This Week in Imaginary Money

A weekly digest of interesting news, essays and threads in the cryptosphere

End of an Experiment:

Data from our mid-year review suggested that long-form deep dives were some of our best performing posts, so in response I decided to adjust formats to bring all the current events and news into a weekly digest and focus the remaining posts on longer topics in greater depth. The numbers were very clear: the old format was considerably more popular with both paid and free subscribers. So this will be the end of a brief but educational experiment wherein we all learned the importance of tradition.

Let me know your thoughts! I read every reply.

News:

We talked a few weeks ago about how Circle’s secrecy about its holdings cast doubt on whether their stablecoin USDC was properly financed. This week Circle disclosed their reserves backing USDC, probably in response to our coverage. This is more transparency than we had before (it rules out the worry that USDC reserves were being deployed on DeFi, e.g.) but it still has an interesting lack of clarity about what percentage of the "cash and cash equivalents" are actually cash. Overall this addresses a lot of the concerns we raised, though. I give it a B+.1

The European Commission (the executive branch of the European Union) announced an intention to apply the "travel rule" to crypto assets. The travel rule requires financial institutions to send and receive identifying KYC/AML information with any significant payment. Applying the travel rule to crypto assets would imply that all addresses must be associated with a specific person and that legal finance could only take place between identified addresses. Anonymous crypto usage would be criminal by default. Assuming the proposal passes it will take ~2 years to become law.

BlockFi received a Cease & Desist from the New Jersey Attorney General prohibiting them from onboarding new customers in New Jersey. That’s not a huge deal in and of itself but it is embarrassing because BlockFi is headquartered in New Jersey. We’ve talked a few times about Block Fi’s recent troubles as a business. As a precaution I have withdrawn my balance with them for now.

Graphs & Numbers:

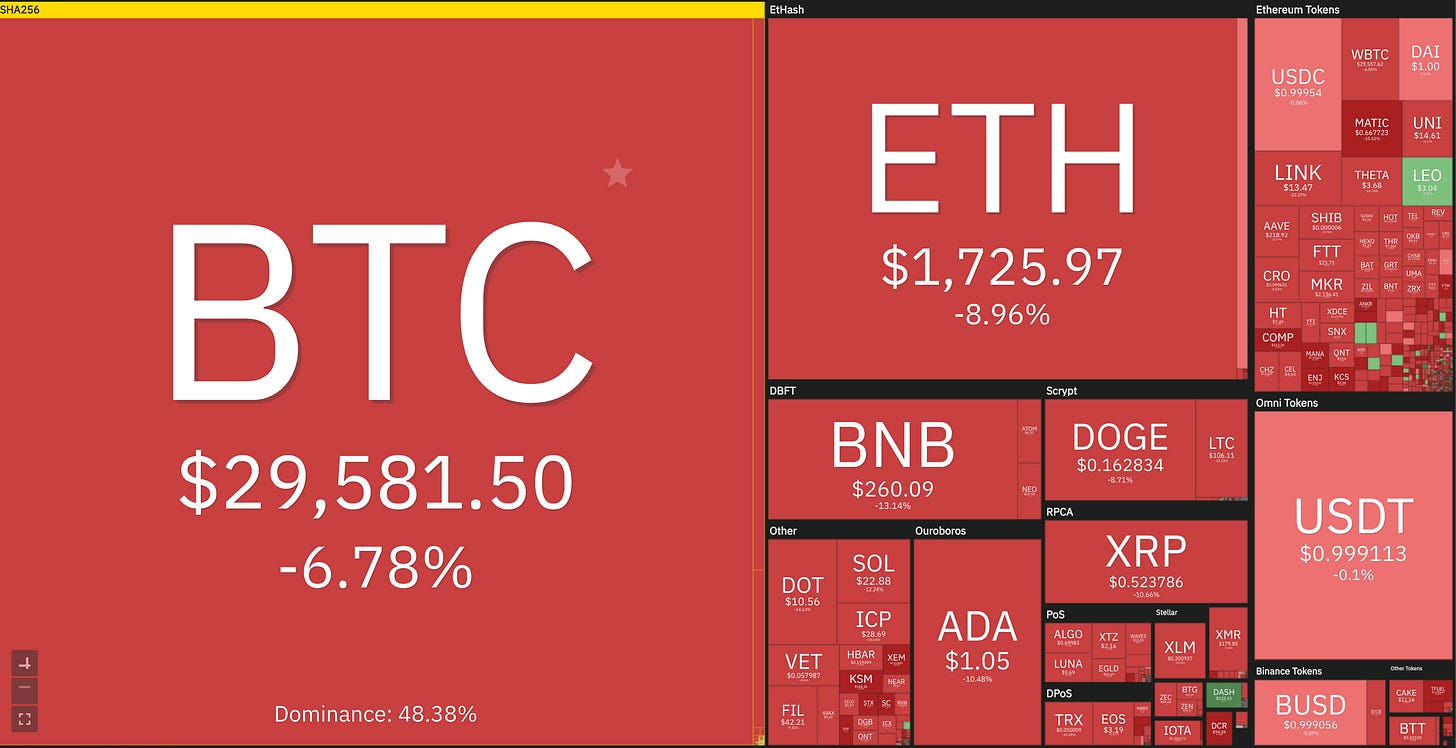

What a difference a day makes!

If Bitcoin really is a globally valuable savings technology, we are still absurdly early in the adoption curve.

The Ethereum Name Service (ENS) is an interesting proxy for unique users playing with DeFi in some way and seems to be growing pretty rapidly. There are now ~10k ENS users controlling a collective ~$277M in funds on DeFi.

Tweets:

It’s tough out there for us content creators right now:

It’s a bit older than last week but this thread is still an entertaining rant listing some of the centralizing forces Ethereum is struggling with right now.

Bitcoin and the Environment:

We wrote earlier this week about how to estimate Bitcoin’s energy footprint intelligently and the Cambridge Bitcoin Energy Consumption Index or CBECI, which updated its methodology this week. CBECI is in stark contrast to Digiconomist, who we wrote about a bit last week.

NFTs:

NFT marketplace OpenSea has raised $100M at a valuation of $1.5B putting it comfortably past the "Unicorn" threshold of $1B. OpenSea has turned over ~$184M worth of volume in the last 30 days, of which it gets a ~2.5% cut, which would imply an annual revenue of ~$55M/year (or ~7 alien CryptoPunks).

The OpenSea valuation seems extreme now but looking at the growth charts for the NFT market it may very well look like a bargain by the end of the year:

Everything is dumb now:

In this video the Malaysian police demonstrate the world’s most expensive game of bubble wrap with a fleet of seized Bitcoin miners:

Money can’t buy you love. But it can buy you an NFT that represents love, which is better than love because you can resell it when you’re done. This particular NFT represents the "digital love" of Polish influencer Marti Renti and the opportunity to have dinner with Marti in the physical world. The NFT apparently sold for ~$250k but you really can’t put a price on love.

Presented without comment:

If you’re looking for a really boring balance sheet, competing stablecoins PAX and BUSD (both run by Paxos) are apparently 96% backed by cash and cash equivalents.