Uptober is the start of whale season

Plus how to solve the Bitcoin environmental crisis together

In this issue:

Uptober is the start of whale season

Solving the Bitcoin environmental crisis together

The shadow cast by hodlers

Uptober is the start of whale season

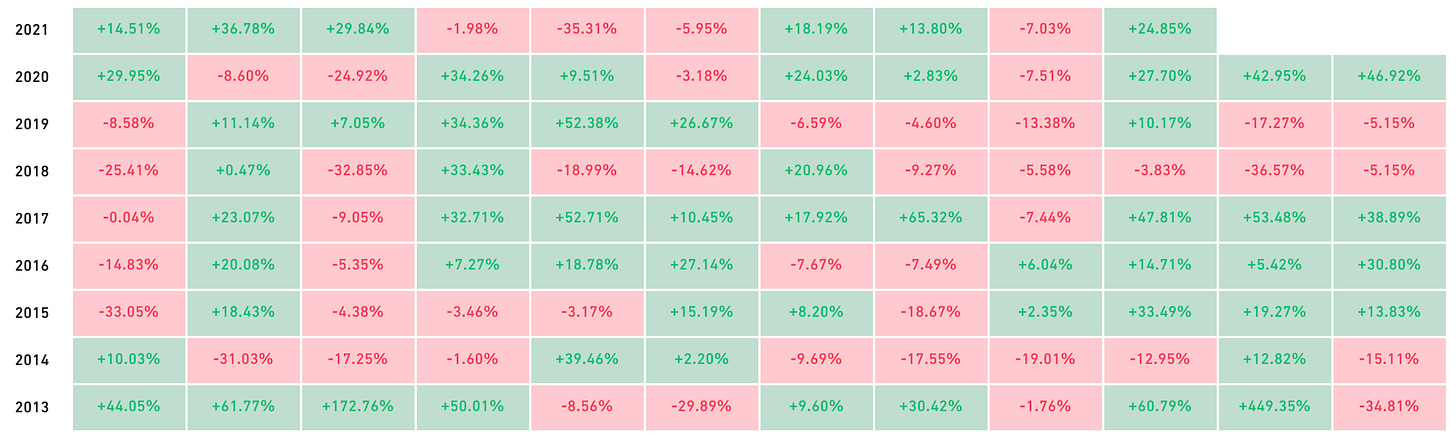

Conventional wisdom in cryptocurrency is that October and November are very good months for Bitcoin. There are a lot of retrofitted explanations for why that is but I don’t really find any of them convincing. It is a historical fact though that Bitcoin returns have been the highest in October (up ~22% on average) and November (up ~66% on average).1 Here’s what that looks like:

Conventional wisdom is also "sell in May and walk away" which has also performed reasonably well. Monthly returns between June and September have averaged ~2.9%. Summer just doesn’t seem to be Bitcoin season. People would rather be out in the sunshine instead of thinking about doomsday money.

Anyway, the Uptober meme is still doing fine, Bitcoin has climbed ~25% so far. That climb took an abrupt leap forward Wednesday morning from ~$52.7k/BTC to ~$55.1k/BTC over the course of a few minutes. Normally price movements this sudden in crypto are caused by margin cascades, where a quick movement in price forces leveraged traders to close their positions driving the price even further up (or down) and forcing more traders to liquidate and so on. Margin cascades tend to overstate how confident the market actually is in a particular price movement because most of the buyers (or sellers) were being forced to trade.

Anyway that isn’t what happened this time. Someone bought ~$1.6B worth of Bitcoin off the open market in just over 5 minutes. There were only a few million dollars worth of shorts liquidated in that time.

There is no way to know who made all those purchases, but I think it is more reasonable to assume it was a coordinated purchase than a coincidence. It is interesting to speculate on what the motives of the buyer might be.

Obviously to make a purchase that large they must be confident in Bitcoin - but making it so abruptly also suggests a sense of urgency. The buyer took most of the Bitcoin available for sale off the market before sellers had a chance to react and bring in more supply - effectively meaning the buyer was bidding against themselves. They single-handedly drove the price up ~3%, which at the scale of the purchases they were making likely cost dozens of millions of dollars.

Another thing you can’t really know but can reasonably suppose is that anyone spending ~$1.6B has probably considered how they plan to do that fairly carefully. That means whoever was buying wanted to move their money into Bitcoin as quickly as possible and was willing to pay a few dozen million for the privilege. Perhaps they know something about Bitcoin that the rest of us don’t yet?

One popular theory for what this enormous trade might reflect is insider knowledge than a Bitcoin ETF is about to be approved. The SEC has been increasingly stern in its language surrounding DeFi applications, decentralized exchanges and especially stablecoins - but in contrast it has been much less critical of Ethereum itself and even openly supportive of Bitcoin. Coinbase also tweeted and then immediately deleted a post suggesting they knew a Bitcoin ETF approval was coming.

If an ETF is approved it would be an enormous signal of legitimacy for Bitcoin and would enable a whole new class of institutional investors to enter the market. When they do they will find there are almost no Bitcoin available for sale. Bitcoin has been moving steadily all year into the hands of long term holders and 90% of the circulating supply is held by someone sitting comfortably in profit. Why sell?

Solving the Bitcoin environmental crisis together

As we’ve written about before on Something Interesting Bitcoin uses a lot of energy and many people worry about its impact on the environment. I am not among those people, I think Bitcoin is both valuable enough to justify the energy investment and also quite a bit more energy efficient than the government currencies it competes against. There are many more significant risks to the climate both in the absolute sense and in comparison to other forms of money. Bitcoin’s energy consumption is just much easier to graph.

That said however Bitcoin still has a carbon footprint and anything that reduces that carbon footprint should be celebrated. For example when China cracked down on Bitcoin mining recently (first in coal-powered provinces and then later across the entire country) it was a huge environmental win. It will still take quite a while for the migration to complete and the market to settle into a new equilibrium and we won’t know the precise carbon impact until it has - but subsidized Chinese coal was some of the dirtiest energy powering Bitcoin, so replacing them will be net positive.

Many of those mining operations are actually migrating to sources of renewable energy. In fact even before the migration out of China a report from Cambridge University estimated the Bitcoin mining network was using ~39% renewable energy. That isn’t because Bitcoin miners are closeted environmentalists. It’s because renewable energy is often pretty cheap.

The difficult thing about renewable energy is that most of it is in remote, often inhospitable places like volcanoes, deserts or tidal channels. Solar and wind energy are intermittent, geothermal and tidal energy is remote. But you can bring a barrel of oil or a bin of coal wherever you want before you burn it and you can burn it whenever you need the energy. Fossil fuels aren’t popular because they are cheap, they are popular because they are convenient.

That makes Bitcoin a great customer for renewable energy - the network does not care when or where energy was produced, only how cheaply it can be bought. That’s why renewable energy companies are moving into the Bitcoin mining industry. Over time the Bitcoin network optimizes to scavenge the cheapest available energy and the cheapest energy tends to come from renewable sources.

So when El Salvador’s volcano-powered Bitcoin mining facility began operating the total amount of power used by the network increased - but the total amount of carbon released by the network did not. The volcano was going to be there either way.

In fact the true environmental impact of adding a mining facility to the network is more complicated. Bitcoin’s mining rewards don’t change when more miners join the network, which means mining is a zero-sum game. Every new low cost miner that joins the network lowers the profit margin for all miners and the most inefficient miners will inevitably be forced off the network.

In other words, El Salvador using a volcano to mine Bitcoin caused the network to use more energy - but it actually probably reduced its carbon footprint by displacing a much less environmentally friendly alternative. A cheap, clean volcanic miner turns on and an expensive, dirty coal-powered miner turns off. Win, win.

Anyone who has an understanding of Bitcoin knows that banning or regulating it is not a serious option. Some people hope to eliminate the network’s environmental footprint by switching to proof-of-stake but as I’ve written about before proof-of-stake doesn’t reduce environmental costs it only hides them. It is actually possible for governments to intervene to make the Bitcoin network greener, though.

Since Bitcoin mining is zero sum, miners with cheap power are functionally a tax on miners with expensive power. Governments who subsidize mining Bitcoin with clean, renewable energy are effectively penalizing any other kind of Bitcoin mining. You can’t ban Bitcoin miners, but you can outcompete them. If you worry about the environmental footprint of Bitcoin consider asking your government to invest in mining Bitcoin in a more ethical way.

Other things happening now …

A neat little visual that demonstrates why tokens are so much more able to overcome the bootstrapping problem of traditional networks. The potential for equity upside of a network is at its highest when its use value is at its lowest. Tokenomics let networks share that equity upside with early adopters as a means of compensating them for joining before the network matures:

A long but very interesting thread by @Punk6529 arguing that NFTs are positioned to disrupt much more than just the art world. The thread is at times a little more dramatic than I would be but there is a lot I agree with:

This graphic from Willy Woo requires a lot of squinting and he doesn’t fully disclose the methodology, but the story it tells is really interesting. The gray lines track the last traded price of coins by percentile. Collectively the lines cast a kind of shadow that is like a distribution of the prices various Bitcoin holders likely assign to their assets. The shadow is darkest where a large cluster of owners last bought in at that price.

I bought some Bitcoin from the Bearwhale. God rest his paper hands. RIP.

Sadly November did not get the catchy nickname.