Bad reasons to buy Bitcoin

Plus Rai stones were the original NFTs and Elon Musk <3s Bitcoin again probably forever this time.

In this issue:

Bad reasons to buy Bitcoin

Rai stones were the original NFTs (reader submitted)

Bitcoin is fast but money is slow (reader submitted)

Bad reasons to buy Bitcoin

Last week fiduciary nightmare and occasional CEO Elon Musk tweeted that he met with Doge developers, which was suspicious because there are no Doge developers. This week Musk tweeted that he met with North American Bitcoin miners and everyone agreed to publish their current and projected renewable energy numbers. This particular conversation appears to have actually happened:

Frustratingly but not altogether surprisingly the market jumped at the positive attention from Elon-senpai:

I have mixed feelings about this development. On the one hand I believe that hashpower migrating out of China and into North America will strengthen the renewable portion of Bitcoin’s energy footprint. I think the news from these disclosures will be largely good and helpful for the market. Better transparency may help ESG-sensitive investors become more comfortable with Bitcoin’s energy use.

On the other hand closed door meetings of miners have a troubled history in Bitcoin. Many people have made and will continue to make the mistake of believing that miners control Bitcoin rather than users. Private meetings of industry insiders are not a good foundation on which to build decentralized trust. The fact that the market responded so positively suggests that many newer Bitcoin holders may be more worried about energy profile than about decentralization. Anyone buying bitcoin because Elon Musk thinks a cartel representing <1% of total mining power is 'potentially promising' is buying Bitcoin for the wrong reasons.

At some point they will sell for the wrong reasons, too.

Rai stones were the original NFTs

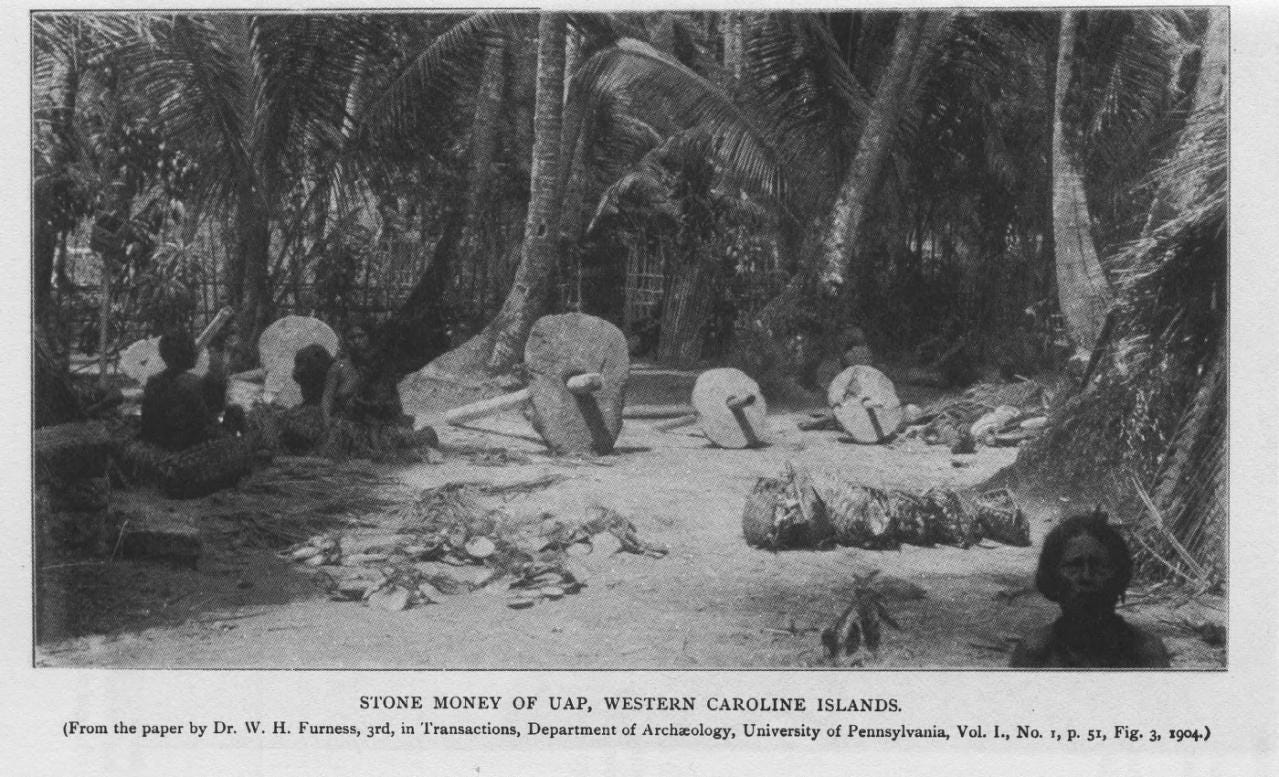

"In your letter "What is money?" you subtitled the photo of Rai stones calling them the greatest money in history. Was that just a snarky note or was there something clever about them?" - BB

My love of Rai stones is sincere although my tone was perhaps a little tongue in cheek. Rai stones were used as money in the islands of Micronesia for ~2000 years or so up until the beginning of the 20th century. They were carved limestone disks with holes in the center in a variety of sizes from a perfectly reasonable ~1.4 in to up to a somewhat less wallet-friendly ~12 ft in diameter.

The larger a stone was the more precious it was, so the really big ones were traded only rarely and usually as ceremonial gifts more than casual commerce. The largest Rai stones weigh up to ~8800 lbs, so rather than lug them around the islands the Yapese people would leave the stones where they were and instead record ownership through oral tradition. I would give you my Rai stone and it would become your Rai stone but the stone itself wouldn’t actually need to move anywhere.

In fact one Rai stone sank to the bottom of the sea when a storm struck the ship carrying it back from the quarry. Everyone agreed that the stone certainly still existed and was therefore perfectly good money. They just kept track of who owned it the same as any other stone. Bitcoin enthusiasts (myself included) are often fond of Rai stones because they are such a good example of why money doesn't need to be physical to be real.

Bitcoin is fast but money is slow

"I mostly agreed with the "What is money?" issue but one thing it failed to mention is transaction speed. Where bitcoin excels on other axes, it certainly lags behind physical currencies and most other crypto in transaction speed - isn't that a huge argument against btc ever being a currency vs a simple store of value?" - SH

Speed of money is a deceptively slippery concept! It is often much slower than it appears because we have built so many technologies and business practices to hide any delays in the system. VISA payments for example feel instant for consumers but are actually from the merchant’s perspective quite slow. VISA is not money but instead a form of short-term debt - the money that eventually pays off that debt takes days to clear. That is why credit card transactions are reversible - they haven’t actually finished happening yet.

In the financial industry the final step where actual money moves is called settlement. Face-to-face payments in physical cash are the gold standard of transaction speed because they settle instantly, but their Achilles heel is they only really work for small payments. Physical cash is great for buying coffee but terrible for buying a house. Most people will buy a lot more coffee than houses, but anyone who buys a home will almost certainly spend more money over their lifetime buying real estate than they will buying coffee. Home purchases are rare but they are really big.

Settlement networks are how we move large amounts of money - things like wire transfers through SWIFT. The purpose of a settlement network is to provide finality - i.e. assurance that the transaction is final and won’t be canceled or reversed. All three of VISA, Bitcoin and the SWIFT network are able to relay a new transaction through their respective networks more or less instantly. Where they differ is not in how quick payment is, but instead how quick settlement is.

On both VISA and SWIFT settlement is a matter of days. Bitcoin on the other hand can offer finality on payments less than 6.25 BTC (~$240k at time of writing) within an average of 10 minutes. By the time days have passed and VISA and SWIFT payments are settling Bitcoin can offer assurances comfortably into the billions. So Bitcoin is by any reasonable measure much faster than either VISA or SWIFT - but it is most useful for large payments where the emphasis is on settlement.

When comparing the speed of Bitcoin to other cryptocurrencies it is important to remember that blockchain security doesn’t scale with the number of blocks, it scales with the amount of hashpower. Early in crypto-history Litecoin forked Bitcoin and advertised itself as 4 times faster because it produced blocks every 2.5 minutes instead of every 10 minutes - but that is effectively like splitting a dollar into four quarters and calling it a raise. The important thing is how much hashpower the network has not how that hashpower is divided up into blocks.

Here is how much network security Bitcoin provides compared to a few other major currencies. The chart is scaled logarithmically because if it was linear none of the other hashrates would even be visible.

All digital payment networks (both crypto and not) are interchangeably instant in terms of notifying the network of the payment. The real difference is in speed of settlement - and Bitcoin is so fast that it ends up looking like a slow payment network instead of the fastest settlement network in history. Bitcoin is actually really, really fast for money. Money is just a lot slower than we tend to think.

Other things happening right now:

Digital lending firm BlockFi ran a promotion intended to give lucky users up to ~$700 in stablecoins. Unfortunately they made a small oopsie-doodle and paid the prizes out in Bitcoin - meaning one user got 705 BTC (~$2.5M at the time). BlockFi is now threatening to sue its own users. Yikes.

According to the FTC Americans have lost ~$80M to cryptocurrency investment scams since October of last year, up about 10x since the previous year.1 The median amount consumers lost was ~$1900. A good rule of thumb in crypto is that anything that seems too good to be true probably is. You can learn more guidelines for staying safe in crypto in our Intro to Cryptocurrency video. If you are ever not sure if something is a scam you are welcome to ask me about it.

The price of Ethereum is down (~$2600/ETH at time of writing) but activity on the network remains high. Miner revenue is comfortably on track to reach another all time high this month. Bitcoin miner revenue remains elevated but is trending back down from the local peak in March.

Over the course of the last week ~$14.2B of net losses were realized as recent investors sold their coins at a loss, the largest realization of net loss in the history of Bitcoin by a roughly ~5x margin. Some of this was Chinese miners forced into selling by new regulatory policy in China, but likely that was just the catalyst that started a cascade of leveraged longs being liquidated.

That’s reported scams. Presumably many other scams were for various reasons unreported.