Not investing is the riskiest decision

also NFTs from Taco Bell and zen riddles for the property courts

In this issue:

Companies keep moving their treasuries into crypto

NFTs are not ICOs just ask Taco Bell

Property rights at the edge of reason

Not investing is the riskiest decision

On Sunday Norweigan Energy conglomerate Aker sent out its shareholder letter announcing a new company called Seetee focused on investing in Bitcoin mining and infrastructure, which would be holding its entire liquid treasury in Bitcoin. They launched with 300M Krone (~$58.5M USD) which they used to purchase ~1170 BTC.

Aker is owned by Kjell Inge Roekke, the second richest man in Norway. Roekke’s shareholder letter makes a forceful financial as well as moral case for Bitcoin, arguing it serves as an economic load-balancer for the renewable energy systems they invest in. The line that stood out the most to me was this one:

Rather than thinking of Bitcoin as a risky element of their portfolio, a growing number of companies are starting to view Bitcoin as the hedge protecting them from other risks. That is a pretty profound change of perspective.

Hong Kong listed Meitu (~$10B market cap) also just announced they purchased $22M worth of ether and $18M worth of Bitcoin. And obviously no story about institutional demand would be complete without MicroStrategy - they bought another $10M worth of bitcoin on this dip. They now own ~91k bitcoin.

Incidentally the US Government holds ~70k bitcoin from various seizures that it hasn’t yet auctioned off. So at the moment MicroStrategy holds more bitcoin than the US Government - or at least more than they acknowledge having. Hopefully the US Treasury has some squirreled away somewhere just in case.

Taco Bell NFTs are the way and the truth

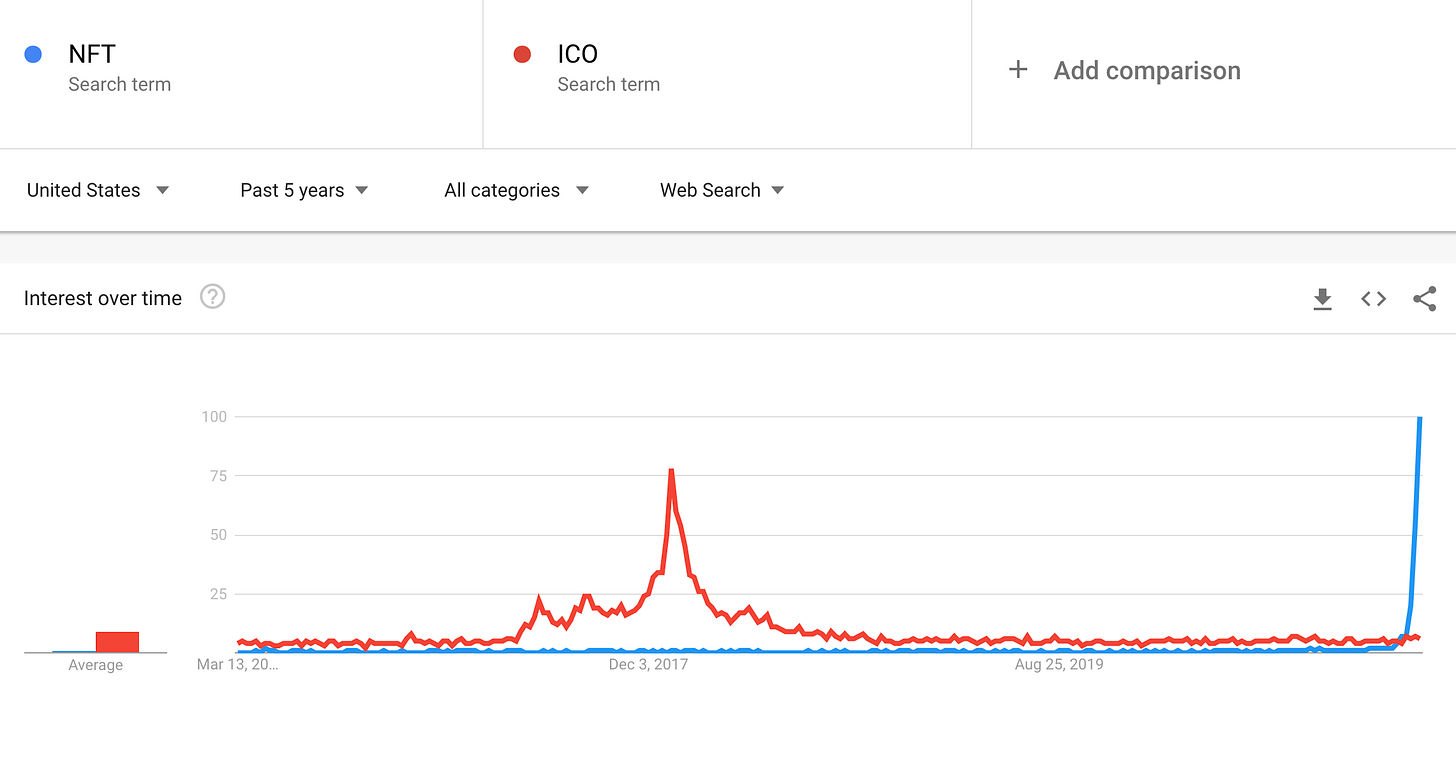

The excitement around non-fungible tokens (NFTs) continues to surge - roughly ~$400M worth of NFTs have been traded in the last 30 days, most notably across NBATopShots (~$260M), CryptoPunks (~$89M) and Hashmasks (~$22M). A lot of comparisons have been drawn to the summer of Initial Coin Offerings (ICOs) in 2017 where dozens of projects raised literally billions from investors with little more than a website and a whitepaper.

I think those comparisons are overly glib. ICOs are strictly financial tools - they were a way of raising money from people who wanted to make money. NFTs are more complicated - most come with no implicit rights or future cash flows. They are more fundamentally aesthetic objects than economic ones. They may carry financial value, but their value cannot be fully understood through financial analysis.

NFTs are a much bigger deal than ICOs were. One way you can see this is by considering how abruptly searching for NFT has grown recently, even compared to the previous hype cycle around ICOs:

NFTs are reaching a fundamentally broader audience, one much further out from the crypto community than ICOs ever reached. In the late peak of the ICO cycle there were a handful of projects with minor celebrity endorsements - Floyd Mayweather, Steven Seagal, Paris Hilton - but ICOs themselves were not something ordinary people knew or cared about.

NFTs on the other hand are everywhere - artists like Beeple and musicians like Grimes are making millions from sales. Billionaires like Chamath Palihapitiya and Mark Cuban are buying them. Christie’s is hosting auctions for them.

Even Taco Bell is making NFTs:

They sold out instantly, obviously. Maybe people are buying Taco Bell collectible NFTs as an ill-considered financial investment but it seems a lot more likely to me they are buying them because they like Taco Bell and it seems like fun. NFTs are pure distilled brand affinity. They confer bragging rights.

Sometimes bragging rights can be quite expensive. On Friday Jack Dorsey (CEO of Twitter) minted an NFT representing his very first tweet. The current bid is $2.5M.

Owning this NFT doesn’t mean anything for the tweet itself - Jack or Twitter can still delete it. In fact someone already bought a tweet for $639 only to have the author delete it. Maybe the NFT is more valuable now as a part of scam history?

Property rights at the edge of reason

NFTs are going to pose some fun new zen riddles for the court system over the next few years. Take this story:

On the face of it it seems like a modestly clever way to cash in on the moment. Fractional ownership of high-value art (including works by Banksy) is already a thing. Burning something of value to imbue some new token with value is an old tradition in the crypto community. But it is … probably illegal?

First off in America (where this took place) the law says that artists "shall have the right … to prevent any destruction of a work of recognized stature, and any intentional or grossly negligent destruction of that work is a violation of that right." I’m no legal scholar but it seems like burning a $380,000 piece counts as intentional destruction of a piece of recognized stature. So there’s that.

More interesting are the questions raised by the NFTs they created. When you buy a painting or other visual work you own the physical piece, but not the intellectual property behind the piece. That remains with the artist. So you can’t take a Banksy, put it in a different frame and sell it as a new piece of art - that would be considered derivative work and thus an unauthorized commercial use of the IP.

On the other hand artists absolutely can and do reference each other - Banksy himself routinely references other famous pieces in his art. So the question becomes, is destroying a work of art and creating an NFT to represent it a financial creation or an artistic one? Is it primarily derivative (like reframing a Banksy) or transformative (i.e. a legitimate new work of art in its own right)?

Other things happening right now:

A hypothesis from Willy Woo about where some of the recent sell pressure might have been coming from:

Paypal is acquiring cryptocurrency security/custody company Curv: