Circle is the new Tether

Plus the IMF recommends Bitcoin if you like numbers that go up

In this issue:

Circle is the new Tether

Floating point arithmetic is dumb, Satoshi is not (reader submitted)

The IMF warns Bitcoin could be a profitable investment

Circle is the new Tether

Payment infrastructure company Circle announced on Thursday they would be going public via a special-purpose acquisition company (SPAC) at a valuation of ~$4.5B. Circle started life in 2013 as a Bitcoin exchange but in the years since it has wandered around through various business models, including a period where it moved away from cryptocurrency entirely. These days Circle’s primary business model is operating a stablecoin called USDC.

USDC is the second largest stablecoin with a market cap of ~$24.5B. The largest stablecoin is Tether (USDT), which at ~$64.2B makes up ~59% of the market. Tether and Circle both operate the same way - you give them $1 and they give you a coin that they promise will always be worth $1. In theory they keep that $1 as collateral to back the value of the stablecoin - but in practice if you have a big pile of dollars in your bank account it is very tempting to put that money to work somehow.

Investing depositor money isn’t intrinsically evil - it is just fractional reserve banking, which is the basic business model of any commercial bank. But the thing about fractional reserve banking is that it is risky. If everyone asks for their money back at the same time it won’t be there. If the bank makes terrible investments and loses all their money depositors will be left with worthless IOUs. That is why there are so many laws that govern risk management and transparency for fractional reserve banks - a bank that puts your dollars in a vault and keeps them there is a very different risk proposition than a bank that takes 90% of deposits and invests them in sub-prime mortgage securities.

For many years Tether swore on a stack of bibles that USDT was 1:1 backed by actual USD in a bank account, until earlier this year when the New York attorney general sued them and they were forced to admit that the backing was more like $0.73 worth of USD for every USDT. This wasn’t really a surprise but it was still a source of concern for the market. Finding out a stablecoin is actually running a fractional reserve is like learning your buddy who owes you money has been hanging out at the casino.

Stablecoins are a fairly important part of the infrastructure of the industry, which is why there are still ~$64.2B worth of Tether depositors in spite of the previous paragraph. But many investors have been excited about the prospect of stablecoins run from more regulated jurisdictions with more transparent operators, so Circle’s growth has been greeted with a lot of excitement - USDC was (until 12/31/2020) fully audited and 100% backed by cash!

Unfortunately since then USDC has grown 5x in market cap and Circle started offering USDC accounts with suspiciously high interest rates considering the dollars were just supposed to be sitting idle in a vault. Circle then skipped its March audit without explanation. The public launch is scheduled for the beginning of the quarter, so they can ride the lingering impression that they are 1:1 backed without disclosing anything about the actual risks to depositors until end of November.

Buried deep in the footnotes of their investor presentation is the truth:

Circle would like very much for you to think of USDC as being a fully-backed stablecoin with little to no risk, but what it actually is doing under the hood is using depositor money to buy Bitcoin and then investing that Bitcoin into DeFi smart contracts to earn yield.1 The fact that Circle will be a publicly listed company without disclosing how user deposits are managed is an astonishing regulatory failure.

Even more concerning, since we know from the last audit that USDC was still fully backed in December they would have bought the Bitcoin they are now using in Q1-21, when Bitcoin went from ~$29k to ~$59k. Their balance sheet should have looked amazing … so why skip the March audit?

Floating point arithmetic is dumb, Satoshi is not

"I wanted to suggest that the part about 64bit floating points might be a coincidence. No one as smart as Satoshi would consider using floats to represent an integer quantity." -AB

That's very much a reasonable interpretation! The relevant passage from the section about various Bitcoin parameters is here:

At first glance a lot of these choices seem arbitrary, but on closer inspection turn out to be very clever. Take the number of bitcoin (21M) and the number of satoshis per bitcoin (100M). Together they mean that Bitcoin has 2100 trillion satoshis - and it turns out that 2100 trillion is very close to the maximum number that can be expressed safely in floating point arithmetic on 64 bit systems. So the number of satoshis is actually very carefully chosen and not random at all.

This could easily be one of those places where we are tempted to retrofit meaning into an otherwise meaningless choice. That said, as smart as Satoshi was, he is pretty widely regarded as a sloppy programmer. His gifts were in economics and cryptography more than software engineering.

