Bitcoin is now Made in America

Plus there's an ETF now, too. That's neat.

In this issue:

The Bitcoin ETF is finally here

Bitcoin is now Made in America

There is no neutral way to measure wealth (reader submitted)

Coinbase is launching support for NFTs

The Bitcoin ETF is finally here

We talked last week about signs that the SEC was about to approve the first Bitcoin Exchange Traded Fund (ETF) and now we have confirmation: On Monday October 18th the ProShares Bitcoin ETF will be SEC approved and ready for open trading on NASDAQ. This is probably the news that the $1.6B market buy a few weeks ago was front-running. People are excited:

An exchange traded fund is a kind of equity wrapper around an asset for people who want exposure to an asset in their portfolio but don’t actually want to deal with the asset itself. So if you want to exposure to oil but you don’t want to store barrels of oil you can buy shares of United States Oil (USO). If you want exposure to gold but you don’t have a vault big enough for all the gold bars you can buy shares of SPDR Gold (GLD). And if you want exposure to Bitcoin but you don’t want to actually handle the money yourself you can buy shares of ProShares Trust (BITO).

Except not quite, because ProShares is not actually a Bitcoin ETF it is actually a Bitcoin futures ETF which means that under the hood what it is doing is making a rolling series of USD denominated bets on the upcoming price of Bitcoin to simulate the value of owning Bitcoin. ProShares does not plan to own any Bitcoin.

If your main goal is to track the price of Bitcoin the best thing to do is to own Bitcoin. The next best thing is an ETF that owns Bitcoin for you. A futures ETF like ProShares is strictly worse. Unlike holding a stack of bitcoin, maintaining a futures position requires finding counterparties to trade with on a regular basis. Those counterparties will need to be compensated (so futures ETFs are more expensive) and they may not always be there when you need them (so futures ETFs are more volatile).

Likely the main reason the SEC decided to approve a futures ETF in spite of these limitations is because the majority of Bitcoin futures are traded on well regulated US markets with good transparency and close supervision. That’s not necessarily true of the markets for actual Bitcoin.

There was a time when approving a Bitcoin ETF would have unlocked a wave of new investment into Bitcoin, but I’m not sure that’s true anymore. There are now a raft of international Bitcoin ETFs (the UK just launched a spot ETF), there are so many publicly traded companies with exposure to Bitcoin that there are Bitcoin exposure indices that track them as a group. I don’t think there are very many institutions that both (a) eagerly want to invest in Bitcoin and (b) haven’t already.

That said, ETF approval is an important badge of legitimacy. It gives investors confidence that America won’t ban Bitcoin the way China just did. It also removes Bitcoin from the cloud of regulatory uncertainty hanging over crypto. It is as close to legal recognition of decentralization as we have today.

So far the market is pleased. At time of writing the price of Bitcoin is ~$62k/BTC hovering just below the previous all time high (~$63.7k/BTC). There has been very, very little price discovery up here (only ~0.6% of all Bitcoin has ever traded above this price), so it is hard to know where we might go next. Traders are optimistic and are positioning themselves for new highs. You can see that in the relative size of the open long positions (red) and open short positions (green):

Uptober continues to live up to its reputation, but it is November that has historically been the most bullish month for Bitcoin. Strap in.

