Bitcoin miners let the hashrate ... mmm drop

Plus paper-finned whales, Lake Seneca is not a hot tub and a $6B rugpull

In this issue:

Bitcoin miners let the hashrate … mmm drop

Why does difficulty change in two week increments? (reader submitted)

Does the hashrate drop mean Bitcoin is using less energy? (reader submitted)

Corporations are people, my friend

Fucking rugpulls, how do they work?

Bitcoin miners let the hashrate … mmm drop

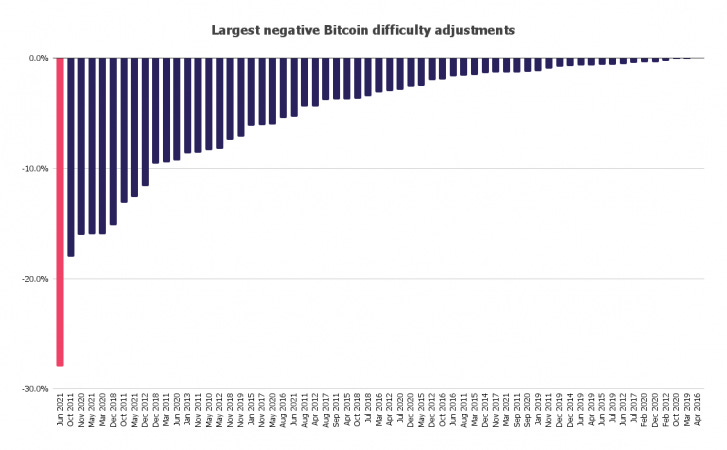

We’ve talked several times recently about China’s ban on Bitcoin mining and the subsequent migration of Bitcoin mining equipment outside of China to more friendly jurisdictions. Slightly more than half of the hashrate has dropped off of the network1 (presumably temporarily) the mining difficulty parameter had the largest drop in the history of Bitcoin, by a pretty solid margin:

The reason that hashrate dropped by ~54% and difficulty only dropped by ~28% is because difficulty adjustments are calculated by averaging over a two week window. If hashrate has a smooth decline of ~X% over a difficulty window you would expect difficulty to decline by ~X/2% for that same window. Hashrate appears to be bottoming out and recovering, but the upcoming difficulty adjustment looks like it will be another ~6-9% down as the network catches up with the changes in mining.

All of which raises an obvious question:

"Why does Bitcoin adjust difficulty in two week increments, instead of adjusting it slightly with every block the way Ethereum and other networks do?” - ZPM

A cool thing about Bitcoin is that it basically worked out of the box. There were a handful of bugs and there have been a lot of upgrades to the network over the years but the basic parameters have proven remarkably stable: 21 million coins, 1 MB blocks, 10 minute blocktimes, 2 week difficulty adjustments, etc, etc.

At first glance a lot of these choices seem arbitrary, but on closer inspection turn out to be very clever. Take the number of bitcoin (21M) and the number of satoshis per bitcoin (100M). Together they mean that Bitcoin has 2100 trillion satoshis - and it turns out that 2100 trillion is very close to the maximum number that can be expressed safely in floating point arithmetic on 64 bit systems. So the number of satoshis is actually very carefully chosen and not random at all.

On the other hand, Satoshi was neither a god nor a prophet and we should resist the urge to deify every choice that he made. It is genuinely difficult to know which decisions were brilliant, which ones were lucky and which ones never actually mattered but have been retrofitted with symbolic significance. All of which is to say I am not sure why two weeks was chosen and I’m not sure it was a particularly careful or thoughtful choice. The perfect number may be larger or smaller.

On the other hand, I do think adjusting the difficulty on every block (as Ethereum does) is a bad idea. That’s because of the risk of isolation attacks where the attacker tricks your node into connecting exclusively with attacker nodes, separating you from the rest of the network. Once you are isolated the attacker can start to build an isolated fork just for you using only some of the network power.

With the current difficulty adjustment window that would mean two weeks of drastically slower blocks on the isolated network, giving you plenty of chances to notice you had been isolated. If difficulty adjusted every block it would only be a matter of hours before the isolated network was operating normally again with blocks appearing every ten minutes. You would have to be paying much closer attention to notice that you had been isolated.