But floating point arithmetic is actually still fairly common in the financial world, so the idea here is less about considering floating point arithmetic a good or desirable way to track satoshis and more about making sure that systems that already used floating point for whatever reason wouldn't be break if they were adapted to use Bitcoin as well. That way the Excel spreadsheet a business has been using for years and no one knows how to update won’t break if they switch to Bitcoin.

Still, who knows? It could very easily be Bitcoin-flavored numerology.

Other things happening right now:

Meebits are 3D avatar NFTs from LarvaLabs, the makers of CryptoPunks. Yesterday afternoon the rarest Meebit, a double-pig, sold for 1000 ETH (~$2.1M at time of sale). The previous high water mark for Meebit sales was a dissected Meebit for 700ETH, although that was ~$2.6M at the time.

Bad news for bad investments - TikTok has officially banned promoting financial services and cryptocurrencies. It is possible this will slow down or even reverse the trend of ponzicoins and memestonks we’ve seen in the past few months. If you’ve never seen the kind of content that goes viral on FinTok then you should take a look at the Twitter account @TikTokInvestors - it is truly breathtaking.

Agustín Carstens is the head of the Bank for International Settlements (BIS) which is something like a bank for central banks. Here he is cheerfully observing that central bank digital currencies (or CBDCs) would give central banks "absolute control" of how money is used. Quick reminder that if someone else has "absolute control" of your money it’s not actually your money.

Senator Elizabeth Warren sent a letter to SEC chair Gary Gensler asking him to weigh in on five questions about cryptocurrency exchanges and regulation no later than July 28th. For the record, Senator Warren, a subscription to Something Interesting is free and I answer subscriber’s questions about cryptocurrency much faster than that. Earlier this year I sent Senator Warren my own letter about cryptocurrency but I am not sure she has had time to read it yet.

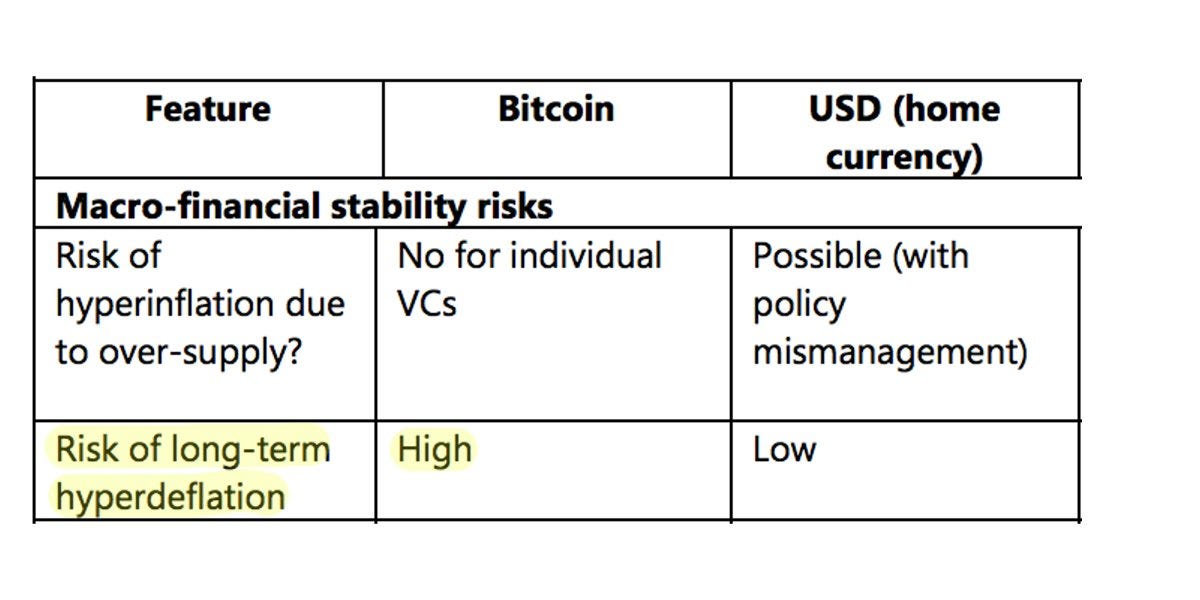

The International Monetary Fund (IMF) warns that Bitcoin comes with a risk of long-term hyperdeflation. Wouldn’t that be awful if all your money kept being worth more money? Hate it when my assets hyperdeflate.

Presented without comment:

You could generously read the description of "yield product" in the slide footnotes to mean a distinct and separate product from basic USDC, which would be more reasonable - but they haven’t disclosed enough to know that with confidence.