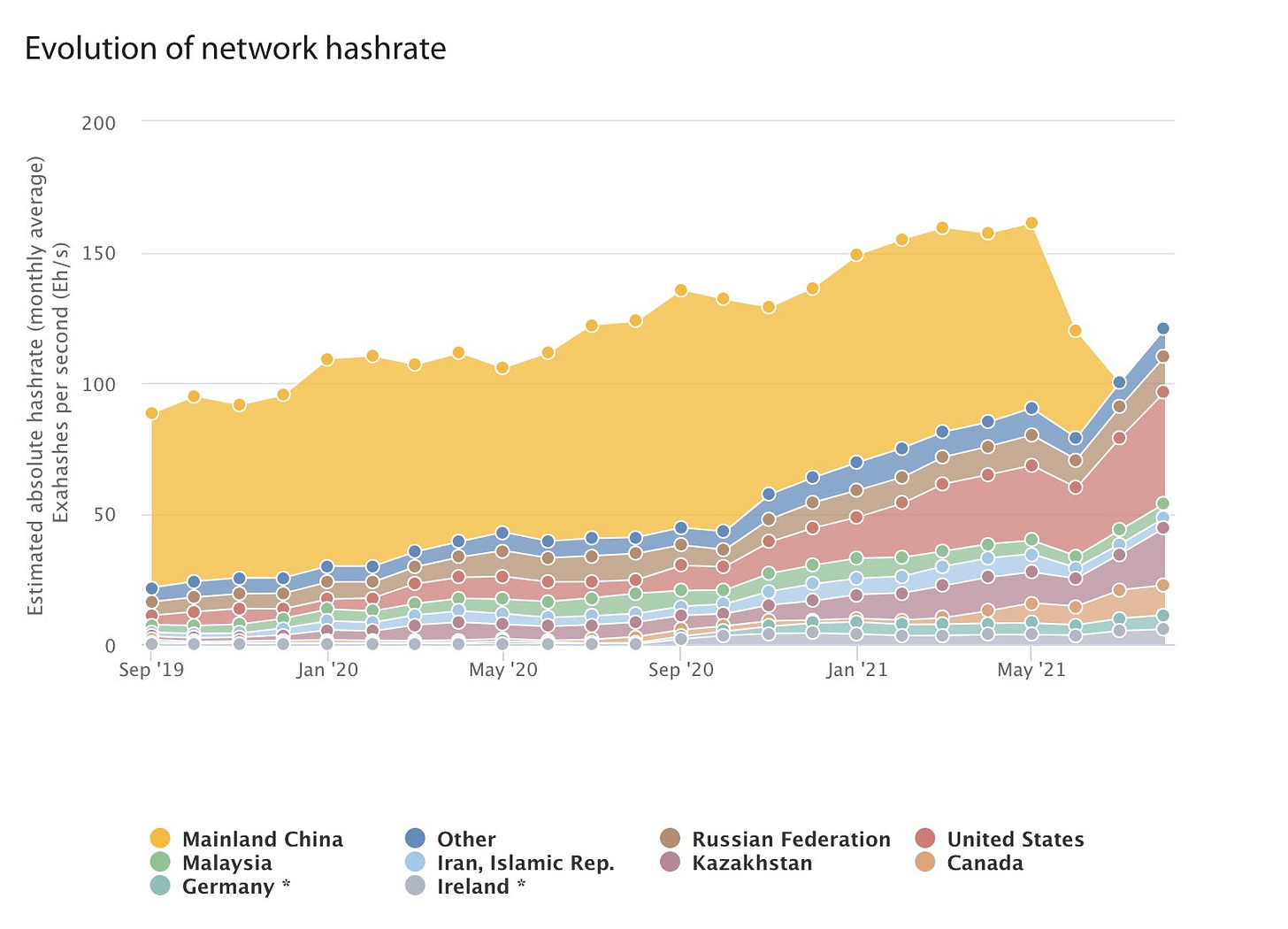

Bitcoin is now Made in America

The Cambridge Bitcoin Electricity Consumption Index (CBECI) just released their first major update since China banned Bitcoin and it is a fascinating view of the network as it adjusts. Chinese hashrate has essentially disappeared, migrating primarily to the United States and Kazakhstan.

The fact that this massive migration took place without any appreciable disruption to the network is pretty incredible, but I also think it would be naive to assume that there are no more Bitcoin miners in China. I think it is more likely that there are still miners operating in China but they are now taking steps to obscure or misdirect their location, which is not especially difficult to do. There is no reason the computer that reports a block to the network and the mining rig that discovered the hash need to be in the same location.

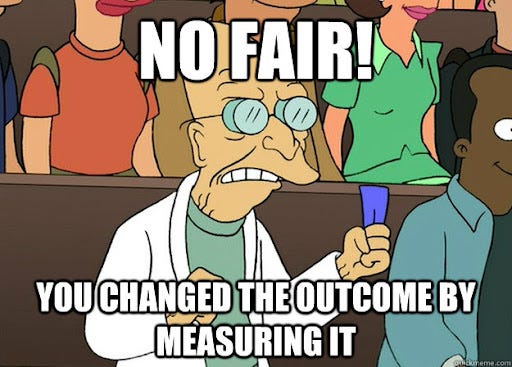

There is no neutral way to measure wealth

“I read your post about wealth taxes but it didn’t click for me. For divisible assets, what if we just said fork over 1% to treasury every year? For non-divisible assets, for most people their house makes up the 90% of it and they already have an assessor. Wealth tax has its shortcomings like everything else, but not intrinsically more preposterous than any other tax. I think the gains tax opens the door to the buy, borrow, die paradigm. I don’t see the moral justification for it.” - IS

My objection to wealth taxes is not taxing the wealthy. Tax the wealthy! My objection is that asking bureaucrats to assign value to things without the aid of market transactions is both (a) impossible and (b) an unacceptable level of power. They can't do it and they shouldn't be allowed to try.

How much should we tax George R.R. Martin for having exclusive rights to the Game of Thrones franchise? How much was WeWork worth in 2019? How should we assess the value of the children’s art that parents hang on their refrigerator? What if the child is Aelita Andre? Who gets to decide? I don’t necessarily disagree with your intuition that the majority of non-divisible asset wealth is probably real estate, but even that claim is hard to empirically measure or defend.

Divisible assets are troubling, too. Stock tickers make it seem like we know the value of people’s equity holdings but that isn’t true because buying or selling a stock changes its value. The price you see on the ticker is the price you can get for selling one share. If you own (or are trying to sell) more than one share, the truth is much more complicated than that.

Having people give their stock to the government instead of selling it doesn’t change anything, because it just means the government is selling instead. Forced selling is forced selling, it will always drive down the market value of an asset. Forced buying and selling can whiplash the stock price of even large, stable businesses.

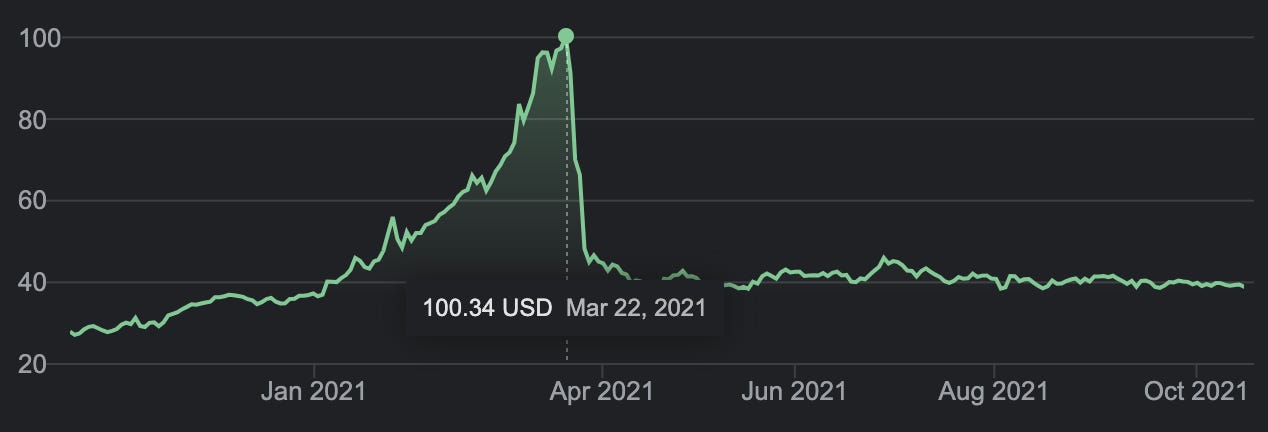

Consider this chart of ViacomCBS’s stock this year:

The rise and subsequent crash at the end of March was not a result of anything that Viacom did or didn’t do - it was entirely the result of exceptionally large and reckless leveraged betting by Archegos Capital, which subsequently collapsed and destroyed around $10B worth of wealth. Should we tax based on the price on March 21 or the price on March 23?

Prices are much weirder and less stable than people’s intuitions. Last year the price of oil briefly dropped to negative $37.36/barrel. This year there was a deli in New Jersey with a market cap of over $2B. At one point Dogecoin had a higher valuation than the Ford company. You can’t take prices at face value and you shouldn’t tax them at face value either.

That said, I completely agree with you about closing the loophole that says you can take a loan against an asset without realizing any gains. A loan that values an asset is a voluntary market transaction that both parties consent to. It is a perfectly reasonable place to checkpoint and tax gains. Let’s do it.1

Other things happening right now:

Coinbase has announced they will be launching an NFT wallet. At time of writing the waitlist has reached ~1.6M users. There are only ~200k monthly active traders on OpenSea. Coinbase has ~56M active users. In the last two months ~2k NFT projects have launched. At that rate it would take ~4.5 years to generate enough NFTs for everyone on Coinbase. #WAGMI

Ethermine (the largest mining pool on Ethereum) has recently decided to stop processing transactions that attempt to front-run other user’s trades, for "compliance" reasons. Ethermine and the next largest ETH mining pool F2Pool together comprise a majority of the hashrate. If they both decided to reject blocks with front-running transactions that would mean those transactions effectively are banned from the network. It raises interesting questions about what "compliant" decentralization is actually accomplishing.

Another approach to wealth taxes that I actually do like are Harberger taxes, where you set the value of your property yourself, but you are legally obligated to sell it to anyone who wants to buy it at the price you listed. That lets taxpayers consent to the market value they are being taxed at but at the cost of forcibly listing everything for sale all the time, which is probably politically untenable in practice.