It is (relatively) easy to make difficulty more efficient in most cases - but difficulty is a security measure so it needs to work in all cases, especially cases with a malicious and clever attacker. That’s much more difficult - Bitcoin developer Greg Maxwell enumerates some of the challenges in this thread. The tl;dr is that the possible upside from a smoother difficulty adjustment are pretty limited and the possible downside from undermining security is huge. So the two week difficulty window probably isn’t optimal but it is probably good enough.

Here is another question a reasonable person might ask about the difficulty drop:

"Since the hashrate of bitcoin is way down, does that mean that bitcoin is using significantly less energy?" (MJ)

Yes! A large drop in Bitcoin hashrate implies that a large percentage of Bitcoin mining equipment was turned off and is no longer consuming power. Bitcoin’s power use is less than half of what it was only a few weeks ago in mid-May.

That said, I probably wouldn’t take a victory lap just yet because there is every reason to believe that these mining rigs will come back online in the coming weeks once they are shipped to new facilities. Mining rigs are expensive and they are only useful for mining Bitcoin, so it is hard to believe they won’t eventually rejoin the network.

When they do turn back on they will be drawing power from a different energy source. Most of the mining capacity in China used hydropower in Sichuan province during the wet season and government subsidized coal in Xinjiang province in the dry season. If the rigs mostly migrate to hydro facilities in the Pacific Northwest that’s probably a win for the environment. If they migrate mostly to coal-powered regions of northern Kazakhstan the story is probably more complicated.2

On a long enough timeline Bitcoin mining seeks out and subsidizes cheap energy sources which are naturally more renewable and sustainable - but in the short run the story is a lot more complicated and hard to draw simple conclusions from.

Corporations are people, my friend

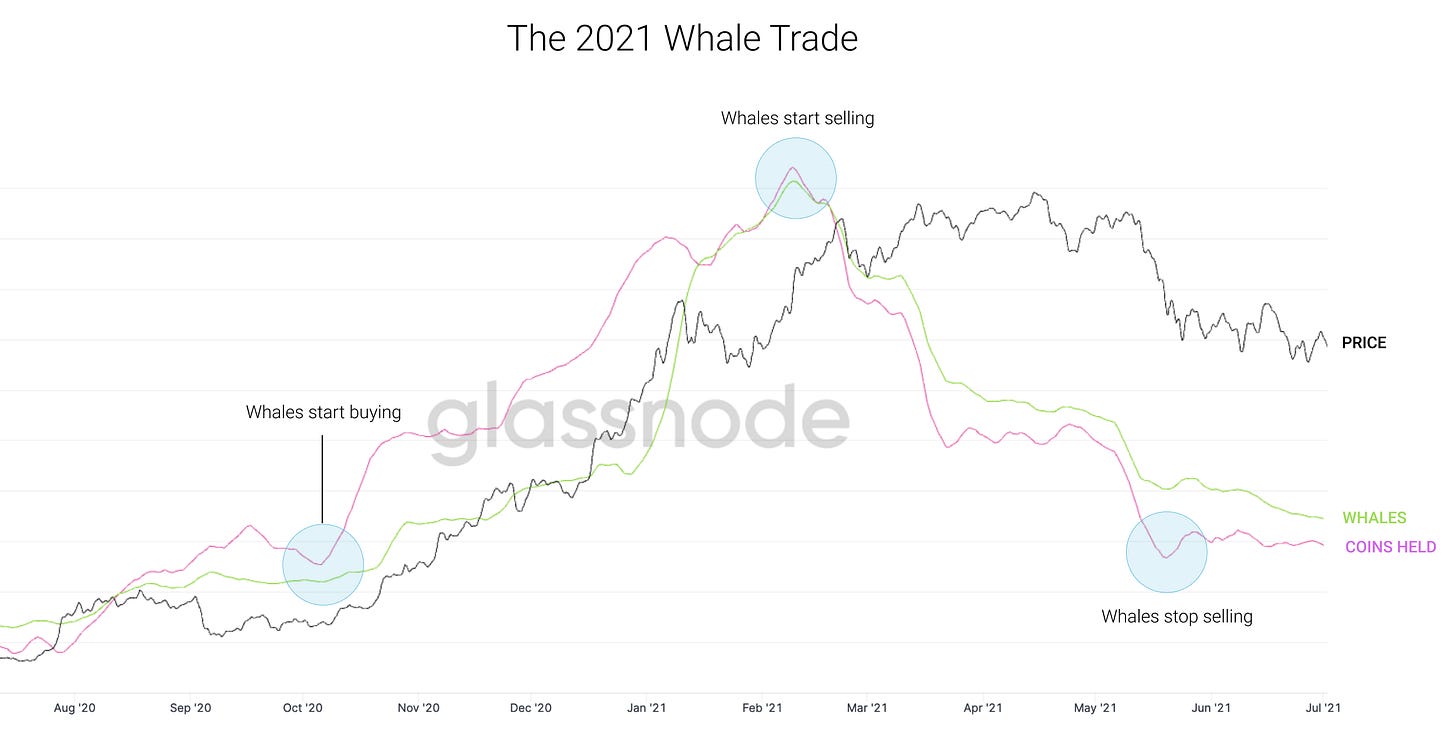

The basic story of the cryptocurrency market in 2021 is that institutions (especially American institutions) got involved in Bitcoin for the first time in a serious way. In keeping with the grand tradition of noobs everywhere getting involved in crypto for the first time, they got overly hyped then impatient and then ultimately lost their nerve. The majority of these new institutional holders have already panic sold, some banking profit but most realizing a loss. Whales! They are just like us.

If you define a whale as "any address who controls more than 1000 BTC" you can see the number of whales (and the number of bitcoin they control) start to rise in October, peak in February. By the end of May the majority of new whales had sold their coins and exited the market again.

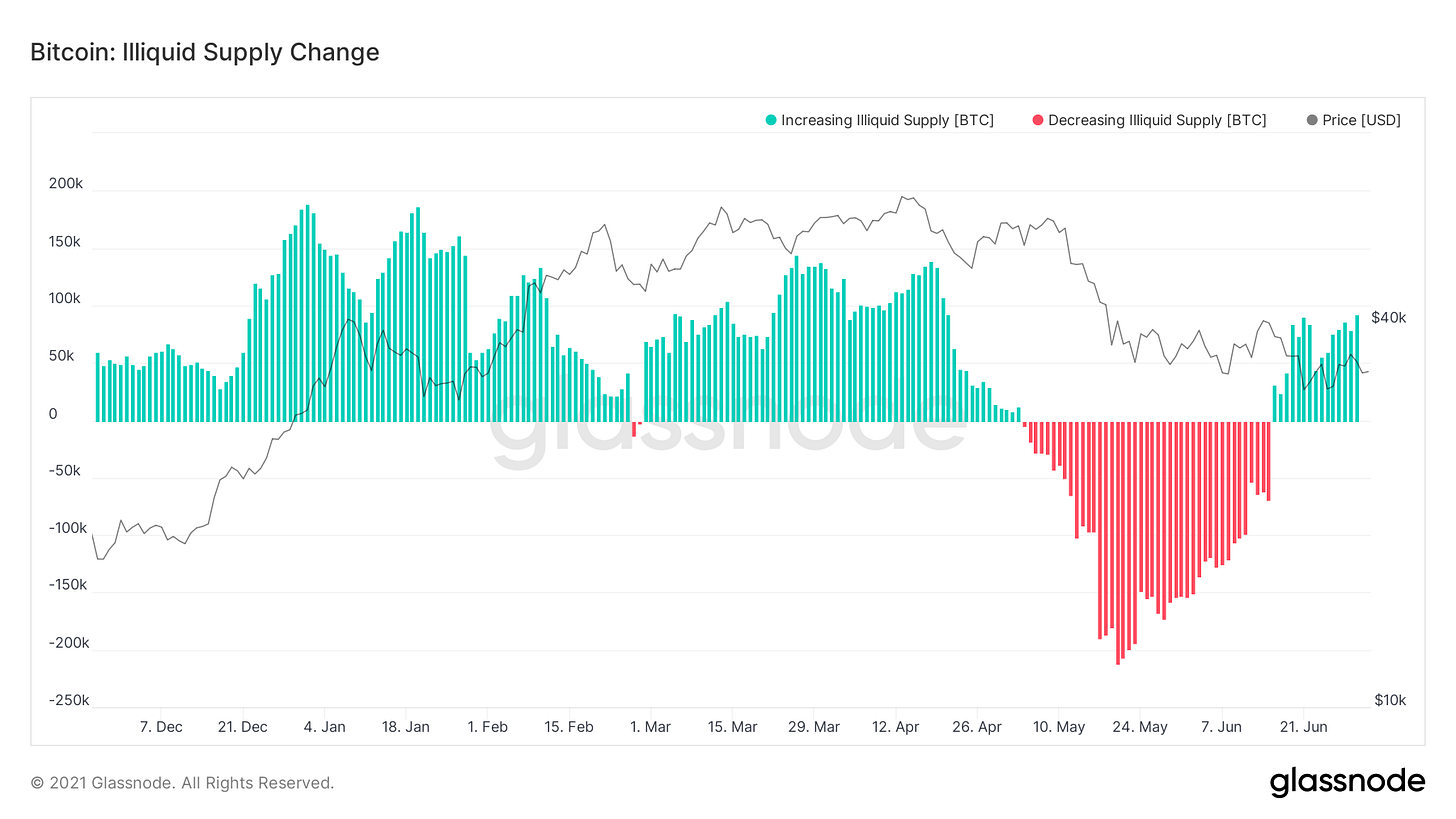

May 25th was the largest day of raw dollar losses in Bitcoin history - sellers lost a collective $4.4B. The coins whales have been selling are going to smaller accounts - accounts that control >100 BTC have collectively sold ~44k BTC (~$1.6B at time of writing) to accounts that control <100 BTC.3 In particular they are being sold to accounts with a strong track record of buying and holding (rather than selling). The coins that paper-handed institutions are dumping may not appear on the open market again for years. The price is down, but long term holders are completely unfazed:

Fucking rugpulls, how do they work?

Back in May we talked about the Dfinity project (rebranded for launch as the Internet Computer Protocol) in response to a reader question. At the time ICP was the fourth largest cryptocurrency with a marketcap larger than Bank of America or Paypal. They promised "instant finality" and "infinite capacity." Our take was that you could safely ignore them because they were obviously liars. To quote:

A good rule of thumb is that if anyone is using words like "instant" and "infinite" to describe their blockchain they are being dishonest about the trade-offs. There are no free, instant or infinite blockchains just as there are no perpetual motion machines and there is no such thing as a free lunch.

Since then the ICP token has fallen from more than 90%:

It gets better though! It turns out that Dfinity (the organization behind ICP) imposed four year vesting programs on small investors but let the tokens allocated to the foundation and other insiders vest immediately - so the founders and insiders could freely dump their ICP but small outside investors were left holding the bag. In short the Dfinity organization seems to have executed a massive ~$6B rugpull, destroying a few hundred billion dollars worth of investor value along the way.

If you were thinking of investing in ICP and didn’t after reading our post, consider the fact that an annual subscription to Something Interesting is only $50 and we have never been credibly accused of a rugpull.

Other things happening right now:

There is an article on NBC right now about a Bitcoin mining operation that took over an aging power plant on Lake Seneca. It opens by unquestioningly quoting a woman as saying "The lake is so warm you feel like you're in a hot tub," which is jaw-droppingly stupid even for anti-Bitcoin environmental rhetoric. Probably NBC should hire someone capable of basic math. Maybe Héctor:

Yikes. 😬

Also yikes. 😬

We also had the slowest block since the dawn of Bitcoin mining back in 2010, it took about ~23 minutes to arrive compared to the target interval of ~10 minutes.

Kazakhstan for its part plans to start taxing Bitcoin miners. Previously Bitcoin mining was actually tax exempt as part of an effort to attract Chinese Bitcoin miners to Kazakhstan.

It is possible that this movement is from whales taking advantage of low fees right now to split their holdings into smaller addresses rather than selling their holdings. Tough to know for sure.