This Week in Imaginary Money

A weekly digest of interesting news, essays and threads in the cryptosphere

A new format for Something Interesting

Adapting from what we’ve learned in the first six months of writing Something Interesting, we’re going to adjust our formats slightly. Starting this week we’ll be doing weekly news summaries every Thursday where we focus on a digest of major stories or interesting threads. The first weekly digest of each month will be free but the rest will be for paid subscribers only. Other posts will focus into a single topic explaining an interesting or more complicated news story in greater detail. Those posts will continue to be available to all subscribers both free and paid. Let me know your thoughts!

News:

Jack Dorsey officially announced Square’s plans to build and release an open-source hardware Bitcoin wallet designed according to 12 guiding principles. A neutral hardware wallet standard would be a huge step forward for Bitcoin.

2014-era cryptocurrency exchange ShapeShift is decentralizing itself out of existence, dissolving its corporate entity entirely and replacing it with a decentralized autonomous organization or DAO. Seems a bit like the corporate equivalent of renouncing your citizenship for statelessness. Shapeshift now exists outside of any legal jurisdiction but also beyond any legal protection.

Graphs & Numbers:

Year to date Bitcoin’s risk-adjusted returns have been pretty disappointing. On the other hand Bitcoin still is dominating those same measures over 1 year, 2 year, 5 year and 10 year windows.

Price rises and falls but the network keeps humming along, adding users:

Tweets:

Cofounder of Dogecoin Jackson Palmer (who left the project and the space years ago) has written a tweetstorm about why he regrets his involvement with cryptocurrency and will never return to it. Unmentioned but probably also one of Jackson’s regrets: leaving Dogecoin entirely when it was only ~$0.0001/DOGE.

Traditional asset exchanges are thin layers over a host of service providers. Cryptocurrency exchanges have to be full-stack. As a result the two have surprisingly divergent business models - one significant difference is that almost all cryptocurrency exchanges give away their data for free, where traditional exchanges generate significant revenue from data sales. Sam Bankman-Fried of FTX and Alameda Research has an excellent thread explaining why.

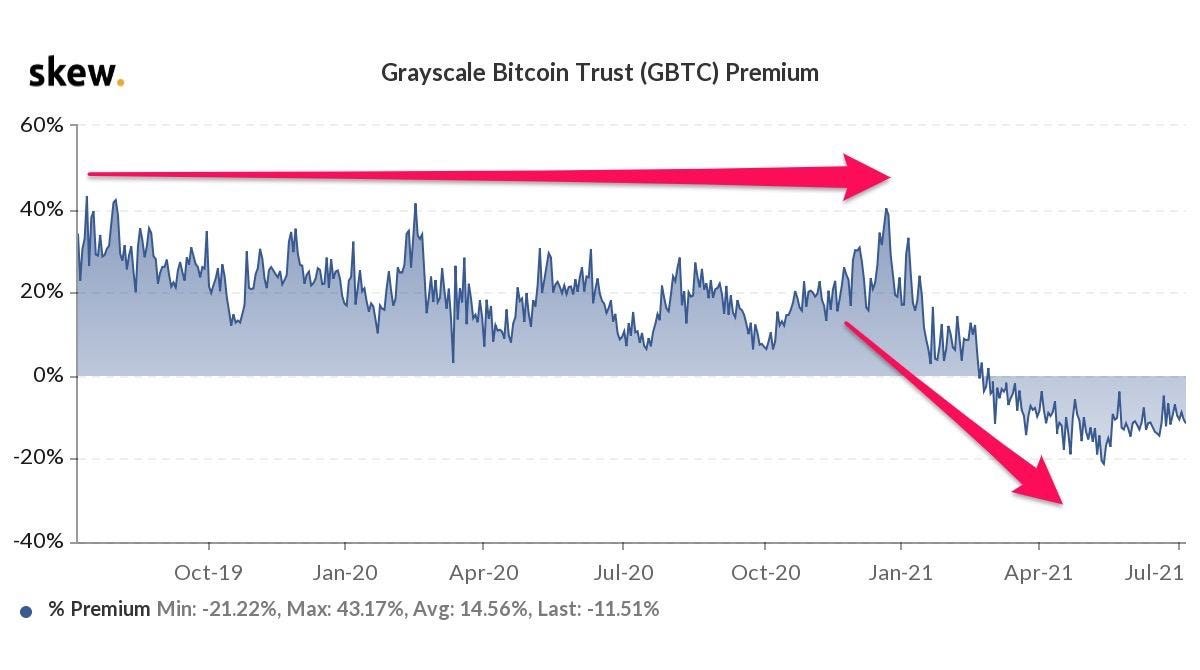

Here is a long, detailed and thoughtful thread from QCP Capital about the implications of the ongoing and upcoming GBTC unlocks, both for the GBTC premium and the broader BTC market.

Bitcoin & the Environment:

We’ve complained about the Digiconomist many times before. They are a for-profit scaremongering publication that exists to provide citations for lazy journalists who want to write DOOM stories about cryptocurrency. Bitcoin magazine has an excellent takedown of how bonkers it is that in spite of more than half the network going offline the Digiconomist model of Bitcoin’s energy use is totally unaffected. The secret? Their model is horseshit.

NFTs:

Celebrities now notably sporting NFT profile pics on Twitter include Mike Tyson, Jay Z, and Josh Hart.

The Institute of Contemporary Art in Miami acquired a CryptoPunk for their collection as a gift from a Trustee, likely the first NFT acquired by an existing traditional art museum.

Damien Hirst has released a 10,000 piece set of NFTs collectively titled "Currency" being sold for $2000/token. The tokens can be kept or (within the first year) burned in exchange for physical prints. The whole project seems like someone who heard about CryptoPunks (10k set, generative art) and Unisocks (burning NFT for physical good) but didn’t quite understand either of them. Better to use the NFTs as provenance / proof of ownership than to destroy them.

Everything is dumb now:

Stanley from the American version of the Office is starting a cryptocurrency based on Stanley nickels. Good thing he got in under the wire before TikTok banned promoting financial investments!

Joe Exotic is selling Tiger NFTs from Prison is a sentence no one needed.

Peter Thiel backed company "Bullish" has ~$6.5B worth of assets (mostly Bitcoin) and is going public with a valuation of ~$9B via a SPAC merger. Bullish is unusual for a public company in that it does not have any customers because it has not yet built an exchange. It does however plan to build an exchange and it plans for that exchange to lots of customers and lots of revenue. It also has a pedigreed suite of advisors and a breathtakingly dumb name. Apparently the market estimates that should all be worth around ~$2.5B give or take.

The new Spike Lee joint is out and it is a commercial: