaining impact is mostly symbolic - the ETF is based on Bitcoin futures rather than Bitcoin itself and there are now many competing ways to acquire Bitcoin exposure without needing to hold raw Bitcoin.

Still, symbolism is important — especially in largely subjective assets like gold, Bitcoin or USD. The biggest piece of information here is not the ETF itself but the fact that a Bitcoin fund has been formally blessed by the SEC. For investors wondering whether it is safe to invest in Bitcoin the knowledge that the US government is not going to ban it is a big deal. It can be lucrative to invest in things the government has banned, of course, but it tends to be a different business.1

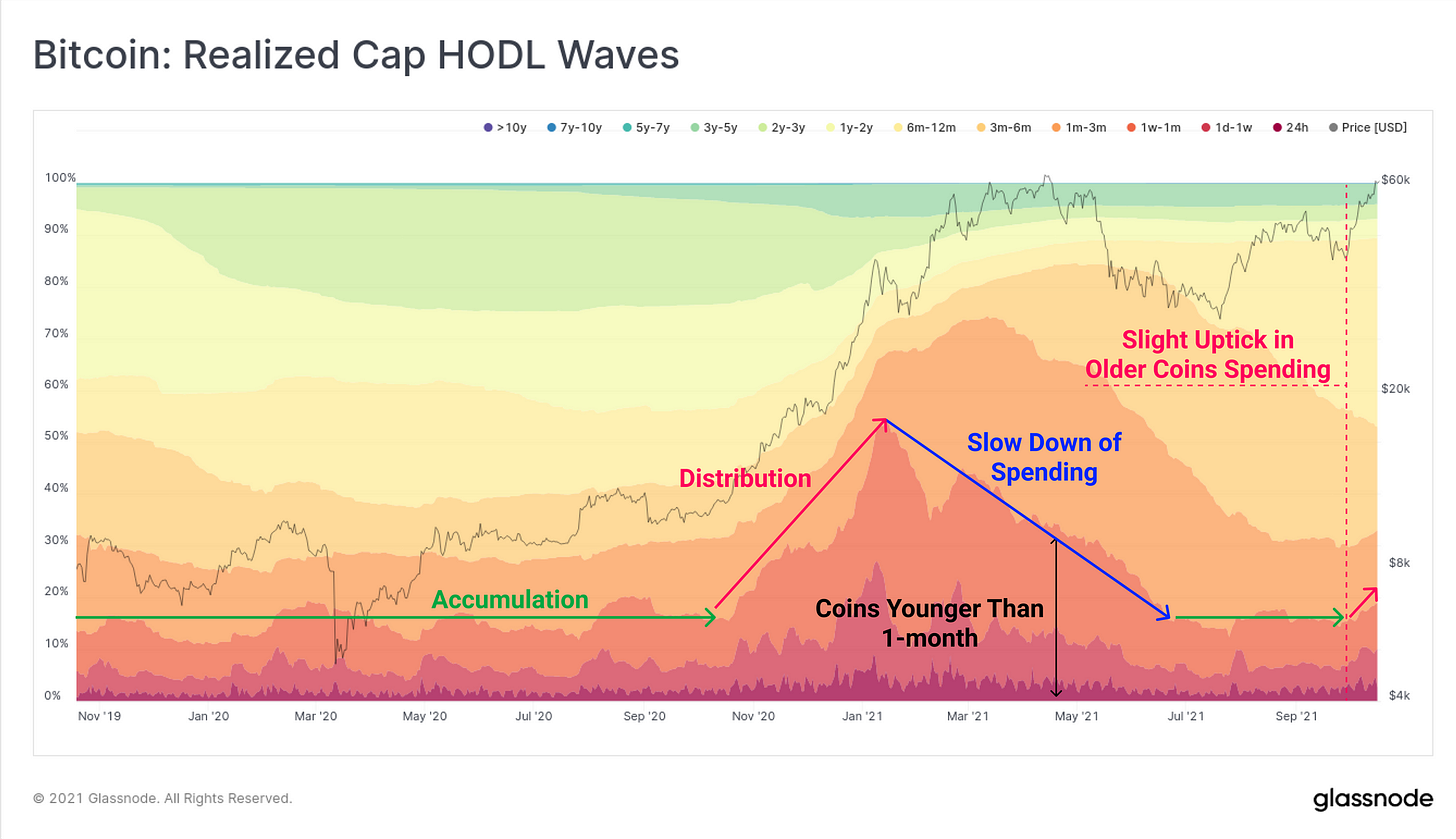

As the tweet above shows long term holders have been treating today’s prices as very cheap - not just refusing to sell but actively acquiring Bitcoin at a rate more typical of bear markets. So have options traders, who are mostly predicting Bitcoin prices well past $100k/BTC by end of year:

On the other hand the price of Bitcoin has remained stuck in a band just below all time highs since the ETF approval became public news. At time of writing the price of Bitcoin is ~$62.3k/BTC. If both long term holders and high-leverage traders are braced and ready for new all time highs it raises an interesting question. Who is it that is selling their Bitcoin now right before a seemingly obvious breakout?

The coins that are changing hands are coins that are between ~3-6 months old — coincidentally Bitcoin’s last high was mid-April, roughly 6 months ago. So there is a band of FOMO buyers who bought in during the last hype cycle and held through the downturn not because of belief but because of paralysis. To them this move up in price is just a chance to recover their investment. You can see that in the contraction of the light orange (3-6 month) wave and the corresponding growth of younger wallets that bought those coins. Seasoned holders weren’t selling.

The Metaverse is vague on purpose

“These were some great thoughts on the abstract nature or definition of the Metaverse, but for the uninitiated I'd love to hear your thoughts on what can be done in the Metaverse concretely. The best example I have in my head is there could exist a digital economy for anything, currency in a game, rewards points at a retailer, etc which have their own value made liquid via crypto tokens and stable coins. I find these examples boring and uninspired. What do you think the practical applications of the Metaverse are?” — VN

It’s hard to be concrete and exciting about the Metaverse at the same time because the more concrete and specific you are about things the Metaverse can enable the more obvious it becomes that the Metaverse is already here. It’s just the Internet.

So you can fall in love in the Metaverse (Tinder), or you can find a job (LinkedIn) or you can answer questions (Google), or you can become famous (TikTok), or you can shop (Amazon), or you can connect with loved ones (Facebook) or you can learn about anything (Wikipedia) or you can live your best life (Something Interesting). The Internet is already accomplishing everything the Metaverse promises — the only concrete difference between the Metaverse as people imagine it and the Internet as it exists today is people assume VR will play a much larger role.2

Metaverse is more of a marketing term than a technical one, like cyberspace or information superhighway. It is deliberately imprecise so the reader can fill in whatever visions of the future they find most compelling. Bullshit artists use empty language that seems to promise a great deal but doesn’t actually mean anything in practice. It reminds me of one of my favorite passages from Isaac Asimov’s Foundation, about carefully examining the words of a skilled diplomat:

“You know, that's the most interesting part of the whole business. I'll admit I had thought his Lordship a most consummate donkey when I first met him – but it turned out that he was actually an accomplished diplomat and a most clever man … When Holk, after two days of steady work, succeeded in eliminating meaningless statements, vague gibberish, useless qualifications – in short, all the goo and dribble – he found he had nothing left. Everything canceled out. Lord Dorwin, gentlemen, in five days of discussion didn't say one damned thing, and said it so you never noticed.” — Isaac Asimov, Foundation

Harberger taxes harvest your emotion

“You mentioned in a footnote of your last post that you liked Harberger taxes, but I don't think they make sense. What if you live in a home next to all your friends and family? You wouldn’t be willing to sell for an equivalent home even if you got a fair market price. I feel like it basically treats non-fungible items as fungible just because you can set a 'price' to them. Ignoring the political reality of implementing something like this, I'm curious what your thoughts are on whether it really seems fair.” — MJ

It’s a good question! Harberger taxes (for those who didn’t see the footnote) are a kind of property tax where you are taxed based on a price that you set for yourself - but the price you set becomes a legally binding offer to sell. So if you say your asset is only worth $100 that’s fine, but it means anyone who offers you $100 or more gets to take it from you.

Harberger taxes set the value of a property at the ask price (the price someone would need to offer to buy the property from you) instead of at the bid price (the price you would get for the property if you were to sell). So if you love your childhood home you would end up paying a higher tax rate than someone who was happy to sell it and move to an equivalent property.

That may be economically efficient but it is also jarring and uncomfortable. That’s what I was thinking about when I described it as "politically untenable" — I don’t think anyone actually wants to structure society that way. So I don't think Harberger taxes are good for emotional possessions like residential real estate. But I do think there is a lot of unemotional property that could be usefully taxed this way.

It seems like an excellent way to manage licenses for public goods like network TV and wireless broadcast spectrums for example. It seems like a reasonable approach to commercial real-estate in high value areas like Times Square. It could be a way to breathe life into expired patents. Harberger taxes are very interesting and in my opinion quite useful! But probably not for personal property. I think they are better suited for corporate taxation.

Other things happening now:

Another compelling visual of the Great Hashrate migration out of China that we talked about on Saturday:

Gaming platform and distribution service Steam announced on Friday that they were banning all games that used blockchain technology, cryptocurrencies or NFTs from their platform. Steam has not commented publicly but developers who have been exiled claim the reason is because NFTs (and other cryptocurrency tech) potentially represents real world value. That would certainly complicate Steam’s legal responsibilities as a platform. Microsoft’s competing platform Epic Games immediately responded saying they supported innovation and welcomed blockchain tech on their platform. Expect underdogs in every industry to be more receptive to disruptive technology than their dominant competitors.

@therationalroot says no words are needed for this chart but just in case it shows Bitcoin’s price growth (logarithmically) wrapped around a spiral that loops once every four years. The dark spots are all-time-highs. The most interesting takeaway (besides 'number go up') is how the all time highs seem to cluster in the top right quadrant (i.e. every four years) and how they seem to come in two waves, in the first and last third of the year. Naively projecting that pattern forward to this cycle would imply $300k-$750k/BTC. Probably nothing.

Not financial or legal advice.

I’m personally a VR skeptic, at least until we move past the era of blindfolding ourselves with heavy goggles.